Outside of NVIDIA’s (NASDAQ: NVDA) recent share price going stratospheric, Amazon (NASDAQ: AMZN) has been a Wall Street darling since the company IPO’d in May 1997 at a split adjusted price of $.07.

Today, Amazon stock trades for $196.88, which means that stock is up over 200,100% since May 1997 turning every $1000 invested into $2 million today.

The only thing that matters from this point on is what the stock will do for the next 1, 5 and 10 years and beyond. Let’s crunch the numbers and give you our best guest on Amazon’s future share price.

No one has a crystal ball and even the Wall Street “experts” are often wrong more than they are right in predicting future stock prices. We will walk through our assumptions and provide you with the story around the numbers (other sites just pick a share price without explaining why they suggest the price they do).

Source: jetcityimage / iStock Editorial via Getty Images

Amazon’s Recent Stock Success

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2017.

| Year | 2014 | 2015 | 2016 | 2017 |

| Share Price (Start of Year) | $19.94 | $15.63 | $32.81 | 37.90 |

| Revenues (Billions) | $89.0 | $107.0 | $136.0 | 177.9 |

| Net Income (Billions) | ($.241) | $.596 | $2.371 | $3.03 |

And performance continued from 2018 to 2023.

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Share Price (Start of Year) | $58.60 | $73.26 | $93.75 | $163.50 | $167.55 | $85.46 |

| Revenues (Billions) | $232.9 | $280.5 | $386.1 | $469.8 | $514.0 | $574.78 |

| Net Income (Billions) | $10.07 | $11.59 | $21.33 | $33.36 | ($2.72) | $30.42 |

In the last decade Amazon’s revenue grew about 540% while its net income moved from losing money to 30.42 billion in profits this past year.

The ride up wasn’t always smooth, however. For example, 2020 saw sales jump 38% and net income nearly double. 2021 saw a continued boom as people moved to e-commerce shopping during Covid.

However, all those sales being “pulled forward” led to challenges in 2022 and the company swinging to a surprise loss. As Amazon embarks into the back half of the decade, a few different key areas will determine its performance.

3 Key Drivers of Amazon’s Stock Performance

- E-Commerce Success: While Covid brought record sales to Amazon, it also led to many competitors investing heavily to compete with Amazon online. While e-commerce is still just 15% of retail sales, putting up huge growth rates in online sales won’t be as easy in the coming years as it was a decade ago.

- Amazon Web Services: Amazon Web Services 1st quarter 2024 revenue was $25.04 billion and the unit should break $100 billion in total sales this year. However, the unit’s 13% year-over year growth isn’t as fast as competing cloud services like Microsoft‘s(Nasdaq: MSFT) Azure and Google (Nasdaq: GOOGL) Cloud. Amazon is at risk of falling behind Microsoft before 2030 if it can’t stop market share losses.

- Advertising: Amazon exits 2023 with a $47 billion advertising business that grew 24% in 2023. Advertising has the ability to be another high-margin business line – Amazon currently gets most its profits from its AWS cloud business – that leads the company past $100 billion in annual profits.

Source: gorodenkoff / iStock via Getty Images

Amazon (AMZN) Stock Price Prediction in 2025

The current consensus 1 year price target for Amazon stock is $218.23, which is 10.84% upside from today’s stock price of $196.88. Of all the analysts covering Amazon, the stock is a consensus buy, with a 1.32 “Buy” rating.

24/7 Wall Street 12 month forecast projects Amazon’s stock price to be $225. We see AWS continue its current 12% growth rate but see Amazon’s advertising business outperforming analyst expectations, particularly in the 4th quarter of 2024 with more streaming ad impressions being sold.

Amazon (AMZN) Stock Forecast Through 2030

- AWS: Assuming AWS stems its market share loss and investments in AI propel counterbalance the threat from Microsoft and Google.

- E-Commerce: Amazon continues to pour investments into ecommerce, forgoing added profits to maintain market share. Our case model assumes growth in new logistics and efficiencies from robotics in warehouses leads to this unit finally delivering strong operating profits.

- Advertising: Amazon’s advertising continued to grow and the now $47 billion business unit and we see a high teens growth rate compounded annually.

Add all these numbers up and take out some amount for “new bets” the company will surely be investing in (and a potential dividend boost)and we see revenue in 2030 at $1.15 trillion and $131 billion in net income. Today, the company trades for about 50X earnings, which we’ll take down to 35 times as the company matures (but continues showing growth).

In our analysis Amazon is worth $2.6 trillion in 2030. Here is our revenue, net income and company size estimates through 2030:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue (Est. Billions) | $638 | $710 | $788 | $867 | $957 | $1,049 | $1,149 |

| Net Income (Est. Billions) | $48.56 | $62.13 | $79.68 | $96.53 | $114.17 | $136.69 | $131.391 |

| Total Enterprise Value (Est. in Trillions) | $1.93 | $2.12 | $2.19 | $2.29 | $2.39 | $2.5 | $2.6 |

