Investing

NVIDIA Announced a 10:1 Stock Split - Here's the Returns of Other Tech Giants After Stock Splits

Published:

Last Updated:

As we predicted months ago, NVIDIA (Nasdaq: NVDA) announced a stock split on May 22nd. The announcement was made alongside impressive earnings, and the company gained 9.3% the next day. NVIDIA is up 13.5% across the past five trading days.

With NVIDIA announcing a stock split, a question on investors’ minds is likely how other megacap tech companies have done after announcing their latest stock splits. Let’s analyze the recent performance of how Apple, Alphabet, and Amazon did after stock split announcements and then look at what catalysts could keep sending NVIDIA’s share price higher.

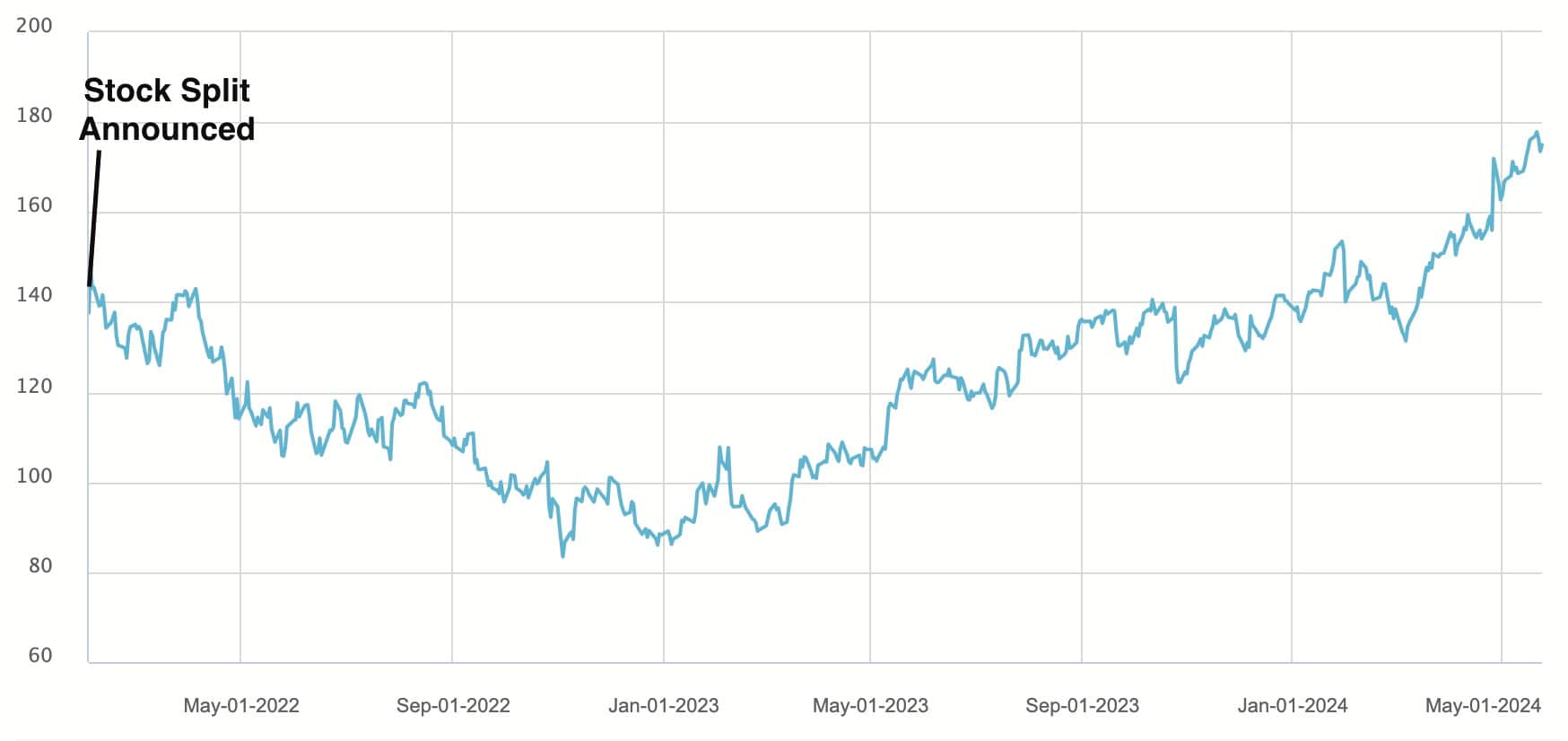

After splitting its shares in March 2022, Amazon (Nasdaq: AMZN) saw a 5% jump the following day. The timing of Amazon’s split wasn’t ideal as technology stocks plummeted throughout the spring and summer of 2022. By mid-June, Amazon was down 25% from where it had announced its stock split.

Amazon rebounded in late summer before seeing its share price drop precipitously at the end of 2022. One year after its stock split announcement, Amazon was down 34%! Yet, the start of 2023 would prove to be the low point for Amazon shares and today they’re up 30% from the date the company announced splitting its shares a little more than two years ago.

