Special Report

50 Top Ranked Colleges That Pay Off the Least

Published:

Last Updated:

For a special few Americans, such as Bill Gates, Steve Jobs, and Mark Zuckerberg, completing college was unnecessary — perhaps even a hindrance — to their vision and success. Most people, however, consider college to be fundamental to achieving their goals and doing well in life.

In fact, the number of people attending degree-granting postsecondary institutions has grown to 17 million – a 30% increase since 2000, according to the National Center for Education Statistics.

Not all college degrees translate to financial success, however. In addition to nearly 70% of students graduating with debt in recent years, many graduates of even the country’s top-ranked schools are earning comparatively low salaries in the working world.

The average median salary for graduates who completed a four-year degree at one of the 206 schools the U.S. News & World Report considers to be the best national universities and national liberal arts colleges is nearly $54,000 a decade after graduating. Graduates from the 50 schools that produce the highest earners bring in nearly $70,000 on average.

On the other end of the spectrum, graduates from 84 schools report a median annual earnings of less than $50,000 a decade after entering school. Graduates from 15 schools report median earnings of less than $40,000 a year, and graduates from three less than $30,000.

In addition to being unable to promise high wages for students later in life, many colleges frequently increase tuition. Barely two decades ago, average tuition for a four-year private college or university was less than $15,000. Today, nearly three-quarters of the top ranked schools charged over $40,000 in tuition and fees in the 2016-2017 school year. This includes 33 of the schools that produced the lowest-earning graduates.

Click here to see the top ranked colleges that pay off the least.

Click here to see our detailed findings and methodology.

50. Furman University (S.C.)

> Typical salary 10 yrs. after entry: $46,700

> Cost of four-year degree:$116,320

> Typical student debt: $20,000

> Most common degree awarded: Social Sciences (15.7%)

[in-text-ad]

49. Westmont College (Calif.)

> Typical salary 10 yrs. after entry: $46,800

> Cost of four-year degree:$121,480

> Typical student debt: $19,500

> Most common degree awarded: Parks, Recreation, Leisure, and Fitness Studies (13.6%)

48. Millsaps College (Miss.)

> Typical salary 10 yrs. after entry: $45,600

> Cost of four-year degree:$85,440

> Typical student debt: $22,394

> Most common degree awarded: Business, Management, Marketing, and Related Support Services (24.1%)

47. Indiana University-Bloomington (Ind.)

> Typical salary 10 yrs. after entry: $44,700

> Cost of four-year degree:$57,480

> Typical student debt: $19,000

> Most common degree awarded: Business, Management, Marketing, and Related Support Services (19.1%)

[in-text-ad-2]

46. Miami University-Oxford (Ohio)

> Typical salary 10 yrs. after entry: $45,500

> Cost of four-year degree:$94,364

> Typical student debt: $16,500

> Most common degree awarded: Business, Management, Marketing, and Related Support Services (24.8%)

45. St Lawrence University (N.Y.)

> Typical salary 10 yrs. after entry: $45,500

> Cost of four-year degree:$108,616

> Typical student debt: $25,000

> Most common degree awarded: Social Sciences (28.4%)

[in-text-ad]

44. Florida State University (Fla.)

> Typical salary 10 yrs. after entry: $44,000

> Cost of four-year degree:$63,308

> Typical student debt: $18,750

> Most common degree awarded: Business, Management, Marketing, and Related Support Services (19.0%)

43. St Olaf College (Minn.)

> Typical salary 10 yrs. after entry: $45,000

> Cost of four-year degree:$99,932

> Typical student debt: $25,304

> Most common degree awarded: Social Sciences (18.6%)

42. University of Vermont (Vt.)

> Typical salary 10 yrs. after entry: $43,900

> Cost of four-year degree:$63,352

> Typical student debt: $17,806

> Most common degree awarded: Social Sciences (11.4%)

[in-text-ad-2]

41. Spelman College (Ga.)

> Typical salary 10 yrs. after entry: $46,000

> Cost of four-year degree:$137,232

> Typical student debt: $25,000

> Most common degree awarded: Social Sciences (26.9%)

40. Pitzer College (Calif.)

> Typical salary 10 yrs. after entry: $45,100

> Cost of four-year degree:$110,496

> Typical student debt: $15,300

> Most common degree awarded: Social Sciences (22.6%)

[in-text-ad]

