The American education system continues to compare unfavorably to other affluent nations. In international testing, American students rank behind 18 countries in science and behind 36 in math. Nationwide statistics in student achievement, however, tell relatively little about the potential success of students in a particular U.S. school district.

American school districts are largely funded by local sources such as property taxes. So while affluent districts can afford to spend thousands more — sometimes tens of thousands more — per student, providing cutting-edge technology, a diverse range of courses, and other amenities, schools in poor districts can sometimes struggle to afford competent teachers and maintain the school building.

While schools in poorer districts receive funding from the state and federal governments, the funding rarely comes close to evening out the playing field. Across the nation, annual per student spending ranges from less than $10,000 to more than $30,000 in some cases.

That difference in spending is actually only one component that contributes to the differences in student success across the country. Children who live in poverty, or those whose parents lack a high school or college education or are much more likely to struggle in school than those growing up in affluent homes with college-educated parents.

To determine the school district where students are least likely to find success, 24/7 Wall St. developed an index based on each district’s share of adults with a bachelor’s degree, child poverty rate, teacher-to-student ratio, per-pupil spending, preschool enrollment, and high school graduation rate.

Click here to see the school districts where students are least likely to succeed.

Click here to see our methodology.

Alabama: Eufaula City School District

> Location: Barbour County

> Per student spending: $8,851

> High school graduation rate: 80%

> Adults with a bachelor’s degree: 17.0%

Compared to many of the school districts on this list, Alabama’s Eufaula City School District has a relatively high graduation rate of 80%. Students in the district, however, face serious obstacles to success. Notably, over half of children live in poverty, one of the highest child poverty rates of any district in the country. Children who live in poverty are much more likely than other students to have difficulty in school.

[in-text-ad]

Alaska: Galena City School District

> Location: Yukon-Koyukuk Census Area

> Per student spending: $6,791

> High school graduation rate: 79%

> Adults with a bachelor’s degree: 31.2%

Only a small share of school districts nationwide have a lower high school graduation rate than that of Galena City School District in Alaska. Just 79% of the class of 2017 graduated on time in the district. The district’s poor outcomes could be due in part to low investment. The district spends less than $7,000 per student annually on average, well below the average national spending of $11,762 per pupil.

Arizona: Chinle Unified District

> Location: Apache County

> Per student spending: $12,758

> High school graduation rate: 63%

> Adults with a bachelor’s degree: 10.0%

Arizona has one of the worst school systems in the United States, and Chinle Unified District ranks as the worst in the state. Not even two-thirds of high school students graduate on time, compared to the average national graduation rate of 85%. The district also has one of the lower adult college attainment rates in the state — just 10% of district residents 25 or older have a bachelor’s degree, about one-third of the national bachelor’s degree attainment rate.

Arkansas: Pine Bluff School District

> Location: Jefferson County

> Per student spending: $11,111

> High school graduation rate: 70%

> Adults with a bachelor’s degree: 19.6%

Children growing up in households with parents who lack a college education have been shown to have more trouble succeeding in K-12 and postsecondary education. In the Pine Bluff School District in Arkansas, the worst-ranked in the state, less than 20% of adults have a bachelor’s degree. This is an even lower bachelor’s degree attainment rate than that of Arkansas, which has one of the least highly educated adult populations of any state.

[in-text-ad-2]

California: Cutler-Orosi Joint Unified School District

> Location: Fresno and Tulare counties

> Per student spending: $11,196

> High school graduation rate: 92%

> Adults with a bachelor’s degree: 5.3%

Poverty can add considerable stress to a child’s life and undermine academic performance. In California’s Cutler-Orosi Joint Unified School District, over 40% of of children live in poverty, one of the highest child poverty rates among U.S. school districts. Students in the district are among the least likely in the country to have parents who graduated from college, an important indicator of success. Just 5.3% of adults in the district have a college degree, one of the lowest shares in both the state and the country.

Colorado: Adams County School District 14

> Location: Adams County

> Per student spending: $9,666

> High school graduation rate: 66%

> Adults with a bachelor’s degree: 8.2%

Just 66% of the class of 2017 graduated on time in Colorado’s Adams County School District 14, one of the lowest high school graduation rate of any district in the state. Children with well-educated parents are more likely to succeed academically, and in the district, only 8.2% of adults have a bachelor’s degree or higher, the smallest share of any district in the state with available data.

