Before U.S. markets opened on Tuesday, Bank of America beat consensus estimates on both the top and bottom lines. Profit rose by 20% year over year, and revenue was up more than 11%. Shares traded up 2.6% shortly after Tuesday’s opening bell.

[in-text-ad]

Morgan Stanley also beat consensus estimates for quarterly revenue and earnings per share (EPS). Profits were lower year over year, but revenue rose by 2.3%. Shares traded up about 3.1%.

Bank of New York Mellon also topped revenue and EPS estimates. Revenue reached a record high, but investors did not approve of the decline in net interest margin. Shares traded up about 1.1% early in Tuesday’s regular session.

Charles Schwab touted its $180 billion in new assets and 1 million new accounts during the quarter, but revenue was down 8.6% year over year even though it beat expectations. EPS was also above estimates. The stock traded up about 12.6%.

Lockheed Martin also beat top-line and bottom-line estimates. The country’s largest defense contract raised fiscal year EPS and revenue guidance. Shares traded up 1.2%.

There are no notable earnings reports due after markets close on Tuesday. Early Wednesday morning, ASML, Baker Hughes, Goldman Sachs, Halliburton and U.S. Bancorp will report quarterly results.

After U.S. markets close on Wednesday, these four companies are expected to report quarterly results.

IBM

Shares of International Business Machines Corp. (NYSE: IBM) have slumped by about 4% over the past 12 months. Since the end of the first quarter, IBM’s stock has added about 5.5%, primarily due to a plan to fire some 8,000 workers and replace them with AI tools.

IBM’s hybrid cloud business, offering a bridge between private and public clouds through its Red Hat software, positions the venerable company well to keep paying a handsome dividend. CEO Arvind Krishna has done well so far to keep the company growing, and analysts expect IBM to continue growing at an annual rate of 3%.

Of 16 brokerages covering the stock, 10 have a Hold rating and four rate it at Buy or Strong Buy. At a recent price of around $134.00 a share, the implied upside based on a median price target of $140.00 is about 4.5%. At the high price target of $162.00, the implied upside is 20.9%.

Second-quarter revenue is expected to come in at $15.57 billion, which would be up 9.3% sequentially and essentially flat year over year. Adjusted EPS are forecast at $2.00, up 47.2% sequentially but down 13.4% year over year. The current full-year estimates call for EPS of $9.43, up 3.3%, on sales of $62.26 billion, up 2.9%.

IBM stock trades at 14.2 times expected 2023 EPS, 13.4 times estimated 2024 earnings of $10.03 and 12.8 times estimated 2025 earnings of $10.47 per share. Its 52-week trading range is $115.55 to $153.21. IBM pays an annual dividend of $6.64 (yield of 4.98%), and total shareholder return for the past 12 months was 0.87%.

Kinder Morgan

Energy infrastructure company Kinder Morgan Inc. (NYSE: KMI) has seen its share price increase by 2.2% over the past 12 months, including a drop of more than 5% in 2023 so far.

[in-text-ad]

The company’s not-so-secret sauce for success is its generous dividend, made possible by guaranteed long-term contracts for about 60% of Kinder’s revenue. Another quarter of Kinder’s revenue is fee-based and very stable. The issue now becomes one of growth and how much the company needs to grow in order to keep paying its dividend. The company just signed on to a $251 million pipeline expansion project in the Eagle Ford natural gas play. This represents a bet that European demand for liquefied natural gas will continue after Russian pulls out of Ukraine.

Of 21 brokerages covering the stock, 15 have Hold ratings and just five have Buy or Strong Buy ratings. At a share price of around $17.00, the potential upside to a median price target of $20.00 is 17.6%. At the high price target of $23.00, the implied upside is 35.3%.

Consensus estimates call for first-quarter revenue of $4.61 billion, up 18.5% sequentially but 10.5% lower year over year, and EPS of $0.24, down 20.5% sequentially and by 11.1% year over year. For the full 2023 fiscal year, analysts forecast EPS of $1.09, down 5.7%, on sales of $18.29 billion, down 4.7%.

Kinder Morgan stock trades at 15.7 times expected 2023 EPS, 14.6 times estimated 2024 earnings of $1.17 and 14.1 times estimated 2025 earnings of $1.22. The 52-week range is $16.00 to $19.36. Kinder Morgan pays an annual dividend of $1.13 (yield of 6.57%). Total shareholder return over the past 12 months was 8.8%.

Netflix

When Netflix Inc. (NASDAQ: NFLX) reported first-quarter earnings in April, the streaming video service missed the sales estimate by about 1% and missed the profit estimate by less than 1%. Over the next two weeks, the stock dropped about 4.8%.

Since then, shares are up by nearly 42% as investors have come to see the success of the company’s ad-supported subscription plan and, especially, its crackdown on password sharing. Contrary to expectations, the end of password sharing resulted in new subscriber growth, and that growth is expected to have continued in the second quarter. Analysts expect new subscriber growth of nearly 2 million in the quarter, compared to a decline of about 1 million in the year-ago quarter.

