The initial public offering market in 2012 is likely to be much stronger than many anticipate. Despite the lingering uncertainty and the underperformance of many popular IPOs in 2011, this year may see some very exciting underwriting activity with more than 200 companies hoping to go public. 24/7 Wall St. has evaluated dozens of IPO candidates to find the Top 17 IPOs To Watch In 2012.

Facebook and its $100 billion valuation, although by far the largest on our list, is just one of many IPO potentials which will be in high demand. A new stock exchange, a host of online media outfits, a giant casino, big name retail, and private equity are all trying trying to have successful IPOs in 2012. You do not have to be an approved Second Market account holder or a venture capitalist to have a stake. Investors in 2012 can invest through business development outfits like GSV Capital Corporation (NASDAQ: GSVC), which owns shares of Facebook and Twitter, and Keating Capital, Inc. (NASDAQ: KIPO). These pre-IPO funds were not available ahead of many of the top 2011 IPOs. There is even the First Trust US IPO Index (NYSE: FPX) fund for investors looking at other investment strategies around IPO investing.

But other than those listed here, there are many other potential IPO candidates waiting in the wings. Among the private equity’s past giant leveraged buyouts are Univision and Clear Channel in media and TXU in power and electricity, which could all be potential IPO candidates if and when the market will accommodate them. Also, such companies as the fashion-deal site called Gilte Groupe, the “Angry Birds” video game maker Rovio, and others are also waiting in the wings with possible IPOs.

24/7 Wall St. has compiled a detailed review of each of the expected top IPOs for 2012. We have included details on the finances, backers, related entities, financial terms, the size of the IPO, and even the underwriting groups.

1. BATS Global Markets, which was founded in 2005, first filed to become a public company in May of 2011. The company, which started as an alternative to the NYSE for equities trading in Europe and the U.S. is now the third largest equity exchange in America and operates the second largest pan-European multilateral trading facility. As such, this IPO is is a key one for investors of exchanges and trading platforms. BATS plans to raise up to $100 million through the offering. More than 90% of the company’s revenues come from trading U.S. equities. These days it is also a primary listing venue, meaning it can conduct IPOs. The global operator of stock and options markets plans to list its shares on its own exchange rather than the NYSE under the ticker BATS. The offering will have a dual-class share structure and the bankers are listed as Morgan Stanley, Citigroup, and Credit Suisse.

1. BATS Global Markets, which was founded in 2005, first filed to become a public company in May of 2011. The company, which started as an alternative to the NYSE for equities trading in Europe and the U.S. is now the third largest equity exchange in America and operates the second largest pan-European multilateral trading facility. As such, this IPO is is a key one for investors of exchanges and trading platforms. BATS plans to raise up to $100 million through the offering. More than 90% of the company’s revenues come from trading U.S. equities. These days it is also a primary listing venue, meaning it can conduct IPOs. The global operator of stock and options markets plans to list its shares on its own exchange rather than the NYSE under the ticker BATS. The offering will have a dual-class share structure and the bankers are listed as Morgan Stanley, Citigroup, and Credit Suisse.

2. Caesars Entertainment Corporation filed for its IPO in late 2011. This IPO is a holdover from the private equity buyout days when the company tried to go public but later retracted the offering. No exchange was specified nor was a ticker set in the filing. As of September 30, 2011, the company owned or operated 52 casinos in a dozen U.S. states and seven countries under the brand names of Caesars, Harrah’s and Horseshoe with a total gaming space of 3 million square feet and about 42,000 hotel rooms. Caesars Entertainment is what’s left of the massive $9.3 billion buyout by Apollo Global Management, LLC (NYSE: APO) and TPG in 2005. Sales in the first nine months of 2011 were more than $6.6 billion and operating income was was over $600 million, with a net loss after items of $467 million. Private equities and casino operators are paying close attention to this IPO. If the real size of the overall company is too large, perhaps the private equity firms may consider breaking the underlying companies up into separate offerings and utilize a ‘keiretsu’ approach under a network of companies.

