The COVID-19 pandemic is, first and foremost, a public health crisis. However, the harm the virus has wrought extends far beyond public health. The U.S. economy has been devastated — and Americans are far less optimistic about their own personal finances and the broader business conditions today than they were just a few months ago.

The growing economic pessimism is well warranted. Consumer spending accounts for about 70% of GDP, and in recent months, social distancing and stay-at-home orders have ground much of the economy to halt, prompting historic unemployment claims in the tens of millions.

24/7 Wall St. reviewed changes in the consumer sentiment index from research company Morning Consult to determine how far consumer confidence has declined in each state from March 1 through May 15.

According to Morning Consult, consumer confidence is not necessarily impacted by the coronavirus’s local or regional spread. Rather, broader national trends appear to have a more significant impact on economic optimism. Still, some of the states where consumer confidence has fallen the most, like Connecticut and Massachusetts, also have higher than typical concentrations of the virus. Here is a look at the states with the highest number of COVID-19 cases.

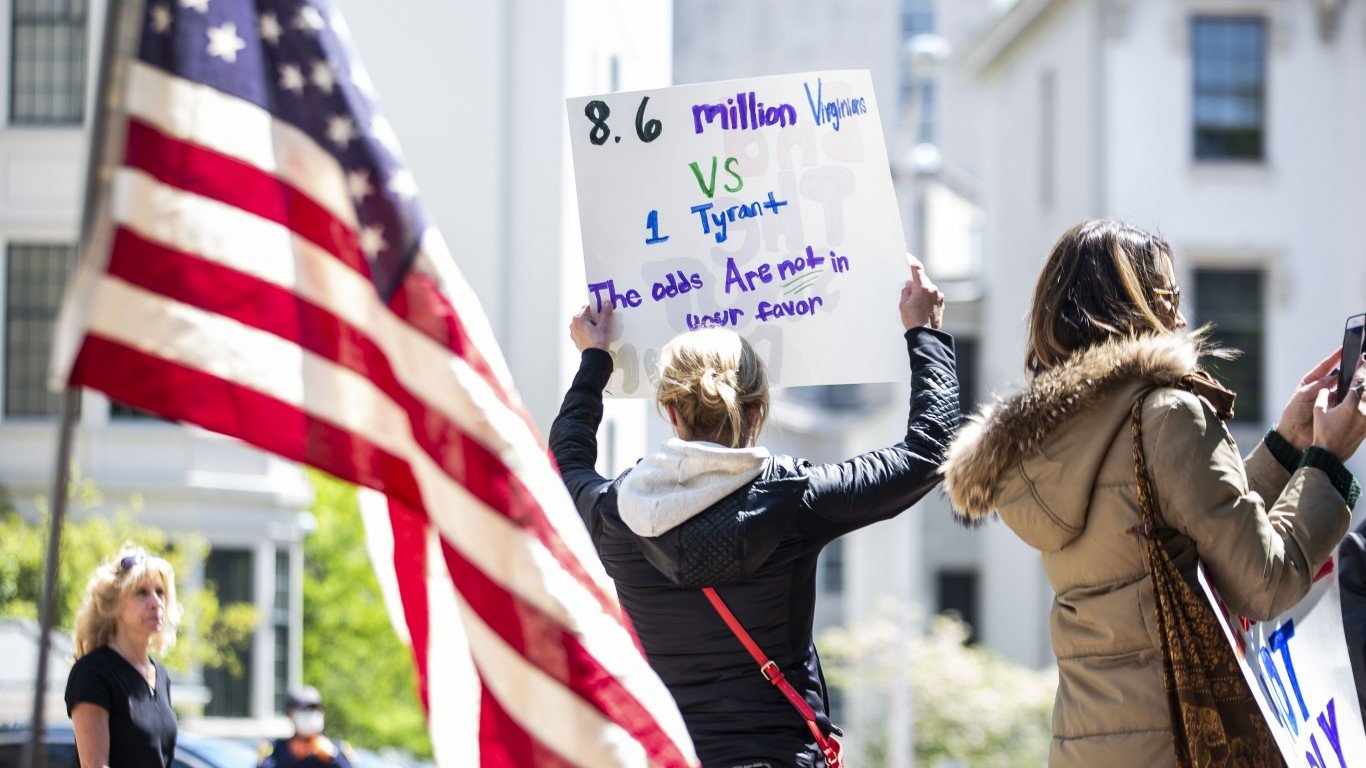

In many states, the precipitous fall in consumer confidence is likely linked at least in part to government-mandated business closures and stay-at-home orders. Some of the states with smaller than average declines, such as Montana and South Dakota, have had some of the shortest and least restrictive orders. However, even as states have begun to relax social distancing measures in one way or another, such easing appears to have had little effect on boosting economic optimism. Here is a look at every state’s rules for staying at home and social distancing.

Click here to see how COVID-19 has wrecked consumer confidence in all 50 states

Click here to read our methodology

50. New Mexico

> Chg. in consumer confidence from March 1 to May 15: -20.1% (115.0 to 91.9)

> Pct. of workers in high-risk industries: 18.8% (18th highest)

> Unemployment claims since mid-March: 146,207 (15.4% of workforce – 7th lowest)

> Chg. in avg. time spent at home: 15.0% more than normal

> COVID-19 cases as of May 18, 2020: 290.9 per 100,000 people — 21st highest (total: 6,096)

Since the beginning of March, consumer confidence in New Mexico has fallen by 20.1% — the smallest decline of any state. The relatively small drop in consumer confidence may be due in part to lower than average job losses. Since mid-March, 146,000 workers in the state have filed for unemployment — or 15.4% of the total work force, a smaller share than in the majority of states.

New Mexico is also well ahead of most states in terms of testing for the virus. As of May 18, the state conducted nearly 6,600 tests for every 100,000 people, well above the comparable scope of testing nationwide of 3,615 tests per 100,000 people.

[in-text-ad]

49. South Dakota

> Chg. in consumer confidence from March 1 to May 15: -21.4% (115.0 to 90.4)

> Pct. of workers in high-risk industries: 14.5% (2nd lowest)

> Unemployment claims since mid-March: 46,726 (10.2% of workforce – 2nd lowest)

> Chg. in avg. time spent at home: 13.0% more than normal

> COVID-19 cases as of May 18, 2020: 456.5 per 100,000 people — 14th highest (total: 4,027)

In South Dakota, confidence in personal finance and the national economy fell from 115 points on March 1 to 90.4 points on May 15, a 21.4% drop. The decline is lower than in nearly every other state partially because consumer confidence has rebounded in South Dakota in recent weeks. On May 1, consumer confidence hit a year-to-date low of 80.5 points.

The relatively small change in consumer confidence — a survey that measures consumer optimism — may be related in part to the state enacting comparatively few restrictions to contain the spread of the coronavirus. South Dakota is one of only a handful of states to not impose a stay-at-home order.

48. Vermont

> Chg. in consumer confidence from March 1 to May 15: -21.6% (95.1 to 74.6)

> Pct. of workers in high-risk industries: 15.4% (10th lowest)

> Unemployment claims since mid-March: 64,990 (18.9% of workforce – 24th lowest)

> Chg. in avg. time spent at home: 17.0% more than normal

> COVID-19 cases as of May 18, 2020: 150.1 per 100,000 people — 10th lowest (total: 940)

Consumer confidence in Vermont fell by 21.6% from March 1 to May 15, a smaller decline than in nearly every state. Rather than optimism, however, the smaller than average decline is largely because consumer confidence was low in Vermont to begin with. Since the beginning of the year — even before the COVID-19 pandemic — Vermonters have had a more pessimistic view of the economy than Americans in any other state. May 15 marks the first time Vermont did not rank last in consumer confidence. It is, however, one of only two states where consumer confidence stands below 75 points.

Vermont has implemented relatively strict shutdown measures to contain the virus. As of May 18, certain businesses like restaurants and salons remained closed.

47. Arkansas

> Chg. in consumer confidence from March 1 to May 15: -21.7% (117.8 to 92.2)

> Pct. of workers in high-risk industries: 17.0% (23rd lowest)

> Unemployment claims since mid-March: 213,915 (15.8% of workforce – 10th lowest)

> Chg. in avg. time spent at home: 9.0% more than normal

> COVID-19 cases as of May 18, 2020: 159.7 per 100,000 people — 11th lowest (total: 4,813)

Confidence in personal finance and business conditions nationwide fell in Arkansas by 21.7% from March 1 to May 15. Not only is this one of the smallest declines in consumer confidence over the period, but also the state’s current consumer confidence index score of 92.2 is higher than in all but six other states.

Arkansas is one of only a handful of states to not implement a stay-at-home order. Partially as a result, the time residents have been spending at home during the pandemic climbed by only 9%, the smallest increase among states.

[in-text-ad-2]

46. West Virginia

> Chg. in consumer confidence from March 1 to May 15: -21.8% (111.6 to 87.3)

> Pct. of workers in high-risk industries: 18.2% (20th highest)

> Unemployment claims since mid-March: 147,691 (18.7% of workforce – 23rd lowest)

> Chg. in avg. time spent at home: 10.0% more than normal

> COVID-19 cases as of May 18, 2020: 82.6 per 100,000 people — 4th lowest (total: 1,491)

West Virginia is one of only five states where consumer confidence dropped less than 22% since the beginning of March, when the potential severity of the coronavirus pandemic in the United States came into sharper focus.

West Virginia was the last state to report its first case of COVID-19, and since that day — March 17 — the virus’s spread has been relatively minimal in the state. As of May 18, there have been fewer than 1,500 known infections in the state — or 83 for every 100,000 people, a fraction of the national known infection rate of 454 per 100,000.

45. Oklahoma

> Chg. in consumer confidence from March 1 to May 15: -22.8% (118.9 to 91.8)

> Pct. of workers in high-risk industries: 19.9% (7th highest)

> Unemployment claims since mid-March: 434,326 (23.7% of workforce – 13th highest)

> Chg. in avg. time spent at home: 10.0% more than normal

> COVID-19 cases as of May 18, 2020: 134.7 per 100,000 people — 8th lowest (total: 5,310)

Since the coronavirus began spreading in the United States, consumer confidence has not suffered as much in Oklahoma as it has in most other states. Currently, the index stands at 91.8 in the state — higher than in all but seven other states and well above the national index score of 86.3 points.

The relative optimism in the state comes despite abysmal economic news in recent weeks. Oklahoma has relatively high employment in industries highly exposed to slowdown in the wake of the pandemic, and since March 15, more than 400,000 state residents have filed for unemployment — equal to nearly one-quarter of the total workforce.

[in-text-ad]

44. Alabama

> Chg. in consumer confidence from March 1 to May 15: -22.9% (128.1 to 98.8)

> Pct. of workers in high-risk industries: 16.8% (21st lowest)

> Unemployment claims since mid-March: 496,706 (22.1% of workforce – 18th highest)

> Chg. in avg. time spent at home: 10.0% more than normal

> COVID-19 cases as of May 18, 2020: 247.3 per 100,000 people — 25th lowest (total: 12,086)

In the early days of the COVID-19 outbreak in the United States around the beginning of March, Alabama had the highest consumer confidence of any state. Although consumer confidence among Alabama residents tumbled by 22.9% since March 1, the decline was smaller than in most states, and Alabama still has the highest consumer confidence score of any state, at 98.8. Nationwide, the consumer confidence index stands at 86.3 points.

Alabama’s stay-at-home order, which started on April 4 and expired on April 30, was one of the shortest among states.

43. Washington

> Chg. in consumer confidence from March 1 to May 15: -23.3% (107.4 to 82.4)

> Pct. of workers in high-risk industries: 15.0% (5th lowest)

> Unemployment claims since mid-March: 1.2 million (31.3% of workforce – 4th highest)

> Chg. in avg. time spent at home: 17.0% more than normal

> COVID-19 cases as of May 18, 2020: 244.6 per 100,000 people — 24th lowest (total: 18,433)

Consumer confidence in Washington state has fallen considerably since March 1, but not as much as in most states. The relatively modest 23.3% decline in consumer confidence came despite widespread layoffs in the wake of the pandemic. Since March 15, 1.2 million people in the state have filed for unemployment, or more than 31% of the total workforce.

Though Washington had the first known case of COVID-19 in the United States, the state was quick to implement a stay-at-home order and other restrictions. It is possible that partially as a result the virus did not spread as much in Washington as it did nationwide. As of May 18, there had been only 245 confirmed cases of COVID-19 for every 100,000 state residents, well below the national infection concentration of 454 per 100,000.

42. Montana

> Chg. in consumer confidence from March 1 to May 15: -23.6% (115.1 to 87.9)

> Pct. of workers in high-risk industries: 19.4% (14th highest)

> Unemployment claims since mid-March: 100,934 (19.2% of workforce – 25th lowest)

> Chg. in avg. time spent at home: 9.0% more than normal

> COVID-19 cases as of May 18, 2020: 44.2 per 100,000 people — the lowest (total: 470)

Montana residents have not lost as much confidence in their financial situation or the broader U.S. economy in both the present and the future as most other Americans. Consumer confidence declined in the state by 23.6% between March 1 and May 15.

