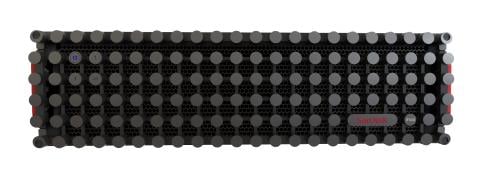

Source: SanDisk Corp.

InfiniFlash is considered the next generation storage platform. The system is available in three different configurations (IF100, IF500 and IF700). This offering provides 5-times the density, 50-times the performance and 4-times the reliability, while consuming 80% less power versus traditional hard disk drive arrays. Also it far surpasses the capabilities of existing all-flash arrays which focus solely on performance.

One of the main factors of this new tech besides the specs is the pricing. Currently InfiniFlash’s all-flash hardware is pegged at less than $1 per gigabyte (GB), and under $2 GB for a system that doesn’t require compression or de-duplication technologies.

Sumit Sadana, executive vice president and chief strategy officer of SanDisk, commented on the new system:

By offering InfiniFlash below $2/GB before compression and de-duplication, we are changing the industry dynamics in favor of dramatically broader flash adoption in new hyperscale and enterprise workloads.

Jim Ganthier, vice president and general manager of engineered solutions from Dell, said:

At Dell, our enterprise and Big Data customers are increasingly demanding higher performance, higher capacity solutions that are delivered in a rapid, reliable, open and cost-effective fashion. Solution and appliance innovations such as InfiniFlash not only address these critical customer success metrics but also deliver on the promise that big data insights can drive differentiated business results.

By creating this new category for flash, SanDisk has the potential to take on more new customers and even further expand its offering of products to its current customers such as Dell.

The downside, of course, is that SanDisk is now competing with its own customers. Moving up the value chain is a good thing for SanDisk. What makes the move in this sector a smart one is that the sector is new and small and there is little competition. The bad news will come from current customers of the company that have previously treated SanDisk as a commodity chip maker.

Shares of SanDisk closed Wednesday up 5% at $83.14. The stock has a consensus analyst price target of $92.53 and a 52-week trading range of $73.03 to $108.77.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.