2. Caesars Entertainment Corporation filed for its IPO in late 2011. This IPO is a holdover from the private equity buyout days when the company tried to go public but later retracted the offering. No exchange was specified nor was a ticker set in the filing. As of September 30, 2011, the company owned or operated 52 casinos in a dozen U.S. states and seven countries under the brand names of Caesars, Harrah’s and Horseshoe with a total gaming space of 3 million square feet and about 42,000 hotel rooms. Caesars Entertainment is what’s left of the massive $9.3 billion buyout by Apollo Global Management, LLC (NYSE: APO) and TPG in 2005. Sales in the first nine months of 2011 were more than $6.6 billion and operating income was was over $600 million, with a net loss after items of $467 million. Private equities and casino operators are paying close attention to this IPO. If the real size of the overall company is too large, perhaps the private equity firms may consider breaking the underlying companies up into separate offerings and utilize a ‘keiretsu’ approach under a network of companies.

Read Also: DJIA 2012 Gain of 12% Projected

![]() 3. The Carlyle Group, L.P. filed to raise up to $100 million in securities in September 2011. As one of the best known names in the world of private equity IPO be one to watch, for investors and other private equity companies. No ticker and no exchange were designated in the filing, but the company named J.P. Morgan, Citi, and Credit Suisse as the lead underwriters. With more than $150 billion in assets under management, this private equity giant is a key player in real assets, global market strategies, and now also in funds of funds after buying a 60% equity interest in AlpInvest. With several private equity companies already publicly traded, Carlyle has been an IPO candidate group for years.

3. The Carlyle Group, L.P. filed to raise up to $100 million in securities in September 2011. As one of the best known names in the world of private equity IPO be one to watch, for investors and other private equity companies. No ticker and no exchange were designated in the filing, but the company named J.P. Morgan, Citi, and Credit Suisse as the lead underwriters. With more than $150 billion in assets under management, this private equity giant is a key player in real assets, global market strategies, and now also in funds of funds after buying a 60% equity interest in AlpInvest. With several private equity companies already publicly traded, Carlyle has been an IPO candidate group for years.

4. Facebook is going to be the king of all IPOs of 2012. The double-question is when exactly will it go public and at what price? Facebook is a monster in social networking that has changed the world and the ways of communication. The company is supposedly going to release its financials in the second quarter to comply with regulatory standards over its number of shareholders. With Mark Zuckerberg aiming for a $100 billion valuation at the offering, Facebook could literally be valued at more than all of the top and important IPOs of 2012 combined. It was just over a year ago that many thought that $30 billion and $40 billion valuation was too high and the many private sales have since commanded a much higher valuation. The underwriting firms and the exchange it will list on are yet unknown, as is the share structure. Will it follow the LinkedIn Corporation (NYSE: LNKD) share structure? Facebook’s estimated $100 billion valuation is expected to come with a $10 billion stock sale. Alexa still ranks Google first in traffic measurement of all global websites, but Facebook is coming on strong in many online measuring metrics.

4. Facebook is going to be the king of all IPOs of 2012. The double-question is when exactly will it go public and at what price? Facebook is a monster in social networking that has changed the world and the ways of communication. The company is supposedly going to release its financials in the second quarter to comply with regulatory standards over its number of shareholders. With Mark Zuckerberg aiming for a $100 billion valuation at the offering, Facebook could literally be valued at more than all of the top and important IPOs of 2012 combined. It was just over a year ago that many thought that $30 billion and $40 billion valuation was too high and the many private sales have since commanded a much higher valuation. The underwriting firms and the exchange it will list on are yet unknown, as is the share structure. Will it follow the LinkedIn Corporation (NYSE: LNKD) share structure? Facebook’s estimated $100 billion valuation is expected to come with a $10 billion stock sale. Alexa still ranks Google first in traffic measurement of all global websites, but Facebook is coming on strong in many online measuring metrics.

5. Glam Media is an online media and advertising network focused on targeting the female market. The company made the news late last year after reportedly speaking to investment banking firms like Goldman Sachs, Morgan Stanley, and BofA about going public, but the filing is not expected before mid-2012. Glam claims to have about 1,000 brand advertisers and sales of over $100 million. It acquired Ning as a custom social site design tool for somewhere in the $150 million area. Whether this will be a normal IPO with a single-class or a dual-class structure is not known and that depends largely on the performance of other recent media and social networking IPOs.

