Home to just 4% of the world’s population and nearly 25% of global economic activity, the United States is one of the richest countries in the world.

Despite the concentration of wealth in the United States, parts of the country have been left behind. In nearly every state, there is at least one town where financial hardship and poverty are the defining characteristics.

24/7 Wall St. reviewed the median annual household income in over 2,600 cities, towns, villages, and Census designated places to identify the poorest town in every state. We only considered areas with populations between 1,000 and 25,000. To ensure accuracy, we only considered places where the margin of error for population and median household income was less than 10%.

Even in wealthy states like Maryland and New Jersey, there are towns where about half of all households earn $35,000 a year or less. In the majority of towns on this list, the share of residents living below the poverty line is more than double the share across the state as a whole. In many of these places, low incomes have forced large segments of the population to depend on government assistance. In the majority of the 50 towns on this list, at least one in every five residents receive SNAP benefits — formerly known as food stamps.

All data on income, education, poverty, and demographics are five-year estimates from the U.S. Census Bureau’s 2017 American Community Survey.

Click here to see the poorest town in every state

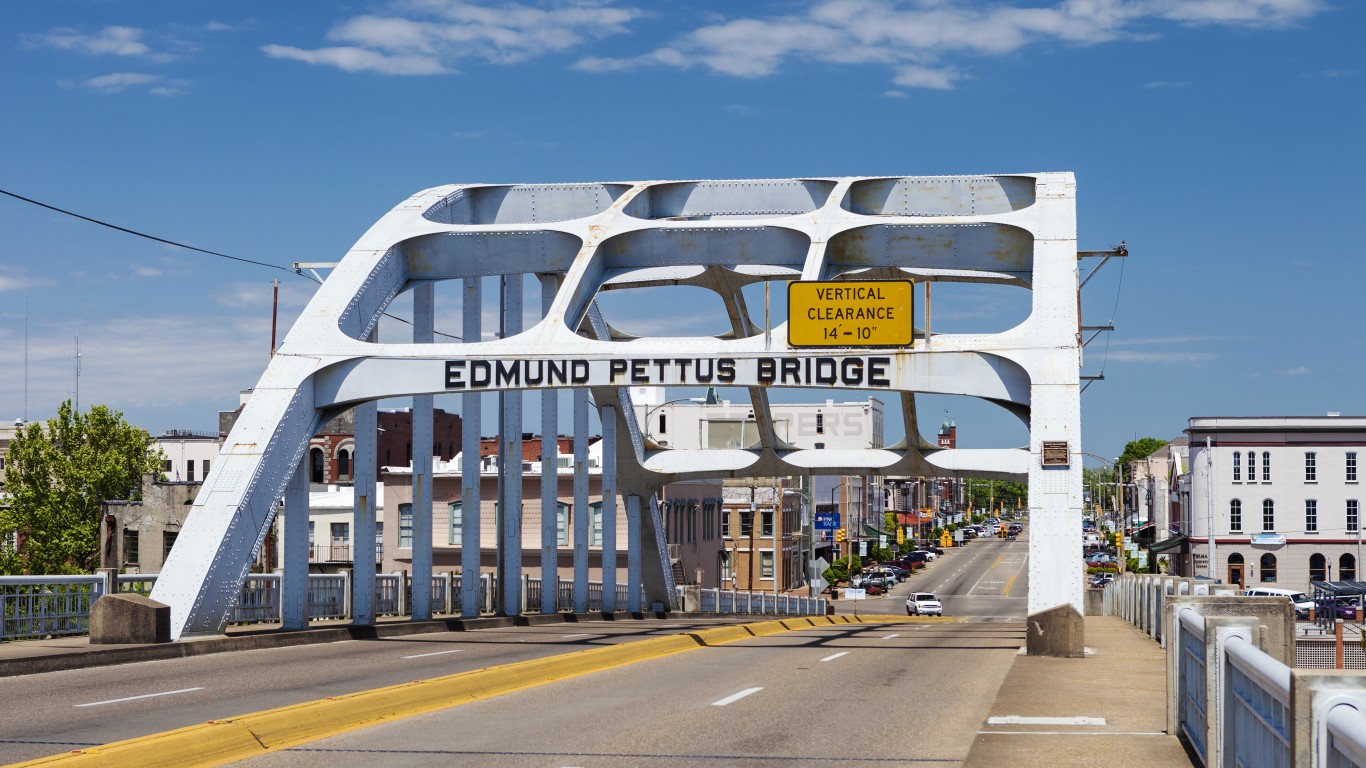

Alabama: Selma

> Median household income: $24,223 (state: $46,472)

> Poverty rate: 38.3% (state: 18.0%)

> Median home value: $89,100 (state: $132,100)

> Population: 19,176

Selma is the only town in Alabama where over half of all households earn less than $25,000 a year. In Jackson, the second poorest town in the state, the typical household earns just over $30,000, and the median annual household income across the state as a whole is $46,472.

Because so many in Selma live on such low incomes, a relatively large share of the population depends on government support to pay for basic necessities. The SNAP, or food stamps, recipiency rate in Selma is 38%, more than double the 15% rate across the state as a whole.

[in-text-ad]

Alaska: Ketchikan

> Median household income: $56,372 (state: $76,114)

> Poverty rate: 12.4% (state: 10.2%)

> Median home value: $237,000 (state: $261,900)

> Population: 8,195

Alaska is one of the wealthiest states in the country. The median annual household income in Alaska is $76,114, more than in every other state except for New Jersey and Maryland. Even in Ketchikan, the poorest town in the state, the typical household earns $56,372 a year — only slightly less than the national median household income of $57,652.

Ketchikan residents are also less likely to live below the poverty line than most Americans. Ketchikan’s 12.4% poverty rate is considerably lower than the 14.6% national poverty rate.

Arizona: South Tucson

> Median household income: $21,160 (state: $53,510)

> Poverty rate: 46.2% (state: 17.0%)

> Median home value: $77,700 (state: $193,200)

> Population: 5,624

South Tucson is the poorest town in Arizona and one of the poorest towns in the United States. The typical South Tucson household earns just $21,160 a year, less than half the median annual household income of $53,510 across Arizona as a whole. Additionally, nearly 15% of South Tucson households earn less than $10,000 a year, more than triple the 4.6% share of all Arizona households.

Arkansas: Helena-West Helena

> Median household income: $21,667 (state: $43,813)

> Poverty rate: 42.5% (state: 18.1%)

> Median home value: $75,400 (state: $118,500)

> Population: 11,210

Trailing only Mississippi, Arkansas is the second poorest state in the country, with a median household income of just $43,813 a year. In Helena-West Helena, Arkansas’s poorest town, over 50% of households earn less than $22,000 a year. Of the area’s 11,200 residents, 42.5% live below the poverty line, more than double the 18.1% poverty rate across the state as a whole.

[in-text-ad-2]

California: Clearlake

> Median household income: $27,034 (state: $67,169)

> Poverty rate: 35.9% (state: 15.1%)

> Median home value: $93,900 (state: $443,400)

> Population: 15,061

With a median annual household income of $27,034, the northern California town of Clearlake is the poorest town in the state. Clearlake’s poverty rate of 35.9% is more than double the poverty rate of 15.1% across the state as a whole.

California has some of the most expensive real estate in the country. Home values are often a reflection of what area residents can afford, however Clearlake is the only town in the state where most homes are worth less than $100,000.

Colorado: Federal Heights

> Median household income: $38,328 (state: $65,458)

> Poverty rate: 21.1% (state: 11.5%)

> Median home value: $47,700 (state: $286,100)

> Population: 12,449

Federal Heights is a small town of about 12,500 just north of Denver. The typical household in Federal Heights earns just $38,328 a year, about $27,000 less than the typical Colorado household. For individuals, as well as across populations, income tends to rise with educational attainment. In Federal Heights, just 10.8% of adults have a bachelor’s degree or higher — less than one-third of the state bachelor’s degree attainment rate of 39.4%.

[in-text-ad]

Connecticut: Willimantic

> Median household income: $33,564 (state: $73,781)

> Poverty rate: 29.9% (state: 10.1%)

> Median home value: $140,400 (state: $270,100)

> Population: 17,550

Connecticut is a relatively wealthy state. The typical Connecticut household earns $73,781 a year, $16,000 more than the typical American household. Economic prosperity is not evenly spread throughout the state, however. In Willimantic, a Census designated place in eastern Connecticut, the typical household earns $33,564 a year — less than half the statewide median. Due to widespread financial insecurity in the area, more than a third of Willimantic residents rely on SNAP benefits to afford groceries.

Delaware: Claymont

> Median household income: $52,277 (state: $63,036)

> Poverty rate: 12.2% (state: 12.1%)

> Median home value: $200,600 (state: $238,600)

> Population: 8,707

The typical Delaware household earns $63,036 a year, slightly over $5,000 more than the typical American household. Delaware is a geographically small state, and as such, it is not as economically varied as many other larger states. Even in Claymont, the poorest town in the state, the typical household earns $52,277 — just $5,000 less than the typical American household.