[in-text-ad]

Connecticut: Hartford School District

> Location: Hartford County

> Per student spending: $20,118

> High school graduation rate: 69%

> Adults with a bachelor’s degree: 16.6%

Connecticut is home to some of the most affluent communities — and to many of the best school districts nationwide. Hartford School District, however, has a median annual household income of $33,841, less than half the state median household income of $74,168. The district, facing challenges common to districts in low-income communities, has a high school graduation rate of 69%, the worst in the state. Just 2.5% of high school students in the district are enrolled in Advanced Placement courses, and the teacher-to-student ratio is well below that of some of the more affluent districts in the state.

Delaware: Lake Forest School District

> Location: Kent County

> Per student spending: $12,296

> High school graduation rate: 85%

> Adults with a bachelor’s degree: 18.7%

Students in Lake Forest School District in Delaware’s Kent County face some of the biggest obstacles to their success. The district, about 40 miles south of the state’s best district, Appoquinimink School District, has a 22.7% child poverty rate and an 85% high school graduation rate, compared to Appoquinimink’s 5.9% child poverty rate and 95% graduation rate

Florida: Gadsden County School District

> Location: Gadsden County

> Per student spending: $9,705

> High school graduation rate: 50%

> Adults with a bachelor’s degree: 16.3%

The Gadsden County School District in Florida ranks as the state’s worst district. The district’s 4.4% enrollment rate of high school students in AP courses is one of the lowest in the state. Only about 50% of high school students graduated on time in 2017, the lowest graduation rate in the state and one of the lowest in the country.

[in-text-ad-2]

Georgia: Emanuel County School District

> Location: Emanuel County

> Per student spending: $9,406

> High school graduation rate: 79%

> Adults with a bachelor’s degree: 12.5%

Enrollment in Advanced Placement courses can be a sign of students’ preparedness to reach college and excel there. Just 0.4% of high school students in Georgia’s Emanuel County School District enroll in AP courses. For contrast, Georgia’s best district, the Decatur City School District, has a high school AP enrollment rate of 42.7%

Hawaii: Hawaii Department of Education

> Location: Hawaii, Honolulu, Kalawao, Kauai, and Maui counties

> Per student spending: $13,748

> High school graduation rate: 83%

> Adults with a bachelor’s degree: 32.0%

There are no separate school districts in Hawaii. Rather, the entire school system is controlled by the Hawaii Department of Education. For this reason, this district, which serves all of Hawaii’s over 180,000 public school students, is both the state’s best and its worst. For that reason, the district compares favorably to most of those on this list. For example, its 83% high school graduation rate is higher than most districts on this list, and closely in line with the 85% national graduation rate.

[in-text-ad]

Idaho: Caldwell School District 132

> Location: Canyon County

> Per student spending: $6,637

> High school graduation rate: 77%

> Adults with a bachelor’s degree: 12.3%

Preschool can be an important step in early childhood development. In Idaho, less than one-third of 3- and 4-year olds are enrolled in preschool, the lowest preschool enrollment rate in the country. In the Caldwell School District, early education enrollment is even lower than across the state, with just 18.7% of young children enrolled in preschool programs.

Illinois: East St. Louis School District 189

> Location: St. Clair County

> Per student spending: $15,773

> High school graduation rate: 71%

> Adults with a bachelor’s degree: 11.2%

Students in the East St. Louis School District 189 face enormous barriers to their success, though funding is not one of them. The district spends $15,773 per student compared to national average spending of $11,762 per student. Still, children living in poverty are more likely to struggle in school, and East St. Louis is one of the poorer areas in the country, with a child poverty rate of 48.3%. The district’s high school graduation rate of 71% is one of the lowest in the state.

Indiana: Gary Community School Corporation

> Location: Lake County

> Per student spending: $13,386

> High school graduation rate: 86%

> Adults with a bachelor’s degree: 13.3%

Children who grow up in a household with parents who completed college have been shown to be more likely to do better in school and more likely to attend college. In the Gary Community School Corporation district, just 13.3% of adults have a bachelor’s degree, which is about half the rate across Indiana. The state itself has one of the lower college attainment rates in the country, with 26.8% of adults holding a bachelor’s degree.

