With the bull market having halted its seven-year rise, investors are wondering which stocks they should be comfortable with and which ones they should be worried about. The reality is that investors tend to hear over and over again which stocks they should buy and when they should buy them, but when they should sell is another matter entirely. Even the great Warren Buffett sells many stocks way too soon.

24/7 Wall St. is revisiting a strategy that was first published in late 2010, and then updated in 2015. This is the 10 stocks to own for the decade! Buying and holding with no end in sight is too long and boring for most of us. A holding period of a decade is more realistic.

In November of 2010, the recession was over, but the public had no idea that the bull market was going to run for more than six years. Despite some intermittent market shocks, the decade from 2010 to 2020 is proving to, at least so far, come with much less turbulence than the prior decade.

Another issue that has prevailed is that investors have been serious buyers of stock during all the big market pullbacks for the past five years or so. Those trends will not last forever, and valuations at the start of May in 2016 had stocks at an expensive 17.7 times forward 12-month earnings expectations for the S&P 500. That is admittedly a premium, even if the Federal Reserve cannot hike interest rates too high.

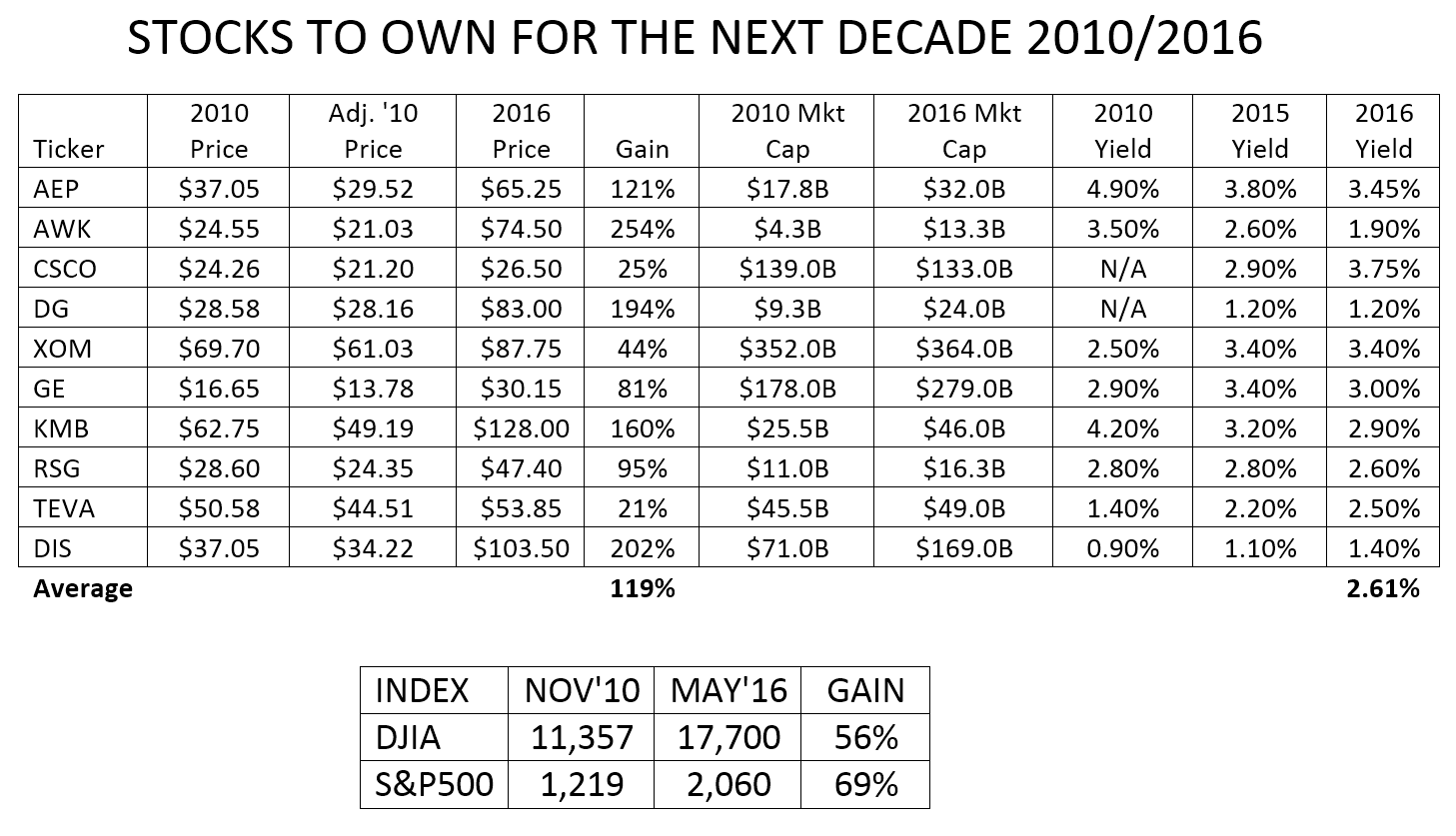

This list of 10 stocks to own for a decade actually outperformed a broader stock market rally, gaining about 119% on average, while the Dow rose 56% and the S&P 500 rose 69%. That outperformance was admittedly very unexpected. The endless rise of the Dow and S&P also was unexpected, along with an endless interest rate policy of rates being almost zero.

These 10 great companies had to be leaders in their industry. They had to have a market position that would not easily waver, and they had to be either paying a dividend or be sure to be paying one soon in order to qualify as a stock to own for the decade. That crossed Apple and Amazon off the list, ditto for Google. In May of 2016, the average yield for these 10 stocks is about 2.6%.

Now that we are in mid-2016, we are less than four years from reaching the year 2020. 24/7 Wall St. has stated numerous times that investors should probably not panic at all about how high the eventual Fed rate hike cycle will go. Regardless, it is important for all investors to assess their investments from time to time.

Picking stocks for a decade is much harder than it sounds. Tech and health care fall in and out of favor, or get replaced. Retail suffers from severe consumer change. And industries go through decade-long hard times now (or secular decline). Most decades also see one or two recessions and one or two bear markets — something that has not been seen this decade. Long-term investors sometimes have to think like a futurist to look through the next business cycle. They have to pick their points, and they have to take the deliberate effort to identify specifically what they want to avoid.

When 24/7 Wall St. embarked on identifying stocks for the decade, too many points to mention were considered. They are not just all Dow stocks, nor are they all growth stocks. We considered vast amounts of economic and consumer trends, business spending trends, interest rate risks, election cycles and even risks around regulation and taxation.

What is ironic in hindsight is that this list of stocks was not designed at all with an effort to outperform a meg-bull market. We wanted to identify the companies that were deeply entrenched with some defensive characteristics rather than high-growth stocks. These included utilities, services selective retail and consumer picks, business spending — and only one technology stock.

The 24/7 Wall St. stock list included the following companies: American Electric Power Co. Inc. (NYSE: AEP) and American Water Works Co. Inc. (NYSE: AWK) in utilities; Republic Services Inc. (NYSE: RSG) in garbage (services); Cisco Systems Inc. (NASDAQ: CSCO) as the sole tech stock; Dollar General Corp. (NYSE: DG) in retail; Exxon Mobil Corp. (NYSE: XOM) as the top energy stock; Kimberly-Clark Corp. (NYSE: KMB); General Electric Co. (NYSE: GE) as the top conglomerate; Walt Disney Co. (NYSE: DIS) dominates in media and entertainment; and Teva Pharmaceutical Industries Ltd. (NASDAQ: TEVA) as the top pick in health care.

When possible, alternative picks have been offered up, now that we are halfway through the decade. That being said, there is a reason each of these was picked as a company to own for the next decade. Most have raised dividends handily since 2010, and many have pursued large share buybacks.

Here are the 10 stocks in great detail, with alternative picks in some cases, for investors to consider holding for the rest of the decade.

