Now that Apple Inc. (NASDAQ: AAPL) has joined the Dow Jones Industrial Average, one big question that keeps arising is whether or not Apple can become the world’s first $1 trillion company. With a $712 billion market cap as of Wednesday’s close, Apple is already larger than many nations. But with it being the largest component by far in the S&P 500 Index, just how does Apple compare to the rest of the S&P 500 Index? Source: thinkstock

Source: thinkstock

For starters, we recently highlighted that Apple was worth more than GE, Wal-Mart, GM, and McDonald’s combined. We also showed what this means if you tally up all of the earnings and sales of all the companies against Apple as well. The notion sounds ludicrous if you consider it without quantifying it — but then you see something else when you quantify it at least ‘sort of.’

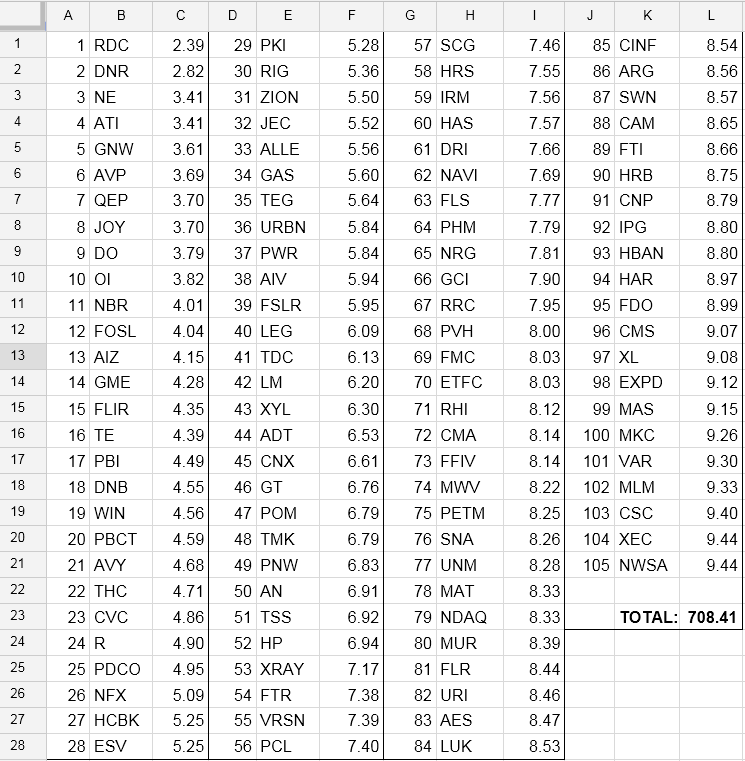

Compared to the S&P 500 Index’s individual stocks, it turns out that Apple is actually worth more than the bottom 105 companies in the S&P 500 Index combined.

This number sounds incredible on the surface. For starters, most investors consider that the S&P 500 includes the 500 largest companies in America. That is not exactly the truth, but the reality is that you never get a small cap stock added to the S&P 500.

24/7 Wall St. has included a table below with the tickers and market cap of each of the bottom 105 S&P 500 members provided by FinViz in this exercise. Again, the tally is as of Wednesday’s closing price — and Apple was worth a bit more on Thursday. It turns out that the bottom 105 stocks by market cap in the S&P 500, as of Wednesday’s closing price, come to a total market cap of $708.4 billion if you see the tally below (in billions).

ALSO READ: As Apple Joins the Dow, 3 More DJIA Stocks Could Get Booted

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.