5. Glam Media is an online media and advertising network focused on targeting the female market. The company made the news late last year after reportedly speaking to investment banking firms like Goldman Sachs, Morgan Stanley, and BofA about going public, but the filing is not expected before mid-2012. Glam claims to have about 1,000 brand advertisers and sales of over $100 million. It acquired Ning as a custom social site design tool for somewhere in the $150 million area. Whether this will be a normal IPO with a single-class or a dual-class structure is not known and that depends largely on the performance of other recent media and social networking IPOs.

6. Gogo Inc., which filed right before Christmas of 2011, provides the in-flight connectivity, entertainment, as well as Internet for several large airlines, including Delta Air Lines, American Airlines, Virgin America, and US Airways. The filing was for up to $100 million, and the stock is set to trade under the ticker GOGO. Investors will have to hope that the performance of Boingo Wireless, Inc. (NASDAQ: WIFI) does not hurt Gogo’s IPO value. As of September 30, 2011, Gogo had equipped 1,177 commercial aircraft. Consolidated sales in the first nine months of 2011 grew 89% to $113.8 million. Lead underwriters included Morgan Stanley, J.P. Morgan, and UBS. Major holders are Ripplewood Holdings, Oakleigh Thorne, and AC Partners.

6. Gogo Inc., which filed right before Christmas of 2011, provides the in-flight connectivity, entertainment, as well as Internet for several large airlines, including Delta Air Lines, American Airlines, Virgin America, and US Airways. The filing was for up to $100 million, and the stock is set to trade under the ticker GOGO. Investors will have to hope that the performance of Boingo Wireless, Inc. (NASDAQ: WIFI) does not hurt Gogo’s IPO value. As of September 30, 2011, Gogo had equipped 1,177 commercial aircraft. Consolidated sales in the first nine months of 2011 grew 89% to $113.8 million. Lead underwriters included Morgan Stanley, J.P. Morgan, and UBS. Major holders are Ripplewood Holdings, Oakleigh Thorne, and AC Partners.

7. GrowOp Technology Ltd. has been an IPO-hopeful for quite some time. The company is the technology provider to much of the medical marijuana growing industry. So far, GrowOp has raised capital through Form D filings. We interviewed founder Derek Peterson in 2011 when an IPO was on track to occur. But the field of supplying growing lab equipment for the use of medical marijuana has undergone quite a bit of change in the last year, causing the company to put the 2011 IPO on hold. With some other companies having in the field having conducted reverse mergers or hoping to raise capital, GrowOp will be a company to watch.

7. GrowOp Technology Ltd. has been an IPO-hopeful for quite some time. The company is the technology provider to much of the medical marijuana growing industry. So far, GrowOp has raised capital through Form D filings. We interviewed founder Derek Peterson in 2011 when an IPO was on track to occur. But the field of supplying growing lab equipment for the use of medical marijuana has undergone quite a bit of change in the last year, causing the company to put the 2011 IPO on hold. With some other companies having in the field having conducted reverse mergers or hoping to raise capital, GrowOp will be a company to watch.

Read Also: Best Big Biotech Stock Picks For 2012

8. Kayak Software has had many amended filings for its IPO of up to $50 million in common stock. It will have one of the dual-class structures and trade as KYAK on NASDAQ. Deutsche Bank is counted in the underwriting group. Kayak.com was started in 2004 by the co-founders of Expedia, Travelocity and Orbitz. It instantly compares hundreds of travel websites in one search. With so many users online looking for travel deals, and with a popular and straight forward business model, Kayak is going to be watched closely. While the acquisition of IATA by Google Inc. (NASDAQ: GOOG) may be a challenge for Kayak, past strength of Priceline.com Inc. (NASDAQ: PCLN) and other online travel sites is likely to keep investors’ interest high.

8. Kayak Software has had many amended filings for its IPO of up to $50 million in common stock. It will have one of the dual-class structures and trade as KYAK on NASDAQ. Deutsche Bank is counted in the underwriting group. Kayak.com was started in 2004 by the co-founders of Expedia, Travelocity and Orbitz. It instantly compares hundreds of travel websites in one search. With so many users online looking for travel deals, and with a popular and straight forward business model, Kayak is going to be watched closely. While the acquisition of IATA by Google Inc. (NASDAQ: GOOG) may be a challenge for Kayak, past strength of Priceline.com Inc. (NASDAQ: PCLN) and other online travel sites is likely to keep investors’ interest high.

