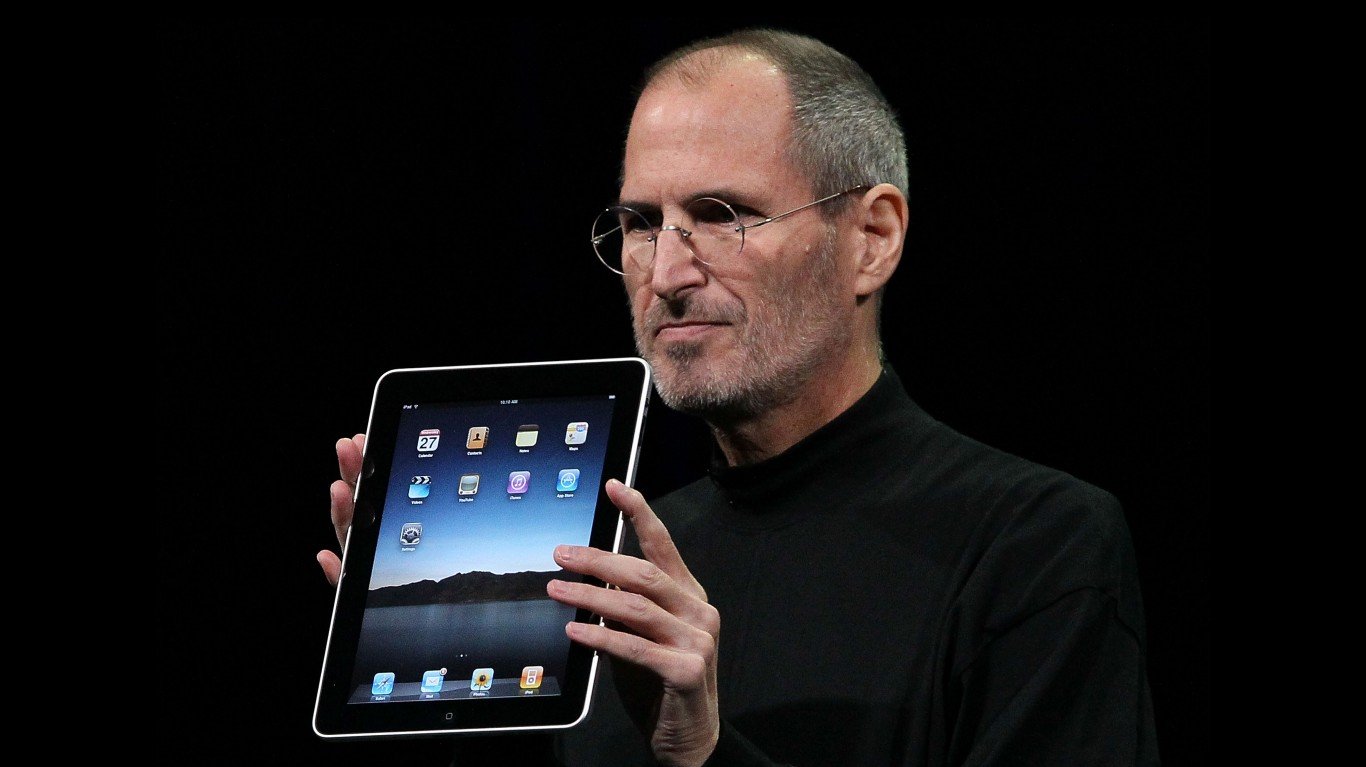

Most industry experts winced when Carl Icahn said Apple Inc. (NASDAQ: AAPL) shares are worth $200 each. Part of his argument is that Apple has enough cash to make a major share buyback. The other part is based on a more exact forecast that Apple earnings will pop 30% in both the company’s 2016 and 2017 fiscal years. At a price-to-earnings (P/E) ratio of nearly 20, and with cash added in, Apple’s stock price should reach exactly $203. It is far-fetched that Icahn can be so exact. However, his case based on earnings growth approaches merit, given Apple’s recent quarterly numbers. Source: Thinkstock

Source: Thinkstock

Apple reported:

The Company posted quarterly revenue of $42.1 billion and quarterly net profit of $8.5 billion, or $1.42 per diluted share. These results compare to revenue of $37.5 billion and net profit of $7.5 billion, or $1.18 per diluted share, in the year-ago quarter.

This earnings growth rate seems shy of Icahn’s forecast. He might argue that iPhone 6 sales will be boosted by holiday sales. These sales are 55% of Apple’s total revenue. If only iPad sales were not faltering, the entire Apple sales machine would kick into higher gear. And Apple would have to launch a series of services like Apple Pay that need to be extraordinary successes.

Of course, beyond current products and services, in the future Apple would need a successful launch of an iPhone 7, a resurrection of iPad sales, a series of breakout new products that might include an upgrade in Apple TV, and tremendous partnerships with content providers. Apple also would have to create more products and services, beyond anything it has released before.

ALSO READ: What to Expect From Earnings: Verizon vs. AT&T

Icahn has a habit of being right. In a case like Apple, he has bought enough stock to put his money where his mouth is. The iPhone 6 had to be a success to bolster any reasonable argument that Apple’s share price might double. At least its new earnings mean that the company has made a start for the case that Apple stock should have a much higher value.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.