OPEC

OPEC Articles

Energy sector analysts at BofA/Merrill Lynch have raised their rating on Exxon and Noble Energy and lowered their ratings on five other oil & gas industry firms.

Published:

Last Updated:

Despite the crude oil production cuts from OPEC and its partners, global oil inventories are not falling quickly and long-term crude oil futures contracts are now declining as well.

Published:

Last Updated:

10 OPEC members maintained April crude oil production at March levels and for the first four months of the production cuts, the cartel is just 5% above its agreed daily quota of 32.5 million barrels...

Published:

Last Updated:

Crude oil bounced near $50 following the U.S. Energy Information Administration's weekly inventory report. Crude inventories fell, but refined products inventories rose even more than crude's decline.

Published:

Last Updated:

Saudi Arabia is prepared to ask OPEC members to extend the cartel's crude oil production cuts for the second half of the year. Whether the move will drive crude prices higher is not clear.

Published:

Last Updated:

A new survey from the Dallas Fed shows oil patch optimism rising as producers and services companies say the oil and gas business is improving.

Published:

Last Updated:

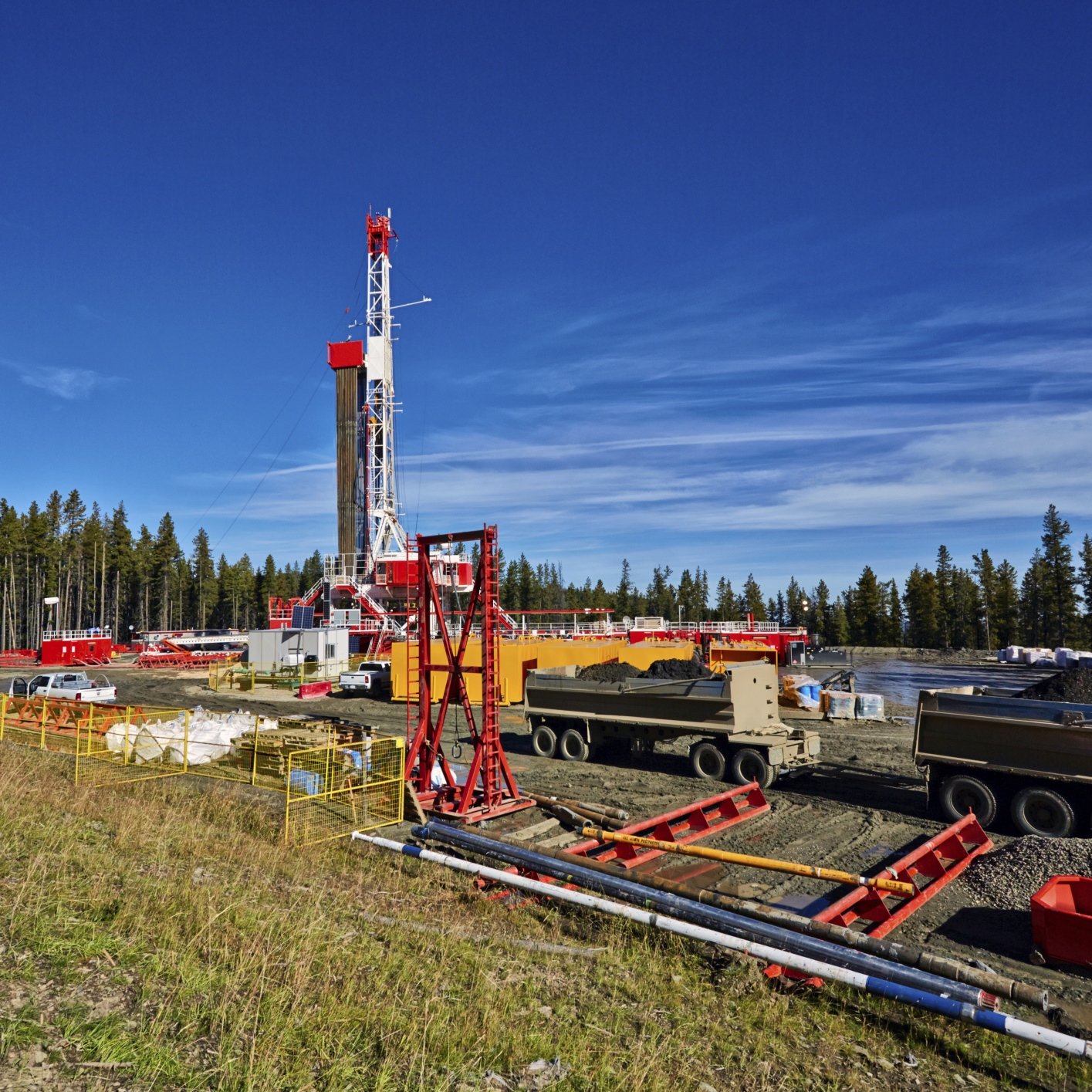

The U.S. onshore rig count rose by a total of 20 last week, with 21 new rigs drilling for oil. Saudi Arabia believes another six months of production cuts will be needed to rebalance the market but...

Published:

Last Updated:

The U.S. commercial crude oil inventory added 5 million barrels last week to an already swelling storage total. Crude prices dropped on the news, but worse news may be yet to come for OPEC and others...

Published:

Last Updated:

The number of rigs drilling for oil rose by 14 last week even as crude prices remained depressed. Hedge funds made a big move back into short positions after several weeks of building up their long...

Published:

Last Updated:

The U.S. Energy Information Administration reported a drop of around half a million barrels in the country's crude oil inventories. Prices showed little change and held on to a gain of about 2%.

Published:

Last Updated:

Saudi Arabia's crude oil production rose above 10 million barrels a day again in February and U.S. production is rising as well. Analysts and traders are becoming cautious on projecting a rebalancing...

Published:

Last Updated:

The U.S. onshore rig count rose by 12 last week, with seven rigs added to drill for oil and five to drill for natural gas. Hedge funds have begun backing off record long positions as market...

Published:

Last Updated:

The International Energy Agency (IEA) fears that decreased investment in exploration for new sources of crude threaten to drive prices much higher unless new projects are approved and begun soon.

Published:

Last Updated:

The U.S. onshore rig count increased by two last week as the nation's producers added seven oil rigs and lost five natural gas rigs. Crude prices dropped by less than 2% last week.

Published:

Last Updated:

The U.S. oil rig count rose by five last week and crude prices rose by about 1% week over week. Hedge funds now hold long contracts on nearly half a billion barrels, a record level.

Published:

Last Updated: