recession

recession Articles

Unprecedented times call for unprecedented actions. The Federal Reserve, Treasury and even politicians in America have managed to forge together bailout and rescue packages to fight the COVID-19...

Published:

It was a difficult mental and physical transition to move from an 11 year raging bull market to an instant recession and bear market in 2020. The stock market has to lose 10% for a “stock...

Published:

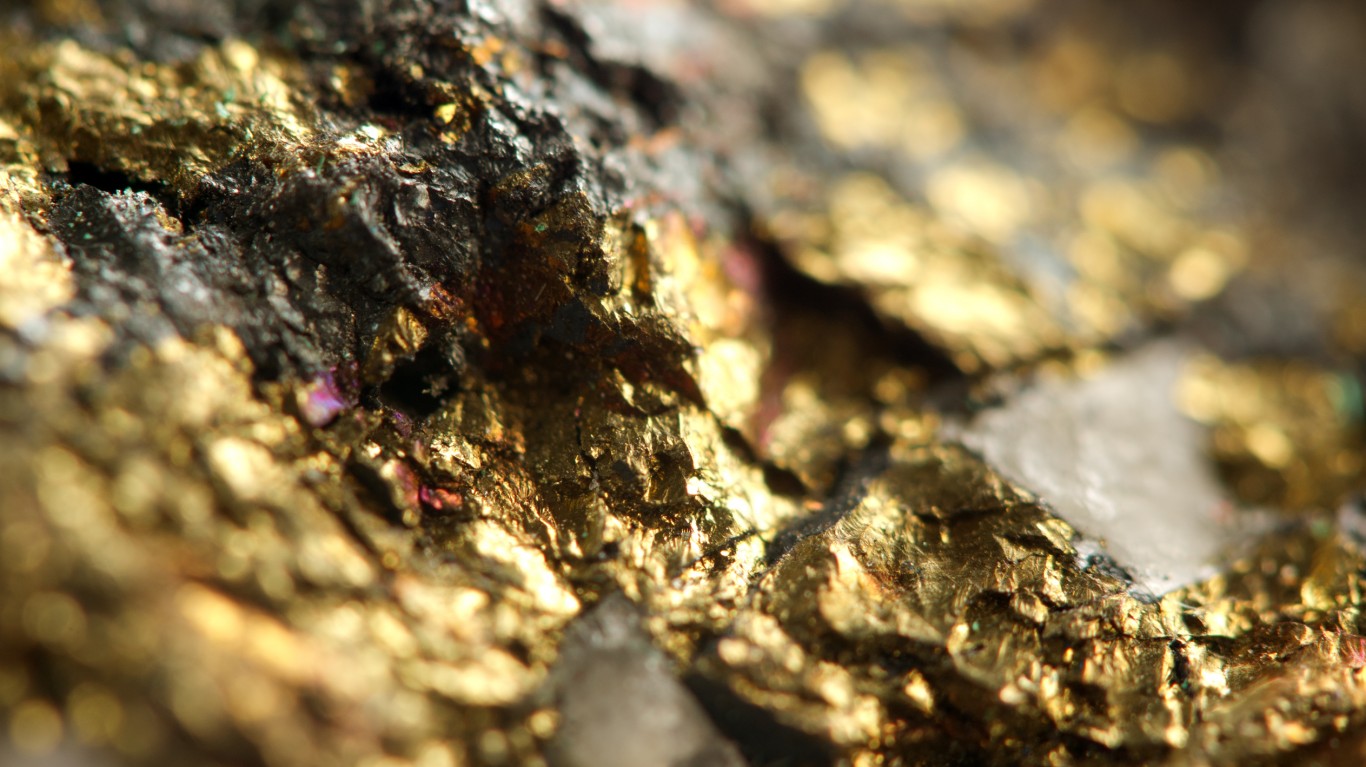

The World Gold Council announced on Wednesday that inflows into gold ETFs rose sharply in March. It was not just the United States driving gold.

Published:

Despite the government aid coming for payroll protection, many small and independent business owners are now worried that they may never recover from the coronavirus-triggered recession.

Published:

Unemployment skyrocketed and payrolls began a major retreat in March. Sadly, the reported numbers are just the start as they did not include the most recent data.

Published:

The number of people who travel by air on a given day has dropped by as much as 80%. That begs the question of whether the United States needs four big carriers.

Published:

With a recession all but certain in the coming economic reports, it's hard to get excited about some of the economic reports that would have included data ahead of the mass layoffs and furloughs.

Published:

A fresh research report from Credit Suisse identifies two food service distributor stocks that have been hit extremely hard yet still have attractive long-term prospects.

Published:

Sometimes it's just the relative performance that really matters to investors. Imagine saying, "Gee, that's great because it's only down 10% in this awful stock market."

Published:

24/7 Wall St. has looked at the preliminary expectations for this week's unemployment and payrolls data. Some of the data seem drastic, but some of the absolute percentages and drops are likely to...

Published:

The interest rate climate was supposed to be stable for 2020. That all ended in an instant recession brought on by the coronavirus outbreak and after the situation was magnified after an oil share...

Published:

The recession is here, and it looks worse with each new forecast. Now, Standard & Poor's has issued a new update on the coronavirus impact on the global economy.

Published:

Americans have almost $16 trillion in mortgage debt outstanding, according to the Federal Reserve. A bill proposed as part of the economic rescue package would delay payments on most of that debt.

Published:

One well-respected equity strategist believes we could see a relief rally in the S&P 500 in April. Could this be one of the best buying opportunities in the past 50 years?

Published:

24/7 Wall St. has tracked multiple S&P 500 and other large-cap stocks that actually closed up for the past week and that are also still higher year to date.

Published: