Banking, finance, and taxes

Does This Mean Genworth's Turnaround Has Finally Turned Back Up?

Published:

Last Updated:

Genworth Financial Inc. (NYSE: GNW) has been down and out long enough that even the more aggressive turnaround investors had started to give up on it. Some investors even wondered if its long-term story was going to remain. This post-earnings reaction was so strong and had so many positive internals for the stock that many turnaround investors may need to reconsider how they want to treat Genworth ahead.

24/7 Wall St. wanted to take a 360-degree view all around the trading action to see if a turnaround is truly on the table here. This view almost aims to discount the news, but we would not want any turnaround investor to not consider the new fundamentals.

It is always important to realize just how much negativity has been circulating around Genworth. With all its problems, short sellers have been an influence. There were some 27.63 million shares in the mid-July short interest, down from 33.66 million at the end of June. Genworth has roughly 500 million shares outstanding, and 82% or so are owned by institutions.

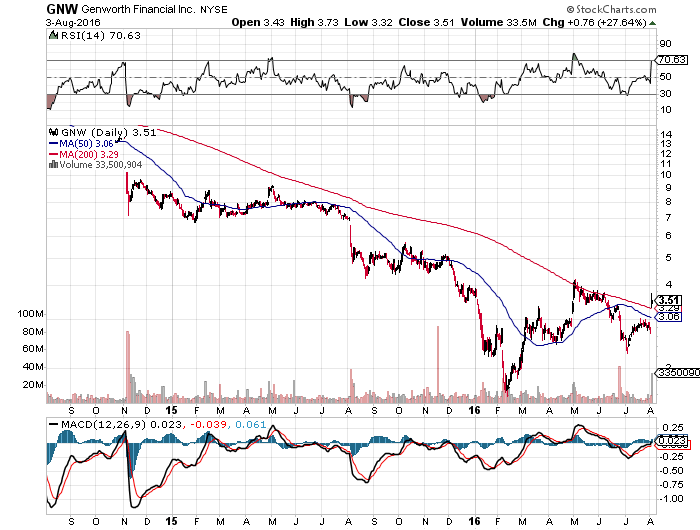

The internal metrics of the trading looked great as well. On the day, Genworth closed up $0.76 at $3.51. That is a 27.6% gain. Earlier in the day, Reuters said that Genworth was poised to have its best day in a whopping seven years. That is no small feat. The $3.51 close was not on the high of the day but was right in the middle of the $3.32 to $3.73 daily range. It was also above the $3.43 opening bell price.

Another issue that makes this move impressive is that trading volume was over 33.4 million shares. This is more than four times the normal 7.28 million shares on an average trading day. Also worth noting is that this was the largest volume since the 41.1 million shares traded on June 24, 2016, when the stock fell to $3.05 from $3.36 the prior day. That June drop saw shares continue to go down the following days, so it will be important to see if these gains continue in the days ahead.

Genworth beat estimates on earnings and on revenues, as there was 24.5% growth in U.S. mortgage insurance segment. Effectively this is on top of some positive data inside the first-quarter report. Life insurance had income of $31 million, flat from the prior quarter but up from $22 million a year ago.

What else may matter here is that the consensus analyst price target was $3.21 on last look. Only three analysts have ratings of Buy or higher, six are at Hold/Neutral and one still has a Sell/Underperform rating. We have included several pre-earnings analyst summaries with commentary for viewing.

At the end of a July, a report from Standard & Poor’s kept a Hold rating. Still, it had a $5 price target for 12 months out. It has a high risk assessment on the stock and it said:

Our risk assessment reflects the significant exposure of the mortgage insurance business to the volatile (albeit recovering) U.S. housing market and to the long-term care insurance market. Also, Genworth is vulnerable to investment losses and has a weaker capital position than many peers.

Also at the end of July, BTIG maintained a Buy rating and a $5 price target. It brought up the first-quarter earnings beat but said that the stock had still slid 30% since that report. Its view then stated:

We do not view lower interest rates during the final stretch of the second quarter (2016) or even an outlook featuring persistently lower rates as justifying a 30% drop in Genworth shares or even a decline of half that much. As a consequence of the pullback, Genworth shares are even deeper in the bargain bin at 0.15x the company’s book value ex. AOCI per share as of March 31… As such, we think even relatively stable second quarter operating results from Genworth could be sufficient to give the stock a boost. At such a low valuation, we believe the impact of interest rates is far down the list of factors that should be driving the company’s share price.

It was back in May that Compass Point kept a Buy rating but lowered its target. The firm said:

Genworth remains a high risk investment as volatility in the shares will likely persist as the company executes its transition strategy. We maintain our Buy rating, but are lowering our price target to $5.25 from $5.50.

Unfortunately, Genworth is just not followed by that many analysts these days. Many of the larger firms that used to cover it have seen their analysts drop coverage. It would not be wise to blindly jump in here without consideration and without seeing how the reaction holds in the coming days. Still, it is encouraging to see the trading pattern and to see Genworth shares making such a significant mark. Time will tell and the verdict remains out.

A chart from StockCharts.com has been included. The additional issue to consider here is that Genworth’s chart may have changed handily. The chart below shows that the 50-day and 200-day moving averages were taken out to the upside. That is generally good, but the trading action in the coming days will need to confirm whether this can hold. Other attempts to breach the 200-day moving average have not held, so stay tuned.

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.