On December 10, Apple Inc. (NASDAQ: AAPL) celebrated its 43rd anniversary as a publicly traded stock. Apple stock made its 1980 debut at $20 per share. Since the IPO, the stock has split 5 times, three 2-for-1 splits, one 7-for-1 split, and one 4-for-1 split. An investor who purchased 1,000 shares of Apple at its IPO would now own 224,000 shares.

The IPO price, adjusted for the splits, would be $0.10 per share. At a current price of around $193 per share, an initial investment of $20,000 to purchase those first thousand shares would now be worth more than $43 million. Apple stock posted its all-time high of $198.23 in mid-July of this year.

Apple’s 21st century

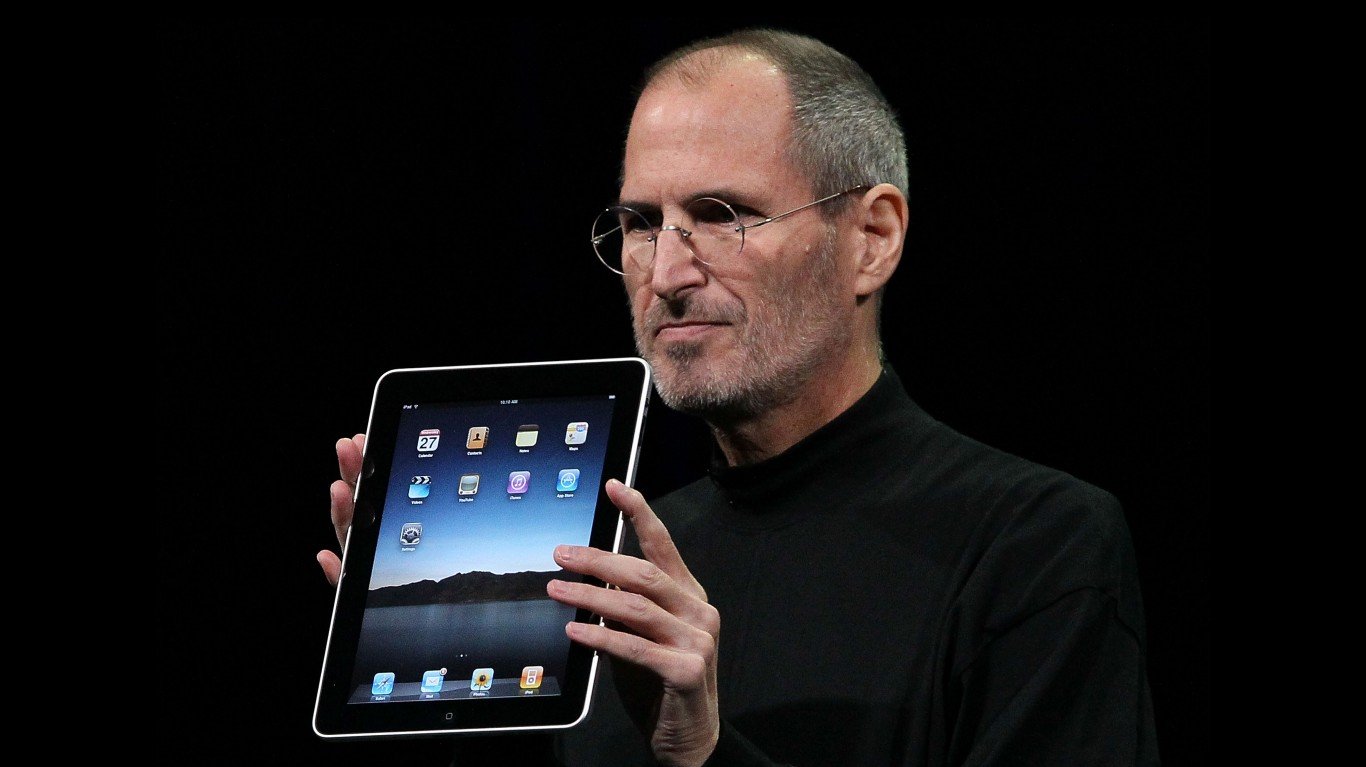

By June of 2000, Apple had completed two 2-for-1 stock splits. The first, in 1987, followed the success of the Macintosh. The second came in 2000, three years after Apple rehired co-founder and former CEO Steve Jobs after firing him in 1985. Jobs launched the iMac in 1998, but the big successes were still to come.

Apple launched the iPod music player in 2001 with a retail price of $399. By January 2006, Apple’s stock price had risen by more than 800%. In June 2007, Apple released its first iPhone for a retail price of $499. A month later, the stock traded down by more than 40% from its high just 18 months earlier.

By January 2008, the stock had recovered about two-thirds of its losses, but by the end of the year, the global financial crisis had given back all those gains, with an additional 35% dip tacked on.

Between the end of 2008 and the end of 2015, Apple stock added about 875%. Between 2015 and the end of 2022, the stock piled up another gain of around 440%. Through Friday, the stock has gained about 700% since the end of 2015.

Warren Buffett’s Berkshire Hathaway Inc. (NYSE: BRK-B) acquired its first shares of Apple stock in 2016. Berkshire’s $363 billion stock portfolio now includes 915.5 million shares, representing just over 48% of the firm’s holdings. Buffett has never sold a single share of Apple stock.