Of 44 analysts covering the stock, 22 have a Buy or Strong Buy rating, while another 19 have Hold ratings. At a share price of around $450.00, the stock has outrun its median price target of $412.00. At the high price target of $535.00, the upside potential is about 18.9%.

Netflix’s second-quarter revenue is forecast at $8.29 billion, up 1.6% sequentially and by 4.0% year over year. Adjusted EPS are forecast at $2.86, down 0.7% sequentially and by 10.6% year over year. For the full 2023 fiscal year, analysts expect to see EPS of $11.31, up 13.7%, on sales of $34.07 billion, up 7.8%.

[in-text-ad]

The shares trade at 39.8 times expected 2023 EPS, 30.5 times estimated 2024 earnings of $14.73 and 24.2 times estimated 2025 earnings of $18.57 per share. The 52-week range is $188.40 to $456.68. Netflix does not pay a dividend. Total shareholder return for the past 12 months was 137.98%.

Tesla

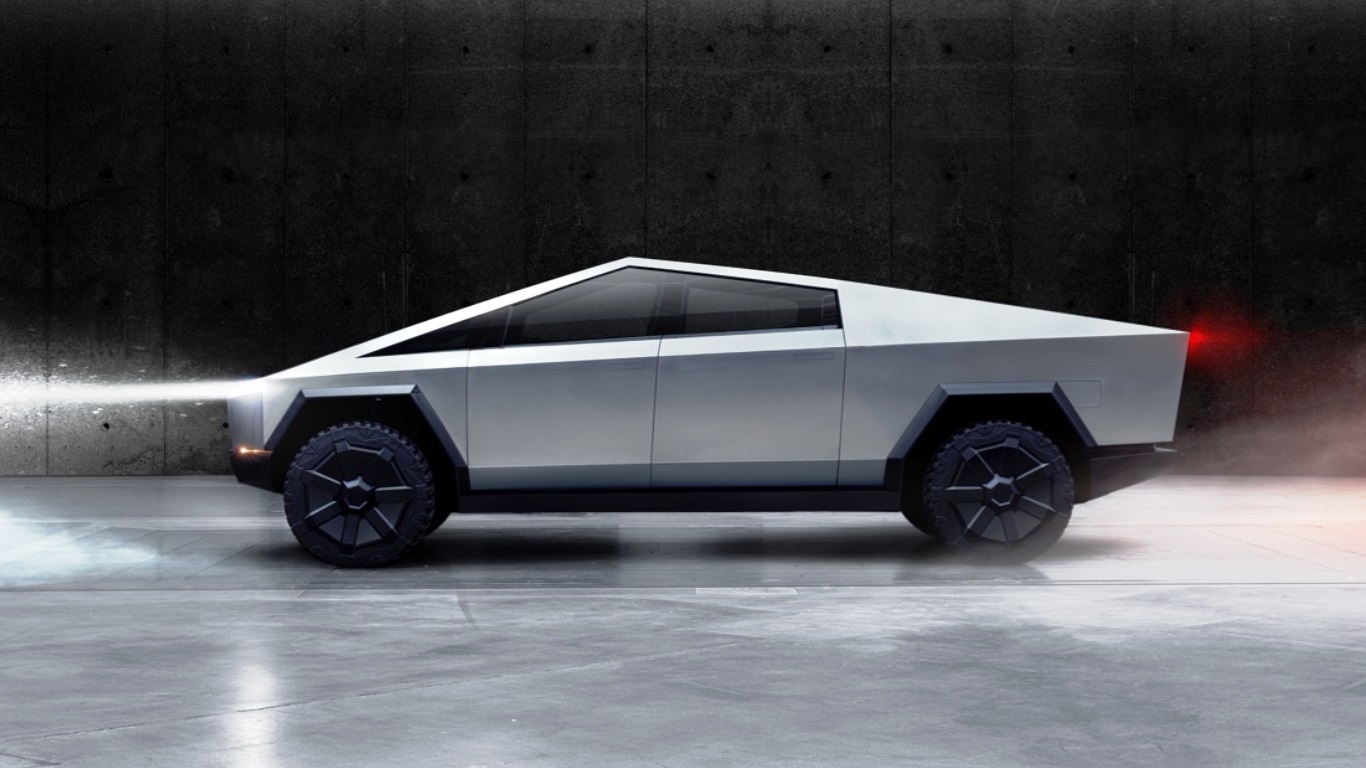

Since the beginning of the year, shares of Tesla Inc. (NASDAQ: TSLA) have added more than 135%, wiping out memories of the stock’s massive share price decline in the fourth quarter of last year and lifting the stock price by more than 20% over the past 12 months.

The world’s premier EV maker is building and selling more vehicles every quarter, and the coming production of the Cybertruck is expected to gin up even more interest in the company’s entire line of cars. The price cuts Tesla fiddled with in the first half of the year appear to have had the results the company wanted.

Sentiment toward Tesla remains moderately bullish. Of 38 analysts covering the stock, 15 have a Buy or a Strong Buy rating, and 18 more have Hold ratings. At a share price of around $290.00, the stock has surpassed its median price target of $240.00. Based on a high price target of $350.00, the upside potential is 20.7%.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.