Montana is one of the least densely populated states in the country and has been largely spared from the worst effects of COVID-19. There have been just 44 known infections in the state for every 100,000 people, less than in every other state and well below the 454 known cases per 100,000 people nationwide as of May 18, 2020.

[in-text-ad-2]

41. Louisiana

> Chg. in consumer confidence from March 1 to May 15: -23.8% (125.4 to 95.6)

> Pct. of workers in high-risk industries: 19.5% (12th highest)

> Unemployment claims since mid-March: 628,201 (30.2% of workforce – 5th highest)

> Chg. in avg. time spent at home: 12.0% more than normal

> COVID-19 cases as of May 18, 2020: 744.8 per 100,000 people — 8th highest (total: 34,709)

Louisiana has been among the hardest hit states by COVID-19 — both economically and in terms of infections. More than 30% of the state’s workforce have filed for unemployment since March 15, a larger share than in all but four other states. Additionally, there have been 745 known COVID-19 cases for every 100,000 people in the state, well above the nationwide rate of 454 known cases per 100,000 people as of May 18, 2020.

Still, though consumer confidence has taken a major hit in the state — declining by 23.8% since the outbreak began — the drop has not been as precipitous as in much of the rest of the country. And as is the case in most states, consumer confidence is inching back up in Louisiana as restrictions ease. On May 1, the state’s consumer confidence index stood at 93.3, 2.3 points lower than now.

40. Georgia

> Chg. in consumer confidence from March 1 to May 15: -24.2% (126.0 to 95.5)

> Pct. of workers in high-risk industries: 19.7% (9th highest)

> Unemployment claims since mid-March: 2.0 million (39.4% of workforce – the highest)

> Chg. in avg. time spent at home: 14.0% more than normal

> COVID-19 cases as of May 18, 2020: 364.0 per 100,000 people — 18th highest (total: 38,287)

The 24.2% dip in consumer confidence in Georgia between March 1 and May 15 was smaller than in most other states. In early March, Georgia had the second highest consumer confidence score among states, and despite the decline, the state remains relatively optimistic. The state’s consumer confidence index stands at 95.5, higher than in every state other than Alabama and Louisiana.

Counterintuitively, Georgia’s economy has been among the hardest hit by COVID-19. Over 2 million workers in the state have been laid off since mid-March. This is equal to nearly 40% of Georgia’s workforce, the largest share of any state.

[in-text-ad]

39. Florida

> Chg. in consumer confidence from March 1 to May 15: -24.6% (118.6 to 89.4)

> Pct. of workers in high-risk industries: 20.1% (6th highest)

> Unemployment claims since mid-March: 2.2 million (21.5% of workforce – 19th highest)

> Chg. in avg. time spent at home: 15.0% more than normal

> COVID-19 cases as of May 18, 2020: 218.0 per 100,000 people — 19th lowest (total: 46,442)

Confidence in personal finance and the broader economy did not take as large a hit in Florida as it did in most other states. Between March 1 and May 15, consumer confidence fell by 24.6% in the state. As is the case in many states where consumer confidence suffered relatively little, Florida had a shorter than average shutdown period, with a statewide stay-at-home order in place from April 3 until May 4.

With a consumer confidence index score of 89.4, Floridians remain relatively optimistic about the economy — at least more so than residents of most other states. Confidence is high in the state despite the fact that more than a fifth of Florida’s workforce were employed in industries at the highest risk of slowdown in the wake of the coronavirus, like tourism, prior to the start of the pandemic.

38. North Carolina

> Chg. in consumer confidence from March 1 to May 15: -24.7% (121.3 to 91.3)

> Pct. of workers in high-risk industries: 17.6% (23rd highest)

> Unemployment claims since mid-March: 936,545 (18.5% of workforce – 21st lowest)

> Chg. in avg. time spent at home: 14.0% more than normal

> COVID-19 cases as of May 18, 2020: 183.2 per 100,000 people — 16th lowest (total: 19,023)

North Carolina is one of many states in the South where consumer confidence fell by less than 25% between March 1 and May 15. Currently, North Carolina is one of only 12 states with a consumer confidence index score above 90. The state has not been hit as hard by the virus as many others along the Eastern Seaboard. As of May 18, there have been 183 known cases of COVID-19 for every 100,000 state residents, well below the 454 known cases per 100,000 people nationwide.

37. Mississippi

> Chg. in consumer confidence from March 1 to May 15: -24.9% (123.3 to 92.6)

> Pct. of workers in high-risk industries: 19.1% (16th highest)

> Unemployment claims since mid-March: 267,943 (21.1% of workforce – 21st highest)

> Chg. in avg. time spent at home: 9.0% more than normal

> COVID-19 cases as of May 18, 2020: 382.8 per 100,000 people — 17th highest (total: 11,432)

Mississippi’s stay-at-home order, which started on April 2 and expired on April 27, was one of the shortest orders among states. Mobility data further indicates the state’s rapid return to normalcy as Mississippi residents are only staying at home about 9% more than average, tied with two other states — Arkansas and Montana — as the lowest change in the country.

The state’s short shutdown duration — despite a higher concentration of coronavirus cases than in most other states — may partially explain why Mississippi is one of only 14 states where consumer confidence fell by less than 25% from the beginning of March through May 15.

[in-text-ad-2]

36. Kentucky

> Chg. in consumer confidence from March 1 to May 15: -25.0% (116.4 to 87.3)

> Pct. of workers in high-risk industries: 19.4% (13th highest)

> Unemployment claims since mid-March: 789,638 (38.4% of workforce – 2nd highest)

> Chg. in avg. time spent at home: 15.0% more than normal

> COVID-19 cases as of May 18, 2020: 177.6 per 100,000 people — 14th lowest (total: 7,935)

Since nationwide layoffs began in earnest in mid-March, few states have seen the scale of job losses Kentucky has. Since March 15, nearly 800,000 people in the state have filed for unemployment — equal to 38.4% of the state’s labor force, the second largest share of any state.

Despite a devastated job market, Kentucky residents are still more likely to be optimistic about their own finances and nationwide business condition as the state’s consumer confidence score stands at 87.3 — slightly higher than the national level of 86.3. Since March 1, consumer confidence dropped by a quarter in Kentucky, a smaller decline than in most other states.

35. Arizona

> Chg. in consumer confidence from March 1 to May 15: -25.1% (118.5 to 88.8)

> Pct. of workers in high-risk industries: 19.3% (15th highest)

> Unemployment claims since mid-March: 580,559 (16.5% of workforce – 13th lowest)

> Chg. in avg. time spent at home: 14.0% more than normal

> COVID-19 cases as of May 18, 2020: 194.3 per 100,000 people — 17th lowest (total: 13,937)

Arizona has not been hit as hard by COVID-19 as much of the rest of the country — a fact that may help explain the smaller drop in consumer confidence than in most states. Only about 16.5% of the state’s workforce have filed for unemployment since May 15, a smaller share than in most other states. Additionally, there have been 194 known cases of COVID-19 for every 100,000 people in the state, well below the national rate of 454 known cases per 100,000 people as of May 18, 2020.

After declining by a relatively low 25.1% between March 1 and May 15, consumer confidence stands at 88.8 points in Arizona, slightly higher than then the national level of 86.3.

[in-text-ad]

34. South Carolina

> Chg. in consumer confidence from March 1 to May 15: -25.5% (124.1 to 92.5)

> Pct. of workers in high-risk industries: 19.6% (10th highest)

> Unemployment claims since mid-March: 523,885 (22.2% of workforce – 17th highest)

> Chg. in avg. time spent at home: 12.0% more than normal

> COVID-19 cases as of May 18, 2020: 175.9 per 100,000 people — 13th lowest (total: 8,942)

Between March 1 and May 25, consumer confidence dipped by 25.5% in South Carolina — a smaller drop than in most states but a larger decline than in most other Southern states. Consumer confidence was high in South Carolina before the pandemic, and even after the decline, it is higher than most other states. Currently, the consumer confidence index score in South Carolina stands at 92.5 — higher than in all but four other states.

As is often the case in states with relatively low declines in consumer confidence, South Carolina’s shutdown lasted less than one month. First put in place on April 7, the state’s stay-at-home order expired on May 4.

33. Texas

> Chg. in consumer confidence from March 1 to May 15: -26.0% (120.6 to 89.3)

> Pct. of workers in high-risk industries: 19.6% (11th highest)

> Unemployment claims since mid-March: 2.1 million (14.8% of workforce – 6th lowest)

> Chg. in avg. time spent at home: 16.0% more than normal

> COVID-19 cases as of May 18, 2020: 169.7 per 100,000 people — 12th lowest (total: 48,693)

In Texas, confidence in personal finance and the national economy overall fell from 120.6 points on March 1 to 89.3 points on May 15, a 26.0% decline. The drop, while substantial, was not as precipitous as it was in most other states.

The relative economic optimism in Texas may be due in part to the state’s job market, which has weathered the COVID-19 pandemic better than most. Since mid-March only about 14.8% of the state’s workforce have filed for unemployment, a smaller share than in all but five other states.

32. Virginia

> Chg. in consumer confidence from March 1 to May 15: -26.1% (118.8 to 87.8)

> Pct. of workers in high-risk industries: 15.7% (13th lowest)

> Unemployment claims since mid-March: 725,195 (16.6% of workforce – 14th lowest)

> Chg. in avg. time spent at home: 18.0% more than normal

> COVID-19 cases as of May 18, 2020: 347.4 per 100,000 people — 19th highest (total: 29,591)

Consumer sentiment has not been as negatively affected in Virginia as it has been in most other states, falling by about 26% from March 1 to May 15. The relatively small decline in optimism may be partially due to the fact that Virginia’s job market has not been as affected since the beginning of the outbreak. Since mid-March, about 725,000 Virginians have applied for unemployment, or 16.6% of the workforce — a smaller share than in most states.

[in-text-ad-2]

31. Tennessee

> Chg. in consumer confidence from March 1 to May 15: -26.2% (123.2 to 90.9)

> Pct. of workers in high-risk industries: 20.3% (5th highest)

> Unemployment claims since mid-March: 519,815 (15.7% of workforce – 9th lowest)

> Chg. in avg. time spent at home: 12.0% more than normal

> COVID-19 cases as of May 18, 2020: 266.0 per 100,000 people — 24th highest (total: 18,011)

Tennessee’s 26.2% decline in consumer confidence between March 1 and May 15 was smaller than the decline in most states but larger than the drop reported in most other Southern states.

The larger reduction in economic optimism, relative to other states in the region, is likely due in part to the kinds of industries concentrated in the state. More than one in every five workers in Tennessee are employed in industries such as transportation and warehousing and tourism that are highly exposed to economic slowdown in the wake of the pandemic — a larger share than in all but four other states.

30. Missouri

> Chg. in consumer confidence from March 1 to May 15: -26.8% (120.7 to 88.3)

> Pct. of workers in high-risk industries: 16.6% (19th lowest)

> Unemployment claims since mid-March: 557,799 (18.2% of workforce – 19th lowest)

> Chg. in avg. time spent at home: 12.0% more than normal

> COVID-19 cases as of May 18, 2020: 178.7 per 100,000 people — 15th lowest (total: 10,945)

Over the last two and a half months, consumer sentiment in Missouri fell by 26.8%. The stay-at-home order went into effect in the state on April 6 and expired on May 3. Despite the partial reopening, consumer confidence has not regained much ground over the last two weeks, climbing only a fraction of a point, from 88.0 on May 1 to 88.3 on May 15.

[in-text-ad]

29. Iowa

> Chg. in consumer confidence from March 1 to May 15: -26.9% (110.6 to 80.9)

> Pct. of workers in high-risk industries: 14.9% (3rd lowest)

> Unemployment claims since mid-March: 312,234 (18.2% of workforce – 18th lowest)

> Chg. in avg. time spent at home: 15.0% more than normal

> COVID-19 cases as of May 18, 2020: 473.8 per 100,000 people — 13th highest (total: 14,955)

Iowa is one of only a handful of states to not implement a stay-at-home order. Social distancing is, at present, the most effective tool for stopping the spread of the coronavirus, and less restrictive policies may partially explain why a larger share of Iowa’s population has been infected. To date, there have been 474 infections for every 100,000 state residents, a larger share than in all but a dozen other states.

Though the 26.9% drop in consumer sentiment over the last two and a half months in Iowa is somewhat smaller than in most states, Iowans are more likely to be pessimistic about their personal finances and national business conditions than most Americans. The consumer confidence index stands at 80.9 in Iowa, well below the comparable 86.3 national level.

28. Idaho

> Chg. in consumer confidence from March 1 to May 15: -27.0% (124.3 to 90.8)

> Pct. of workers in high-risk industries: 16.1% (16th lowest)

> Unemployment claims since mid-March: 136,010 (15.7% of workforce – 8th lowest)

> Chg. in avg. time spent at home: 12.0% more than normal

> COVID-19 cases as of May 18, 2020: 137.9 per 100,000 people — 9th lowest (total: 2,419)

On March 1, Idaho had the fourth-highest consumer confidence of any state. By May 15, after a 27% drop in consumer confidence, the state ranked 11th. Compared to other states, the state has avoided worst-case outcomes regarding the spread of the coronavirus and the economy. Idaho has among the 10 lowest rates of confirmed cases and related deaths per capita. The state has also had just 15.7% of its labor force file for unemployment from March 21 through May 16, a lower share than all but seven other states. Yet, despite somewhat better outcomes compared to other states, consumer confidence in the state has declined 27% since March 1.

27. Nebraska

> Chg. in consumer confidence from March 1 to May 15: -27.2% (119.3 to 86.9)

> Pct. of workers in high-risk industries: 15.7% (11th lowest)

> Unemployment claims since mid-March: 123,030 (12.0% of workforce – 3rd lowest)

> Chg. in avg. time spent at home: 15.0% more than normal

> COVID-19 cases as of May 18, 2020: 550.7 per 100,000 people — 10th highest (total: 10,625)

Over the last two and a half months, consumer confidence has fallen by 27.2% in Nebraska — roughly in the middle of all declines reported by states. In recent weeks, confidence in personal finances and the broader national economy has made a substantial comeback in the state. Consumer sentiment hit a year-to-date low of 78.6 points in Nebraska on April 15. Now, one month later, the consumer sentiment index stands at 86.9. Over the course of that month, restrictions have been loosened considerably in much of the state, including reopening of restaurants and salons.

[in-text-ad-2]

26. Delaware

> Chg. in consumer confidence from March 1 to May 15: -27.3% (115.5 to 84.0)

> Pct. of workers in high-risk industries: 17.0% (22nd lowest)

> Unemployment claims since mid-March: 96,194 (19.9% of workforce – 23rd highest)

> Chg. in avg. time spent at home: 17.0% more than normal

> COVID-19 cases as of May 18, 2020: 813.6 per 100,000 people — 6th highest (total: 7,869)

Like other densely-populated states, Delaware has struggled with a relatively wide spread of the coronavirus, with 814 confirmed cases per 100,000 residents, well ahead of the U.S. infection rate of 454 per 100,000. Yet Delaware’s consumer confidence has not dropped as much as in half the states, falling 27.3%. This may be due in part to the fact that Delaware’s workers are unlikely to be affected by the economic effects of the pandemic as more than 85% are employed in low-or-moderate-risk industries.

25. Kansas

> Chg. in consumer confidence from March 1 to May 15: -27.4% (112.6 to 81.8)

> Pct. of workers in high-risk industries: 15.8% (14th lowest)

> Unemployment claims since mid-March: 253,447 (17.1% of workforce – 16th lowest)

> Chg. in avg. time spent at home: 14.0% more than normal

> COVID-19 cases as of May 18, 2020: 286.4 per 100,000 people — 22nd highest (total: 8,340)

Over the last two and a half months, consumer confidence fell by 27.4% in Kansas. In the vast majority of states, Americans have become more optimistic about their financial future and the national economy in recent weeks. Kansas, however, is a notable exception. Over the first two weeks of May, consumer confidence in the state fell from 82 points to 81.8. The slight dip occurred even as Gov. Laura Kelly began reopening the state’s economy by lifting the state’s stay-at-home order on May 3.

[in-text-ad]

24. Indiana

> Chg. in consumer confidence from March 1 to May 15: -27.5% (119.9 to 86.9)

> Pct. of workers in high-risk industries: 18.0% (21st highest)

> Unemployment claims since mid-March: 673,220 (19.8% of workforce – 25th highest)

> Chg. in avg. time spent at home: 14.0% more than normal

> COVID-19 cases as of May 18, 2020: 422.2 per 100,000 people — 15th highest (total: 28,255)

As the coronavirus outbreak became more and more severe, Indiana’s consumer confidence fell by 33 points, or 27.5%. As a result, Indiana’s confidence rank among states dropped from 14th to 23rd among all states. Indiana ranks near the middle in a number of key indicators that can help explain the middling decline in consumer confidence — it ranks 25th among states with 19.8% of the labor force filing for unemployment since mid-March and 18% of its workers in high-risk industries, the 21st highest percentage among states.

23. Utah

> Chg. in consumer confidence from March 1 to May 15: -27.6% (123.2 to 89.2)

> Pct. of workers in high-risk industries: 17.0% (25th lowest)

> Unemployment claims since mid-March: 159,131 (10.0% of workforce – the lowest)

> Chg. in avg. time spent at home: 14.0% more than normal

> COVID-19 cases as of May 18, 2020: 229.0 per 100,000 people — 21st lowest (total: 7,238)

Like every U.S. state, Utah’s economy has been left reeling from the effects of the COVID-19 pandemic, but both in terms of the direct economic impact and the health effects, Utah may be better off than most states. The state’s unemployment rate in April rose to 9.7%, which is staggeringly high but still lower than the 14.7% national unemployment rate — Utah is one of only eight states with an unemployment rate below 10%. The state has also had relatively few diagnosed COVID-19 cases per capita, with 229 confirmed cases per 100,000 residents, compared to the 454.4 cases per 100,000 Americans.

Even with these somewhat positive outcomes compared to most other states, consumer confidence in Utah fell by 27.2%, a larger decline than the majority of states.

22. California

> Chg. in consumer confidence from March 1 to May 15: -27.7% (111.5 to 80.6)

> Pct. of workers in high-risk industries: 17.9% (22nd highest)

> Unemployment claims since mid-March: 4,452,894 (22.9% of workforce – 15th highest)

> Chg. in avg. time spent at home: 19.0% more than normal

> COVID-19 cases as of May 18, 2020: 199.3 per 100,000 people — 18th lowest (total: 78,839)

Despite a 27.7% drop in consumer confidence from March 1 through May 15, California actually ranks higher in consumer confidence among states than it did at the beginning of March, moving from 40th to 36th. California was the first state to issue a stay-at-home order, and only some areas of the state are beginning the process of reopening. California residents are staying at home 19% more than before the pandemic, one of the highest percentages among states. This elongated lockdown could be harming consumer confidence, though most California workers are employed in low-risk industries.

[in-text-ad-2]

21. Illinois

> Chg. in consumer confidence from March 1 to May 15: -27.8% (112.0 to 80.9)

> Pct. of workers in high-risk industries: 18.8% (17th highest)

> Unemployment claims since mid-March: 1,039,031 (16.1% of workforce – 11th lowest)

> Chg. in avg. time spent at home: 18.0% more than normal

> COVID-19 cases as of May 18, 2020: 757.3 per 100,000 people — 7th highest (total: 96,485)

Illinois has had the largest total increase in new COVID-19 cases from May 12-18, with an average of nearly 2,400 daily cases during that time. Illinois ranks 40th in new unemployment filings during the pandemic, with 16.1% of workers filing for unemployment. That percentage, however, could increase significantly as 18.8% of workers in the state are in high-risk industries — the 17th highest share in the nation.