Florida: Belle Glade

> Median household income: $25,873 (state: $50,883)

> Poverty rate: 39.1% (state: 15.5%)

> Median home value: $111,400 (state: $178,700)

> Population: 19,175

Belle Glade, a small town just south of Lake Okeechobee, is the poorest town in Florida. The typical household in Belle Glade earns just $25,873 a year, about half the median income of $50,883 across the state as a whole. Over 39.1% of area residents live below the poverty line compared to 15.5% of all Floridians — and about one in every four households earn less than $10,000 a year, compared to just 7.2% of households across the state as a whole.

[in-text-ad-2]

Georgia: Brunswick

> Median household income: $24,417 (state: $52,977)

> Poverty rate: 39.0% (state: 16.9%)

> Median home value: $91,800 (state: $158,400)

> Population: 15,919

Brunswick, a town of about 16,000 in southeastern Georgia, is the only town in the state where over half of households earn less than $25,000 a year. Brunswick also has a 39% poverty rate, one of the highest in both the state and the country. Due to widespread financial insecurity, more than a third of all Brunswick residents rely on SNAP benefits to afford groceries — more than double the 14.5% state SNAP recipiency rate.

Hawaii: Hawaiian Paradise Park

> Median household income: $51,908 (state: $74,923)

> Poverty rate: 22.2% (state: 10.3%)

> Median home value: $255,300 (state: $563,900)

> Population: 11,564

Hawaii is one of the wealthiest states in the country. The median annual household income in Hawaii is $74,923, more than in every other state except New Jersey, Maryland, and Alaska. Even in Hawaiian Paradise Park, the poorest town in the state, the typical household earns $51,908 a year — compared to the national median household income of $57,652.

Even though the median income in Hawaiian Paradise Park is higher than the median incomes in most towns on this list, the town’s poverty rate is high. More than one in every five town residents live below the poverty line, more than double the 10.3% state poverty rate and well above the 14.5% national poverty rate.

[in-text-ad]

Idaho: Bonners Ferry

> Median household income: $30,971 (state: $50,985)

> Poverty rate: 22.5% (state: 14.5%)

> Median home value: $148,200 (state: $176,800)

> Population: 2,502

Bonners Ferry is a small town in northern Idaho of less than 3,000 people. The typical household in Bonners Ferry earns just $30,971 a year, less than any every other town in the state. Jobs in forestry and lumber production are far more concentrated in Bonners Ferry than they are nationwide, and annual wages for logging workers are typically lower than most other jobs.

Illinois: Centreville

> Median household income: $17,441 (state: $61,229)

> Poverty rate: 48.1% (state: 13.5%)

> Median home value: $47,900 (state: $179,700)

> Population: 5,094

The typical household in Illinois earns $61,229 a year, about $3,600 more than the typical American household income. Despite Illinois’ relatively high median annual household income, the state is home to the poorest town in the United States. In Centreville, a small town of about 5,000 just outside of East St. Louis, the typical household earns just $17,441 a year, and 48.1% of the population lives below the poverty line. Due to widespread financial insecurity, 36.9% of the population depends on SNAP benefits to afford groceries. Meanwhile, the SNAP recipiency rates across the state and nationally are 13.3% and 12.6%, respectively.

Indiana: Knox

> Median household income: $33,709 (state: $52,182)

> Poverty rate: 21.5% (state: 14.6%)

> Median home value: $76,600 (state: $130,200)

> Population: 3,520

Knox is a small northern Indiana town of 3,500. The poorest town in the state, Knox has a median annual household income of $33,709, about $18,500 less than the median income across the state as a whole. Real estate values are often indicative of what area residents can afford. In Knox, the typical home is worth just $76,600 — well below Indiana’s $130,200 median home value.

[in-text-ad-2]

Iowa: Onawa

> Median household income: $31,089 (state: $56,570)

> Poverty rate: 25.3% (state: 12.0%)

> Median home value: $93,500 (state: $137,200)

> Population: 2,849

Onawa, a small town in western Iowa, is the only town in the state where more than one in every four residents live below the poverty line. As the poorest town in the state, Onawa has a median annual household income of just $31,089, about $25,000 less than the median annual income across Iowa as a whole. Because of widespread financial insecurity, Onawa’s 24.9% SNAP benefit recipiency rate is more than double the 11.2% rate for all of Iowa residents.

Kansas: Fort Scott

> Median household income: $31,542 (state: $55,477)

> Poverty rate: 18.7% (state: 12.8%)

> Median home value: $63,800 (state: $139,200)

> Population: 7,822

The typical household in Kansas earns $55,477 a year, nearly in line with the median annual household income of $57,652 nationwide. Income levels in the state, however, are uneven. In Fort Scott, a town of about 8,000 people in eastern Kansas, the typical household earns just $31,542 a year.

The area’s low incomes are reflected in property values. The typical Fort Scott home is worth just $63,800, less than half the $139,200 median home value across the state.

[in-text-ad]

Kentucky: Glasgow

> Median household income: $30,731 (state: $46,535)

> Poverty rate: 29.0% (state: 18.3%)

> Median home value: $110,600 (state: $130,000)

> Population: 14,318

With a median annual household income of $46,535, about $10,000 less than the national median, Kentucky is one of the poorest states in the country. In Glasgow, a town of about 14,000 in southern Kentucky, incomes are even lower. The typical Glasgow household earns just $30,731 a year. The area’s high poverty rate is indicative of the low incomes. Some 29% of Glasgow residents live below the poverty line, well above the 18.3% state poverty rate and the 14.6% national rate.

Louisiana: Bastrop

> Median household income: $21,364 (state: $46,710)

> Poverty rate: 43.5% (state: 19.6%)

> Median home value: $73,000 (state: $152,900)

> Population: 10,643

Bastrop is the poorest town in one of the poorest states. The median annual household income in Louisiana is $46,710, about $10,000 less than the national median. In Bastrop, a small town in northern Louisiana, the typical household lives on just $21,364 a year. Bastrop’s 43.5% poverty rate is more than double the 19.6% state poverty rate and nearly triple the 14.6% national poverty rate. Due to widespread financial hardship, over a third of Bastrop’s 10,600 residents depend on SNAP benefits.

Maine: Presque Isle

> Median household income: $37,036 (state: $53,024)

> Poverty rate: 23.2% (state: 12.9%)

> Median home value: $108,700 (state: $179,900)

> Population: 9,246

Presque Isle is a small town in northeastern Maine. The typical household in the town earns just $37,036 a year, the lowest median income of any town in the state. Presque Isle is the only small town in the state where most households earn less than $40,000 a year. The town’s poverty rate of 23.2% is also the highest of any Maine town, as is the 12.0% of area households earning less than $10,000 a year. Statewide, just 6.4% of households earn less than $10,000 a year.

[in-text-ad-2]

Maryland: Cumberland

> Median household income: $32,825 (state: $78,916)

> Poverty rate: 24.4% (state: 9.7%)

> Median home value: $89,600 (state: $296,500)

> Population: 20,084

With a median annual household income of $78,916, Maryland is the wealthiest state in the country. Still, Maryland’s poorest town ranks among the poorest towns in the country. In Cumberland, a northern Maryland town situated along the West Virginia state border, the typical household earns just $32,825 a year — nearly $25,000 less than the national median income and less than half the state median. Additionally, nearly one in every four Cumberland residents live below the poverty line.

Many of Maryland’s wealthier towns are located on the other side of the state, in and around the Washington D.C. metro area.

Massachusetts: North Adams

> Median household income: $38,774 (state: $74,167)

> Poverty rate: 17.8% (state: 11.1%)

> Median home value: $147,500 (state: $352,600)

> Population: 13,211

North Adams is a small northwestern Massachusetts city of 13,000, located near the Vermont and New York state borders. Of all towns and cities in the state of comparable size, North Adams has the lowest median household income by far. The typical household in the town earns just $38,774 a year — nearly $8,000 less than the median income in Athol, the second poorest town in the state.

Overall, Massachusetts is one of the wealthiest states in the country. The typical household in the state earns $74,167 a year, $16,500 more than the typical American household income.

[in-text-ad]

Michigan: Hamtramck

> Median household income: $24,369 (state: $52,668)

> Poverty rate: 50.9% (state: 15.6%)

> Median home value: $53,900 (state: $136,400)

> Population: 21,959

Hamtramck is the poorest town in Michigan and one of the poorest towns in the United States. The majority of area households earn $25,000 a year or less — less than half the statewide median annual household income of $52,668. Hamtramck is one of only three towns in the United States where over half of the population lives below the poverty line. Due to widespread financial insecurity, about 45% of Hamtramck’s 22,000 residents rely on SNAP benefits.

