Successful hedge fund managers are the rockstars of the investment world. Their names are also known beyond the financial crowd, often mentioned in regular media, at times with curiosity. Hedge funds, after all, are (mostly) out of reach for regular investors.

Hedge funds pool money from investors and employ different investment strategies with the goal of improving returns. But because they are not regulated as heavily as mutual funds, hedge funds can pursue riskier strategies. (Different from hedge funds, these are the world’s biggest asset management firms in 2021.)

Not all hedge funds and hedge fund managers employ the same strategies. They may use a wide variety of financial instruments and risk management techniques to achieve different goals, as funds may have different risk levels, acceptable volatility, and expected returns.

To find the top 20 best-performing hedge fund managers, 24/7 Wall St. reviewed Great Money Managers Research Update by LCH Investments NV, which lists estimates of net gains since inception. The criteria for inclusion include that the founder or manager should be the lead investment manager.

The most successful 20 funds – including Ken Griffin’s Citadel, Ray Dalio’s Bridgewater, Israel Englander’s Millennium, and Paul Singer’s Elliott Management – made $65.4 billion net of fees for their investors in 2021, accounting for 37% of the $176 billion that all hedge funds made last year. (Find out if any of these managers are among the richest Americans of all time.)

The top 20 managers have made $677.0 billion net of fees for their investors since inception, accounting for 42.2% of the $1,604 billion in net gains hedge fund managers have made since inception. The top 20 managers managed 18.8% of the $3.57 trillion managed by the industry at the end 2021.

The top gainers in 2021 in dollar terms were Chris Hohn’s TCI Fund Management, with net gains of $9.5 billion, and Citadel with net gains of $8.2 billion. These are large multi-strategy hedge funds. Still, in all, hedge funds didn’t necessarily perform well in 2021. Hedge fund returns in 2021 totaled 10.3%, well behind the S&P 500 increase of nearly 27%, according to hedge fund research provider HFR.

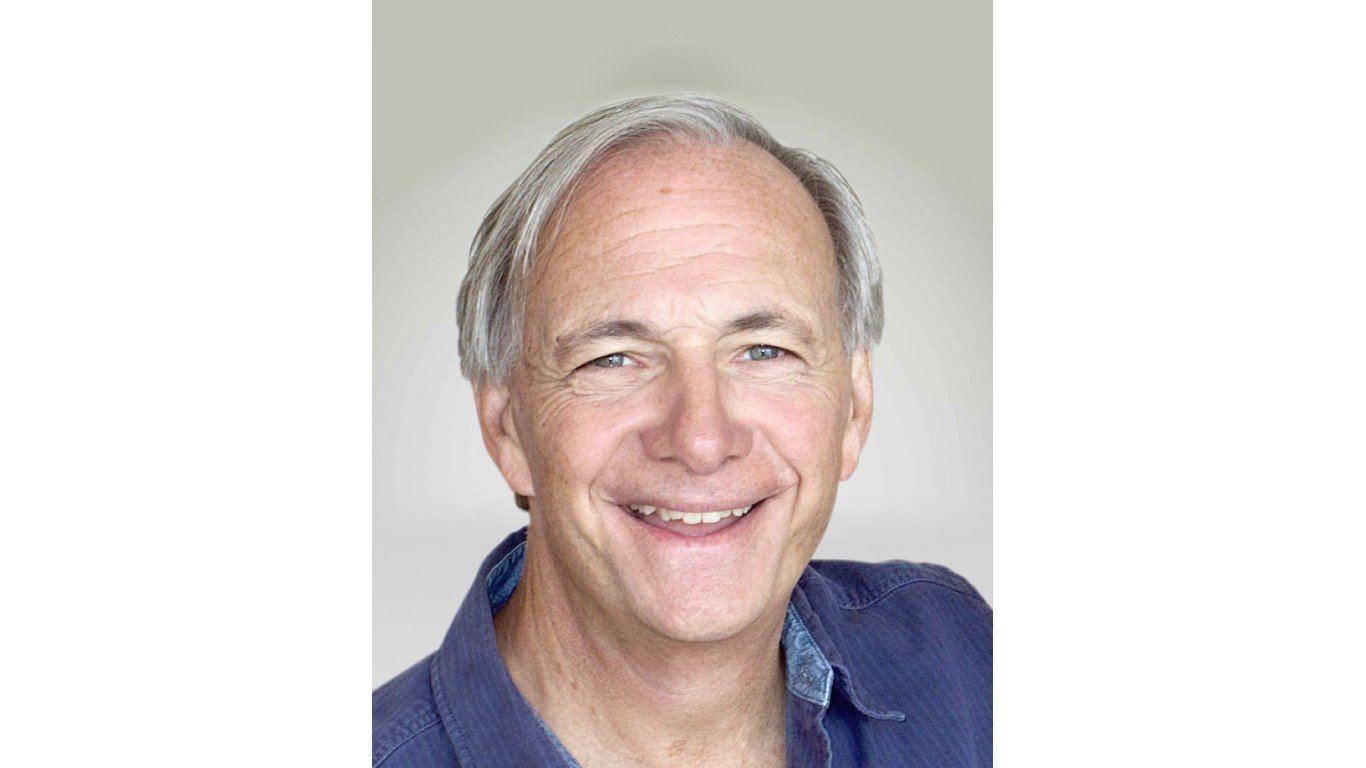

The world’s biggest hedge fund, Ray Dalio’s Bridgewater, made $5.7 billion in net gains in 2021, a significant improvement from its 2020 notable loss.