39. Kenyon College (Ohio)

> Typical salary 10 yrs. after entry: $44,700

> Cost of four-year degree:$116,812

> Typical student debt: $17,525

> Most common degree awarded: Social Sciences (28.9%)

38. Smith College (Mass.)

> Typical salary 10 yrs. after entry: $44,400

> Cost of four-year degree:$109,624

> Typical student debt: $19,000

> Most common degree awarded: Social Sciences (25.7%)

37. University of California-Santa Cruz (Calif.)

> Typical salary 10 yrs. after entry: $43,000

> Cost of four-year degree:$64,344

> Typical student debt: $16,500

> Most common degree awarded: Biological and Biomedical Sciences (17.7%)

[in-text-ad-2]

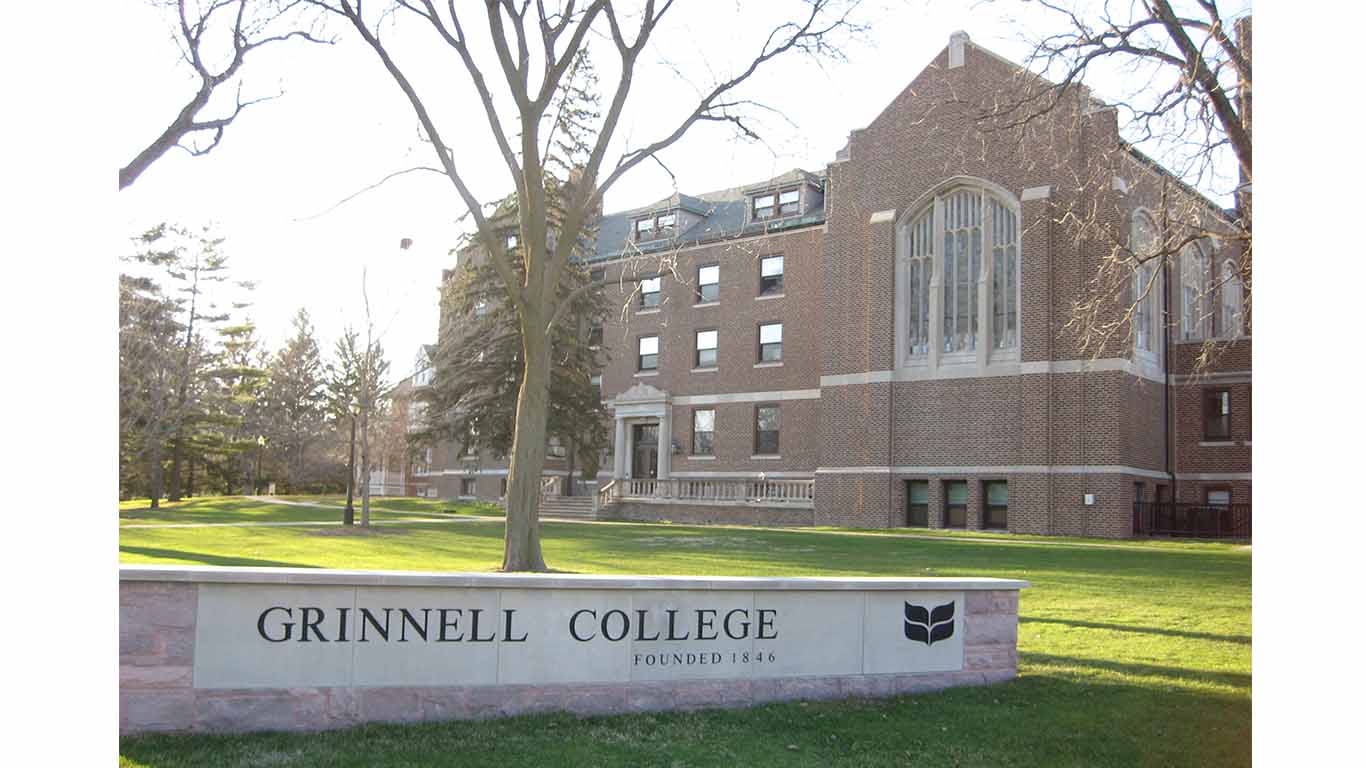

36. Grinnell College (Iowa)

> Typical salary 10 yrs. after entry: $43,100

> Cost of four-year degree:$75,076

> Typical student debt: $10,077

> Most common degree awarded: Social Sciences (32.1%)

