Chip manufacturer Taiwan Semiconductor Manufacturing Co. (NYSE: TSM), aka TSMC, reported fourth-quarter and full-year 2020 results early Thursday morning. Full-year revenue was up more than 31% to $45.51 billion, and gross margin was up by 710 basis points to 53.1%. Earnings per share rose by 50% to NT$19.97 (US$0.70 at an exchange rate of NT$28.52 to US$1.00).

A key number in the annual results is the company’s capital spending. TSMC reported capex last year of about $17.8 billion and forecast spending in 2021 in the range of $25 billion to $28 billion. Operating cash flow in 2020 totaled $28.8 billion, and free cash flow totaled about $11.1 billion. In other words, TSMC can pay cash for investing in its future and still have a nice pile left that it could share with investors.

Compare TSMC’s planned level of spending this year with planned spending in a capital intensive industry like oil and gas production. Exxon Mobil already has said it plans capex in the range of $16 billion to $19 billion in 2021, and Chevron has set a target of around $14 billion.

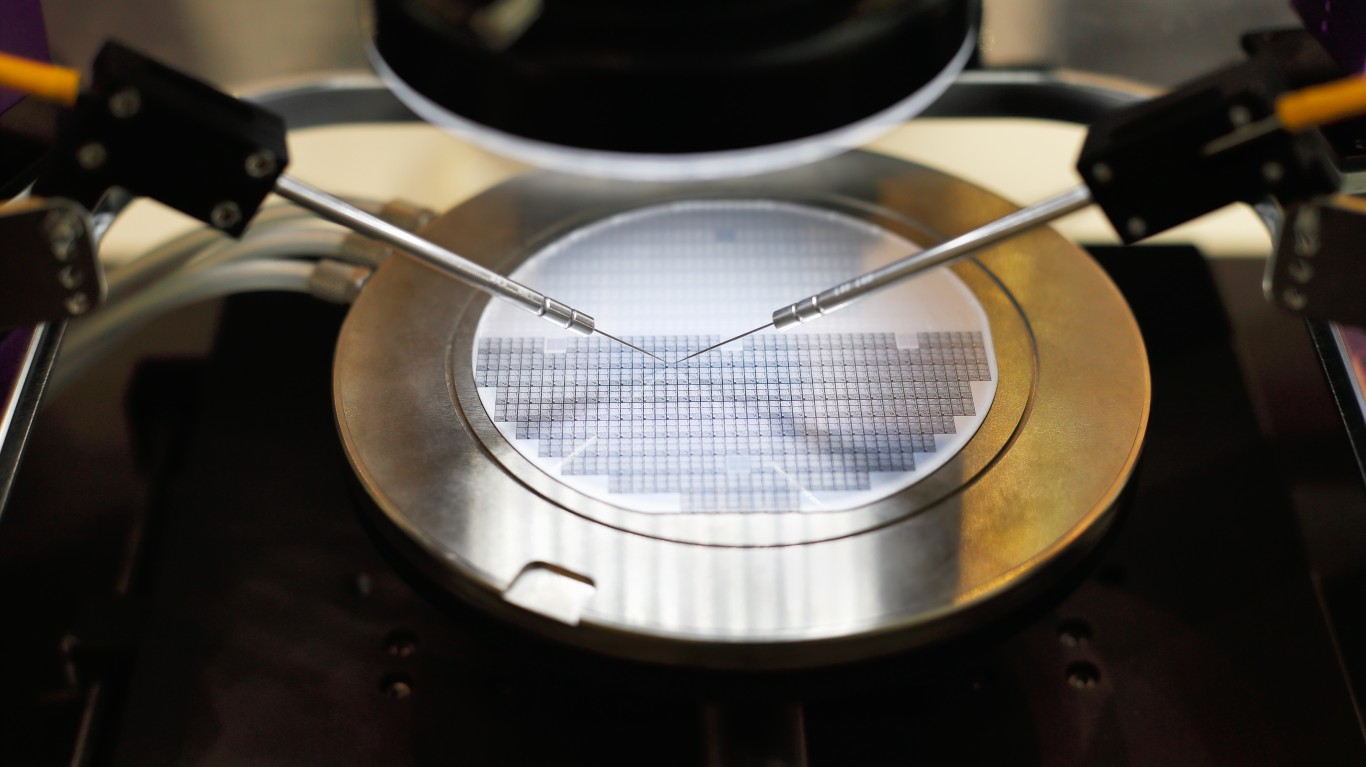

The suppliers that will benefit from TSMC’s capital spending are semiconductor equipment makers like Applied Materials Inc. (NASDAQ: AMAT), Lam Research Corp. (NASDAQ: LRCX) and KLA Corp. (NASDAQ: KLAC), among others. We reviewed a half-dozen semiconductor capital equipment stocks late last month following a sector review by analysts at Needham. Given TSMC’s plans for this year, that review is worth an update.

ASML Holding N.V. (NASDAQ: ASML) is based in the Netherlands and is the largest company by market cap ($216.4 billion) in this group. It makes extreme ultraviolet (EUV) systems and has reportedly received an order for 13 from TSMC for delivery in 2021.

Since December 29, ASML’s stock has added more than 6% to its share price, and it traded at a new 52-week high of around $536 shortly after Thursday’s opening bell. The stock’s 52-week low is $191.25, and the consensus price target on the shares is $438.11. ASML pays a dividend yield of 0.56% ($2.85 annually), and the company’s stock price jumped more than 66% in 2020.

Applied Materials makes and sells a variety of manufacturing systems used to make semiconductor chips. More than half the company’s sales are to chip foundries (fabs), with the remaining 44% divided equally between memory chip and flash memory makers.

Shares added 16.4% since the end of December and more than 43% in 2020. Shares posted a new 52-week high of nearly $105 in the first few minutes of Thursday’s trading session, about $9 above the consensus price target of $95.96 and nearly 7% higher than Wednesday’s closing price. The stock trades at around 21 times expected 2021 earnings. The company pays an annual dividend of $0.88 (yield of 0.90%).

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.