It didn’t last for the entire trading session, but Microsoft Corp.’s (NASDAQ: MSFT) market cap passed that of Apple Inc. (NASDAQ: AAPL), dethroning a company that had held the top position for two years. Artificial intelligence (AI) and cloud computing have trumped hardware and consumer services. Each company has a market cap just shy of $2.9 trillion. (Here are seven more stocks that will join the trillion-dollar club.)

What happened? Of Microsoft, Tom Hancock, head of focused equity at GMO, said, “Big picture, they got there by embedding themselves in every IT department in the world,” according to The Wall Street Journal. Years ago, that meant Windows on personal computers (PCs), then Windows on servers, Azure for cloud computing and now AI applications. Apple, in the meantime, seems to have a product in the hands of everyone in the world. This includes the iPhone, Mac, iPad and Apple Watch. It has started to sell services like Apple Pay and Apple TV+ to those people.

Apple’s Prospects

The biggest question about Apple is whether iPhone sales will continue to be flat. There are concerns that each Apple smartphone generation is not different enough from the one before it. That, by itself, would make some investors turn away from the company.

Microsoft’s Prospects

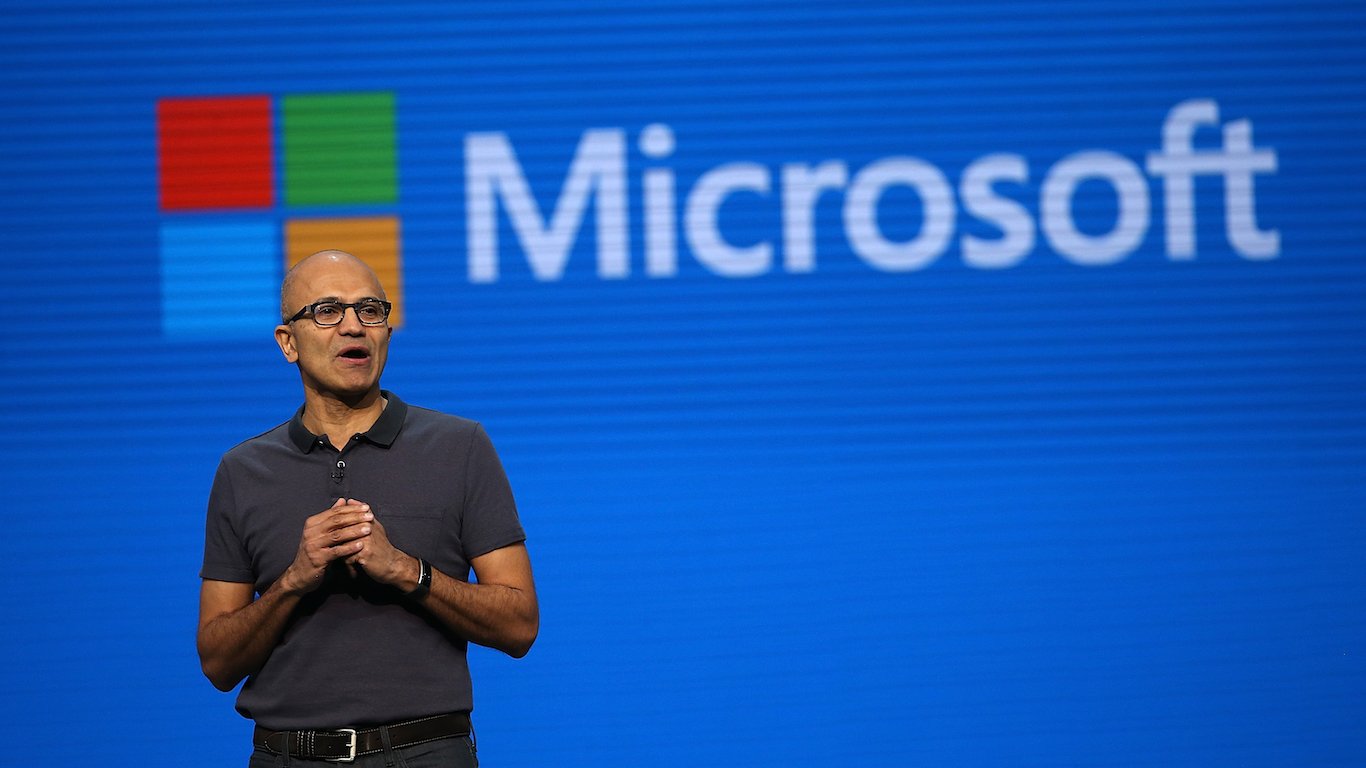

Microsoft’s revenue was up 13% to $56.5 billion in the most recent quarter. Earnings rose 27% to $2.99 a share. Cloud revenue rose 24% to $31.8 billion. “With copilots, we are making the age of AI real for people and businesses everywhere,” Satya Nadella, board chair and CEO, commented.

AI, it seems, is the tech of the future. Hardware may never sunset, but it is much less exciting to Wall Street.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.