35. Mount Holyoke College (Mass.)

> Typical salary 10 yrs. after entry: $44,100

> Cost of four-year degree:$109,288

> Typical student debt: $19,968

> Most common degree awarded: Social Sciences (31.0%)

[in-text-ad]

34. Ohio State University-Main Campus (Ohio)

> Typical salary 10 yrs. after entry: $42,900

> Cost of four-year degree:$72,272

> Typical student debt: $16,188

> Most common degree awarded: Business, Management, Marketing, and Related Support Services (17.5%)

33. Centre College (Ky.)

> Typical salary 10 yrs. after entry: $43,300

> Cost of four-year degree:$89,624

> Typical student debt: $23,250

> Most common degree awarded: Social Sciences (28.7%)

32. Washington College (Md.)

> Typical salary 10 yrs. after entry: $44,000

> Cost of four-year degree:$120,316

> Typical student debt: $25,107

> Most common degree awarded: Social Sciences (21.8%)

[in-text-ad-2]

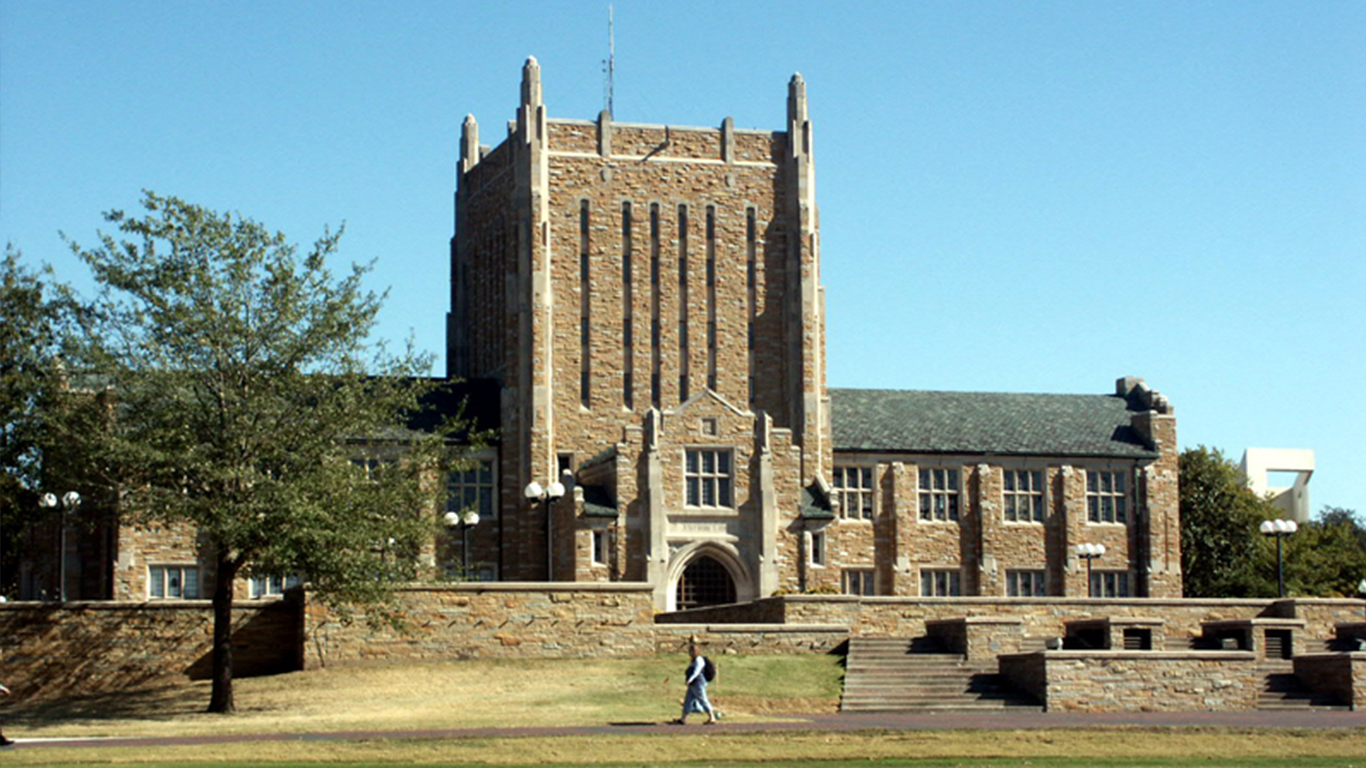

31. University of Tulsa (Okla.)

> Typical salary 10 yrs. after entry: $43,600

> Cost of four-year degree:$107,376

> Typical student debt: $20,000

> Most common degree awarded: Engineering (22.3%)