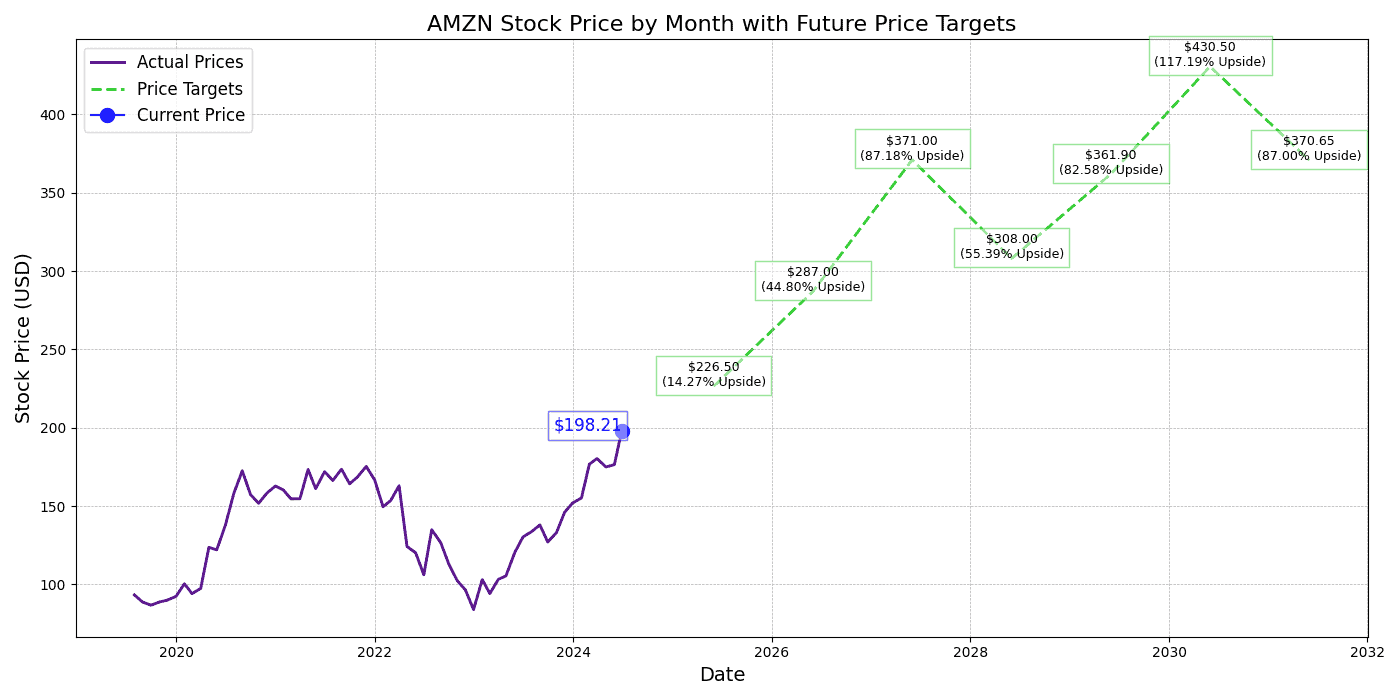

Amazon’s Share Price Estimates 2025-2030

Source: 24/7 Wall Street

| Year | Price Target | % Change From Current Price |

| 2024 | $226.50 | Upside of 15.04% |

| 2025 | $287.00 | Upside of 45.77% |

| 2026 | $371.00 | Upside of 88.44% |

| 2027 | $308.00 | Upside of 56.44% |

| 2028 | $361.90 | Upside of 83.82% |

| 2029 | $430.50 | Upside of 118.66% |

| 2030 | $370.65 | Upside of 88.26% |

Price Forecast and Prediction for 2025: We expect to see revenue growth just over 11% and EPS of $5.74 for the year. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for Amazon at $287 in 2025, which is a 45.77% higher than the stock is trading today.

Price Forecast and Prediction for 2026: We estimate the price to be $371, after revenue estimates to come in around 10% higher year-over-year. With an EPS of $7.42 and in our opinion the last year Amazon trades near its current P/E of 50, 2026 could mark the year Amazon starts trading at a more mature valuation closer to 35 times earnings. That would represent a 88.44% gain over today’s share price of $196.88

Price Forecast and Prediction for 2027: We expect the stock price increase not to be as pronounced as more tempered growth is expected from Amazon and even with earnings estimates of $8.80 per share, the stock price target for the year is $308.00. That is a 17% year hit from the previous year, but still up 56.44% from today’s stock price.

Price Forecast and Prediction for 2028: When predicting more than a 3 years out, we expect Amazon to remain growing its top line at 10% but being more efficient and operating margins to grow. In 2028, we have Amazon’s revenue coming in around $957 billion and an EPS of $10.34 suggesting a stock price estimate at $361.90 or a gain of 83.82.% over the current stock price.

Price Forecast and Prediction for 2029: 24/7 Wall Street expects Amazon to continue its 10% revenue growth again and to generate $12.30 per share of earnings. With a price to earnings multiple of 35, the stock price in 2029 is estimated at $430.50, or a gain of 118.66% over today’s price.

Price Forecast and Prediction for 2030: We estimate Amazon’s stock price to be $370 per share with 10% year-over-year revenue growth but compressed margins from more competition in its AWS unit. Our estimated stock price for Amazon will be 88.26% higher than the current stock price, marking a double in Amazon’s stock price today of $196.88.

What’s Next for Amazon Stock

6/28/2024

Amazon started off Friday at an all-time high once again and the e-commerce giant launched a plan to compete with lost cost competitors, like Temu and Shein, to attract budget-conscious consumers. Amazon plans on using its extensive logistical empire to deliver low cost goods faster and without compromising on price.

6/27/2024

On Wednesday, Amazon stock reached a market cap of $2 trillion for the first time ever. The stock is now up 25% in 2024 and moving ahead of analyst predictions by a wide margin.

06/26/2024

All eyes will be on Amazon July 16-17th as Amazon Prime Day kicks off two record sales day for Amazon’s ecommerce sector. Investors will keep their eye on total sales numbers to gauge the health of consumer spending for the back half of the year.

Walmart’s CFO John Rainey leaked sales are struggling and expects the second half of 2024 to be sluggish in a recent Bank of America Conference and Amazon Prime Day could give us an early look to see if the sales slowdown is specific to Walmart or more widespread.

In 2023, Amazon Prime Day brought in $12.9 billion in sales which was a 6.7% increase year-over-year. Estimates for 2024 will be over $13.5 billion in global sales.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.