Click here to see the 20 best-performing hedge funds of all time

20. Third Point (Dan Loeb)

> Net gains since inception: $18.80 billion

> Start year: 1995

> Net gains in 2021: $3.30 billion

> Assets under management: $16.50 billion

[in-text-ad]

19. King Street (F Biondi/B Higgins)

> Net gains since inception: $19.40 billion

> Start year: 1995

> Net gains in 2021: $1.80 billion

> Assets under management: $11.50 billion

18. Davidson Kempner (Marvin Davidson, Thomas Kempner/Anthony Yoseloff )

> Net gains since inception: $19.60 billion

> Start year: 1983

> Net gains in 2021: $2.40 billion

> Assets under management: $29.50 billion

17. Brevan Howard (Alan Howard)

> Net gains since inception: $22.90 billion

> Start year: 2003

> Net gains in 2021: $0.40 billion

> Assets under management: $18.40 billion

[in-text-ad-2]

16. Tiger Global (Chase Coleman)

> Net gains since inception: $25.00 billion

> Start year: 2001

> Net gains in 2021: $-1.50 billion

> Assets under management: $35.00 billion

15. Egerton (John Armitage)

> Net gains since inception: $25.70 billion

> Start year: 1995

> Net gains in 2021: $3.10 billion

> Assets under management: $26.50 billion

[in-text-ad]

14. SAC/Point 72 (Steve Cohen)

> Net gains since inception: $27.70 billion

> Start year: 1992

> Net gains in 2021: $1.70 billion

> Assets under management: $24.00 billion

13. Appaloosa (David Tepper)

> Net gains since inception: $30.70 billion

> Start year: 1993

> Net gains in 2021: $2.10 billion

> Assets under management: $13.10 billion

12. Och Ziff/Sculptor (Dan Och/Jimmy Levin)

> Net gains since inception: $31.70 billion

> Start year: 1994

> Net gains in 2021: $1.90 billion

> Assets under management: $37.40 billion

[in-text-ad-2]

11. Farallon (Tom Steyer/Andrew Spokes)

> Net gains since inception: $32.60 billion

> Start year: 1987

> Net gains in 2021: $3.30 billion

> Assets under management: $40.00 billion

10. Baupost (Seth Klarman)

> Net gains since inception: $34.70 billion

> Start year: 1983

> Net gains in 2021: $3.40 billion

> Assets under management: $29.00 billion

[in-text-ad]

9. TCI (Chris Hohn)

> Net gains since inception: $36.50 billion

> Start year: 2004

> Net gains in 2021: $9.50 billion

> Assets under management: $44.40 billion

8. Viking (Andreas Halvorsen)

> Net gains since inception: $38.00 billion

> Start year: 1999

> Net gains in 2021: $1.30 billion

> Assets under management: $29.90 billion

7. Elliott Management (Paul Singer)

> Net gains since inception: $39.30 billion

> Start year: 1977

> Net gains in 2021: $6.00 billion

> Assets under management: $51.50 billion

[in-text-ad-2]

6. Lone Pine (Steve Mandel)

> Net gains since inception: $42.20 billion

> Start year: 1996

> Net gains in 2021: $0.00 billion

> Assets under management: $31.00 billion

5. Millennium (Israel Englander)

> Net gains since inception: $42.40 billion

> Start year: 1989

> Net gains in 2021: $6.40 billion

> Assets under management: $52.00 billion

[in-text-ad]

4. DE Shaw (various)

> Net gains since inception: $43.70 billion

> Start year: 1988

> Net gains in 2021: $6.40 billion

> Assets under management: $38.00 billion

3. Soros Fund Management (George Soros/Various)

> Net gains since inception: $43.90 billion (to 31.12.17)

> Start year: 1973

> Net gains in 2021: $0.00 billion

> Assets under management: $0.00 billion

2. Citadel (Ken Griffin)

> Net gains since inception: $50.00 billion

> Start year: 1990

> Net gains in 2021: $8.20 billion

> Assets under management: $43.70 billion

[in-text-ad-2]

1. Bridgewater (Ray Dalio)

> Net gains since inception: $52.20 billion

> Start year: 1975

> Net gains in 2021: $5.70 billion

> Assets under management: $99.20 billion

Sponsored: Want to Retire Early? Start Here

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.