30. Wheaton College (Mass.)

> Typical salary 10 yrs. after entry: $44,100

> Cost of four-year degree:$124,692

> Typical student debt: $23,189

> Most common degree awarded: Social Sciences (23.1%)

[in-text-ad]

29. Whitman College (Wash.)

> Typical salary 10 yrs. after entry: $43,800

> Cost of four-year degree:$118,196

> Typical student debt: $15,750

> Most common degree awarded: Social Sciences (23.2%)

28. Clark University (Mass.)

> Typical salary 10 yrs. after entry: $42,800

> Cost of four-year degree:$88,260

> Typical student debt: $23,798

> Most common degree awarded: Social Sciences (26.3%)

27. SUNY College of Environmental Science and Forestry (N.Y.)

> Typical salary 10 yrs. after entry: $42,000

> Cost of four-year degree:$73,284

> Typical student debt: $17,418

> Most common degree awarded: Natural Resources and Conservation (38.4%)

[in-text-ad-2]

26. Skidmore College (N.Y.)

> Typical salary 10 yrs. after entry: $43,000

> Cost of four-year degree:$108,692

> Typical student debt: $18,495

> Most common degree awarded: Visual and Performing Arts (17.4%)

25. Wheaton College (Ill.)

> Typical salary 10 yrs. after entry: $42,500

> Cost of four-year degree:$95,600

> Typical student debt: $21,500

> Most common degree awarded: Social Sciences (14.0%)

[in-text-ad]

24. Ohio Wesleyan University (Ohio)

> Typical salary 10 yrs. after entry: $42,700

> Cost of four-year degree:$111,292

> Typical student debt: $22,191

> Most common degree awarded: Social Sciences (15.4%)

23. Knox College (Ill.)

> Typical salary 10 yrs. after entry: $41,700

> Cost of four-year degree:$84,004

> Typical student debt: $23,080

> Most common degree awarded: Social Sciences (24.1%)

22. Luther College (Iowa)

> Typical salary 10 yrs. after entry: $41,800

> Cost of four-year degree:$97,284

> Typical student debt: $26,968

> Most common degree awarded: Visual and Performing Arts (13.9%)

[in-text-ad-2]

21. Cornell College (Iowa)

> Typical salary 10 yrs. after entry: $40,900

> Cost of four-year degree:$82,928

> Typical student debt: $26,332

> Most common degree awarded: Social Sciences (17.9%)

20. Sewanee-The University of the South (Tenn.)

> Typical salary 10 yrs. after entry: $40,600

> Cost of four-year degree:$82,400

> Typical student debt: $15,417

> Most common degree awarded: Social Sciences (18.7%)

[in-text-ad]

19. Lawrence University (Wis.)

> Typical salary 10 yrs. after entry: $41,100

> Cost of four-year degree:$100,652

> Typical student debt: $26,133

> Most common degree awarded: Visual and Performing Arts (21.9%)

18. Hendrix College (Ark.)

> Typical salary 10 yrs. after entry: $40,500

> Cost of four-year degree:$94,252

> Typical student debt: $18,225

> Most common degree awarded: Biological and Biomedical Sciences (20.4%)

17. Lewis & Clark College (Ore.)

> Typical salary 10 yrs. after entry: $41,100

> Cost of four-year degree:$134,380

> Typical student debt: $19,500

> Most common degree awarded: Social Sciences (22.2%)

[in-text-ad-2]

16. Transylvania University (Ky.)

> Typical salary 10 yrs. after entry: $39,700

> Cost of four-year degree:$87,252

> Typical student debt: $23,320

> Most common degree awarded: Business, Management, Marketing, and Related Support Services (14.3%)

15. Oberlin College (Ohio)

> Typical salary 10 yrs. after entry: $40,300

> Cost of four-year degree:$117,944

> Typical student debt: $24,000

> Most common degree awarded: Visual and Performing Arts (24.4%)

[in-text-ad]

14. SUNY Buffalo State (N.Y.)

> Typical salary 10 yrs. after entry: $38,100

> Cost of four-year degree:$47,596

> Typical student debt: $15,000

> Most common degree awarded: Education (18.8%)

13. Agnes Scott College (Ga.)

> Typical salary 10 yrs. after entry: $38,800

> Cost of four-year degree:$74,068

> Typical student debt: $22,750

> Most common degree awarded: Social Sciences (21.0%)