9. Living Social has not yet filed for a public offering but is one of the long-standing IPO candidates. It competes directly with Groupon, Inc. (NASDAQ: GRPN) and claims to be the fastest growing ongoing deals sites out there. The company’s financials are not public and revenue figures vary from source to source. Living Social has over 34 million U.S. members and over 46 million users globally, 603 daily deal markets worldwide in 25 countries, over 22 million vouchers bought by members worldwide, and more than 3,900 employees located throughout each market served. It has reportedly been trying to raise up to $400 million in December, with a projected market value of $6 billion at the time.

9. Living Social has not yet filed for a public offering but is one of the long-standing IPO candidates. It competes directly with Groupon, Inc. (NASDAQ: GRPN) and claims to be the fastest growing ongoing deals sites out there. The company’s financials are not public and revenue figures vary from source to source. Living Social has over 34 million U.S. members and over 46 million users globally, 603 daily deal markets worldwide in 25 countries, over 22 million vouchers bought by members worldwide, and more than 3,900 employees located throughout each market served. It has reportedly been trying to raise up to $400 million in December, with a projected market value of $6 billion at the time.

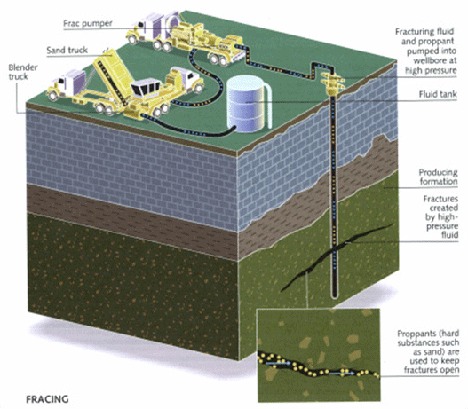

10. Platinum Energy Solutions, Inc. is not the largest of the pending oil and gas IPOs of 2012, but itis still relatively new and is focused on the controversial hydraulic fracturing sector in the domestic shale regions in America. The Houston-based outfit filed for an IPO of up to $300 million in common stock under the FRAC ticker on the NYSE at the very end of the third quarter in 2011, with Morgan Stanley and J.P. Morgan set to lead the offering. Platinum’s customers are Petrohawk in the Eagle Ford Shale, a major independent operator in Altamont Field in Utah, and Encana Corporation (NYSE: ECA) in the Haynesville Shale. With fracking so controversial and with most operations being so new, investors (and competitors) will be paying close attention to this IPO. Source: Thinkstock

Source: Thinkstock

11. Restoration Hardware, a high-end furniture retail company, is yet another private equity buyout which filed in September 2011 to sell up to $150 million in common stock. It still has no proposed ticker nor a proposed exchange, but it used to trade as RSTO on NASDAQ. The private equity buyers were Catterton Management, Tower Three Partners, and Glenhill Capital. As of July 30, 2011, the retailer operated 87 stores and 10 outlet stores in the U.S. and Canada. In 2010, it sent out about 46.5 million catalogs and generated over 12.1 million unique visits on its website. In the first half of 2011, revenues rose 27% to $420.4 million over the first six months in 2010, and net income rose to $1.1 million from a net loss of $11.3 million. While not a major private equity buyout, the company listed BofA and Goldman Sachs as the lead underwriters, and many smaller private equity shops with a focus on retail and consumer spending will be paying close attention here. Source: Restoration Hardware

Source: Restoration Hardware

12. Silver Spring Networks, Inc., which offers smart grid networking technology solutions, filed to sell up to $150 million. For those interested in the green or efficient energy sector, this IPO is the one to watch. The smart grid helps in advanced electricity metering, improved grid reliability, efficient energy management, and compliance with regulatory mandates. Morgan Stanley, Goldman Sachs, and Credit Suisse are the book-runners, but there are ten firms in total on the offering. SSN’s sales were $175.7 million in the first nine months of 2011 and the company is losing money. Rather than just selling “green” this outfit sells efficiency, and that is likely to make IPO watchers look at the opportunity several years out rather than backwards.

