Insurance is one of those things in life that you need, even if you hate it. Most people don’t love dealing with their insurance company, especially when it’s time to submit a claim. It’s strange, but insurance companies are one of the only organizations that benefit from not doing their job, so it’s no wonder that consumers really don’t like them!

Today, we’re going to look at some of the most hated insurance companies in the United States. To compile this list, 24/7 Wall Street used data from the ACSI Insurance and Health Care Study 2022-23. It details customer satisfaction according to certain benchmarks in various insurance agencies, which we will look at according to each industry.

Property and Casualty Insurance

Property and casualty insurance (often abbreviated to P&C insurance) is primarily geared toward protecting property or things related to that property. This can include insurance for houses, cars, clothing, and furniture.

3. Progressive

- Customer Satisfaction Index ‘23: 77

- Customer Satisfaction Index ‘22: 76

- Percent Change: 1%

Progressive is an American insurance company and is currently the largest motor insurance carrier in the United States. While Progressive is a large auto insurer, they do have other branches that operate through other companies. While they scored a 77, it does represent a slight increase in overall satisfaction from the previous year.

2. Farmers

- Customer Satisfaction Index ‘23: 75

- Customer Satisfaction Index ‘22: 75

- Percent Change: 0%

Farmers is another well-known insurance group based in America, and like Chubb, the company is based in Zurich. They provide extensive insurance options in most industries, but their P&C insurance was reported to be the second-lowest, with a score of 75.

1. Chubb

- Customer Satisfaction Index ‘23: 67

- Customer Satisfaction Index ‘22: NM

- Percent Change: NA

Chubb Insurance is an American-based company, although it’s technically incorporated in Switzerland. It is often cited as the largest property and casualty insurance company in the world and operates in 55 countries and territories. As of 2018, Chubb had $174 billion in assets. Despite its size, Chubb ranked last in the Customer Satisfaction Index (CSI), with a low score of 67 in 2023.

Life Insurance

Life insurance is a type of policy that exists to insure an individual in the case of their death. In most cases, these insurance policies are taken out for the benefit of loved ones and family.

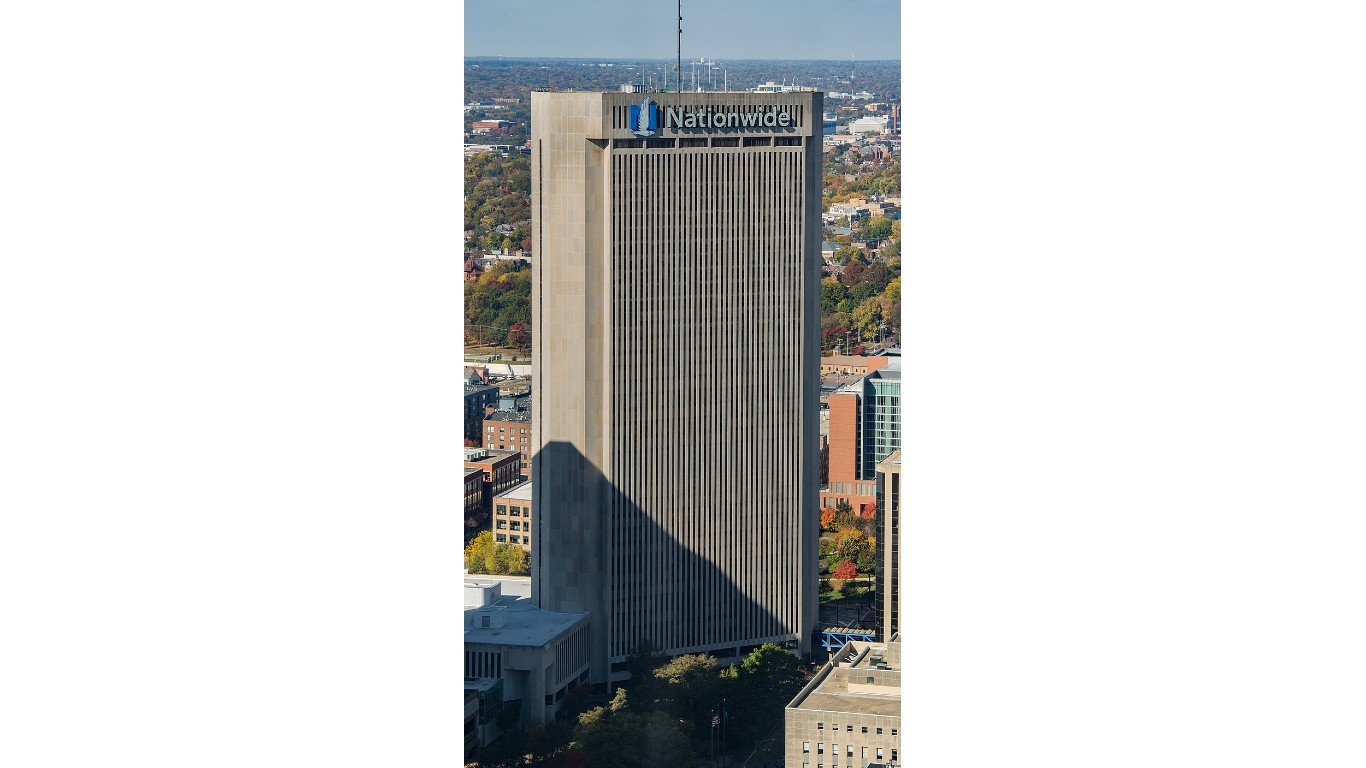

3. Nationwide

- Customer Satisfaction Index ‘23: 79

- Customer Satisfaction Index ‘22: 79

- Percent Change: 0%

Nationwide is a very large insurance group that was also founded as a mutual insurance company. While they ranked low within the life insurance category, they have expanded services into multiple types of insurance, including P&C, retirement, and investment insurance.

2. Prudential

- Customer Satisfaction Index ‘23: 79

- Customer Satisfaction Index ‘22: 78

- Percent Change: 1%

Prudential, originally named The Widows and Orphans Friendly Society, started as a mutual insurance company, meaning it was owned by its policyholders. When it was founded, the only insurance that the company offered was burial insurance, but they have since expanded and become a Fortune 500 company offering various types of insurance. Year on year, they have grown by a single point in the CSI.

1. Mass Mutual

- Customer Satisfaction Index ‘23: 77

- Customer Satisfaction Index ‘22: 78

- Percent Change: -1%

Mass Mutual (short for Massachusetts Mutual Life Insurance Company) is primarily a life insurance company that operates out of Springfield, Massachusetts. It is one of the largest companies in the United States, regularly ranking within the Fortune 500 list. Year on year, MassMutual decreased by a single point on the CSA, resulting in them being near the bottom of the list.

Health Insurance

Health insurance is designed to protect people and families from costs that are usually associated with medical treatment and care. In the United States, this is a major element of health care since all treatment costs money, and having insurance is almost a requirement for any high level of care. Policies usually cover things like medications, surgeries, doctor visits, and preventative care, but they can be customized.

3. Centene

- Customer Satisfaction Index ‘23: 75

- Customer Satisfaction Index ‘22: 72

- Percent Change: 4%

Centene is an insurance company that operates as an intermediary for government and privately sponsored programs. While they still rank in the bottom three of the big companies, they recently had a large jump in CSI, bringing them up 4% in the past year. If this trend continues, they could easily be one of the highest-rated companies in the health insurance category within a few years.

2. Kaiser Permanente

- Customer Satisfaction Index ‘23: 73

- Customer Satisfaction Index ‘22: 73

- Percent Change: 0%

Listed as an “integrated managed care consortium,” Kaiser Permanente is a group of three groups, including the Kaiser Foundation Health Plan, Kaiser Foundation Hospitals, and Permanente Medical Groups. While Kaiser’s care aspect has been well-regarded, there have been issues with patient dumping, along with criminal and civil charges. The company didn’t move year over year in the CSI.

1. Cigna

- Customer Satisfaction Index ‘23: 72

- Customer Satisfaction Index ‘22: 71

- Percent Change: 1%

Cigna is a large healthcare and insurance company operating out of Connecticut, offering medical, dental, disability, and life insurance policies. Unlike some of the other companies on the list, Cigna also runs certain full-service staff-model health organizations around the country under the name Evernorth Care Group. They are one of the 20 largest companies in the United States by revenue. Recently, they increased their CSI by one percent but still rank among the bottom of the big companies surveyed.

Smart Investors Are Quietly Loading Up on These “Dividend Legends”

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.