20. New York

> Chg. in consumer confidence from March 1 to May 15: -27.9% (112.4 to 81.0)

> Pct. of workers in high-risk industries: 15.1% (7th lowest)

> Unemployment claims since mid-March: 2.2 million (23.4% of workforce – 14th highest)

> Chg. in avg. time spent at home: 22.0% more than normal

> COVID-19 cases as of May 18, 2020: 1,791.6 per 100,000 people — the highest (total: 350,121)

In New York state, consumer confidence fell by 27.9% over the last two and a half months. While the decline was substantial — more than in most states — it is not reflective of how hard New York has been hit by the coronavirus itself. New York has the highest diagnosed cases per capita to date of any state, at 1,792 for every 100,000 people.

While the virus spread more in New York than anywhere else, the state’s economy has been spared the kind of damage other states have reported. New York’s April unemployment rate stands at 14.5%, slightly below the overall U.S. unemployment rate of 14.7%.

[in-text-ad]

19. North Dakota

> Chg. in consumer confidence from March 1 to May 15: -28.0% (116.9 to 84.2)

> Pct. of workers in high-risk industries: 19.8% (8th highest)

> Unemployment claims since mid-March: 67,251 (16.9% of workforce – 15th lowest)

> Chg. in avg. time spent at home: 14.0% more than normal

> COVID-19 cases as of May 18, 2020: 254.1 per 100,000 people — 25th highest (total: 1,931)

Over the last two and a half months, consumer confidence in North Dakota has taken a larger hit than in most other states. Growing pessimism related to the future of the U.S. economy in the state has likely been fueled in part by the state’s dependence on the oil and gas industry — one of the hardest hit by the economic shutdown.

North Dakota is the second largest producer of crude oil among states, and oil and gas extraction employs a far larger than typical share of the state’s workforce. Partially as a result, about one in every five workers in North Dakota work in an industry at high-risk of heavy job losses in the wake of the pandemic.

18. Ohio

> Chg. in consumer confidence from March 1 to May 15: -28.3% (116.6 to 83.6)

> Pct. of workers in high-risk industries: 17.0% (24th lowest)

> Unemployment claims since mid-March: 1,218,841 (21.1% of workforce – 22nd highest)

> Chg. in avg. time spent at home: 14.0% more than normal

> COVID-19 cases as of May 18, 2020: 243.4 per 100,000 people — 23rd lowest (total: 28,454)

Ohio’s economy was one of the hardest hit by the effects of the COVID-19 pandemic, with the state’s unemployment rate rising from 4.1% in January to a staggering 16.8% in April, the sixth highest unemployment rate of any state. Ohio was one of the first states to issue a statewide stay-at-home order, which it did on March 23. Some parts of the state economy reopened in mid-May, but it remains to be seen if this will have a positive impact on consumer confidence, which fell by 28.3% in the state between March 1 and May 15.

17. Wyoming

> Chg. in consumer confidence from March 1 to May 15: -28.3% (124.2 to 89.0)

> Pct. of workers in high-risk industries: 25.5% (3rd highest)

> Unemployment claims since mid-March: 37,266 (12.9% of workforce – 4th lowest)

> Chg. in avg. time spent at home: 10.0% more than normal

> COVID-19 cases as of May 18, 2020: 98.0 per 100,000 people — 6th lowest (total: 566)

Compared to most of the country, Wyoming has been relatively untouched by the virus itself. The state has had 566 total confirmed cases as of May 18. Even adjusting for the state’s low population, Wyoming has fewer than 100 diagnosed cases per 100,000, compared to the nation’s 454 cases per 100,000.

The impact of COVID-19 on the state economy has been substantial, but relatively less severe than in most states, with unemployment in the state increasing from 3.7% in March to 9.2%, one of the smaller increases among states. The state’s 9.2% unemployment rate is the fifth lowest among states. Still, consumer confidence in Wyoming has fallen more than most states.

[in-text-ad-2]

16. Maryland

> Chg. in consumer confidence from March 1 to May 15: -28.7% (113.9 to 81.2)

> Pct. of workers in high-risk industries: 15.7% (12th lowest)

> Unemployment claims since mid-March: 528,334 (16.3% of workforce – 12th lowest)

> Chg. in avg. time spent at home: 21.0% more than normal

> COVID-19 cases as of May 18, 2020: 658.0 per 100,000 people — 9th highest (total: 39,762)

Maryland is one of 18 states in which consumer confidence has fallen by more than 28%, dropping to 81.2, the 32nd highest among states. Maryland’s consumer confidence dropped more than in most states despite state workers appearing to be more insulated from the repercussions of the coronavirus outbreak. The state has the highest median annual household income of all states at over $83,000 and the second highest share of workers in low-risk industries at 56%.

15. Michigan

> Chg. in consumer confidence from March 1 to May 15: -28.9% (114.5 to 81.4)

> Pct. of workers in high-risk industries: 16.4% (17th lowest)

> Unemployment claims since mid-March: 1,436,250 (29.1% of workforce – 8th highest)

> Chg. in avg. time spent at home: 17.0% more than normal

> COVID-19 cases as of May 18, 2020: 519.4 per 100,000 people — 11th highest (total: 51,915)

Michigan’s struggles with COVID-19 may be harming consumer confidence. As of May 18, Michigan had the 11th highest number of confirmed cases per 100,000 residents, the sixth highest number of deaths per 100,000 residents, and the 15th highest average daily new cases from May 12-18. More than 29% of Michigan workers have filed for unemployment benefits since mid-March, the eighth highest share in the country. The state already had one of the highest poverty rates in the country at 14.1% — a full percentage point higher than the U.S. rate.

[in-text-ad]

14. Rhode Island

> Chg. in consumer confidence from March 1 to May 15: -28.9% (111.0 to 78.9)

> Pct. of workers in high-risk industries: 17.1% (25th highest)

> Unemployment claims since mid-March: 164,246 (29.7% of workforce – 7th highest)

> Chg. in avg. time spent at home: 17.0% more than normal

> COVID-19 cases as of May 18, 2020: 1,210.1 per 100,000 people — 4th highest (total: 12,795)

Rhode Island had one of the lower consumer confidence index scores before the coronavirus outbreak, at 111.0 at the beginning of March. Consumer confidence in the state fell by nearly 29% by May 15. Even as American consumer confidence increased between May 1 and May 15, Rhode Island’s continued to drop. This may be due in part to the fact that no other state has experienced a larger recent increase in COVID-19 cases per capita. Rhode Island averaged 20.1 new cases per 100,000 residents from May 12-18.

