Aytu BioScience Inc. (NASDAQ: AYTU) has been a stock market darling since it broke onto the COVID-19 testing scene. As a result, the stock has absolutely exploded this year. Although many were concerned at the onset of the year about Nasdaq compliance, the stock price quickly quieted these concerns when COVID-19 hit the scene.

Aytu BioScience stock traded as low as $0.34 a share in February before it came out with a test to help fight the pandemic. Since then, the shares have reached as high as $2.99, but they have normalized and found a trading range between $1.25 and $1.65.

Testing for the coronavirus has become a lucrative field. Other companies specifically dealing with this include Quest Diagnostics Inc. (NYSE: DGX), Co-Diagnostics Inc. (NASDAQ: CODX) and Becton, Dickinson and Co. (NYSE: BDX). Their stocks have seen solid gains since they entered the coronavirus test business as well.

What Aytu BioScience Does

Aytu BioScience is a specialty pharmaceutical company. It focuses on the development and commercialization of novel products in the fields of hypogonadism (low testosterone), cough and upper respiratory symptoms, insomnia, and male infertility.

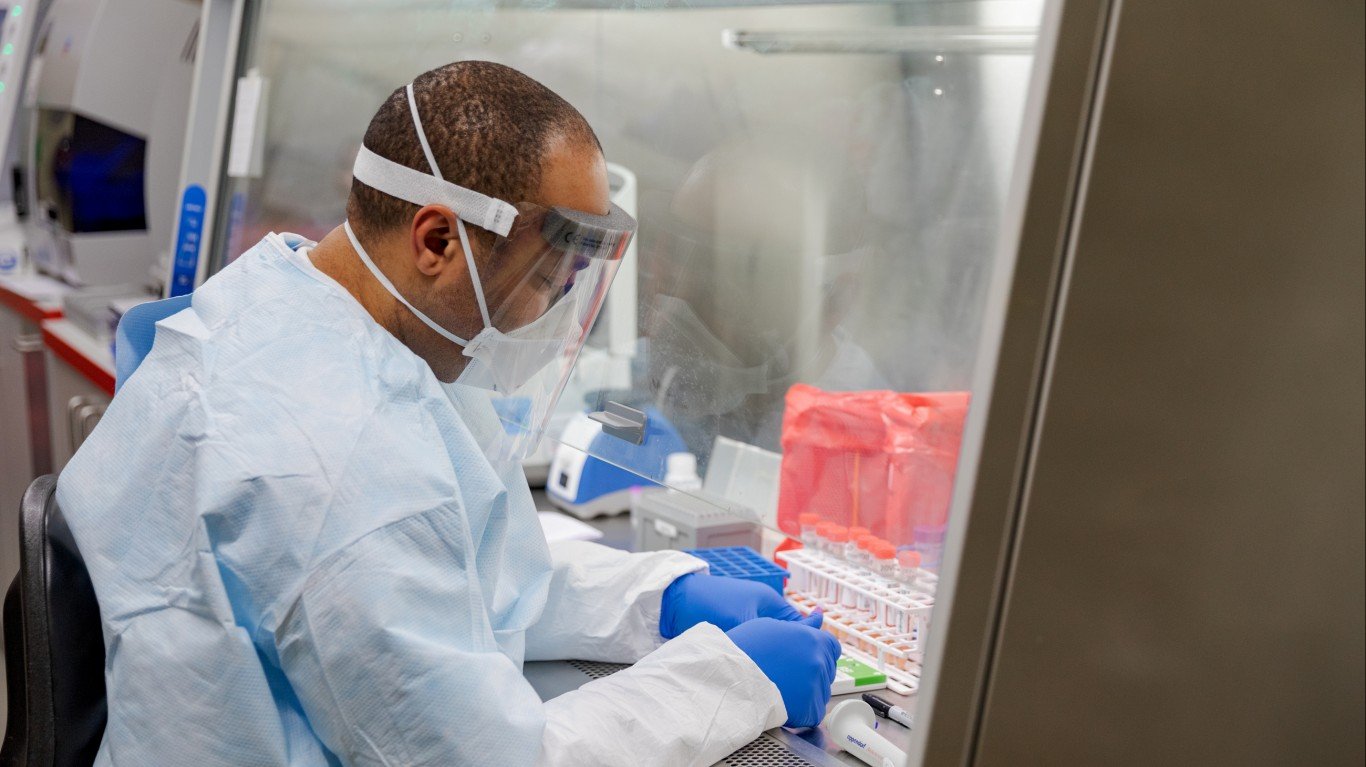

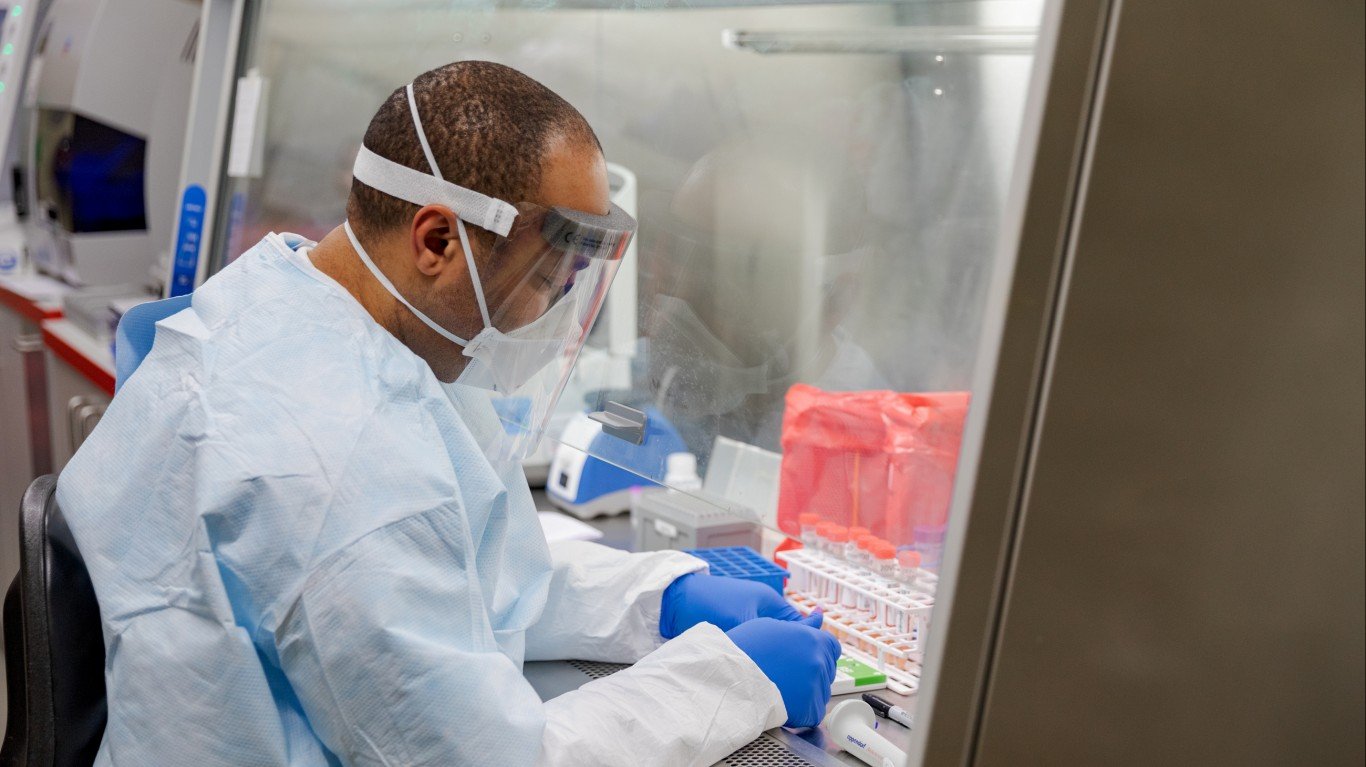

What has set this company apart from the rest is that it has secured an exclusive distribution agreement for the right to commercialize a rapid COVID-19 test. The company said that the test has been licensed from L.B. Resources in Hong Kong. It licensed North American rights from a product developer named Zhejiang Orient Gene Biotech.

The test is intended for professional use, at point of care. What stands out here is that the test is said to deliver clinical results in two to 10 minutes, wherever it is administered.

