Banking, finance, and taxes

Why Major Banks May Have Sold Off Too Much Over Oil, Market and Economy

Published:

Last Updated:

The market volatility and financial market uncertainty has been hard on many sectors. The first fall-guy sector is of course oil. But then you have to think about the financiers for the energy sector and for the world’s emerging markets. The major U.S. banks, and foreign banks for that matter, have been gutted in the market carnage seen in 2016.

24/7 Wall St. wanted to evaluate how badly off the banking sector has been. We not only took a look at how much they are down from highs, but at how much each of the four money center banks would have to rally to hit a new 52-week high. That also was compared with their current consensus analyst price targets and other data regarding dividends and additional color.

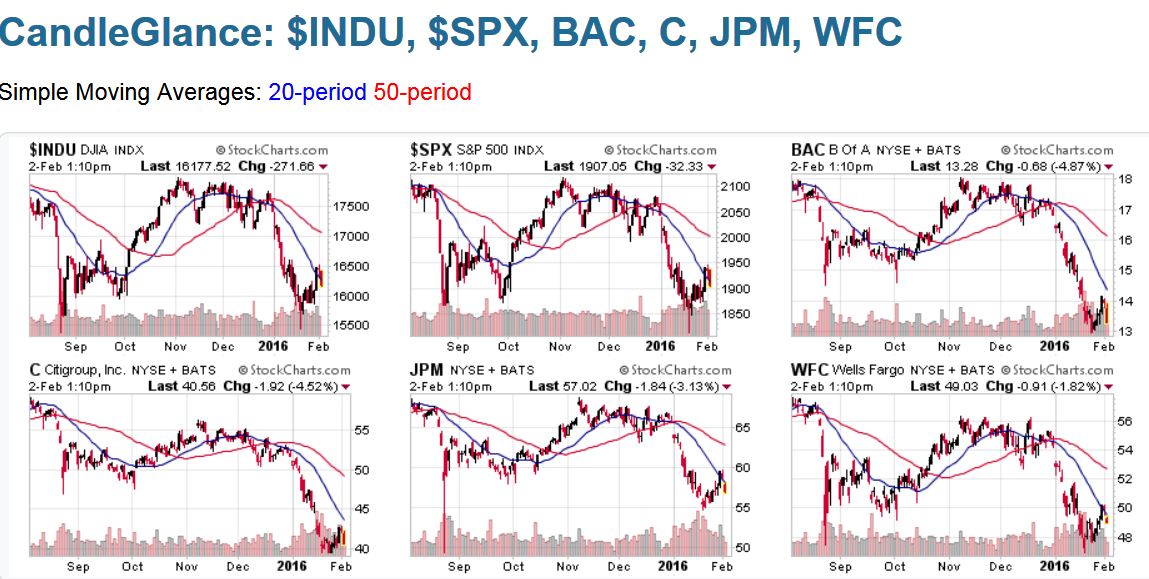

Calling a bottom is almost never good idea, particularly in extremely volatile markets. And for that matter, this is not a call that bank stocks have bottomed. That being said, this selling pressure on the banks up to the last attempted recovery has started to feel extreme — maybe too extreme. A chart view of the major banks below shows where these banks bottomed out in the January selling climax, and it will be interesting to see what happens if there is a retest for support and how they act if that occurs.

The financial markets may have been cruel to the big banks and financials so far in 2016. Still, even wondering if these have become too oversold, the markets are still nowhere close to having priced in another financial crisis. The markets are trying to absorb the risks of gradual Federal Reserve rate hikes, quantitative easing in Japan and Europe, oil default risks, weak emerging markets, high-yield bond default risks, sovereign wealth fund selling pressure, stock and bond market volatility, and just about everything else you can throw on the floor.

At $13.29, Bank of America Corp. (NYSE: BAC) would have to rally more than 30% to hit its 52-week high of $18.48. Its consensus analyst price target is currently almost identical to its 52-week high at $18.43. The dividend yield is still rather low at 1.5%, so investors will be looking for its dividend hike to be approved in its Comprehensive Capital Analysis and Review (CCAR) for the Federal Reserve, which was a disappointment for the Bank of America dividend in 2015.

Bank of America shares were already down a sharp 17% so far in 2016 ahead of Tuesday. A recent analyst upgrade was too big to ignore. Mike Mayo, the esteemed banking analyst at CLSA, raised his rating to Outperform from Sell and raised his target to $16.00 from $15.00. That may be under the consensus target by some amount, but Mayo had been consistently bearish on Bank of America.

Citigroup

Last seen down over 4% at $40.73, Citigroup Inc. (NYSE: C) shares would have to rise more than 49% to hit its 52-week high of $60.95. The consensus analyst target is $59.46. And the yield also is a paltry 0.5%, so investors will be paying close attention to its CCAR.

Most analysts have trimmed their Citigroup target prices marginally. Just don’t tell that to Oppenheimer, after it maintained its Outperform rating and raised its target to $67 from $66 on January 28. The Oppenheimer call was based on the belief that the bank stocks have gotten too cheap relative to the markets, even in the face of rising interest rates. Citigroup’s performance ahead of this was down by a sharp 17.8% since the end of 2015.

JPMorgan

Shares of JPMorgan Chase & Co. (NYSE: JPM) were last seen trading lower by 2.9% to $57.13. Jamie Dimon would have to see his shares rise more than 23% to hit its 52-week high of $70.61. The consensus price target here was still up at $72.22 on last look, above its 52-week high. JPMorgan has a dividend yield of almost 3.1% and it is still considered to have a fortress balance sheet.

The stock was down over 10% since the end of 2015, even before the drop on Tuesday. After earnings, price targets look marginally lower. It was just about a week ago that JPMorgan was downgraded to Neutral from Buy at Nomura Securities.

Because Wells Fargo & Co. (NYSE: WFC) was last seen down about 1.5% at $49.19, its shares would have to rise right at 20% to hit its 52-week high of $58.77. The consensus price target is still up at $57.92. Wells Fargo is the least battered by oil and emerging markets because of a larger focus here in the old USA and by not having so much exposure to the trading and derivatives that the regulators are trying to remove from the financial markets. Wells Fargo dominates the U.S. mortgage markets now, and its dividend yield is just over 3%.

Among the top banks, Wells Fargo remains the king of stock buybacks. That may be why its shares were down the least of the four major banks so far in 2016, with a drop of 8%. While Argus gave a post-earnings Buy rating reiteration, its price target was cut to a more realistic $58 from $63. Yet, Susquehanna raised its rating to Positive from Neutral the following day.

The following chart of the major banking stocks has been provided from StockCharts.com. It shows how extreme the slide has been for each in the past six months, and it includes 20-day and 50-day moving averages.

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.