12. Silver Spring Networks, Inc., which offers smart grid networking technology solutions, filed to sell up to $150 million. For those interested in the green or efficient energy sector, this IPO is the one to watch. The smart grid helps in advanced electricity metering, improved grid reliability, efficient energy management, and compliance with regulatory mandates. Morgan Stanley, Goldman Sachs, and Credit Suisse are the book-runners, but there are ten firms in total on the offering. SSN’s sales were $175.7 million in the first nine months of 2011 and the company is losing money. Rather than just selling “green” this outfit sells efficiency, and that is likely to make IPO watchers look at the opportunity several years out rather than backwards.

13. Smith Electric Vehicles Corp. filed in November 2011 to sell up to $125 million in common stock and it plans to list under the ticker SMTH on the NASDAQ. It also hired UBS and BofA as the lead underwriters. Smith design, produces and sells zero emission, medium-duty commercial electric vehicle trucks and vans with set routes of up to 120 miles. It is already selling to major commercial fleets in the U.S. and Europe. In the 12 months ending September 30, 2011 it had sold 320 vehicles. It recently noted an order backlog of 120 vehicles, and it has allocated nearly all of its estimated 540 production slots through July 2012 with written indications of interest from existing and potential customers for approximately 2,220 vehicles from 2012 to 2015. The company’s owners are Tanfield Group in the U.K. (almost 30%), Continental Casualty Company in Chicago (about 15.6%) and Potomac Energy Fund (about 7.2%).

13. Smith Electric Vehicles Corp. filed in November 2011 to sell up to $125 million in common stock and it plans to list under the ticker SMTH on the NASDAQ. It also hired UBS and BofA as the lead underwriters. Smith design, produces and sells zero emission, medium-duty commercial electric vehicle trucks and vans with set routes of up to 120 miles. It is already selling to major commercial fleets in the U.S. and Europe. In the 12 months ending September 30, 2011 it had sold 320 vehicles. It recently noted an order backlog of 120 vehicles, and it has allocated nearly all of its estimated 540 production slots through July 2012 with written indications of interest from existing and potential customers for approximately 2,220 vehicles from 2012 to 2015. The company’s owners are Tanfield Group in the U.K. (almost 30%), Continental Casualty Company in Chicago (about 15.6%) and Potomac Energy Fund (about 7.2%).

14. Toys R Us was supposed to be one of the top IPOs of 2011, but it was delayed due to market conditions and likely due to lack of investors’ interest. The leading toy and children merchandise retailer in America was taken private in 2005 and is owned almost equally by affiliates of Bain Capital, KKR, and Vornado Realty Trust (NYSE: VNO). It seems investors are not willing to buy into old private equity buyouts where all of the funds go straight to the owners rather than the company. Many other private equity LBOs that are on the sidelines are eager to see how such a large buyout repackaged as an IPO fares. Although an established business, in the world of private equity it is one of the top IPOs to watch. The retailer had 11 underwriters in its most recent filing last year before it pushed back its IPO plans.

14. Toys R Us was supposed to be one of the top IPOs of 2011, but it was delayed due to market conditions and likely due to lack of investors’ interest. The leading toy and children merchandise retailer in America was taken private in 2005 and is owned almost equally by affiliates of Bain Capital, KKR, and Vornado Realty Trust (NYSE: VNO). It seems investors are not willing to buy into old private equity buyouts where all of the funds go straight to the owners rather than the company. Many other private equity LBOs that are on the sidelines are eager to see how such a large buyout repackaged as an IPO fares. Although an established business, in the world of private equity it is one of the top IPOs to watch. The retailer had 11 underwriters in its most recent filing last year before it pushed back its IPO plans.

Read Also: The Top 17 IPOs of 2011

15. TransUnion, one of the leading consumer credit reporting and monitoring businesses, filed in July 2011 to sell up to $325 million in common stock under the ticker TRUN on the NYSE. On top of keeping credit scores so merchants can evaluate credit, TransUnion also runs and owns TrueCredit.com, a consumer credit protection mechanism. In today’s world, credit rating and credit monitoring may be more important than ever. With book-runners listed as BofA, J.P. Morgan, and Deutsche Bank, the filing listed nine underwriters in total. Founded in 1968, TransUnion now claims about 45,000 business customers in multiple industries. Sales were $956.5 in 2010 and $503.4 million in the first half of 2011 alone, while net income in the same periods was $36.6 million in 2010 and -$2.6 million in the first half of 2011 due to fees tied to debt extinguishment.

