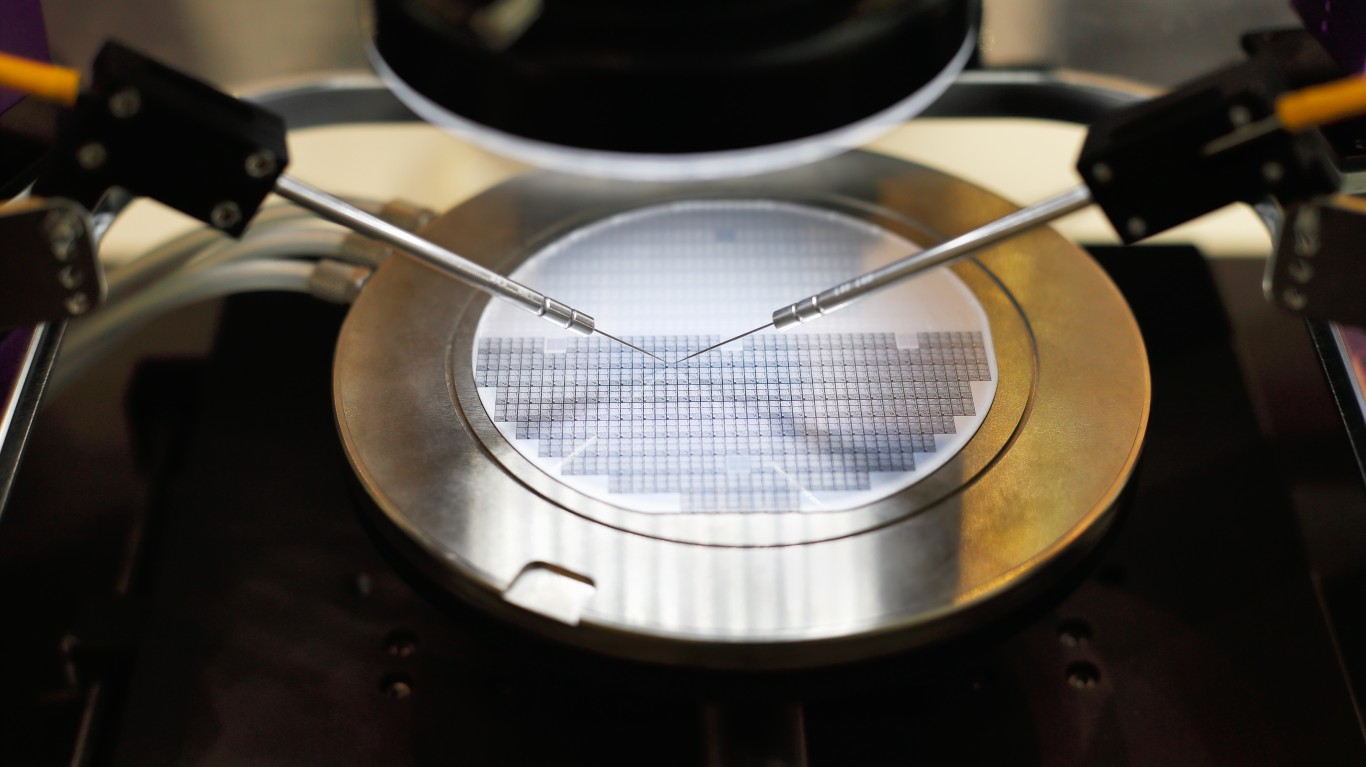

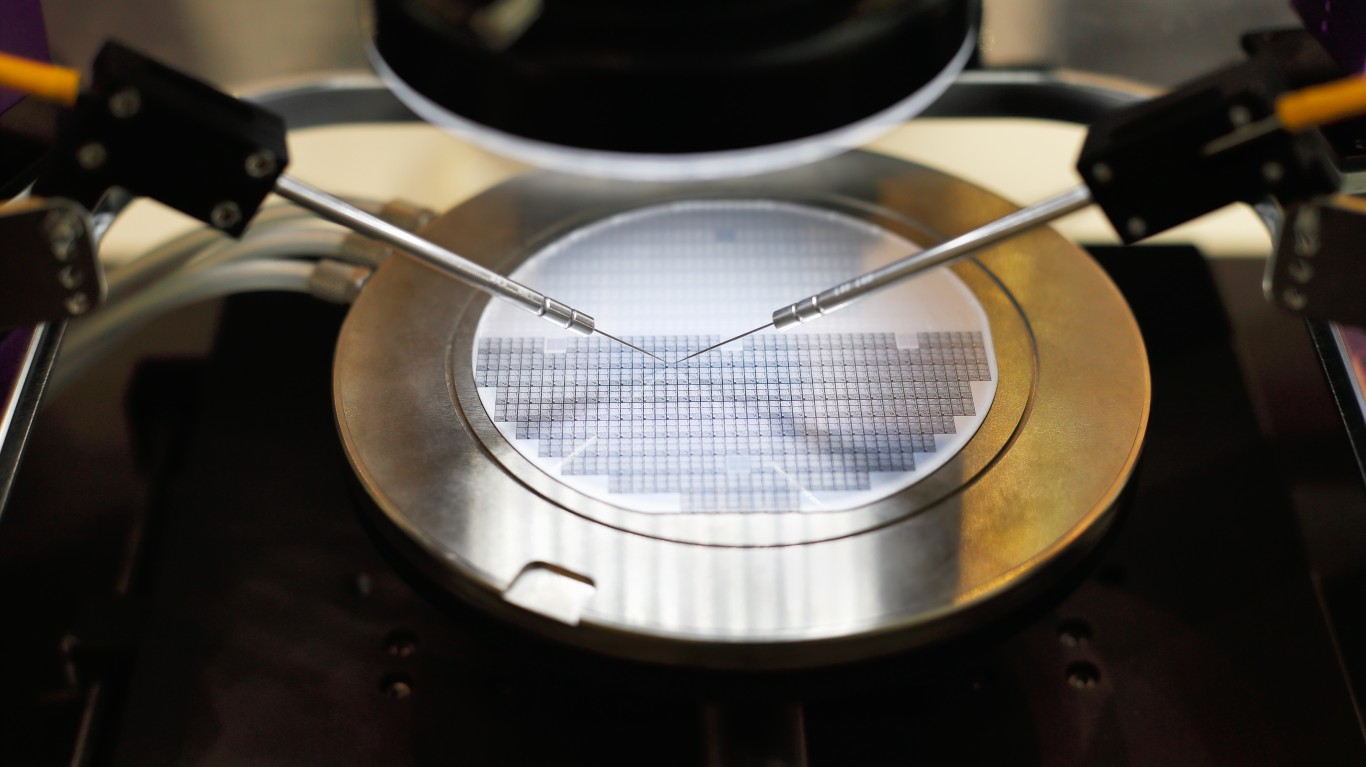

Tightness in the supply of semiconductors and recurring coronavirus outbreaks in China have affected the supply of everything from automobiles to smartphones. Now, the impact of inflation may reduce demand among consumers for semiconductors, while new lockdowns in China and the macroeconomic picture colored by the Russian invasion of Ukraine are expected to ratchet up pressure on the industry.

None of that means that there are no opportunities in the semiconductor industry, either among firms that design the chips, make the chips, or manufacture the machines that fabricate the chips.

[in-text-ad]

In a research note published Wednesday, analyst Mark Lipacis and his team identified seven semiconductor stocks trading at a sharp discount (18%) to the S&P 500 index and that also trade similarly to where semiconductor stocks were trading at their last two mid-cycle corrections. According to the Jefferies analysts, the mid-cycle correction pattern and the discount levels to the S&P 500 (SPX) are strong buying signals:

The Pattern Says Buy. In 2015 and 2018, relative to the SPX, the SOX (PHLX Semiconductor Index) ultimately bottomed close to the respective mid-cycle correction level. The SOX is currently trading at the May mid-cycle correction recently, suggesting limited relative downside from current levels.

The Level Says Buy. In 2015 and 2018, the SOX ultimately bottomed at a 21-23% P/ E discount to the SPX. The median semiconductor stock is currently trading at an 18% discount, [with four semiconductor stocks ] trading at a 25-30% discount.

The analysts go on to say that stocks that were the worst performers in the previous downturns were the best performers in the following upturn. Added to that are Wall Street estimates that set low bars for revenue and earnings growth in the first half of this year.

Here are seven stocks that Lipacis and his team believe are top buys.

AMD

Advanced Micro Devices Inc. (NASDAQ: AMD) is a leading chip designer and producer for the personal computer, server and graphics markets. Jefferies rates the stock a Buy and has a price target of $155 on the shares. At a share price of around $93.40, the upside potential based on Jefferies’ price is 66%. The consensus price target on the stock is $150. Wall Street is estimating 2022 EPS at $4.01 and 2023 EPS at $4.68, while Jefferies has estimates of $4.04 and $4.64 for 2022 and 2023, respectively. In 2021, AMD posted EPS of $2.79.

According to Jefferies, as of Tuesday’s close, AMD stock traded down 33% from its December 2021 peak, while the SOX traded down 21% and the S&P 500 traded down 5%.

