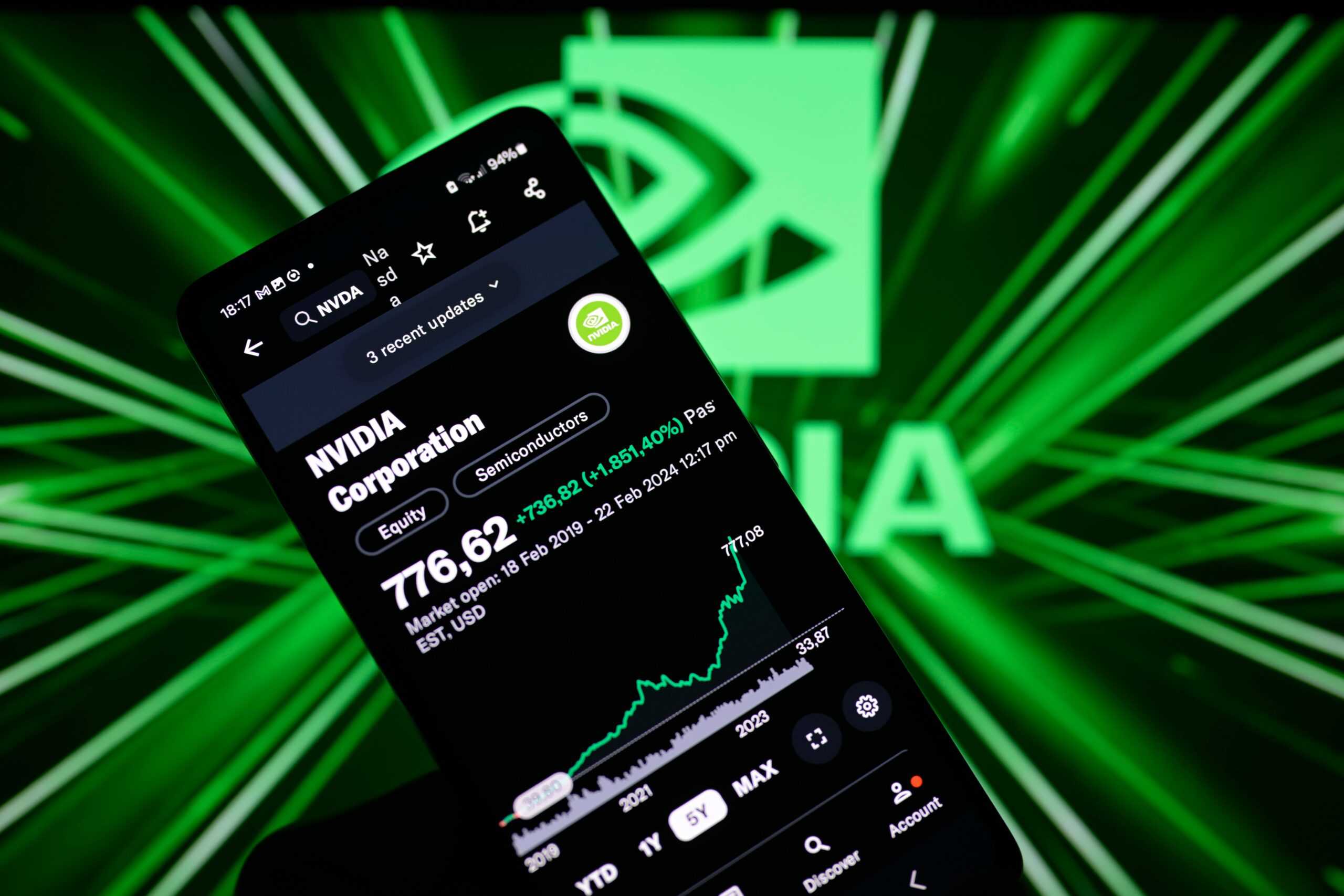

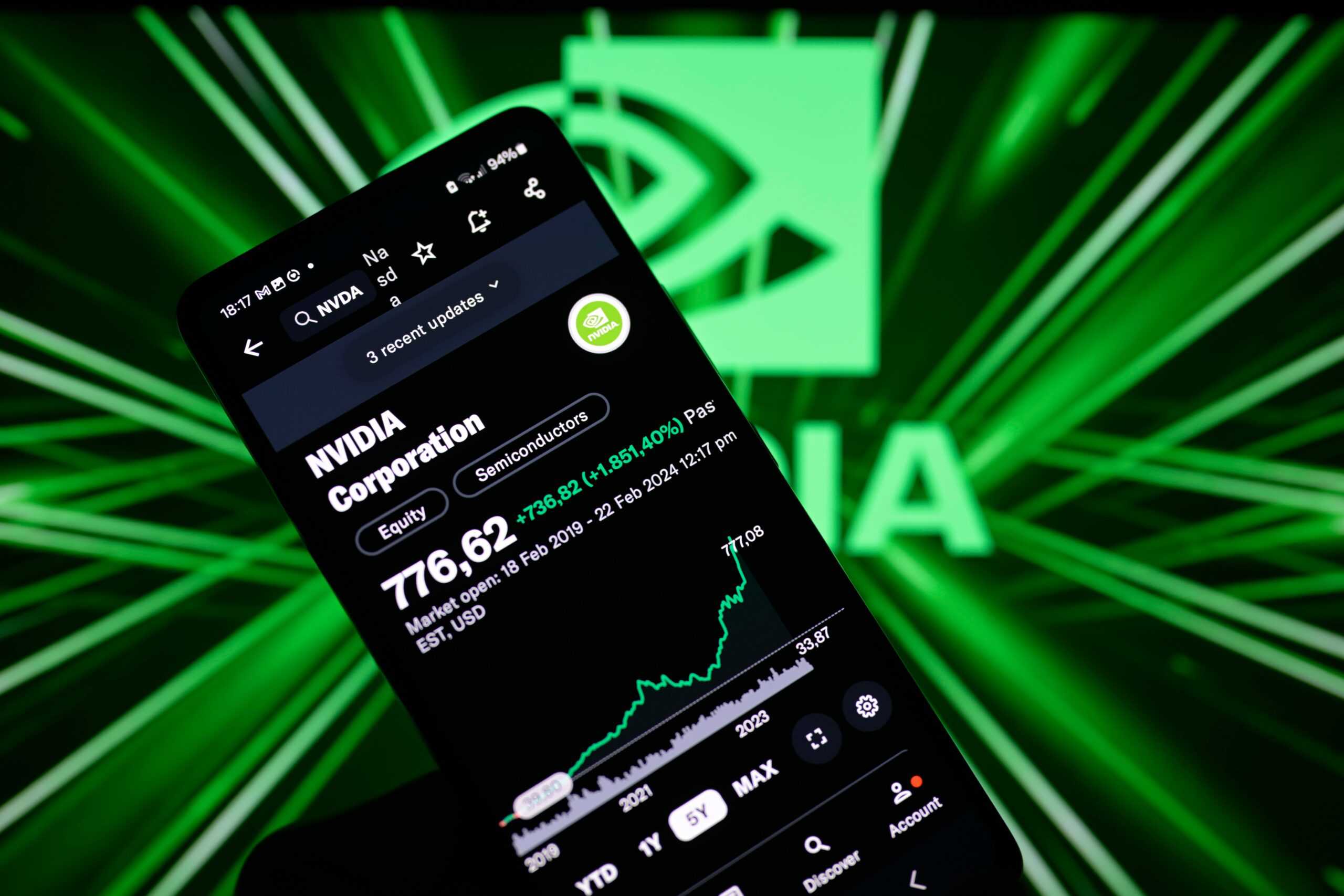

In today’s 24/7 Wall St. podcast episode, Doug McIntyre and Lee Jackson discuss the AI driven market we have today, and ask whether it’s run it’s course. The ‘Magnificent Seven’ have dragged the rest of the market higher year to date, but multiples at companies like Nvidia (Nasdaq: NVDA) have become stretched and geopolitical risks loom on the horizon. Doug cautions that any weakness in bellwether stocks like Apple (Nasdaq:AAPL) could trigger a broader fear based sell off as people rush for the exits. You don’t want to be the last one in, or the last one out.

Transcript:

It’s Doug McIntyre, the editor-in-chief at 24-7 Wall Street.

And I’m here with Lee Jackson, who is our senior editor for all things that have to do with the stock market, finance, publicly held companies.

We’re going to talk a little bit today about whether the market has really run its course.

And if it has, is it one of the things where you have sort of a gradual tapering off, which has happened before in history?

Or do you have one of these, you know, resets that’s like, 15 in a couple of days so we’ll look into that so lee here’s my observation this is unprecedented I mean there’s some cases in the past where you’ve had really great aggressive market runs but this has been fueled by seven stocks the magnificent seven as you call them but one of the things is that’s group has started to thin out And you’re seeing really big market movers that have carried a lot of this on their shoulders, particularly Apple.

There’s some other ones like Tesla, but you know, once Apple, which was the number one market cap company for a long, long time starts to really die out as a market leader, you’ve got an AI driven stock market.

So where does that leave us?

Well, you know, this kind of, huge run-up has happened, but it’s only been a few times over the last, say, 40 years.

And the Magnificent Seven was kind of more from the old Fang rally that kind of started in 2020 and 21, which was, you Apple, Netflix, Google, you know, other names for those stocks, of course, now.

But that’s kind of morphed into this.

And the difference between now and, say, 2000 and 1999 is at least the AI stocks that have bled everything higher, at least they make some money.

But they’re now even NVIDIA is trading at a huge, huge multiple.

And even it’s starting to run into a wall.

Yeah, it’s starting to run into a wall.

Some of the things, as you know, that make the market collapse have nothing to do with stocks or publicly held companies.

Right.

There is certainly a threat right now, particularly in the Middle East, that you could have some real geopolitical ugliness.

It isn’t just that the market gets nervous about those things.

Usually big problems in the Middle East affect oil prices, right?

So, you know, everybody says, well, inflation is tamed, inflation is tamed, it’s going down.

But the Fed is not quite there yet.

They’re still, you know, pushing the question about rates further and further into the year.

If you have real problems that cause inflation to come back, even if it’s just energy based, that by itself could cripple this market badly.

Oh, absolutely.

And I think there’s a good chance that a summer hike, which was kind of built in after they paused last month, that could get moved to the fall.

And Powell is going to be very reluctant to lower rates in the fall in front of the election.

Yeah, you don’t want to be the spoiler.

You don’t want to be the Fed chair who decided that he was going to affect the Elections.

I think you’re right.

I think if you get to August, September, they’re just going to leave it alone and say, you know, we can wait till after the election.

Right.

We’ll wait till the end of the year.

Now, of course, we have earnings.

People sometimes forget that there’s earnings and anything to do with stock prices.

But I would think that Apple could be pretty rough.

I understand it’s done badly, but if Apple does badly, it will still be considered a bellwether.

I know it’s not an AI-based stock, but Apple has still been a really, really big lifter of this market.

If you see any weakness at all as you move into Microsoft and Alphabet, I think that’s another thing that could trigger a big sell-off.

Yeah, absolutely.

And remember, the big shareholders are not mom and pop accounts.

The big shareholders are BlackRock, Fidelity, Vanguard.

And if they see it going wrong, they will pull the ripcord on anything and take down 20% of their position, maybe more.

It’s because they probably have huge gains.

They have huge gains.

And look, so do individuals.

I mean, there’s a point at which, unless you’re incredibly greedy, if you’ve held a stock and it’s up, 60% and you smell a sell down, I think those people say, well, I’m going to lock in my 40% before it becomes, you know, 20%.

So I think you could see a lot of people hit the exits if it looks like the market is going to start to sell

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.