Minnesota: Brainerd

> Median household income: $34,358 (state: $65,699)

> Poverty rate: 16.4% (state: 10.5%)

> Median home value: $110,400 (state: $199,700)

> Population: 13,394

Brainerd is a small town of less than 15,000 in central Minnesota. It is the only town in the state where over 50% of households earn less than $35,000 a year. Though the median household income in Brainerd is the lowest in the state — and about $23,000 less than the national median annual household income — the poverty rate is not especially high relative to most towns on this list. Some 16.4% of Brainerd’s population lives below the poverty line, well above the 10.5% state poverty rate, but only slightly higher than the 14.6% national poverty rate.

Mississippi: Vicksburg

> Median household income: $29,799 (state: $42,009)

> Poverty rate: 36.1% (state: 21.5%)

> Median home value: $96,800 (state: $109,300)

> Population: 22,961

Vicksburg is the poorest town in the poorest state in the country. The typical Mississippi household earns just $42,009 a year, nearly $16,000 less than the typical American household. In Vicksburg, over half of households earn less than $30,000 a year. Additionally, more than one in every three Vicksburg residents live below the poverty line, compared to 21.5% of Mississippi residents and 14.6% of Americans.

[in-text-ad-2]

Missouri: Fredericktown

> Median household income: $24,640 (state: $51,542)

> Poverty rate: 28.9% (state: 14.6%)

> Median home value: $84,500 (state: $145,400)

> Population: 3,999

Fredericktown is a small eastern Missouri town of about 4,000 people. The poorest town in the state, Fredericktown has a median annual household income of $24,640, less than half the median income of $51,542 across the state as a whole.

Incomes typically rise with educational attainment. In Fredericktown, just 16.7% of adults have a bachelor’s degree or higher, compared to 28.2% of adults in Missouri.

Montana: Conrad

> Median household income: $43,372 (state: $50,801)

> Poverty rate: 16.0% (state: 14.4%)

> Median home value: $118,000 (state: $209,100)

> Population: 2,841

Though Conrad ranks as the poorest town in Montana, the median income in the small northern Montana city is not much lower than the median income across the state as a whole. The typical household in Conrad earns $43,372 a year, only about $7,000 less than the median annual household income statewide. Similarly, Conrad’s 16.0% poverty rate is only slightly higher than Montana’s 14.4% poverty rate.

[in-text-ad]

Nebraska: Red Cloud

> Median household income: $35,742 (state: $56,675)

> Poverty rate: 17.4% (state: 12.0%)

> Median home value: $48,800 (state: $142,400)

> Population: 1,138

Red Cloud is a small town in southern Nebraska with a lowest-in-the-state median annual household income of $35,742. Additionally, fewer than 1% of all households in Red Cloud earn at least $200,000 a year. Real estate values are often indicative of what area residents can afford — and not only does Red Cloud have the lowest median income in the state, but also the least expensive housing market. Red Cloud is the only town in the state where most homes are worth less than $50,000.

Nevada: Laughlin

> Median household income: $32,610 (state: $55,434)

> Poverty rate: 18.4% (state: 14.2%)

> Median home value: $143,100 (state: $216,400)

> Population: 7,758

The typical household in Laughlin, Nevada, earns $32,610 a year, less than in every other town in the state. Laughlin also has the state’s highest poverty rate. Some 18.4% of Laughlin residents live on poverty level incomes, compared to 14.2% of people across Nevada as a whole. Due to the lower incomes, a relatively large share of Laughlin residents rely on government assistance. The town’s SNAP benefit recipiency rate is 16.8% — compared to the 12.3% share of Nevada residents who receive SNAP benefits.

New Hampshire: Littleton

> Median household income: $37,419 (state: $71,305)

> Poverty rate: 19.5% (state: 8.1%)

> Median home value: $159,500 (state: $244,900)

> Population: 4,420

The typical New Hampshire household earns $71,305 a year, nearly $14,000 more than the typical American household income. Despite its ranking among the wealthier states in the country, New Hampshire is not without several lower-income areas. In Littleton, a small town along the Vermont state border, over half of households earn about $37,500 or less a year — the lowest median income in the state.

Littleton also has the state’s highest poverty rate. Nearly one in every five Littleton residents live on poverty level income, well above the 14.6% national poverty rate and more than double the 8.1% statewide poverty rate.

[in-text-ad-2]

New Jersey: Holiday City-Berkeley

> Median household income: $35,204 (state: $76,475)

> Poverty rate: 8.4% (state: 10.7%)

> Median home value: $145,800 (state: $321,100)

> Population: 12,242

The median annual household income in New Jersey is $76,475, second highest in the country after Maryland. Not all parts of the state are equally prosperous, however. In Holiday City-Berkeley, a Census designated place in central New Jersey, over 50% of households earn only about $35,000 or less a year.