[in-text-ad-2]

Iowa: Burlington Community School District

> Location: Des Moines County

> Per student spending: $9,960

> High school graduation rate: 73%

> Adults with a bachelor’s degree: 19.6%

Per student funding in Iowa’s Burlington County is less than $10,000, lower than the national average spending per pupil $11,762, and below that of most districts in the state. The district’s 73% high school graduation rate for the 2016-17 senior class was the lowest in the state among districts with comparable data.

Kansas: Kansas City Unified School District 500

> Location: Leavenworth and Wyandotte counties

> Per student spending: $11,186

> High school graduation rate: 71%

> Adults with a bachelor’s degree: 14.6%

The Kansas City School District, with roughly 22,000 students, is one of the largest in the state. With a 71% graduation rate, it is also the district where students are least likely to succeed in the state. Just 14.6% of adults in the district have a bachelor’s degree, less than half both the statewide and national bachelor’s attainment rates. Only 2% of high schoolers in the district enroll in AP courses.

[in-text-ad]

Kentucky: Clay County School District

> Location: Clay County

> Per student spending: $10,167

> High school graduation rate: 79%

> Adults with a bachelor’s degree: 9.5%

Kentucky has one of the worst-rated early education systems in the country, and students in the Clay County School District have an even lower likelihood of receiving quality early education. Just 18.2% of 3- and 4-year olds in the district are enrolled in Pre-K, less than the statewide enrollment rate of 41.3% and the national rate of 47.5%.

Children whose parents have a college education have been shown to be more likely to do better in school and more likely to attend college. In the Clay County School District, however, less than 10% of adults have a bachelor’s degree, compared to the state’s bachelor’s degree attainment rate of 24%, which is one of the lowest of any state.

Louisiana: Morehouse Parish School District

> Location: Morehouse Parish

> Per student spending: $11,775

> High school graduation rate: 69%

> Adults with a bachelor’s degree: 13.9%

In Louisiana’s Morehouse Parish School District, located in the northernmost part of the state, just 69% of the class of 2017 graduated on time, nearly the smallest share of any district reviewed in the state. High enrollment in Advanced Placement courses in a school district can be a sign students there are excelling at their studies. The average enrollment rate across all school districts with available data in the U.S. is 18.4% of high school students, but in this district, no students are reported as enrolled in AP classes.

Maine: Lewiston

> Location: Androscoggin County

> Per student spending: $11,511

> High school graduation rate: 76%

> Adults with a bachelor’s degree: 19.2%

Maine’s Lewiston School District is located not far from Bates College. While the presence of a nearby college or university often corresponds with higher local educational attainment rates, less than 20% of adults in the district have a bachelor’s degree, compared to 32.1% of adults in the state. Many of the state’s school districts lack comparable high school graduation rates, but of those with data, Lewiston’s 76% graduation rate for 2017 was the worst in the state.

[in-text-ad-2]

Maryland: Baltimore City Public Schools

> Location: Baltimore city

> Per student spending: $15,168

> High school graduation rate: 71%

> Adults with a bachelor’s degree: 30.4%

Generally, Maryland’s education system compares favorably to the rest of the country, and the average district spending per pupil is considerably higher than the nationwide average. In the vast majority of school districts in the state, a smaller than average share of school-aged children live in poverty. One of the few major exceptions is the Baltimore City School District, where nearly 30% of children live in poverty, compared to a national child poverty rate of 17.3%.

Massachusetts: Chelsea School District

> Location: Suffolk County

> Per student spending: $13,658

> High school graduation rate: 57%

> Adults with a bachelor’s degree: 17.4%

Massachusetts is home to some of the most affluent communities and to many of the best school districts in the United States. The Chelsea School District, however, has a high school graduation rate of just 57%, the worst in the state among districts with comparable data. With just two exceptions, every other district in the state has a high school graduation rate of at least 70%. Massachusetts is one of the states with the highest preschool enrollment rates, at nearly 60% of 3- and 4-year olds. In the Chelsea School District, just 32.6% of preschool-age children are in school.

[in-text-ad]

Michigan: Westwood Heights Schools

> Location: Genesee County

> Per student spending: $9,164

> High school graduation rate: 39%

> Adults with a bachelor’s degree: 10.1%

In Michigan, students in the Westwood Heights Schools district are the least likely to succeed, with just 39% of high school seniors graduating on time in 2017, one of the lowest graduation rates in both the state and the country. In comparison, 85% of high school students graduated on time nationwide.

High enrollment in Advanced Placement courses in a school district can be a sign students there are excelling at their studies. The average enrollment rate across all school districts nationwide with available data is 18.4% of high school students, but in this district, no students are reported as enrolled in AP classes.

Minnesota: Brooklyn Center School District

> Location: Hennepin County

> Per student spending: $12,122

> High school graduation rate: 50%

> Adults with a bachelor’s degree: 18.6%

In the Brooklyn Center School District north of Minneapolis, the high school graduation rate in 2017 was just 50%, one of the worst in both the state and country as a whole. The average high school graduation rate across all U.S. districts with available data is 85%. Districts with high enrollment in AP courses are more likely to have students who are likely to excel in school and be more successful in college. The district’s Advanced Placement enrollment of 0.2% is well below the nationwide average of 18.4%.

Mississippi: Holmes County School District

> Location: Holmes County

> Per student spending: $8,238

> High school graduation rate: 78%

> Adults with a bachelor’s degree: 11.0%

Mississippi’s Holmes County School District has one of the lowest teacher-to-student ratios of any district in the state and the country as a whole. Studies have shown that children who grow up in poverty are more likely to struggle in K-12 schooling and are less likely to attend college than their peers. Across the country, 17.3% of school-aged children live in poverty, but in the Holmes County School District, over half of all children do, one of the highest child poverty rates in the country.

[in-text-ad-2]

Missouri: Riverview Gardens School District

> Location: St. Louis County

> Per student spending: $8,776

> High school graduation rate: 83%

> Adults with a bachelor’s degree: 12.6%

High per-student spending in school districts is by no means a guarantee students will be more successful than those in lower spending districts. Nevertheless, schools in low-spending districts can sometimes struggle to afford to maintain the school building and to hire as many teachers as are needed. In the roughly 6,100-student Riverview Gardens School District in St. Louis, the schools spend $8,776 per student annually, one of the lower per pupil spending among state public school districts and well below the national average district spending of $11,762 per student.

Montana: Libby K-12 Schools

> Location: Lincoln County

> Per student spending: $11,037

> High school graduation rate: N/A

> Adults with a bachelor’s degree: 23.2%

There are only 63 teachers for every 1,000 students in Montana’s Libby school district, the lowest teacher-to-student ratio of any school district with available data in the state. Students in the district also do not benefit from as much investment as students elsewhere in the state. Libby spends just $11,037 per pupil annually, nearly the lowest average per student spending of any district in Montana and less than half the amount other districts in the state spend per student.

[in-text-ad]

Nebraska: South Sioux City Community Schools

> Location: Dakota County

> Per student spending: $11,637

> High school graduation rate: 90%

> Adults with a bachelor’s degree: 11.7%

Early childhood education can better prepare students for success later in their academic career, and in Nebraska’s South Sioux City Community Schools, just 32.1% of 3- and 4-year olds are enrolled in preschool, compared to 42.3% of the age group across the state as a whole.

Children with well-educated parents are more likely to succeed academically, and in South Sioux City, just 11.7% of adults have a bachelor’s degree, compared to 31.7% of adults across Nebraska.

Nevada: Nye County School District

> Location: Nye County

> Per student spending: $11,570

> High school graduation rate: 79%

> Adults with a bachelor’s degree: 11.5%

As a whole, Nevada has one of the worst education systems in the country, and not surprisingly, the district in the state where students are the least likely to succeed compares unfavorably to most districts nationwide. The district has a lower than average graduation rate and one of the lower teacher-to-student ratios of any district in country.

New Hampshire: Manchester School District

> Location: Hillsborough County

> Per student spending: $11,849

> High school graduation rate: 77%

> Adults with a bachelor’s degree: 28.3%

New Hampshire has one of the best education systems in the country, but that does not mean every district in the state fares as well. With over 14,000 students enrolled, the Manchester School District is one of the larger districts in the state. It is also the district where students have the worst chance of success. The district’s high school graduation rate of 77% is the lowest of any district in the state with comparable data.

[in-text-ad-2]

New Jersey: Bridgeton City School District

> Location: Cumberland County

> Per student spending: $16,544

> High school graduation rate: 73%

> Adults with a bachelor’s degree: 5.0%

Though the Bridgeton City School District has higher than average per-pupil spending, many disadvantages exist outside of the classroom. Children with well-educated parents are more likely to succeed academically, and in the Bridgeton City School District, only 5.0% of adults have a bachelor’s degree or higher, the smallest bachelor’s degree attainment rate of any district in the state with available data.

New Mexico: Gallup-McKinley County Schools

> Location: McKinley County

> Per student spending: $10,649

> High school graduation rate: 67%

> Adults with a bachelor’s degree: 11.6%

As a whole, New Mexico has one of the worst education systems in the country, and not surprisingly, the district where students are the least likely to succeed in the state compares unfavorably to the vast majority of districts nationwide. Studies have shown that children who grow up in poverty are more likely to struggle in school and less likely to attend college than their peers from wealthier homes. Across the country, 17.3% of school-aged children live in poverty, but in the Gallup-McKinley County Schools district, 45.5% do, more than double the national poverty rate among 5-17 year olds.

[in-text-ad]

New York: Utica City School District

> Location: Oneida County

> Per student spending: $15,193

> High school graduation rate: 68%

> Adults with a bachelor’s degree: 17.6%

Just 68% of students in the class of 2017 graduated on time in New York’s Utica City School District — well below the comparable 85% graduation rate nationwide. Early childhood education can better prepare students for success later in their academic career, and in the Utica school district, just 38.7% of 3- and 4-year olds are enrolled in preschool, compared to preschool enrollment rate of 57.8% across the state as a whole.

North Carolina: Robeson County Schools

> Location: Robeson County

> Per student spending: $8,367

> High school graduation rate: 87%

> Adults with a bachelor’s degree: 12.8%

Studies have shown that children who grow up in poverty face a number of serious obstacles to obtaining a quality education. Across the country, 17.3% of school-aged children live in poverty, but in the Robeson County Schools district, 42.0% do, one of the higher child poverty rates in the state and the country. High per-student spending is by no means a guarantee students will be more successful than those in lower-spending districts, but schools in districts that spend less often struggle more than some more affluent districts. Schools in Robeson County spend $8,367 per student, well below the national district average spending of $11,762 per pupil.

