In a Tuesday letter to Intel’s board of directors, hedge fund manager Dan Loeb rips the company for, among other things, failing to keep up with competitors like Samsung and Taiwan Semiconductor in the development of new chip-making technology. Intel shares are down more than 15% in 2020, while other chipmakers have flourished, including Nvidia (up 75% this year) and AMD (up about 60%).

Another segment of the semiconductor industry that has skyrocketed this year is the one that supplies the technology and machines that actually make the billions of chips that are sold every year. For the most part, these semiconductor equipment companies have had a strong 12-month run, even including the mid-March collapse caused by the COVID-19 outbreak. Their share price appreciation this year has ranged from around 18% to 75%. And it could be getting better.

Needham raised its price target on Applied Materials Inc. (NASDAQ: AMAT) from $82 to $110, selected the stock as its top pick in the semiconductor capital equipment segment, and added the stock to its Conviction List. After noting that this market favored NAND chips in its last growth cycle (Applied Materials’ “weakest segment”), Needham believes that the next cycle will favor the DRAM and foundry/logic segments, playing to the company’s strength.

Looking at the industry as a whole, Needham said, “There is no denying that all leading [semiconductor capital equipment] players have great businesses.” Here’s our look at six of those companies as we head into a new year.

Applied Materials

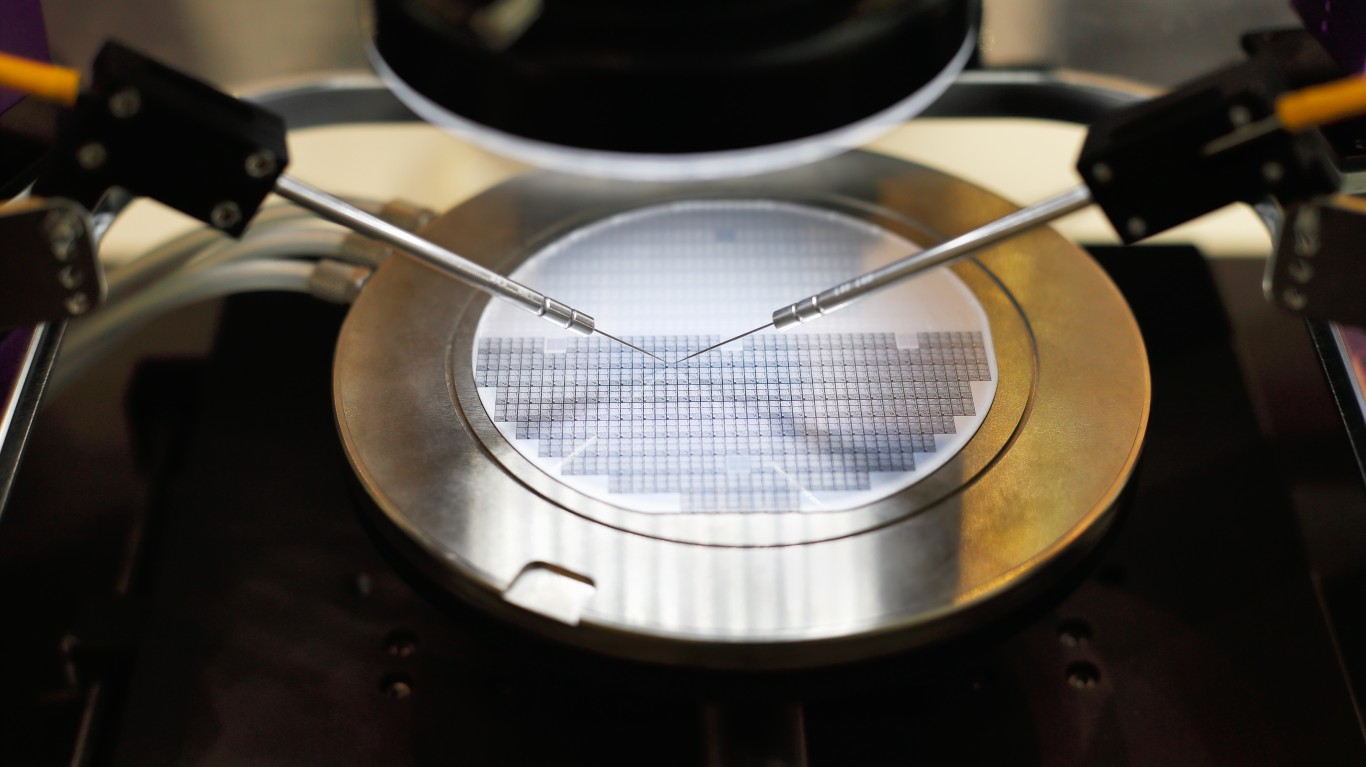

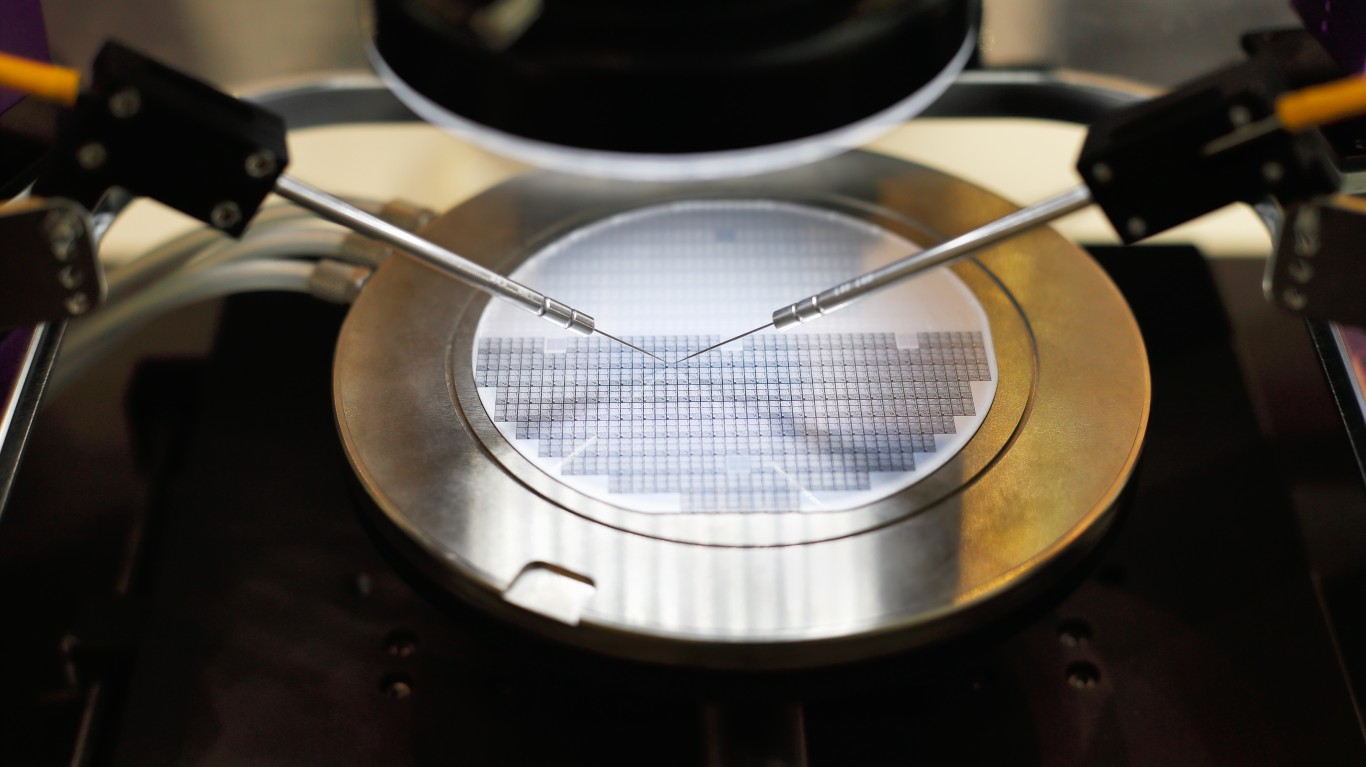

Applied Materials makes and sells a variety of manufacturing systems used to make semiconductor chips. The company also makes products for manufacturing liquid crystal displays (LCDs) and organic light-emitting diode (OLED) displays. More than half the company’s sales are to chip foundries (fabs), with the remaining 44% divided equally between memory chip and flash memory makers.

The stock closed at $84.27 on Tuesday, in a 52-week range of $36.64 to $90.61. The consensus price target is $89.28, implying a potential upside of about 6%. At the current price, Applied Materials stock trades at 17.9 times expected 2021 earnings. The company pays an annual dividend of $0.88 per share (yield of 1.04%). The share price has gained more than 30% for the year to date.

ASML

Based in the Netherlands, ASML Holding N.V. (NASDAQ: ASML) also is the largest company by market cap in this group. In its most recent quarterly report, ASML said it shipped 10 Extreme Ultraviolet (EUV) systems and reportedly has received an order for 13 from Taiwan Semiconductor for delivery in 2021. The EUV systems generated about two-thirds of $3.1 billion in total systems revenue in the quarter.

The company’s stock closed at $484.01 on Tuesday, in a 52-week range of $191.25 to $489.45. Analysts have a consensus price target of $424.22, and the shares traded at about 1.1% below the 52-week high. The stock trades at nearly 54 times expected 2021 earnings. ASML pays a dividend yield of 0.59% ($2.85 annually), and its stock price has jumped nearly 58% in 2020.

ASE Technology

ASE Technology Holding Co. Ltd. (NYSE: ASX) is a Taiwan-based provider of semiconductor manufacturing services, including packaging and testing. With more than half its first-quarter revenues coming from those two businesses, ASE is well set up to take advantage of a total spend of $3.2 billion this year and $3.4 billion next year on assembly and packaging equipment and estimated spending of $5.7 billion on testing next year.

Shares closed at $5.74 on Tuesday, in a 52-week range of $3.17 to $5.94 and with a 12-month price target of $6.43. The stock trades at a discount of about 12% to its price target and at a multiple of around 20 based on its estimated 2021 earnings. ASE pays a dividend yield of 2.37% (payment of $0.146 annually). The share price has increased by 18% this year.

KLA

KLA Corp. (NASDAQ: KLAC) manufactures and services process control systems. More than half the company’s revenue is derived from sales to fabs. China (25%), Taiwan (24%) and Korea (21%) are its biggest customers, with Japan and the United States each contributing 11% to revenues in the most recent quarter.

KLA shares closed at $254.36 on Tuesday, about 20 times expected 2021 earnings. The stock’s 52-week range is $110.19 to $268.89, and the consensus price target is $250.82. Shares trade about 5.4% below the 52-week high. KLA pays an annual dividend of $3.60 (yield of 1.42%), while the share price has added nearly 62% in 2020.

Lam Research

Lam Research Corp. (NASDAQ: LRCX) makes products used in thin film deposition, plasma etch, photoresist strip and wafer cleaning in the semiconductor manufacturing process. The company has embarked on a vision it calls Equipment Intelligence that will create “self-aware, self-maintained, and adaptive tools and processes” for companies building the next generation of chips.

The stock closed at $473.22 on Tuesday, nearly 3% above the consensus 12-month price target of $460.39. The 52-week trading range is $181.38 to $516.65, and Tuesday’s closing price is about 8% below the high. At its current price, the shares trade at about 20.5 times expected 2021 earnings. Lam Research pays a dividend yield of 1.10% ($5.20 annually), and shares are up nearly 48% this year.

Teradyne

Massachusetts-based Teradyne Inc. (NASDAQ: TER) develops and sells automatic semiconductor test equipment around the world. Sales totaled $2.3 billion in the 2019 fiscal year and amounted to more than $1.5 billion in the first half of 2020.

The stock closed at $117.20 on Tuesday, just 2.6% below its 52-week high of $122.37 and about 9% above its price target of $106.53. Based on the closing price, Teradyne trades at a multiple of nearly 24 times expected 2021 earnings. Teradyne’s annual dividend is $0.40 (yielding 0.34%). The stock has added 75% to its share price in 2020.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.