Incomes tend to rise with educational attainment, and in Holiday City-Berkeley, only 11.7% of adults have a bachelor’s degree or higher. Meanwhile, the bachelor’s degree attainment rate across New Jersey is 38.1%.

New Mexico: Deming

> Median household income: $25,428 (state: $46,718)

> Poverty rate: 34.3% (state: 20.6%)

> Median home value: $87,200 (state: $163,900)

> Population: 14,339

Deming is the poorest town in one of the poorest states. The typical Deming household earns just $25,428 a year, compared to the median annual household income of $46,718 across the state as a whole — which itself is about $11,000 less than what the typical American household earns in a year. Serious financial hardship is common in Deming, as 20.0% of area households live on less than $10,000 a year, more than double the 9.5% share of households across the state as a whole. Nationwide, only 6.7% of households earn so little.

[in-text-ad]

New York: New Square

> Median household income: $23,924 (state: $62,765)

> Poverty rate: 64.4% (state: 15.1%)

> Median home value: $338,200 (state: $293,000)

> Population: 7,995

Home to some of the wealthiest and some of the poorest towns in the United States, New York has the worst income inequality of any state. In New Square, a small town in southern New York, most households earn $24,000 a year or less. Meanwhile, less than 60 miles away, in the Long Island neighborhood of East Hills, the typical household earns $199,000 a year. New Square also has a poverty rate of 64.4% — the highest in both the state and the country.

North Carolina: Forest City

> Median household income: $24,383 (state: $50,320)

> Poverty rate: 37.4% (state: 16.1%)

> Median home value: $88,500 (state: $161,000)

> Population: 7,250

The typical household in Forest City, North Carolina, earns just $24,383 a year, less than half the median annual household income of $50,320 across the state as a whole. Forest City also has the state’s highest poverty rate and SNAP benefit recipiency rate, at 37.4% and 37.7%, respectively.

Incomes tend to rise with educational attainment, and in Forest City, just 14.6% of adults have a bachelor’s degree or higher, compared to 29.9% of adults in North Carolina.

North Dakota: Devils Lake

> Median household income: $43,791 (state: $61,285)

> Poverty rate: 17.1% (state: 11.0%)

> Median home value: $96,600 (state: $174,100)

> Population: 7,313

The typical household in Devils Lake, North Dakota, earns just $43,791 a year, well below the statewide median income of $61,285. In addition to low incomes, the town also has a relatively high share of extremely poor residents. In Devils Lake, 11.4% of households live on less than $10,000 a year, the largest share of any town in the state and nearly double the 5.9% share of households statewide living on such low incomes.

Real estate values often reflect what area residents can afford — and Devils Lake is the only town in North Dakota where most homes are worth less than $100,000.

[in-text-ad-2]

Ohio: East Cleveland

> Median household income: $21,184 (state: $52,407)

> Poverty rate: 40.5% (state: 14.9%)

> Median home value: $56,800 (state: $135,100)

> Population: 17,375

Half of all households in East Cleveland earn $22,000 or less per year, and over a quarter of all area households earn less than $10,000 a year. Additionally, 40.5% of town residents live on poverty level incomes, and 41.9% rely on SNAP benefits — each well more than double the corresponding statewide rates.

Higher educational attainment typically leads to higher incomes, and in East Cleveland, just 11.9% of adults have a bachelor’s degree or higher, less than half the 27.2% share of adults in Ohio with a bachelor’s degree.

Oklahoma: Wewoka

> Median household income: $25,567 (state: $49,767)

> Poverty rate: 41.7% (state: 16.2%)

> Median home value: $46,400 (state: $125,800)

> Population: 3,396

Over a third of Wewoka, Oklahoma, residents rely on SNAP benefits to afford groceries, and an even larger 41.7% of the population lives below the poverty line. The typical household in the central Oklahoma town earns just $25,567 a year, $24,200 less than the typical Oklahoma household. Low incomes in the area are reflected in the low home values. Wewoka is one of just two Oklahoma towns where most homes are worth less than $50,000. Across the state as a whole, the typical home is worth $125,800.

[in-text-ad]

Oregon: Coquille

> Median household income: $31,220 (state: $56,119)

> Poverty rate: 21.7% (state: 14.9%)

> Median home value: $134,500 (state: $265,700)

> Population: 3,846

The typical household in Oregon earns $56,119 a year, nearly in line with the national median income of $57,652. In some parts of the state, however, residents are far less likely to be as financially secure as the typical American. In Coquille, for example, a small town in the western part of the state, the typical household earns just $31,220 a year.

College graduates typically earn far more than those with just a high school diploma, and in Coquille, just 12.1% of adults have a bachelor’s degree, a fraction of the 32.3% statewide bachelor’s degree attainment rate.

Pennsylvania: Johnstown

> Median household income: $23,636 (state: $56,951)

> Poverty rate: 37.9% (state: 13.1%)

> Median home value: $41,500 (state: $170,500)

> Population: 19,967

The median annual household income in Pennsylvania of $56,951 is nearly in line with the national median household income of $57,652. Still, the state is home to some of the poorest towns in the United States. In Johnstown, a town of about 20,000 70 miles east of Pittsburgh, the median household income is about half what it is across the state as a whole, and 37.9% of the population lives below the poverty line, the highest poverty rate of any town in the state and more than triple the 13.1% poverty rate across Pennsylvania.

Rhode Island: Central Falls

> Median household income: $30,794 (state: $61,043)

> Poverty rate: 30.7% (state: 13.4%)

> Median home value: $149,100 (state: $242,200)

> Population: 19,395

Central Falls, a small town in northern Rhode Island, is by far the poorest town in the state. The typical household in town earns just $30,794 a year, about half the median income in Westerly, the second poorest town in the state. Additionally, Central Falls’ 30.7% poverty rate is more than double the poverty rate of any other town for which accurate data is available in the state.

Incomes tend to rise with educational attainment, and Central Falls is home to a far smaller than typical share of college graduates. Just 8.0% of adults in town have a bachelor’s degree or higher. In every other Rhode Island town, at least 30% of adults have a bachelor’s degree.

[in-text-ad-2]

South Carolina: Central

> Median household income: $26,623 (state: $48,781)

> Poverty rate: 40.8% (state: 16.6%)

> Median home value: $106,400 (state: $148,600)

> Population: 5,161

Central is the poorest town in one of the poorest states in the country. The typical Central household earns just $26,623 a year, compared to the median annual household income of $48,781 across the state as a whole — which itself is about $9,000 less than what the typical American household earns in a year.

Low incomes are likely partly the result to the large number of students living in the area, as Central is home to Southern Wesleyan University and its roughly 1,500 students. In most towns on this list, large shares of the population rely on SNAP benefits to afford groceries. In Central, just 5.7% of residents receive SNAP benefits, compared to 14.0% of residents across the state.

South Dakota: Sisseton

> Median household income: $38,500 (state: $54,126)

> Poverty rate: 22.8% (state: 13.9%)

> Median home value: $70,100 (state: $152,700)

> Population: 2,548

In Sisseton, more than one in every five residents rely on SNAP benefits, more than double the 10.6% SNAP recipiency rate across the state as a whole. The greater than typical dependence on government benefits is due to the relatively large number of low-income residents. Half of all Sisseton households earn $38,500 or less a year, and 8.4% of households earn less than $10,000 a year.

Native American Indian reservations have some of the worst economic conditions in the United States, and Sisseton, South Dakota, is located entirely within the Lake Tahoe Reservation in the northeastern corner of the state.

[in-text-ad]

Tennessee: Camden

> Median household income: $28,750 (state: $48,708)

> Poverty rate: 25.1% (state: 16.7%)

> Median home value: $92,000 (state: $151,700)

> Population: 3,554

Camden, a small town in northwestern Tennessee, is the only town reviewed in the state where most households earn less than $30,000 a year. The typical Tennessee household earns $48,708 a year, about $20,000 more than the median income in Camden, but about $9,000 below the median nationwide. The area’s low incomes are profoundly detrimental to the quality of life of a large share of residents, as more than one in every four live below the poverty line — nearly 10 percentage points higher than the state poverty rate of 16.7%.

Texas: San Benito

> Median household income: $26,583 (state: $57,051)

> Poverty rate: 37.4% (state: 16.0%)

> Median home value: $55,100 (state: $151,500)

> Population: 24,474

San Benito is a southern Texas town just north of the U.S.-Mexico border. It is the only town in Texas where most households earn less than $30,000 a year.

Texas is one of the largest states both by geography and population — and incomes vary considerably from town to town. In University Park, the wealthiest town in the state, the typical household earns $211,741 a year, eight times as much as the typical household in San Benito. Incomes typically go up with educational attainment, and in San Benito, just 11.7% of adult residents have a bachelor’s degree or higher, compared to a near nation-leading 87.2% bachelor’s degree attainment rate in University Park.