12. Colorado College (Colo.)

> Typical salary 10 yrs. after entry: $39,700

> Cost of four-year degree:$109,736

> Typical student debt: $18,000

> Most common degree awarded: Social Sciences (28.2%)

[in-text-ad-2]

11. Bard College (N.Y.)

> Typical salary 10 yrs. after entry: $38,700

> Cost of four-year degree:$116,608

> Typical student debt: $20,000

> Most common degree awarded: Liberal Arts and Sciences, General Studies and Humanities (39.0%)

10. Beloit College (Wis.)

> Typical salary 10 yrs. after entry: $37,900

> Cost of four-year degree:$94,388

> Typical student debt: $23,250

> Most common degree awarded: Social Sciences (22.0%)

[in-text-ad]

9. Sarah Lawrence College (N.Y.)

> Typical salary 10 yrs. after entry: $37,000

> Cost of four-year degree:$133,020

> Typical student debt: $13,126

> Most common degree awarded: Liberal Arts and Sciences, General Studies and Humanities (100.0%)

8. Berea College (Ky.)

> Typical salary 10 yrs. after entry: $33,400

> Cost of four-year degree:$12,268

> Typical student debt: $5,428

> Most common degree awarded: Biological and Biomedical Sciences (9.9%)

7. Reed College (Ore.)

> Typical salary 10 yrs. after entry: $35,200

> Cost of four-year degree:$83,520

> Typical student debt: $14,346

> Most common degree awarded: Social Sciences (20.3%)

[in-text-ad-2]

6. St John’s College (Md.)

> Typical salary 10 yrs. after entry: $35,200

> Cost of four-year degree:$117,824

> Typical student debt: $21,000

> Most common degree awarded: Liberal Arts and Sciences, General Studies and Humanities (100.0%)

5. Earlham College (Ind.)

> Typical salary 10 yrs. after entry: $33,400

> Cost of four-year degree:$75,676

> Typical student debt: $18,500

> Most common degree awarded: Biological and Biomedical Sciences (16.7%)

[in-text-ad]

4. Thomas Aquinas College (Calif.)

> Typical salary 10 yrs. after entry: $30,200

> Cost of four-year degree:$81,840

> Typical student debt: $16,188

> Most common degree awarded: Liberal Arts and Sciences, General Studies and Humanities (100.0%)

3. St. John’s College (N.M.)

> Typical salary 10 yrs. after entry: $27,600

> Cost of four-year degree:$96,508

> Typical student debt: $19,500

> Most common degree awarded: Liberal Arts and Sciences, General Studies and Humanities (100.0%)

2. College of the Atlantic (Maine)

> Typical salary 10 yrs. after entry: $26,400

> Cost of four-year degree:$69,852

> Typical student debt: $15,334

> Most common degree awarded: Multi/Interdisciplinary Studies (100.0%)

[in-text-ad-2]

1. Bennington College (Vt.)

> Typical salary 10 yrs. after entry: $24,600

> Cost of four-year degree:$111,604

> Typical student debt: $19,500

> Most common degree awarded: Visual and Performing Arts (46.5%)

Detailed Findings and Methodology

While the group of schools considered for this article consists approximately of half universities and half liberal arts colleges, the majority of schools producing graduates earning the least are liberal arts colleges. Only 14 of the 50 listed are universities. This could result from a higher share of university students majoring in subjects such as the STEM – science, technology, engineering and mathematics – disciplines, which often lead to higher paying jobs.

In over half of the colleges on the list the yearly tuition fees are higher than the reported median earnings of graduates. At Bennington College – which holds the number one position on this list with most graduates not even earning $25,000 a year — a year’s tuition is $25,970 more than the median earnings after attending. The most common major at this school is Visual and Performing Arts.

To identify the 50 top-ranked colleges that produce graduates that earn the least, 24/7 Wall St. reviewed the median earnings of former students who received federal financial aid that are working and not enrolled in school 10 years after entry from the U.S. Department of Education, last updated in 2017. These earnings were then compared with U.S. News & World Report’s 2017 rankings of the 206 best national universities and liberal arts colleges, with the exceptions of United States service academies and Soka University of America, New College of Florida, and Hillsdale College, for which data was not available. Tuition data is for 2016-2017 and was provided by U.S. News. The percentage of students earning over $25,000 a year 10 years after entering school was provided by the U.S. Department of Education.

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.