Applied Materials

Equipment manufacturer Applied Materials Inc. (NASDAQ: AMAT) designs, manufactures and sells the machines and software used to fabricate semiconductor processors and integrated circuits. Jefferies has a Buy rating on the stock with a price target of $197.

[in-text-ad]

At a recent share price of around $120, the upside based on Jefferies’ target is 64%. At the consensus price target of $165, the stock’s potential upside is 37.5%. The consensus earnings per share (EPS) estimates for 2022 and 2023 are $8.62 and $9.37, respectively. Jefferies estimates 2022 EPS at $8.55 and 2023 EPS at $9.22. Its 2021 EPS totaled $6.84.

According to Jefferies, as of Tuesday’s close, Applied Materials stock traded down 25% from its December 2021 peak, while the SOX traded down 21% and the S&P 500 traded down 5%.

Lam Research

Like Applied Materials, Lam Research Corp. (NASDAQ: LRCX) designs and makes the machines that fabs use to manufacture semiconductors. Jefferies rates the stock a Buy and has given the shares a price target of $869. The upside potential based on a recent price of about $485.60 is almost 79%. At the consensus price target of $700, the upside potential is a still-awesome 44.2%. Jefferies has estimated 2022 EPS at $34.55 and 2023 EPS at $39.90. Consensus estimates are $35.34 and $39.27. Lam Research reported 2021 EPS of $27.28.

According to Jefferies, as of Tuesday’s close, Lam Research stock traded down 32% from its December 2021 peak, while the SOX traded down 21% and the S&P 500 traded down 5%.

Lattice Semiconductor

Lattice Semiconductor Corp. (NASDAQ: LSCC) sells programmable gate arrays and application-specific integrated circuits, and it licenses its technology to other technology companies. Lattice stock is Buy-rated by the Jefferies team and has a price target of $83.

At a share price of around $51, the upside potential is nearly 61%. At the consensus price target of $75, the upside potential is 47%. Jefferies expects Lattice to report 2022 EPS of $1.37, compared with a consensus estimate of $1.41. For 2023, Jefferies estimates EPS of $1.56, compared to a Wall Street estimate of $1.72. The company reported EPS of $1.06 in 2021.

According to Jefferies, as of Tuesday’s close, Lattice stock traded down 35% from its December 2021 peak, while the SOX traded down 21% and the S&P 500 traded down 5%.

Marvell Technology

Marvell Technology Inc. (NASDAQ: MRVL) designs and sells a wide variety of embedded and standalone chips. Its products are used in network controllers, hard disk drives and flash drives, among many other things. The company’s stock is rated as a Buy with a price target of $105 by Lipacis and his team.

[in-text-ad]

At a share price of about $63.40, the upside potential based on the Jefferies price target is 65.6%. At the consensus price target of $95, the upside potential is nearly 50%. Jefferies’ analysts estimate Marvell’s 2022 EPS at $2.29, compared to a consensus of $2.30. The firm’s 2023 EPS is $2.94 compared to the consensus of $2.89. In 2021, Marvell reported EPS of $1.57.

According to Jefferies, as of Tuesday’s close, Marvell stock traded down 30% from its December 2021 peak, while the SOX traded down 21% and the S&P 500 traded down 5%.

Microchip Technology

This firm designs, manufactures and sells embedded chips and control software to a variety of industries, including automotive, computing, lighting and security. Jefferies has a Buy rating on Microchip Technology Inc. (NASDAQ: MCHP) stock, with a price target of $109.

The potential upside based on a recent price of around $70 a share is 55.7%. Based on a consensus price target of $95, the upside potential at the current price is 35.7%. Jefferies estimates 2022 and 2023 EPS at $5.19 and $5.47, respectively, compared to consensus estimates of $5.14 for 2022 and $5.41 for 2023. Last year, Microchip Technology reported EPS of $3.29.

According to Jefferies, as of Tuesday’s close, Microchip Technology stock traded down 22% from its December 2021 peak, while the SOX traded down 21% and the S&P 500 traded down 5%.

Nvidia

The chips Nvidia Corp. (NASDAQ: NVDA) designs and sells are used for graphics processing and a variety of other cutting-edge technologies, like artificial intelligence and machine learning. Jefferies rates the stock a Buy and has a price target of $370.

Based on a recent price of around $215, the upside potential to the Jefferies target is 72%. Using the consensus price target of $350, the upside potential is 62.8%. For 2022 and 2023, Jefferies estimates EPS of $5.00 and $5.68, respectively, while the consensus estimates call for 2022 EPS of $5.52 and 2023 EPS of $6.59. Last year, Nvidia reported EPS of $4.44.

According to Jefferies, as of Tuesday’s close, Nvidia stock traded down 32% from its December 2021 peak, while the SOX traded down 21% and the S&P 500 traded down 5%.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.