13. Oregon

> Chg. in consumer confidence from March 1 to May 15: -29.0% (107.3 to 76.2)

> Pct. of workers in high-risk industries: 16.4% (18th lowest)

> Unemployment claims since mid-March: 383,659 (18.3% of workforce – 20th lowest)

> Chg. in avg. time spent at home: 15.0% more than normal

> COVID-19 cases as of May 18, 2020: 88.0 per 100,000 people — 5th lowest (total: 3,687)

Consumer confidence has not been particularly high in Oregon throughout this year compared to other states. After declining by 29.0% between March 1 and May 15, the consumer sentiment index in the state stands at 76.2 — sixth lowest among states and well below the 86.3 national level.

The low confidence in the state is likely partially explained by several factors. For one, Oregon was one of the first states to implement a stay-at-home order, which effectively ground the economy to a halt. Additionally, the state’s unemployment rate hit 14.2% in April, higher than in most states.

12. New Jersey

> Chg. in consumer confidence from March 1 to May 15: -29.1% (111.8 to 79.3)

> Pct. of workers in high-risk industries: 17.4% (24th highest)

> Unemployment claims since mid-March: 1,088,905 (24.4% of workforce – 12th highest)

> Chg. in avg. time spent at home: 22.0% more than normal

> COVID-19 cases as of May 18, 2020: 1,661.8 per 100,000 people — 2nd highest (total: 148,039)

Only neighboring New York state has had more diagnosed COVID-19 cases — New Jersey had 148,039 confirmed cases as of May 18. This comes to 1,662 per 100,000 residents, close to four times the national confirmed cases per capita figure.

The state was one of the first to issue a statewide stay-at-home order and one of the first to close businesses. The statewide order went into effect on March 21 and is currently set to expire on June 5.

[in-text-ad-2]

11. New Hampshire

> Chg. in consumer confidence from March 1 to May 15: -29.4% (109.5 to 77.3)

> Pct. of workers in high-risk industries: 15.1% (9th lowest)

> Unemployment claims since mid-March: 190,167 (24.8% of workforce – 11th highest)

> Chg. in avg. time spent at home: 17.0% more than normal

> COVID-19 cases as of May 18, 2020: 269.2 per 100,000 people — 23rd highest (total: 3,652)

Before the coronavirus hit the U.S., New Hampshire had some of the best economic indicators of any state. Its 7.6% poverty rate was the lowest among all states, and its median annual household income of $75,000 was seventh highest. Yet the state still had a relatively low consumer confidence score than the majority of other states.

Throughout the pandemic, New Hampshire’s consumer confidence score declined by 29.4%, down to 77.3 — seventh lowest among states. Nearly a quarter of workers in New Hampshire, 24.8%, have filed for unemployment since mid-March — the 11th highest percentage in the country.

10. Pennsylvania

> Chg. in consumer confidence from March 1 to May 15: -29.9% (114.8 to 80.5)

> Pct. of workers in high-risk industries: 16.7% (20th lowest)

> Unemployment claims since mid-March: 1,852,824 (28.8% of workforce – 9th highest)

> Chg. in avg. time spent at home: 16.0% more than normal

> COVID-19 cases as of May 18, 2020: 492.4 per 100,000 people — 12th highest (total: 63,056)

Pennsylvania ranks among the states hardest hit by the coronavirus. There have been 492 known cases in the state for every 100,000 residents to date — more than in all but 11 other states and slightly more than the national figure of 454 cases per 100,000 people. The state has also had a far longer than average shutdown period. Gov. Tom Wolf implemented a stay-at-home order on April 1 that is not set to expire until June 4.

Both of these factors have likely influenced the state’s precipitous decline in consumer confidence. Over the last month and half, optimism regarding the economy and personal finances among Pennsylvanians fell by 29.9%.

[in-text-ad]

9. Massachusetts

> Chg. in consumer confidence from March 1 to May 15: -30.0% (107.7 to 75.4)

> Pct. of workers in high-risk industries: 15.0% (6th lowest)

> Unemployment claims since mid-March: 864,165 (22.7% of workforce – 16th highest)

> Chg. in avg. time spent at home: 22.0% more than normal

> COVID-19 cases as of May 18, 2020: 1,261.2 per 100,000 people — 3rd highest (total: 87,052)

The Massachusetts labor force has been decimated by the economic effects of the COVID-19 pandemic. In March 2020, the state’s unemployment rate of 2.9% was sixth lowest in the country. In April, the unemployment rate rose to 16.3%, 15th highest among states. Massachusetts has been particularly hard hit by the coronavirus itself, with over 1,260 diagnosed cases per 100,000 state residents, compared to a national figure of 454 cases per 100,000.

The state has started to open industries in a limited capacity, including construction and manufacturing. Based on the Morning Consult index, consumer confidence in Massachusetts is the third lowest of any state.

8. Hawaii

> Chg. in consumer confidence from March 1 to May 15: -30.2% (106.1 to 74.1)

> Pct. of workers in high-risk industries: 27.1% (2nd highest)

> Unemployment claims since mid-March: 232,651 (35.0% of workforce – 3rd highest)

> Chg. in avg. time spent at home: 19.0% more than normal

> COVID-19 cases as of May 18, 2020: 45.1 per 100,000 people — 2nd lowest (total: 640)

Hawaii is isolated from the rest of the country, and partially as a result, it has not reported many cases of the coronavirus. To date, there have been 45 known cases for every 100,000 people in the state, a fraction of the national figure and the second lowest among states.

Still, heavily dependent on tourism, Hawaii’s economy has been hit hard. Since mid-March, more than 230,000 people have filed for unemployment in the state, and the unemployment rate stands at a staggering 22.3% — third highest among states. Since March 1, consumer confidence has tumbled by 30.2% in Hawaii.

7. Alaska

> Chg. in consumer confidence from March 1 to May 15: -30.6% (112.8 to 78.3)

> Pct. of workers in high-risk industries: 21.8% (4th highest)

> Unemployment claims since mid-March: 96,200 (27.9% of workforce – 10th highest)

> Chg. in avg. time spent at home: 10.0% more than normal

> COVID-19 cases as of May 18, 2020: 54.1 per 100,000 people — 3rd lowest (total: 399)

Alaska is another state that is heavily dependent on oil and gas extraction to report a steep decline in consumer confidence in recent months. The industry has been hit badly in 2020 following a price war between Saudi Arabia and Russia and the shutdown to contain the spread of COVID-19 — the combination of which led to negative West Texas Intermediate oil prices for the first time in history.

With a relatively large oil and gas extraction sector, layoffs have been worse in Alaska than in most other states. Since mid-March, over 96,000 workers in the state have applied for unemployment benefits — equal to about one-quarter of the total workforce.