Utah: South Salt Lake

> Median household income: $41,457 (state: $65,325)

> Poverty rate: 22.5% (state: 11.0%)

> Median home value: $184,200 (state: $238,300)

> Population: 24,722

South Salt Lake, Utah, is a small city within the broader Salt Lake City metro area. Compared to other similarly sized towns, South Salt Lake’s 22.5% poverty rate is by far the highest in the state and more than double Utah’s 11.0% poverty rate. The typical household in South Salt Lake earns $41,457 a year — about $24,000 less than the typical Utah household and $16,000 less than the typical American household.

[in-text-ad-2]

Vermont: St. Johnsbury

> Median household income: $36,958 (state: $57,808)

> Poverty rate: 15.0% (state: 11.4%)

> Median home value: $148,800 (state: $220,600)

> Population: 5,789

St. Johnsbury is a small town in northern Vermont along the I-91 corridor. The typical household in St. Johnsbury earns just $36,958 a year, the least of any town of comparable size in the state and well below Vermont’s median annual household income of $57,808. Despite the area’s low incomes, relatively few residents face serious financial hardship. St. Johnsbury’s poverty rate of 15.0%, while the highest in the state, is only slightly worse than the 14.6% national poverty rate.

Virginia: Bensley

> Median household income: $37,692 (state: $68,766)

> Poverty rate: 29.8% (state: 11.2%)

> Median home value: $131,300 (state: $255,800)

> Population: 6,363

The typical household in Bensley, a small Census designated place just south of Richmond, earns just $37,692 a year, about $31,000 less than the typical Virginia household. Bensley also has the highest poverty rate in the state at 29.8%, which is nearly triple Virginia’s 11.2% poverty rate.

High school dropouts typically earn less than half the income college graduates earn a year. In Bensley, only about a third of adults have a high school diploma, compared to 89% of adults across the state as a whole.

[in-text-ad]

Washington: Chewelah

> Median household income: $31,858 (state: $66,174)

> Poverty rate: 20.0% (state: 12.2%)

> Median home value: $136,200 (state: $286,800)

> Population: 2,601

Chewelah is a small city of less than 3,000 in northeast Washington. The typical household in Chewelah earns just $31,858 a year, less than half the median income of $66,174 across the state as a whole. Incomes typically rise with educational attainment, and in Chewelah, just 16.9% of adults have a bachelor’s degree, less than half the 34.5% share of adults in Washington.

West Virginia: Beckley

> Median household income: $39,695 (state: $44,061)

> Poverty rate: 20.2% (state: 17.8%)

> Median home value: $114,300 (state: $111,600)

> Population: 16,963

West Virginia’s median annual household income of $44,061 is among the lowest of all states and about $13,600 less than the median household income nationwide. In Beckley, a small city in southern West Virginia, the typical household earns less than $40,000 a year. Beckley is also the only town in the state where more than one in every five residents live below the poverty line.

Wisconsin: Whitewater

> Median household income: $31,827 (state: $56,759)

> Poverty rate: 40.2% (state: 12.3%)

> Median home value: $164,400 (state: $169,300)

> Population: 14,762

Whitewater, a small town in southern Wisconsin, has a median annual household income of $31,827, the lowest of any town of comparable size in the state. For reference, the typical Wisconsin household earns $56,759 a year. Whitewater’s poverty rate of 40.2% is also by far the highest in the state and more than triple Wisconsin’s 12.3% poverty rate.

The low incomes in Whitewater are likely attributable to the large share of full-time students. There are currently about 13,000 students enrolled at the University of Wisconsin Whitewater.

[in-text-ad-2]

Wyoming: Wheatland

> Median household income: $46,924 (state: $60,938)

> Poverty rate: 4.8% (state: 11.1%)

> Median home value: $166,200 (state: $204,900)

> Population: 3,617

Wheatland is a small town in southeastern Wyoming. It is the only town in the state where most households earn less than $50,000 a year. Despite a low median household income, relatively few area residents face serious financial hardship. Just 4.8% of the town’s 3,617 residents live below the poverty line. Across the state as a whole, 11.1% of the population lives in poverty.

Incomes tend to rise with educational attainment, and as is often the case, Wyoming’s poorest town is also its least educated. Just 18.6% of adults in Wheatland have a bachelor’s degree, below the 26.7% of adults statewide.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.