Consumer Electronics

Full 360-Degree Intel Earnings Preview (INTC, MSFT, SMH, SOXL)

Published:

Last Updated:

Intel Corporation (NASDAQ: INTC) reports earnings after the close of trading and Thomson Reuters has estimates for the DJIA component of $0.61 EPS and $13.9 billion in revenues; next quarter estimates are $0.65 EPS and $14.3 billion in revenue.

Intel Corporation (NASDAQ: INTC) reports earnings after the close of trading and Thomson Reuters has estimates for the DJIA component of $0.61 EPS and $13.9 billion in revenues; next quarter estimates are $0.65 EPS and $14.3 billion in revenue.

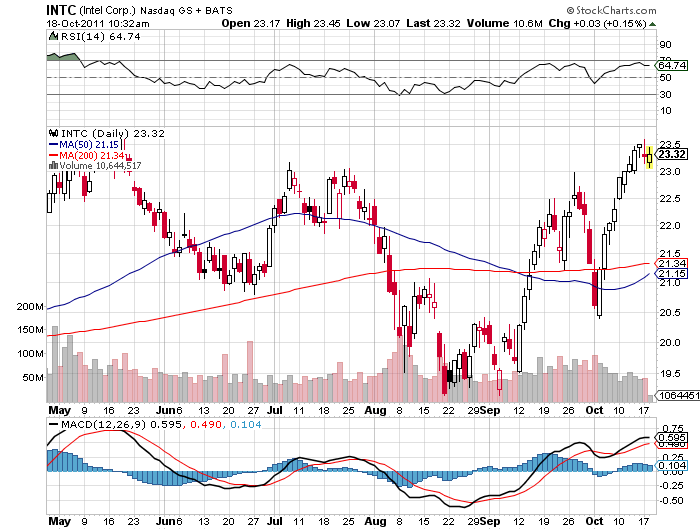

Shares are trading around $23.25 this morning, and its 52-week trading range is $18.90 to $23.96. The consensus analyst price target is well above the year high and implies close to 10% upside to $25.55. Intel of course also offers that high 3.6% dividend yield.

The obvious concerns have been about reports of slow demand in DRAM, slow PC sales, and more while the move so far in tablets and smartphones has not really yet included Intel. It has also been surprising that shares are so close to a 52-week high.

Options traders are not exactly looking for the biggest price move today. After looking at the closest put and call strike prices, it seems that options traders are only bracing for a move of up to $0.40 to $0.55 in either direction.

Intel’s stock chart has run into some resistance of late up around the $23.50 mark and it is about $2.00 lower where the moving averages come into play: $21.34 for the key 200-day moving average and $21.15 for the 50-day moving average. We would also note that Intel was challenging the $20.50 level at the start of October.

After the report, we would be paying close attention to Microsoft Corporation (NASDAQ: MSFT) for the PC market and then we would be paying immediate attention to the Semiconductor HOLDRs (NYSE: SMH) and then that crazy triple-leveraged Direxion Daily Semicondctor Bull 3X Shares (NYSE: SOXL).

JON C. OGG

JON C. OGG

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.