15. TransUnion, one of the leading consumer credit reporting and monitoring businesses, filed in July 2011 to sell up to $325 million in common stock under the ticker TRUN on the NYSE. On top of keeping credit scores so merchants can evaluate credit, TransUnion also runs and owns TrueCredit.com, a consumer credit protection mechanism. In today’s world, credit rating and credit monitoring may be more important than ever. With book-runners listed as BofA, J.P. Morgan, and Deutsche Bank, the filing listed nine underwriters in total. Founded in 1968, TransUnion now claims about 45,000 business customers in multiple industries. Sales were $956.5 in 2010 and $503.4 million in the first half of 2011 alone, while net income in the same periods was $36.6 million in 2010 and -$2.6 million in the first half of 2011 due to fees tied to debt extinguishment.

16. Twitter is another online phenomenon from which Wall Street is eagerly awaiting an IPO. But last year was too soon for the microblogging site to go public due to some top level management shuffles and lack of clarity in a real business model. The posting site is used by millions of people for anything from business, gossip to live news. In December, Kingdom Holdings’ majority owner Prince Alwaleed bin Talal bought a $300 million stake from insiders. It remains unclear when Twitter will file for an IPO. Some reports say it will be in 2012, while others project it will be “in the next couple of years.” This is likely an IPO story for later in 2012 as the company’s financial situation is not well known by the public.

16. Twitter is another online phenomenon from which Wall Street is eagerly awaiting an IPO. But last year was too soon for the microblogging site to go public due to some top level management shuffles and lack of clarity in a real business model. The posting site is used by millions of people for anything from business, gossip to live news. In December, Kingdom Holdings’ majority owner Prince Alwaleed bin Talal bought a $300 million stake from insiders. It remains unclear when Twitter will file for an IPO. Some reports say it will be in 2012, while others project it will be “in the next couple of years.” This is likely an IPO story for later in 2012 as the company’s financial situation is not well known by the public.

17. Yelp, the online user-review business, formally filed for an offering in November 2011. It is going to have a dual-class A and B share structure similar to much of the 2011 Internet offerings. Its proposed ticker is YELP with no exchange selected. Book-runners are Goldman Sachs, Citigroup, and Jefferies. Yelp’s users have contributed over 22 million reviews of local businesses, including restaurants, boutiques and salons, dentists, mechanics, and plumbers. The company claims 61 million unique website visitors in its statistics. At the end of the last quarter on September 30, 2011, Yelp had about 19,000 active business accounts, up 75% from the prior year. Sales in the first nine months of 2011 were up 80% year-over-year to $58.4 million, but it turned in a net loss of $7.6 million for the same period. After so many rumored buyouts Yelp is going to be closely followed by many online companies and interested investors. Backers include Bessemer Ventures, Elevation Partners, and Benchmark Capital.

17. Yelp, the online user-review business, formally filed for an offering in November 2011. It is going to have a dual-class A and B share structure similar to much of the 2011 Internet offerings. Its proposed ticker is YELP with no exchange selected. Book-runners are Goldman Sachs, Citigroup, and Jefferies. Yelp’s users have contributed over 22 million reviews of local businesses, including restaurants, boutiques and salons, dentists, mechanics, and plumbers. The company claims 61 million unique website visitors in its statistics. At the end of the last quarter on September 30, 2011, Yelp had about 19,000 active business accounts, up 75% from the prior year. Sales in the first nine months of 2011 were up 80% year-over-year to $58.4 million, but it turned in a net loss of $7.6 million for the same period. After so many rumored buyouts Yelp is going to be closely followed by many online companies and interested investors. Backers include Bessemer Ventures, Elevation Partners, and Benchmark Capital.

If you enjoyed the Top IPOs of the year, you can sign up in the box below to join our morning email list to receive news directly in your inbox. We also include major analyst upgrades and downgrades, special situation developments, observations on Warren Buffett and key market gurus, as well as special exclusive feature stories.

JON C. OGG

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.