It’s not every day that the largest brokerage firms issue new Buy ratings or they reiterate their Buy rating predicting that a stock could more than double. Most Dow Jones industrials and S&P 500 stocks are given upside targets of 8% to 10% at this stage of the bull market, and we have to keep in mind that the bull market just turned 10 years old.

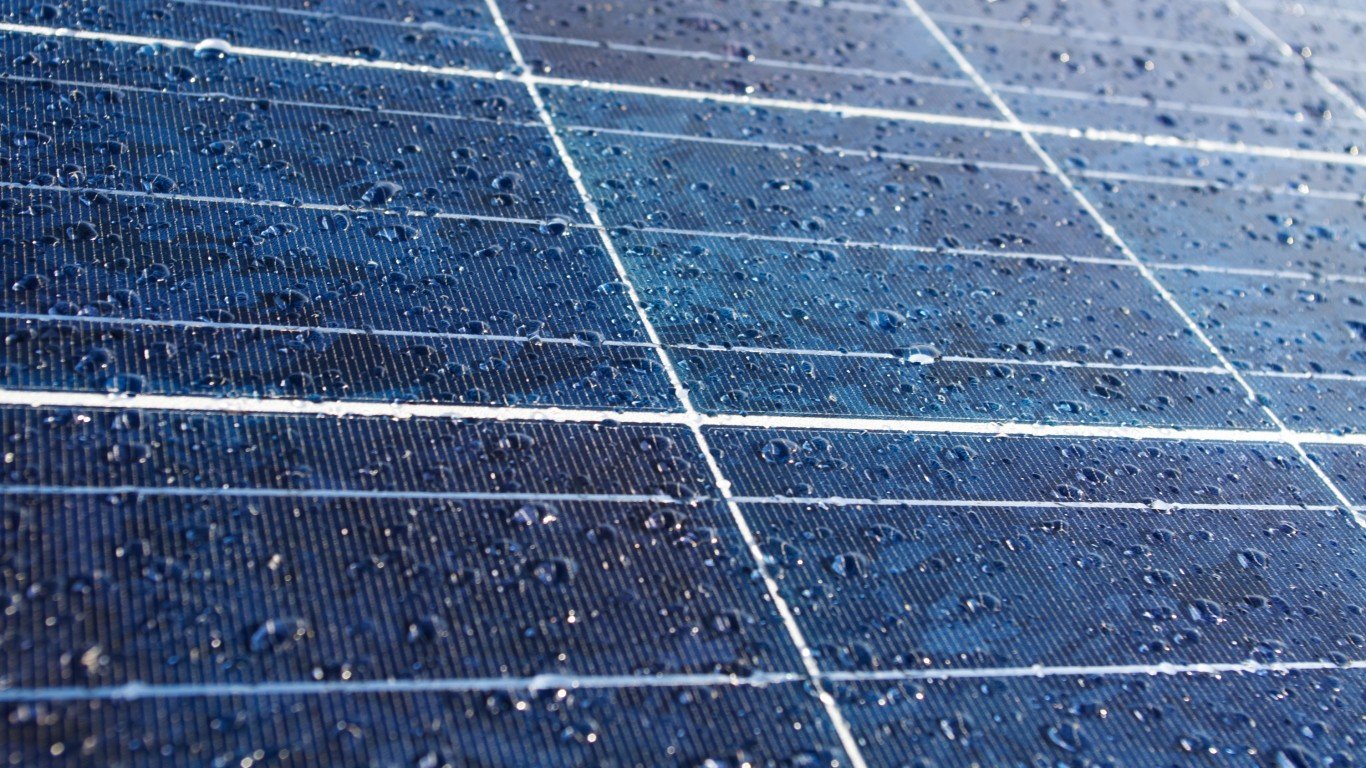

Merrill Lynch reiterated Vivint Solar Inc. (NYSE: VSLR) as Buy and raised its price objective to $10.00 from $9.50. What stands out here is that the old price objective was already 100% higher than the prior $4.75 closing price.

The firm’s Julien Dumoulin-Smith sees Vivint Solar shares as undervalued after a meaningfully positive update, with stronger deployments, better marketing channels and scaling residential solar. Also note that Vivint Solar had a prior consensus target price from Refinitiv (Thomson Reuters) of $8.05.

The recent underperformance of the stock was called entirely unwarranted. Monday’s research points to 15% growth guidance after what was called a solid execution in the last quarter. This sets the stage for growth in 2019 and 2020 in the report with confidence in the growth trajectory ahead. The report said:

Guidance came meaningfully above our prior assumption of 4% annually through 2023. We revise our annual deployment growth estimates to 10% for 2019 to 2023 to conservatively reflect execution risk, which we admit is overly punitive as we already reflect higher risk by ascribing a 20% discount rate for DevCo NPVs (relative to 15% for peer RUN) due to historical challenges around financing growth. As such, we see an upside skew and an inflection in shares ahead as management continues to execute through 2019.

Higher costs associated with the dynamic pricing model were far offset by the higher value contracts incentivized underscoring healthy sustainable growth at higher unit-level margin and a successful shift through 2018.

Here is how the Merrill Lynch “double your money” call was justified:

We see Vivint Solar as among the most undervalued stocks in our broader coverage, with greater than 100% potential upside reflected in our valuation, and still further upside skew. Vivint is now trading ex-growth at a roughly 24% discount to the value of its existing assets, in stark contrast to peer SunRun (RUN), which receives well-deserved credit for the ability to maintain volumetric growth through the 2023 in addition to existing assets when assuming the 6% unlevered discount rate. We estimate approximately 10% unlevered returns for VSLR, as such given meaningfully higher incremental returns relative to cost of capital, Vivint should receive credit for accretive capital deployment and view existing NPV as severely discounting value.

Vivint Solar shares were last seen trading up 4.3% at $4.95 on Monday, in a 52-week range of $3.10 TO $7.44. The last time Vivint Solar was a $10 stock was in late 2015.

Smart Investors Are Quietly Loading Up on These “Dividend Legends”

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.