Late in April, the company announced that it has partnered with Sterling Medical Devices to finalize the development of the Healight platform technology. Basically, this tech is a novel endotracheal catheter that acts as a potential treatment for the coronavirus.

Management believes the Healight platform technology has the potential to affect outcomes positively for critically ill patients infected with coronavirus and other infections. Aytu, with support of the team at Cedars-Sinai, is working with the U.S. Food and Drug Administration (FDA). The aim is to determine an expedited regulatory process with the potential to enable near-term use of the technology initially as a coronavirus intervention for critically ill intubated patients.

Annual Meeting

Aytu BioScience held its 2020 annual meeting in late April. A few key developments there will have an impact on the direction of the company. To start, a few new directors will get their turn on the board.

In the meeting, stockholders elected Joshua Disbrow, Steven Boyd, Gary Cantrell, Carl Dockery, John Donofrio Jr., Michael Macaluso and Ketan Mehta to the company’s board of directors for one-year terms.

Separately, stockholders approved an advisory vote on executive compensation and ratified the appointment of Plante & Moran as the independent auditor for the company for the 2020 year. Stockholders also approved the board of directors to authorize a reverse split of the company’s common stock.

However, the board did not elect to proceed with a reverse stock split at that time. This decision is the result of Aytu regaining compliance with Nasdaq listing requirements, including having a $1.00 closing bid price for the company’s common stock. Additionally, the board noted that effecting a reverse split would not be in the best interest of shareholders at the time.

Check out the company’s 8-K from this meeting on the U.S. Securities and Exchange Commission website.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.