1. American Electric Power: The Electric Company

American Electric Power Co. Inc. (NYSE: AEP) is roughly the sixth largest electric utility stock by market cap, at about $31 billion. It remains held back a bit by coal-fired plants and regulatory issues, but AEP has managed to deliver on earnings and dividend growth year in and year out. It is well run and takes pride in protecting shareholders.

With banks paying nothing on interest now, utility stocks have become this decade’s equivalent of a certificate of deposit. They are also outflanking the Treasury note market for investors seeking yield, but AEP and other utilities are valued much more in a low-rate environment compared to 2010. AEP yields 3.5%, versus about 5% back in late 2010. It serves about 5.4 million customers spread over 11 states.

Shares of American Electric were recently trading at $64.50, with a consensus analyst price target of $67.53 and a 52-week trading range of $52.29 to $67.19. Also worth consideration on AEP:

- Analysts were mixed on regulatory news.

- Deutsche Bank has it as one of four top utility picks.

- Merrill Lynch raised AEP and other targets.

Alternative Pick: Duke Energy Corp. (NYSE: DUK) seems to have its woes from years past in the rear-view mirror now, and its $54 billion market cap should speak for itself. Duke yields about 4.2% and is the largest utility in America in dollar terms, serving roughly 7.5 million retail electric customers.

2. American Water Works: Best Water Utility of Them All

American Water Works Co. Inc. (NYSE: AWK) shares have risen and risen, and sadly there is just not a similar alternative pick. This is the biggest water utility company in America, with over 15 million customers located in 47 states. Unlike regular utilities, it is impossible to deregulate water. With water being a secular investment theme, there is just one thing to ask here: what’s not to like? Just watch out for chasing valuations too high.

Shares of American Water Works recently traded at $73.93. The stock has a consensus price target of $69.08 and a 52-week range of $48.36 to $74.85. Also worth consideration for American Water Works:

- Is American Water’s premium too high for its safe dividend?

- Nine great companies that can hike dividends for a decade.

3. Cisco Systems: The Only Tech Stock

Cisco Systems Inc. (NASDAQ: CSCO) is one of the great stocks for the decade that actually has lagged the broader market since 2010. It has increased its dividend handily to the highest Dow tech dividend yield. If one company dominates the networking and communications market unlike any other company it is Cisco. Even under a new chief executive officer, Cisco is spending billions buying back stock and is considered a more nimble operation than when it was selected in 2010.

Cisco shares recently traded at $26.86, with a consensus price target of $29.62 and a 52-week range of $22.46 to $29.90. Also of interest on Cisco:

- See Cisco’s bullish and bearish case for 2016.

- Cisco has among largest stock buybacks of 2016 (and all-time).

4. Dollar General: Secular Retail Growth Trend

Dollar General Corp. (NYSE: DG) is the king of dollar stores, and it was located at ground zero of what we thought would be a secular winning theme for retail investors. The rise of the dollar stores has been amped by them “reaching up” into higher prices, taking away business from Wal-Mart and others. Its shares looked very opportunistic in 2010 because its former private equity backers were selling vast amounts of stock, but that has ended and shareholders now have complete control.

Dollar General now also pays a dividend and is worth almost $24 billion, about one-ninth of Wal-Mart. It is a winner from a strong dollar. In 2010 it had 8,900 stores in 70% of states, and in March 2016 it operated almost 12,500 stores located in 43 states.

Dollar General shares were trading at $82.93. The consensus price target of $94.14, and the 52-week range is $59.75 to $87.42. Also of interest in Dollar General:

- Dollar General gets a big upgrade ($100) from Merrill Lynch.

- Buffett should have never sold it and nine other stocks!

- Analysts loved Dollar General earnings and chased it higher.

5. Exxon Mobil: Oil and Gas

Exxon Mobil Corp. (NYSE: XOM) has been the one energy stock that has stood its tests of time. It is even making money during these hard energy times of 2014 to 2016, and doing it without the broad massive and public layoffs seen at other companies in the sector. Having a $400 billion market value has to be worth something. So does a 3.5% dividend yield that was just raised again despite oil being so weak.

