Commodities & Metals

Commodities & Metals Articles

There are over 1,000 different varieties of bananas, but the long yellow banana that nearly all Americans are familiar with is the Cavendish variety. It is the world’s most popular banana variety...

Published:

The cost of natural gas used in the home fell sharply last month, which helped to keep U.S. inflation in check.

Published:

After months of drifting downward, gasoline prices are rising again. The trend is likely to continue, and here's why.

Published:

Agriculture generates about 4.3% of gross domestic product globally. In the United States, meanwhile, farming accounts for less than 1% of GDP, according to the World Bank. Though by no means an...

Published:

When it comes to companies and organizations that have shaped the course of history behind the scenes, oil companies sit toward the top of the list. Few companies have as big an impact on our...

Published:

Gold just reached the highest price in its history, and the price of gold has outrun stocks in the past year.

Published:

There has always been a degree of scorn from Wall Street and “so-called” investment professionals for those who invested in Gold. Laughed at as “Gold Bugs,” the argument against the precious...

Published:

The price of gold is very near its all-time high, and some analysts believe it could rise another 50% in the medium term.

Published:

How will gold perform over the latter half of this year? The World Gold Council's latest outlook has just been published.

Published:

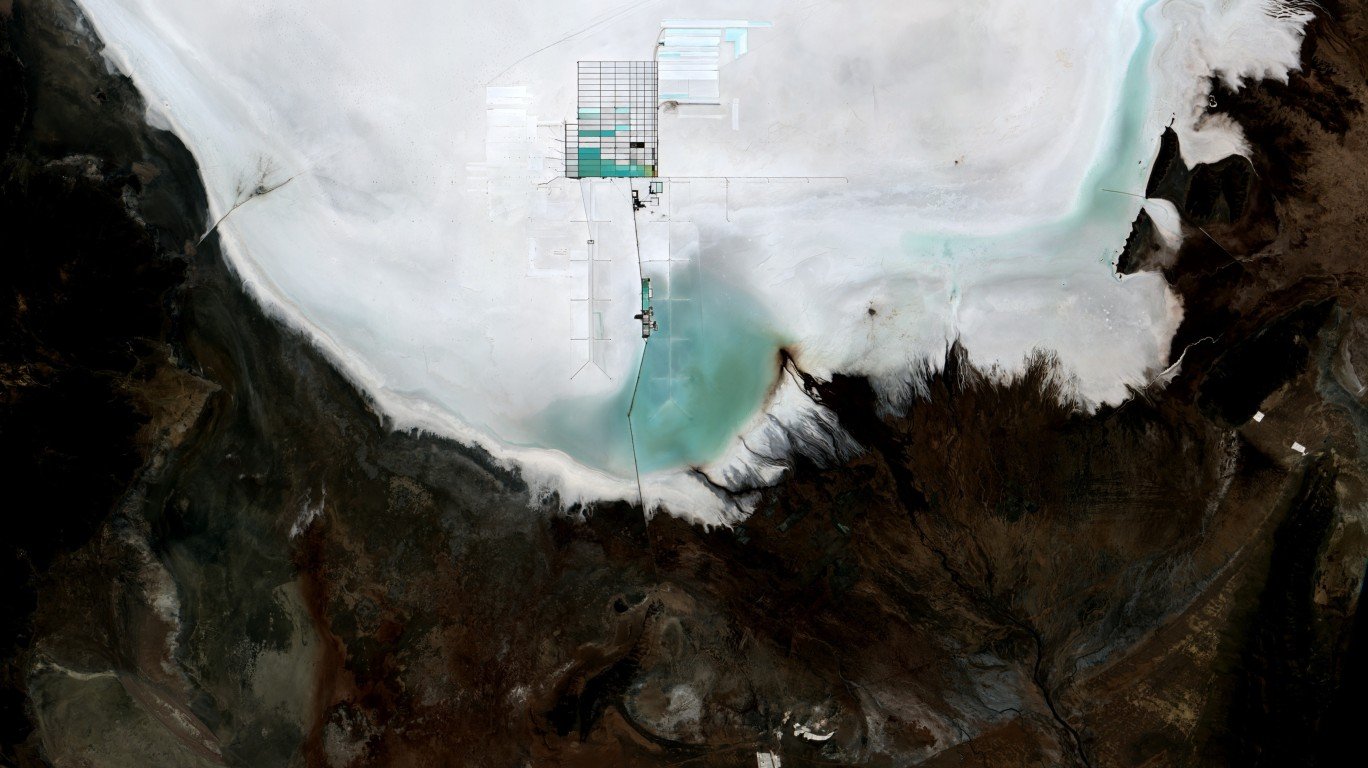

The country with the world's largest deposits of lithium finally has taken action to develop its resources, awarding three contracts to Russian and Chinese groups since the beginning of the year.

Published:

Short seller Grizzly Research has issued a report on lithium miner Sigma Lithium blasting the company and its management. Investors do not appear to agree.

Published:

Gold, which has been a hedge against rocky markets for decades, is in the midst of a surge.

Published:

Two-thirds of Americans drink coffee every day. That is more than 200 million cups. Coffee is like gasoline. A rise in prices hit the pocketbooks of tens of millions of people. Fortunately, the price...

Published:

Credit Suisse strategist Zoltan Pozsar looks ahead to what the commodities markets might look like once the Russian invasion of Ukraine ends.

Published:

Gold prices have posted a new 52-week high Thursday morning. Here are 10 equities that were moving higher as a result.

Published: