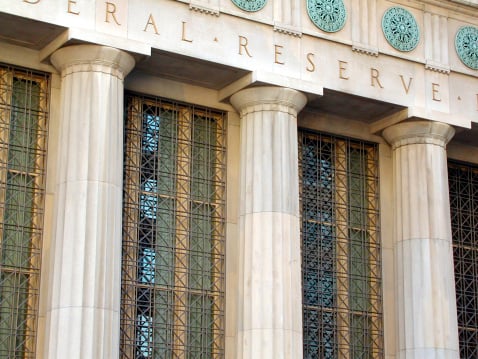

The Beige Book was released by the Federal Reserve at 2:00 p.m. Eastern on Wednesday, and what was often ignored may have been given almost no media coverage at all. After all, Janet Yellen was testifying, the Greeks were rioting and CNBC had its key Delivering Alpha conference, which twisted moves in many individual stocks. Source: Thinkstock

Source: Thinkstock

As a reminder, the Fed site noted that the Beige Book was prepared at the Federal Reserve Bank of Atlanta and was based on information collected before July 3, 2015. This document is also a summary of comments received from businesses and other contacts outside the Federal Reserve — it is not commentary on the views of Federal Reserve officials.

All 12 Federal Reserve Districts showed that economic activity expanded from mid-May through June.

Districts indicated moderate growth in nonfinancial business services and the transportation activity was mixed. It may seem unsurprising that manufacturing activity was uneven after having seen prior industrial production reports.

Improvements were also seen in consumer spending, but this varied from district to district and some noted strong dollar weakness. Districts reported that auto sales were up in all but the St. Louis district. Tourism was broadly higher, except in New York.

ALSO READ: 10 Cities Where Incomes Are Growing (and Shrinking) the Fastest

Oil and natural gas drilling declined in Dallas, Cleveland, Minneapolis and in Kansas City. Capital spending in energy was down in some districts.

Prices for inputs and finished goods were effectively stable since the prior Beige Book report. Demand for loans was higher in New York, Atlanta, Richmond and Dallas. Most districts noted modest wage pressures.

By the title of this report, it seems as though no one cared. After all, we have already seen lots of Fed data. with more coming later in the week.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.