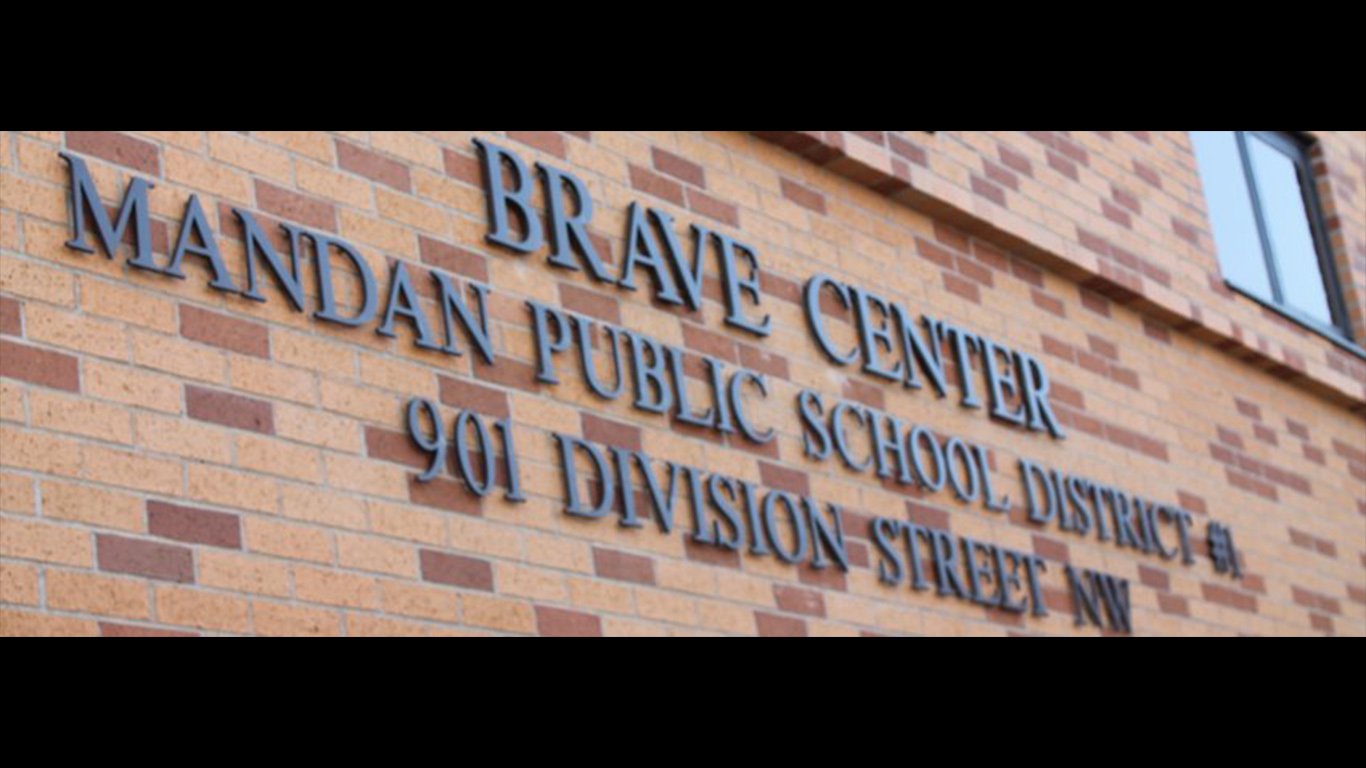

North Dakota: Mandan Public School District 1

> Location: Morton County

> Per student spending: $11,789

> High school graduation rate: 81%

> Adults with a bachelor’s degree: 27.5%

In the vast majority of school districts in North Dakota, there are over 80 teachers for every 1,000 students. The Mandan Public School District 1 is one of only a handful where there are fewer than 70 teachers for every 1,000 students. The district also spends $11,789 per student annually, in line with the national average per pupil expenditure but less than spending in most other districts in the state.

[in-text-ad-2]

Ohio: Lima City School District

> Location: Allen County

> Per student spending: $12,181

> High school graduation rate: 63%

> Adults with a bachelor’s degree: 11.4%

In the Lima City School District, the district where students are the least likely to succeed in Ohio, just 63% of high school students graduated on time in 2017, one of the lowest graduation rates in both the state and the country. The average high school graduation rate across all U.S. districts with available data is 85%.

Oklahoma: Muskogee Public Schools

> Location: Muskogee County

> Per student spending: $7,710

> High school graduation rate: 73%

> Adults with a bachelor’s degree: 19.5%

Though high per-student spending in school districts is by no means a guarantee students will be more successful than those in lower spending districts, schools in poor districts can sometimes struggle to afford to maintain the building and hire as many teachers as are needed. Oklahoma’s Muskogee Public Schools district spends just $7,710 per student, one of the lower per pupil spending among state public school districts. For contrast, the national district average spending is $11,762 per student. The district also has one of the lowest teacher-to-student ratios of any district in the state and the country as a whole.

[in-text-ad]

Oregon: North Bend School District 13

> Location: Coos County

> Per student spending: $5,419

> High school graduation rate: 50%

> Adults with a bachelor’s degree: 21.3%

High enrollment in Advanced Placement courses in a school district can be a sign students there are excelling at their studies. The average enrollment rate across all school districts nationwide with available data is 18.4% of high school students, but in this district, no students are reported as enrolled in AP classes. The district also has one of the lowest teacher-to-student ratios of any district in the state and the country as a whole.

