Source: Thinkstock

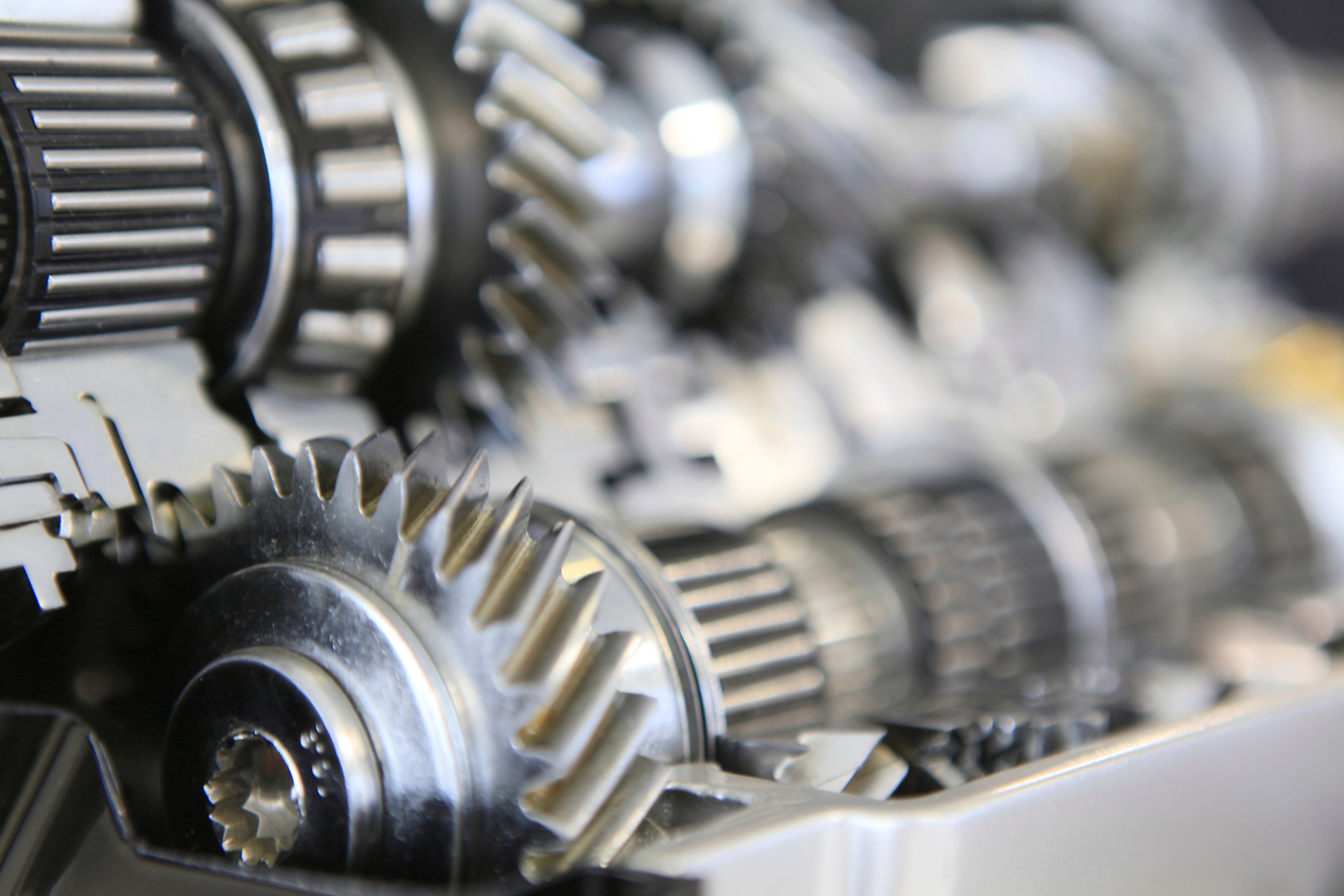

Leading the charge is Caterpillar Inc. (NYSE: CAT), which has added more than 3.5% to trade above $80.10. The Buffett acquisition combined with some encouragement for commodity prices have pushed the stock to a three-week high.

The second-biggest gain has been posted by Apple Inc. (NASDAQ: AAPL), hardly an industrial stock, but China looms large in any view of Apple, and any change in commodity prices depends heavily on prospects for China’s manufacturing sector. If commodity prices rise, China’s economy is likely to be improving, and that bolsters the outlook of for purchases of iPhones.

Chevron Corp. (NYSE: CVX) and Exxon Mobil Corp. (NYSE: XOM) are both up around 2% on higher crude oil prices. Again, an improved outlook for commodity prices helps directly, but indirectly higher prices typically indicate higher demand, which indicates that manufacturers like Precision Castparts could see an increase in their business.

The Buffett acquisition and rising crude oil prices have given the DJIA a boost. How long the boost will last and how big it eventually will be remain to be seen.

ALSO READ: 6 Analyst Stock Picks Called to Rise 50% to 100%

Sponsored: Want to Retire Early? Start Here

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.