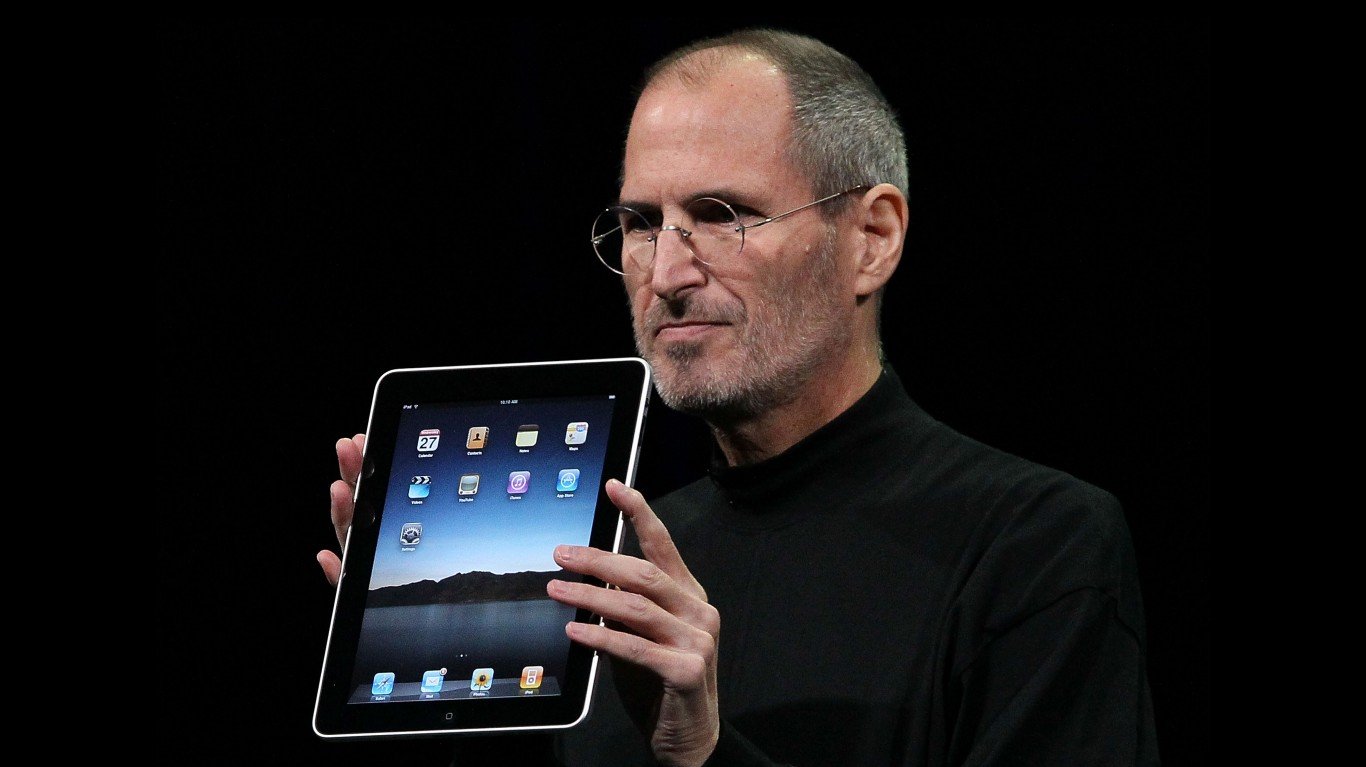

Apple Inc. (NASDAQ: AAPL) already was recovering from its lows when Carl Icahn tweeted that he had purchased a large stake in the consumer electronics giant. Also note that Apple’s stock price has been challenging $500 for more than a week now. So what happens when UBS issues a research report maintaining its Buy rating but adjusting its price target up to $560 from $500? Source: JoeInQueens, via Wikimedia Commons

Source: JoeInQueens, via Wikimedia Commons

The long and short of it is that Apple is trading up almost 1% and is over the $504.00 level. The stock has traded as high as $510.57 on Tuesday and $513.74 on Monday. Those will be crucial stock levels to watch if the rally recovers.

While many analysts upgrade or downgrade shares, or raise or lower price targets, solely based on when a target is hit, the UBS team here is raising its earnings estimates as well. That makes the Apple target price upgrade more than just a refresh to adjust for the market performance.

UBS sees earnings in its 2014 of $44.65 per share, versus a prior target of $42.39 per share, and versus a consensus estimate from Thomson Reuters of $42.31 per share. The boost to earnings is after making certain assumptions less conservative from the coming iPhone refresh and also due to a likely deal with China Mobile expected this year.

With shares trading at $504, the 52-week trading range is $385.10 to $705.07. The $560 UBS price target compares to a $525.92 consensus target from Thomson Reuters.

Smart Investors Are Quietly Loading Up on These “Dividend Legends”

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.