If you believe in big oil not dying, then chances are very high Exxon Mobil is your pick — ditto if you think it will go back up. We can talk about the rise of renewables all day long, but the reality is that the lion’s share of the world’s energy will be on fossil fuels for some time.

Shares of Exxon traded recently at $88.11, with a consensus price target of $84.43 and a 52-week range of $66.55 to $89.96. Also of interest for Exxon Mobil:

- Exxon Mobil survived first-quarter earnings.

- Merrill Lynch raised its target on Exxon.

- Buffett shouldn’t have sold Exxon.

- See Exxon’s bullish and bearish case for 2016.

6. General Electric: Conglomerate

General Electric Co. (NYSE: GE) was slow to recover after the recession, but recover it has, and it has been jettisoning its consumer finance operations to be valued as an industrial conglomerate rather than as a conglomerate melded with a bank. GE has bought Alstom, has sold endless billions in financial assets, has sold GE appliances, has finished its Synchrony exit, and is focused on no more large deals. Its stock recovery might have even been stronger had it not added oil services so much in the mix. Now a massive stock buyback plan aims to shrink the float by almost 20%, from 10 billion shares originally down to 8 billion or so in the years ahead.

GE’s dividend hikes had to be put on hold (still at roughly 3%), but that most likely will resume after 2016. GE is harder to analyze for a full net value at almost 20 times earnings, but the buybacks and other efforts should lower that value in time. Health care, energy, water filtration, infrastructure, jet and rail engines should all assure GE’s future growth.

GE shares recently traded at $30.63. The consensus price target is $33.17. The 52-week range is $19.37 to $32.05. Also worth noting on General Electric:

- How analysts view GE after first-quarter 2016 earnings.

- GE is much less dependent on finance now.

- GE could outspend Apple on stock buybacks in 2016.

- See GE’s bullish and bearish case for 2016.

Alternative Pick: 3M Co. (NYSE: MMM) remains a very solid competitor for investors wanting a conglomerate. Its 2.6% dividend yield keeps rising, and its dividend payouts still have room to rise. 3M has been buying shares too, and it is also valued at almost 21 times earnings.

7. Kimberly-Clark: Consumer Products

Kimberly-Clark Corp. (NYSE: KMB) has been restructuring but remains a top defensive stock and consumer products leader. It dates back into the 1800s and now is worth $45 billion, and it comes with almost a 3% dividend yield. Its products include paper towels, tissues, diapers and sanitizers, among many other aspects of consumer products.

The rivalry of in-store promotions, generic brands and a weak international market (that darned pesky strong U.S. dollar) are all real, yet Kimberly-Clark keeps delivering dividend growth. Investors have to pay a premium price (about 20 times earnings), but that is now normal for large consumer products players, and it was an issue back in 2010 as well.

Kimberly-Clark shares were trading at $126.13, with a consensus price target of $136.83 and a 52-week range of $103.04 to $138.76. Also of Interest on Kimberly-Clark:

- Kimberly-Clark can hike its dividend for 10 years.

- Deutsche Bank’s analyst downgrade (April 25).

Alternative Pick: Procter & Gamble Co. (NYSE: PG) has been paring down its portfolio and jettisoned Duracell to Buffett’s Berkshire Hathaway. The company is a mega-cap at $220 billion in market value, and it is even more pricey at 22 times earnings, but with a 3.3% yield.

8. Republic Services: Waste Management

Republic Services Inc. (NYSE: RSG) still holds close to a duopoly position in large public garbage collection operations. The waste management business is highly regulated, but it can be very profitable, as we all hate garbage but keep making more and more of it. There are regulatory, environmental and pricing risks. Still, the company can win from lower gasoline and diesel costs, even if its recycling efforts are not profitable with commodity prices and demand low.