The 7-year breaks

In trying to figure out where Apple stock will be seven years from now, it may be more interesting to look at the company’s growth over the three seven-year periods between 2001 and 2022.

2001 to 2008

- Revenue growth: $7.98 billion to $37.49 billion (up 370%)

- Net income growth: -$25 million to $61.19 million

- Gross profit margin: 23.03% to 35.20% (up 52.8%)

- Net Margin: -0.47% to 16.32%

2008 to 2015

- Revenue growth: $37.49 billion to $233.72 billion (up 523%)

- Net income growth: $6.19 billion to $53.39 billion (up 763%)

- Gross profit margin: 35.20% to 40.06% (up 13.8%)

- Net Margin: 16.32% to 22.85% (up 40.01%)

2015 to 2022

- Revenue growth: $233.72 to $394.33 billion (up 68.7%)

- Net income growth: $53.39 billion to $99.80 billion (up 86.9%)

- Gross profit margin: 40.06% to 43.31% (up 8.11%)

- Net Margin: 22.85% to 25.31% (up 10.77%)

2023 y/y

- Revenue: $383.29 billion (down 2.80%)

- Net income: $97.00 billion (down 1.8%)

- Gross profit margin: 44.13% (up 1.9%)

- Net margin: 25.31% (flat)

Until the 2023 fiscal year that ended in September, Apple had only posted a year-over-year revenue dip in two other years and a net income decline in three other years. Apple’s price-to-sales (P/S) multiple for the next 12 months is forecast at 7.5x, a slight decline from its trailing 12-month multiple of 7.8x. The price-to-earnings (P/E) multiple for the next 12 months is forecast at 29.2x, down from 31.2x for the trailing 12 months.

Projected 2030 stock prices for Apple

Our predicted prices for Apple stock in 2030 are $920 (base), $1,577 (bull), and $513 (bear). We’ll break down each of these scenarios in more detail below.

Base case for Apple

It took more than five years from the launch of the iPod in 2001 for Apple to sell 100 million of the devices. Sales of the first 100 million iPhones, launched in 2007, took more than four years. iPod sales reached their peak of 54.83 million units in 2008. Annual iPhone sales reached 93 million in 2011 and reached a peak of 237.9 million units sold in 2021. iPad, launched in early 2010, reached a sales peak of 97 million in 2014, and Apple Watch, launched in 2015, posted its highest annual sales to date in 2022 with 53.9 million units sold.

Apple needs a new, next big thing. Refreshing iPhones, iPads, and Watches with more powerful chips, more storage, and more capable software will only take a $3 trillion company so far. Raising prices for services like Apple Music and Apple TV+ offers incremental revenue, but the best Apple can hope for is that higher prices will help keep gross margins above 40% and net margins above 25%.

Will that next big thing be VisionPro, Apple’s mixed reality headset that will cost early users $3,500? The headset is supposed to arrive early in 2024 and only in company stores. On the September quarter’s conference call, CEO Tim Cook said the company plans “a very different [sales] process than the normal grab-and-go kind of process” for the VisionPro.

Apple also missed the AI bandwagon and now has to play catch-up. The company has developed its own large language model, dubbed Ajax, for internal use, but polishing it up for a commercial release is not scheduled to happen until late next year.

Analysts fully expect Apple to see revenue and profit growth in 2024 and beyond. If the company can maintain its roughly 25% annualized share price growth rate until 2030, the share price will rise to $740 before any potential stock split. That’s our base case.

Bear case for Apple

Until Apple gins up its next big thing, it will depend on its services revenue to continue rising. Since 2012, services revenue has increased from $3 billion to $22.3 billion. That works out to annual growth of about 40%.

Now that its fintech agreement with Goldman Sachs appears to be over, Apple needs to find a replacement. The longer that takes, the harder it will be to keep up the growth pace.

Apple Watch’s health-related features provide another opportunity to grow the company’s services revenue.

Sales of iPhones, iPads, and Watches also have to maintain high sales levels with high margins. Apple has been able to do this for virtually as long as it’s been in existence.

Added growth will have to come from VisionPro, and the successful integration of generative AI capability with the company’s Macs, iPads, iPhones, and Watches.

One last thing to consider is how low CEO Tim Cook will remain in his job. In an interview with Dua Lipa last month, Cook, who is 63, said he has a detailed succession plan, but he did not reveal any of those details. If he stays through 2025, Cook will receive more than 1 million shares of Apple stock to add to the million he already holds.

That’s a lot to juggle, and failing to do so could reduce the company’s growth rate by as much as 10 percentage points, yielding a share price of $513 in 2030. That’s our bear case for the stock.

Bull case for Apple

Our base case for Apple’s stock price in 2030 yields a share price gain of around 280%. Over the past 20 years, Apple’s share price has risen by more than 600%. That seems almost impossible to repeat in just seven years.

If Apple can get the VisionPro headset down around $1,000 by 2025 or 2026, sales of the device could soar. A longer shot is an Apple-quality generative AI app. Keeping services revenue at an annual growth rate of 40% or more will boost gross margin and profits even more.

Let’s assume that Apple succeeds wildly with the headset, achieves modest success with its AI efforts, and keeps increasing its services revenue. That could lift its average share price increase over the seven-year period from around 25% (our base case) to around 35%. If that happens, Apple stock could reach $1,577 a share by 2030. That’s our bull case for the stock.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.