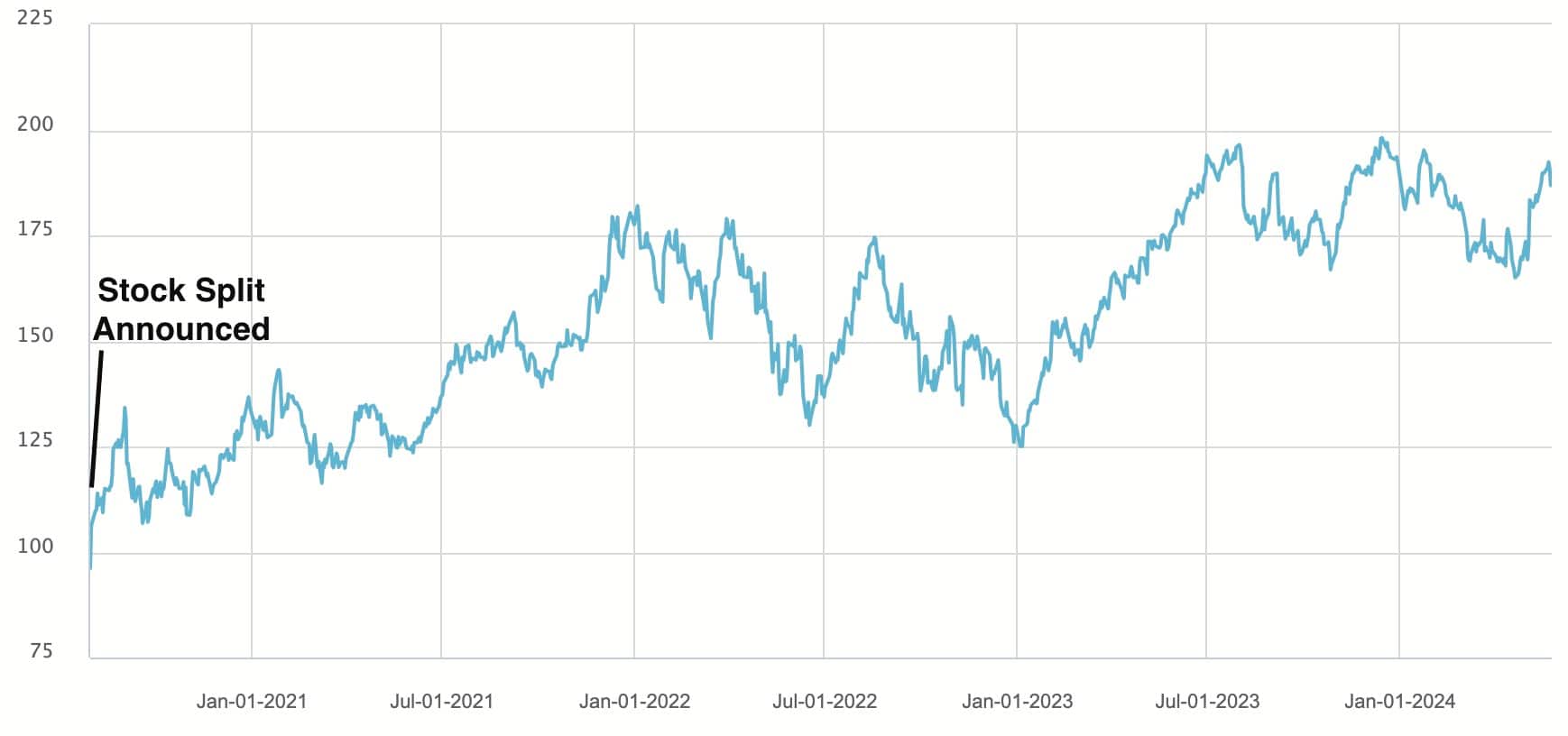

Alphabet (Nasdaq: GOOGL) jumped 8% the day after announcing its stock split. It’s worth noting that stock splits are often announced alongside earnings, so there can be multiple factors in play.

However, the post-stock split enthusiasm didn’t last long. After hitting a split-adjusted $148 share price the day after announcing the split, Alphabet fell all the way down to $83 per share in November 2022. Today, its share price has rebounded and Alphabet is trading about 27% higher than when it announced its stock split.

Apple (Nasdaq: AAPL) jumped 10% the day after announcing its stock split. While the company had declines in the years that followed, it didn’t see a fall like Amazon and Alphabet to values below where it announced its split. Overall, Apple is up 98% in less than four years since announcing its split. That’s not a bad return for a company worth nearly $3 trillion today!

Overall, the next-day returns have been sensational for companies that have announced splits in recent years. Here’s a sampling of major splits across the past four years:

Over a longer time period stocks that split have outperformed the market as well. A study by macro researcher Strategas Securities found that stocks that split had a median performance of 4.1% (versus a market median of 2.7%) across the next six months.

Yet, as Amazon and Alphabet show, while the next-day performance of popular stocks announcing stock splits has been fantastic recently, splits have also come before periods of underperformance. Both companies split their stock right before periods of extreme volatility for technology stocks.

After earnings, analysts now predict NVIDIA will have normalized earnings of $26.97 this fiscal year according to S&P Capital IQ. That leaves the company trading for about 39X this fiscal year’s earnings.

The biggest driver around NVIDIA’s financial performance in the year ahead will be the reception to the company’s new Blackwell platform. Early results and supply chain chatter have been positive. That brings up how performance in Fiscal 2026 (January 2025 to January 2026) could swing NVIDIA’s stock.

Right now, Wall Street is predicting about $35 per share in profits off $155.3 billion in sales. If NVIDIA outperformed and pushed sales growth to north of 30% (right now Wall Street is at 28.8%) combined with outperformance in FY25 could get the company to around $40 in EPS next year.

If NVIDIA had $40 of EPS and kept trading at a similar multiple to today (39X current year earnings), that would get its stock to around $1,560 per share at today’s pre-stock split prices.

Of course, these numbers assume some pretty optimistic scenarios, but this exercise does show that even after its incredible recent run, there are very plausible scenarios where NVIDIA keeps running even after this stock split.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.