Pennsylvania: Reading School District

> Location: Berks County

> Per student spending: $10,504

> High school graduation rate: 67%

> Adults with a bachelor’s degree: 9.2%

Children whose parents have a college education have been shown to be more likely to do better throughout school and go on to college themselves. In Pennsylvania’s Reading School district, however, less than 10% of adults have a bachelor’s degree, compared to 31.4% of adults statewide. In the district, 24.2% of preschool-aged children are enrolled in a preschool program, compared to the state’s 46.6% preschool enrollment rate. Early childhood education can contribute to children’s success in school.

Rhode Island: Woonsocket School District

> Location: Providence County

> Per student spending: $12,969

> High school graduation rate: 67%

> Adults with a bachelor’s degree: 15.3%

Woonsocket School District in northern Rhode Island ranks as the worst school district in the state. The district’s 67% high school graduation rate is well below the average 85% national graduation rate. The district’s poor outcomes may be due in part to limited resources. For example, there are only 67 teachers for every 1,000 students in the district, the lowest student-to-teacher ratio of any district with available data in the state.

[in-text-ad-2]

South Carolina: Lexington School District 4

> Location: Lexington County

> Per student spending: $9,968

> High school graduation rate: 72%

> Adults with a bachelor’s degree: 9.1%

South Carolina’s Lexington School District 4 spends less than $10,000 per student annually, below the average national per pupil spending of $11,762. Greater investment in education can help improve outcomes, and in the district, just 72% of the class of 2017 graduated on time, well below the comparable 85% national graduation rate.

South Dakota: Rapid City School District 51-4

> Location: Meade and Pennington counties

> Per student spending: $8,537

> High school graduation rate: 75%

> Adults with a bachelor’s degree: 30.8%

Though high per-student spending in school districts is by no means a guarantee students there will be more successful than those in lower spending districts, schools in poor districts can sometimes struggle to afford to maintain the building and hire as many teachers as are needed. In the Rapid City School District 51-4, schools spend just $8,537 per student, one of the lower per-pupil spending among public school districts both state and nationwide. The district’s high school graduation rate of just 75% is 10 percentage points below the national rate of 85%.

[in-text-ad]

Tennessee: Union County School District

> Location: Union County

> Per student spending: $8,634

> High school graduation rate: 87%

> Adults with a bachelor’s degree: 8.8%

Children whose parents have a college education have been shown to be more likely to do better in school and more likely to attend college themselves. In the Union County School District, however, only 8.8% of adults have a bachelor’s degree, compared to the state’s 27.3% bachelor’s degree attainment rate. Preschool enrollment in the district is also quite low — just 18% of 3- and 4-year olds in the district are enrolled in preschool, less than half the statewide preschool enrollment rate of 39.5%

Texas: Donna Independent School District

> Location: Hidalgo County

> Per student spending: $10,339

> High school graduation rate: 87%

> Adults with a bachelor’s degree: 7.2%

Studies have shown that children who grow up in poverty are more likely to struggle in school and less likely to attend college than their peers from wealthier homes. Across the country, 17.3% of school-aged children live in poverty, but in the Texas Donna Independent School District, over half do, one of the highest child poverty rates in the state and the country. Children whose parents have a college education have been shown to be more likely to do better in school and more likely to attend college themselves. In this district, however, just 7.2% of adults have a bachelor’s degree, compared to 29.6% of adults statewide.

Utah: Ogden School District

> Location: Weber County

> Per student spending: $8,396

> High school graduation rate: 69%

> Adults with a bachelor’s degree: 19.8%

Students in school districts with lower per-pupil spending often do not receive the same quality of education as those in affluent, high-spending districts. In Utah’s Ogden School district, schools spend $8,396 per student annually, well below the $11,762 national average. The district’s 69% high school graduation rate is also one of the worst in the country.

[in-text-ad-2]

Vermont: Burlington School District

> Location: Chittenden County

> Per student spending: $18,804

> High school graduation rate: 84%

> Adults with a bachelor’s degree: 51.3%

As a whole, Vermont has one of the best education systems in the country, so while the Burlington School District ranks as the worst in the state, it compares favorably to many school districts nationwide. The district has a higher adult bachelor’s degree attainment rate and a lower child poverty rate than the nationwide figures. The district’s per-student spending of $18,804 is also the second highest of any district on this list.