Having long-term contracts is a boom here and may offset environmental remediation costs, which go back many years (or decades). Republic was worth closer to $11 billion in 2010, and that is over $16 billion in 2016. Bill Gates’s Cascade Investment arm owns just over 30% of Republic now, with Gates likely viewing Republic as a futurist with a protected market. Its dividend yield is about 2.5%.

Republic Services shares were trading at $47.14, within a 52-week range of $38.99 to $48.76. The consensus price target is $51.50.

Alternative Pick: Waste Management Inc. (NYSE: WM) is a rival, with both companies valued at close to 20 times blended forward earnings. Its yield is a tad better at 2.8% than Republic’s, and in some ways Waste Management may look slightly more attractive than Republic. Over the past five years, Republic’s stock has risen almost 50%, versus just over 50% for Waste Management. Does anyone know how to out-guess the odds of a coin toss here? Also of interest in waste management, two in one:

- Why did Buffett sell out?

9. Teva Pharma: Generic Drugs Galore!

Teva Pharmaceutical Industries Ltd. (NASDAQ: TEVA) has been another laggard in the group versus the market since 2010, but what Teva has going for it on top of a branded portfolio is being the world’s most dominant player in generic drugs. A pending acquisition should help out as well, assuming Teva’s deal reaction recovers in the wake of pricing concerns.

Teva has doubled its dividend in the past five years. It is also valued at about 10 times earnings. The 2016 election rhetoric around drug prices remains a risk, but this has happened before, and generic drugs are only going to see their shares of all drug prescriptions rise through time. Saving money in drugs at a time when health care costs are rising is a must.

Shares of Teva traded at $54.20, with a consensus analyst target of $74.60 and a 52-week range of $52.62 to $72.31. Also of interest for Teva:

- Credit Suisse sees 15% upside, less than peers.

- Multiple analysts are chasing Teva higher in February.

Alternative Pick: Mylan N.V. (NASDAQ: MYL) successfully fought off a $40 billion buyout from Teva, but its own effort to buy Perrigo was thwarted and it is trying to buy a Swedish company instead. Mylan is less of a sure bet, but its stock price has sold off enough (under $50, versus a 2015 peak above $70), and it is and worth $21.5 billion, that Mylan most likely has a lot of cushion. Again, an alternative means it is the back-up pick rather than an equal.

10. Walt Disney: Media and Entertainment (and Star Wars)

Walt Disney Co. (NYSE: DIS) has managed to outperform far more than ever imagined back in 2010. It trades at a premium valuation because of its media and entertainment dominance. It also has acquired the Star Wars franchise in what proved to be a dirt cheap deal. Marvel and Pixar are wins as well, and efforts like “Frozen,” theme park growth and ticket price optimization are all helping. Dividend hikes and share buybacks have helped too. Broad negativity around ESPN and cord-cutting has been overblown, as Disney owns a big stake in Hulu.

Shares of Disney were trading at $103.78. The consensus price target is $110.21, while the 52-week range is $86.25 to $122.08. Also of interest in Disney:

- Buffett sold and regretted twice!

- Disney is adding two more cruise ships.

- Star Wars hit almost $1 billion in sales in less than two months.

Alternative Pick: For those investors looking for a would-be rival ahead, Comcast Corp. (NASDAQ: CMCSA) seems to have serious Disney envy. It now owns NBC and is in the process of acquiring DreamWorks Animation SKG for movies and for theme park exposure. By adding content it aims to reduce its exposure from the rise of cord-cutters. Its NBCUniversal owns a piece of Hulu. The core Disney is still perhaps its own best replacement, but the reality is that Comcast is melding lots and lots of one-time or consumption revenues on top of its core revenue stream for cable, phone lines and broadband. Disney still remains its own best alternative.

A table showing the price back in 2010 and adjusted for prices in May 2016 has been included here. Also included is the performance since then adjusted for dividends, yields of the dividends now and compared to 2015 and 2010, and how each one’s market cap has changed from 2010 to 2016.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.