[in-text-ad-2]

6. Nevada

> Chg. in consumer confidence from March 1 to May 15: -30.6% (121.8 to 84.5)

> Pct. of workers in high-risk industries: 33.5% (the highest)

> Unemployment claims since mid-March: 456,202 (29.8% of workforce – 6th highest)

> Chg. in avg. time spent at home: 17.0% more than normal

> COVID-19 cases as of May 18, 2020: 229.1 per 100,000 people — 22nd lowest (total: 6,952)

Nevada is one of just eight states in which consumer confidence fell by more than 30% over the last two and a half months. The state, which had relatively high consumer confidence on March 1 with a score of 121.8, dropped to 25th among all states with a score of 84.5, slightly lower than the overall U.S. score of 86.3. This is likely due in part to the state’s soaring unemployment. As of April 2020, Nevada had by far the highest unemployment rate at 28.2%. No other state had an unemployment rate above 23%. More than a third of Nevada workers are in industries at high risk of slowdown in the wake of the pandemic like tourism and hospitality, nearly double the national concentration.

5. Colorado

> Chg. in consumer confidence from March 1 to May 15: -30.7% (112.8 to 78.2)

> Pct. of workers in high-risk industries: 18.6% (19th highest)

> Unemployment claims since mid-March: 408,889 (13.1% of workforce – 5th lowest)

> Chg. in avg. time spent at home: 16.0% more than normal

> COVID-19 cases as of May 18, 2020: 389.8 per 100,000 people — 16th highest (total: 22,202)

After a 30.7% drop in Colorado’s consumer confidence from March 1 through May 15, the state fell to having the ninth-lowest consumer confidence in the nation with a score of 78.2. Residents may be concerned about the relatively high rate of infections in their state. Colorado has the 16th-highest most confirmed COVID-19 cases per 100,000 residents.

Though 18.6% of Colorado’s labor force is in high-risk industries, as compared to 17.7% of America’s labor force, relatively few of its workers have lost their jobs. Just 13.1% of the state’s labor force has filed for unemployment since mid-March, the fifth-smallest share of all states.

[in-text-ad]

4. Wisconsin

> Chg. in consumer confidence from March 1 to May 15: -30.8% (112.3 to 77.7)

> Pct. of workers in high-risk industries: 15.8% (15th lowest)

> Unemployment claims since mid-March: 550,576 (17.7% of workforce – 17th lowest)

> Chg. in avg. time spent at home: 16.0% more than normal

> COVID-19 cases as of May 18, 2020: 218.2 per 100,000 people — 20th lowest (total: 12,687)

Even though its 218 confirmed cases per 100,000 residents is less than half the overall U.S. figure, just a handful of other states have lower consumer confidence scores than Wisconsin, at 77.7. Nearly 56% of all workers in Wisconsin are in high- or moderate-risk industries more exposed to slowdown in the wake of the virus, one of the higher shares among states. Wisconsin’s unemployment rate of 14.1% is slightly below the U.S. unemployment rate of 14.7%.

3. Connecticut

> Chg. in consumer confidence from March 1 to May 15: -31.1% (109.6 to 75.5)

> Pct. of workers in high-risk industries: 14.2% (the lowest)

> Unemployment claims since mid-March: 353,836 (18.7% of workforce – 22nd lowest)

> Chg. in avg. time spent at home: 18.0% more than normal

> COVID-19 cases as of May 18, 2020: 1,066.9 per 100,000 people — 5th highest (total: 38,116)

Connecticut residents tend to be pessimistic about the financial and business conditions of the country as a whole. The state has consistently ranked in the bottom 10 in consumer confidence throughout 2020, dropping 31.1% to a fourth-lowest score among states of 75.5 from March 1 to May 15.

The steep drop in consumer confidence may be partially attributable to the struggles state has had with the virus. Connecticut has confirmed over 1,000 cases per 100,000 residents, more than double the U.S. figure. Yet no state’s labor force has been less affected — Connecticuts’ April unemployment rate of 7.9% is the lowest of any state . This is partially because the state’s workforce is concentrated in industries less likely to be affected by the virus, such as finance and insurance. Just 14.2% of Connecticut workers are employed in high-risk fields, the lowest share of any state.

2. Minnesota

> Chg. in consumer confidence from March 1 to May 15: -32.0% (116.0 to 78.9)

> Pct. of workers in high-risk industries: 14.9% (4th lowest)

> Unemployment claims since mid-March: 662,429 (21.5% of workforce – 20th highest)

> Chg. in avg. time spent at home: 19.0% more than normal

> COVID-19 cases as of May 18, 2020: 291.8 per 100,000 people — 20th highest (total: 16,372)

From March 1 through May 15, consumer confidence has fallen in Minnesota by 32.0% — the second largest drop among states. Declining confidence in the economy is evidenced in part by adherence to the state’s stay-at-home order. According to mobility data, the time Minnesota residents are spending at home is about 19% higher than usual, a larger increase than in most states.

Consumer confidence appears to have been hit hardest in wealthier states. In Minnesota, the typical household earns $70,315 a year, more than $8,000 more than the typical household nationwide.

[in-text-ad-2]

1. Maine

> Chg. in consumer confidence from March 1 to May 15: -32.1% (111.3 to 75.6)

> Pct. of workers in high-risk industries: 15.1% (8th lowest)

> Unemployment claims since mid-March: 136,079 (19.9% of workforce – 24th highest)

> Chg. in avg. time spent at home: 13.0% more than normal

> COVID-19 cases as of May 18, 2020: 128.0 per 100,000 people — 7th lowest (total: 1,713)

Consumer confidence in Maine dropped from 111.3 on March 1to 75.6 on May 15 — a steeper decline than in any other state. Maine has consistently had low consumer confidence throughout 2020, even before the pandemic. The state never ranked outside the bottom 10.

In spite of the low consumer confidence, the job market in Maine has fared better than in most other states. The state’s April unemployment rate of 10.6% is lower than in the majority of states. Maine has also had just 128 confirmed cases of COVID-19 per 100,000 residents, less than a third of the U.S. figure.

Methodology

To determine how far consumer confidence has fallen in each state, 24/7 Wall St. reviewed changes in the consumer sentiment index from research company Morning Consult from March 1 through May 15. States are ranked based on percent change, from the smallest to the largest decline in consumer confidence.

Data on known cases of the coronavirus came from state health departments. Cases per 100,000 residents by state were calculated using population data from the 2018 American Community Survey from the U.S. Census Bureau.

April unemployment rates came from the Bureau of Labor Statistics. Total unemployment claims for March 15 through May 16 are also from the BLS. Unemployment claims as a share of the total workforce was calculated using February employment estimates, also from the BLS.

Mobility data came from Google and represents the typical amount of time a state resident spent at home on May 13 compared to a normal baseline. The baseline is the median amount of time for the corresponding day of the week during the five week period of Jan. 3 – Feb. 6, 2020.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.