Virginia: Petersburg City Public Schools

> Location: Petersburg city

> Per student spending: $11,784

> High school graduation rate: 71%

> Adults with a bachelor’s degree: 17.5%

Enrollment in AP courses can be a sign of students’ preparedness to reach college and excel there. The Petersburg City Public Schools district’s AP enrollment rate of 1.5% of high school students is one of the lower rates in both the state and across all districts nationwide. Preschool has been shown to be instrumental in improving development in children from an early age. In the district, just 19.1% of preschool-aged children attend a program, compared to 47.8% of 3- and 4-year olds statewide.

[in-text-ad]

Washington: Toppenish School District

> Location: Yakima County

> Per student spending: $9,968

> High school graduation rate: 66%

> Adults with a bachelor’s degree: 8.7%

Students in the Toppenish School District in Washington are the least likely to succeed in state. Just two-thirds of high school students graduated on time in 2017, one of the lowest graduation rates in both the state and the country. The comparable high school graduation rate across all U.S. districts with available data was 85%. High enrollment in Advanced Placement courses in a school district can be a sign students there are excelling at their studies. The average national enrollment rate across all school districts with available data is 18.4% of high school students, but in the Toppenish School District, no of students are reported as enrolled in AP classes.

West Virginia: McDowell County School District

> Location: McDowell County

> Per student spending: $13,451

> High school graduation rate: 83%

> Adults with a bachelor’s degree: 4.9%

Studies have shown that children who grow up in poverty are more likely to struggle in school and less likely to attend college than their peers from wealthier homes. Across the country, 17.3% of school-aged children live in poverty, but in the McDowell County School District, 42.1% do, one of the highest child poverty rates in the state and the country. Children whose parents have a college education have been shown to be more likely to do better in primary and secondary school and to go on to college themselves. In the district, however, less than 5% of adults have a bachelor’s degree, compared to the state’s 20.2% attainment rate, which is the lowest in the country.

Wisconsin: Milwaukee School District

> Location: Milwaukee County

> Per student spending: $12,714

> High school graduation rate: 62%

> Adults with a bachelor’s degree: 23.8%

In the Milwaukee School District, the district where students are the least likely to succeed in Wisconsin, just 62% of high school students graduated on time in 2017, one of the lowest graduation rates in both the state and the country. The comparable high school graduation rate across all U.S. districts with available data was 85%. The district also has one of the lowest teacher-to-student ratios of any district in the state and the country as a whole.

[in-text-ad-2]

Wyoming: Fremont County School District 25

> Location: Fremont County

> Per student spending: $16,759

> High school graduation rate: 74%

> Adults with a bachelor’s degree: 19.3%

Fewer than three in every four students in the class of 2017 graduated on time in Wyoming’s Fremont County School District 25 — well below the comparable 85% graduation rate nationwide. Students who live below the poverty line often face considerable stress outside of the classroom that can negatively affect their academic performance, and in Fremont, one in every five children live in poverty, a far larger child poverty rate than in nearly every other school district in the state with available data.

Methodology

To determine the worst school district in every state, 24/7 Wall St. developed an index based on various socioeconomic measures, school finance, student, and environmental factors. The share of children aged 5 to 17 living with their family in poverty as of 2017 came from the U.S. Census Bureau’s Small Area Income and Poverty Estimates program and was included in the index. Per-pupil expenditure for 2016 came from the Census Bureau’s Annual Survey of School System Finances and was included in the index. The average cohort graduation rate (ACGR) for the 2015-2016 school year came from the National Center for Education Statistics and was included in the index. The number of teachers per student in the 2016-17 school year also came from the NCES and was included in the index. The share of adults aged 25 and over with at least a bachelor’s degree came from the Census Bureau’s 2017 American Community Survey and was included in the index. All data are for the most recent period available. Any school district with a student population of less than 500 was excluded. Any school district that did not have data on a cohort-level graduation rate was excluded, with the exception of the state of Montana, for which graduation rates were not included in the index. School districts in which the 2016-2017 cohort graduation rate was significantly different from previous years were excluded from ranking.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.