Many people dream of a relaxing retirement with travel, hobbies, and spending time with family. But turning that dream into a reality requires careful financial planning. It isn’t odd for those planning for retirement to look for specific benchmarks, such as how much they should have saved at 50.

While reaching a specific savings goal by 50 is a critical benchmark for a secure retirement for many, factors like health, lifestyle choices, and debt can significantly impact this target.

We don’t recommend throwing benchmarks out the window completely, though. Generally, it’s recommended that you have 3 to 6 times your annual salary saved by 50. However, this guideline should be a starting point. Considering other factors is vital for saving enough for your retirement, specifically.

Let’s explore how to adjust this one-size-fits-all savings target into a customized retirement plan.

Importance of Saving by 50

Saving for retirement by 50 is a vital step towards financial security. Saving early is important, as it allows you to harness the power of compound interest. Your money grows not just on its initial value but also on the accumulated interest over time. The earlier you start saving, the more money you’ll have to snowball.

That said, don’t feel like you’ve missed the bandwagon if you’re approaching 50. There is no better time to start saving than today.

Reaching your savings goal by 50 also provides some peace of mind. Having a nice financial cushion helps reduce stress and allows you to be more flexible with retirement planning. If you surpass your goal, you can take on larger obstacles later with ease, too.

We recommend saving 3 to 6 times your annual salary by 50 for most individuals, as we explained above. This target puts you on the “average person’s” retirement path. That said, you are not an “average person.” We recommend adjusting this goal to meet your needs for the best results.

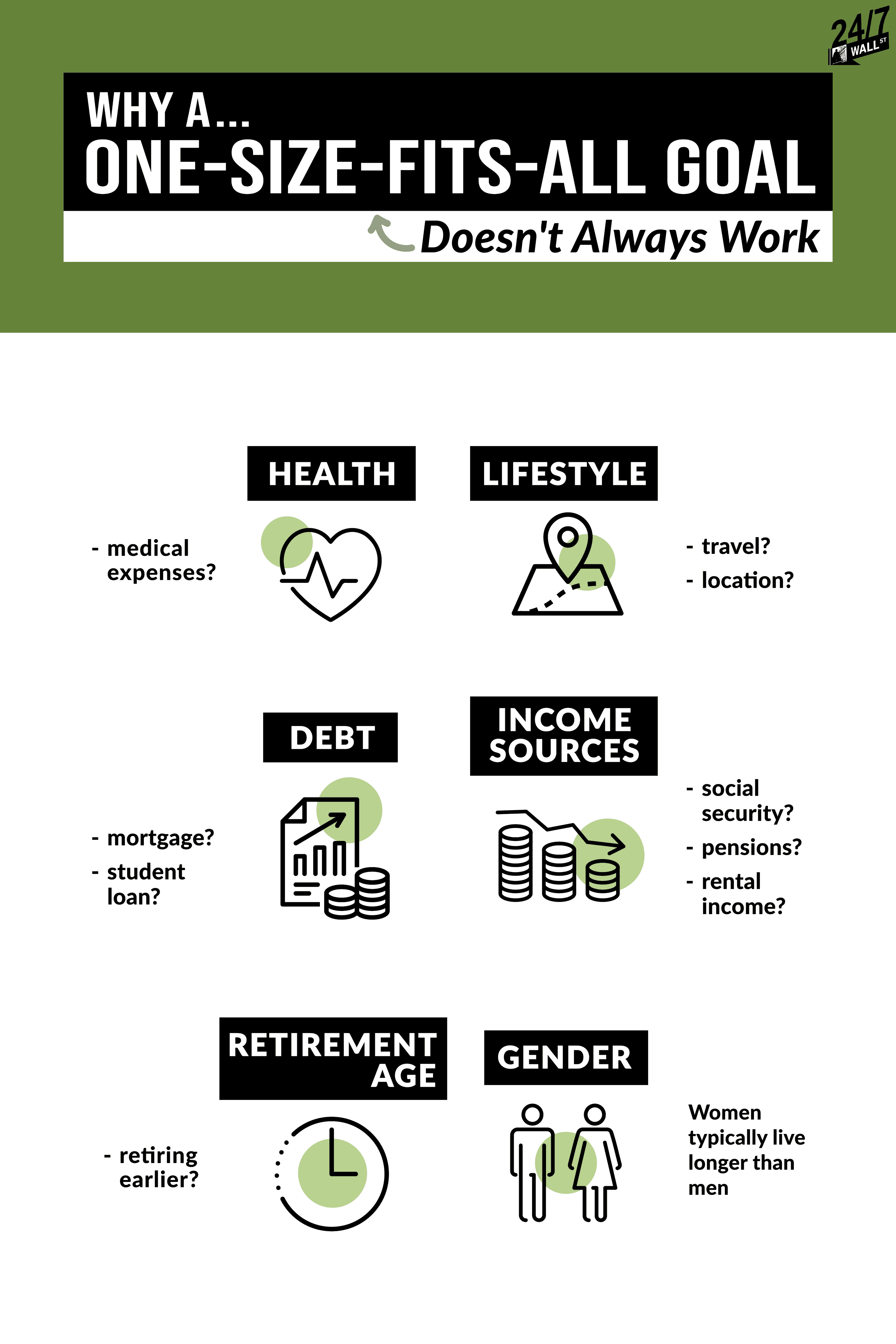

Why a One-Size-Fits-All Goal Doesn’t Always Work

We all want a retirement goal that will be “enough.” Sadly, this goal is often harder to define than it is to reach! Individual circumstances heavily impact how much money you’ll need in retirement, and you may not even know these circumstances yet. Things can change a lot between 50 and retirement.

For instance, here are just some factors that affect retirement savings goals:

- Health: Medical expenses can be costly and often increase as we age. Those with chronic health conditions or a family history of health problems may need more money to cover these costs. Of course, no one truly knows how healthy they will be after retirement.

- Lifestyle: Do you want to travel extensively in retirement? Planning on retiring somewhere expensive? How you plan to live during retirement greatly impacts the amount of money you need.

- Debt: Carrying a significant mortgage or student loans into retirement reduces your monthly income and requires a larger savings base to compensate. Preferably, your debt should get paid down before retirement, but this isn’t always practical.

- Income Sources: What sources of income will you have in retirement? Social Security benefits, pensions, and rental income can all supplement your savings. Factor these in to determine how much you need to have saved.

- Retirement Age: If you plan on retiring earlier, you’ll need more money to cover your longer retirement period.

- Gender: Women typically live longer than men. For this reason, women also need more money saved up for retirement. Their retirement will be longer, on average.

With all these factors in mind, let’s adjust the “3 to 6 times your income” goal to meet your specific situation.

Developing a Personalized Retirement Savings Plan

Now that you’ve considered what may affect your retirement needs, let’s examine how you can create a retirement plan that considers these factors.

Firstly, you’ll want to estimate your retirement income needs. Basically, you need to know how much money you’ll need by calculating your anticipated expenses. Consider how much money you need now. Then, factor in areas where you may save money (like the lack of a commute) and areas where you may spend more money (like travel).

Next, take this number and determine how much you need to save to reach your target. Consider your current income and what is doable, too. While extravagant travel during your golden years may seem fun, is it worth working an extra ten years?

You can maximize your retirement savings by choosing the proper “vehicle” for retirement. You can choose from an IRA, 401(k), and other investment accounts for tax advantages. Some companies also offer 401(k) matches, helping you save more quickly.

If all this feels overwhelming, you can consider talking to a financial advisor. These advisors help people retire daily, so they’re very good at offering personalized guidance.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.