The Business Roundtable has released its fourth-quarter 2014 CEO Economic Outlook Index, which is effectively a more muted expectation for what CEOs are thinking they should expect in 2015. CEOs in the survey said that congressional action on tax extenders and trade promotion authority are critical to spur more investing and to improve the current economic outlook. The Business Roundtable looks for CEOs’ plans for sales, capital spending and hiring. Source: Thinkstock

Source: Thinkstock

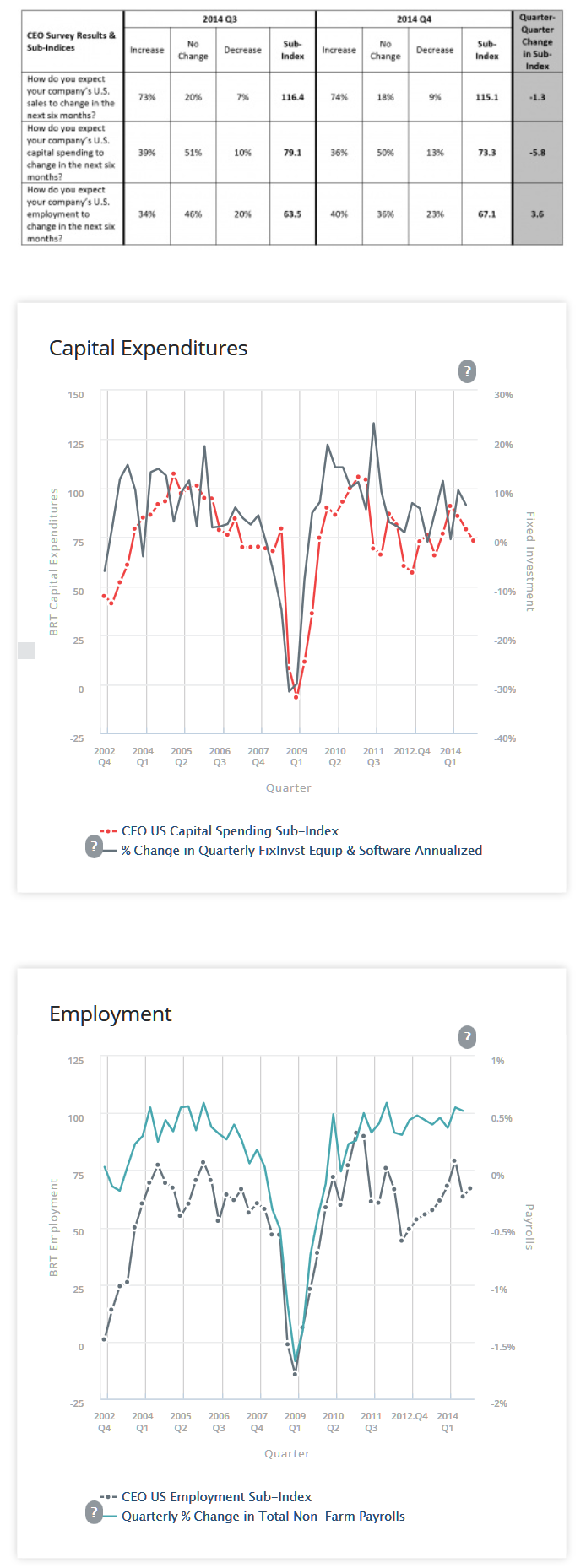

The new report shows a moderate decline from the third quarter. Unfortunately, capital spending expectations declined the most in the outlook. When CEOs were asked to identify the two most significant factors holding back increased U.S. investment spending, those CEOs said that U.S. tax policy and regulatory issues are limiting U.S. investment spending.

CEOs said they expect 2015 gross domestic product growth of 2.4%, unchanged from their 2014 expectation. CEO expectations for investment fell by a sharp 5.8 points and sales declined by 1.3 points. The good news is that plans for hiring increased 3.6 points, following last quarter’s sharp 15.7 point decline.

ALSO READ: The Most and Least Tax-Friendly States for Business

The fourth-quarter 2014 survey was completed between October 22 and November 12, 2014. Responses were received from 129 member CEOs, 63% of the total Business Roundtable membership. Why this matters should be simple enough to understand. If a CEO is less confident, the message all the way down the company line is likely to be more guarded and cautious, and that doesn’t send the best message for being aggressive on new projects, hiring, business spending and other key issues.

AT&T’s Randall Stephenson, who is also Chairman of the Business Roundtable, said:

The economy ended the year essentially where it started – performing below its potential. Congress and the Administration should act now on tax extenders and Trade Promotion Authority to encourage additional business investment in the United States to help the economy grow and create more jobs.

Source: BusinessRoundtable.com

Source: BusinessRoundtable.com

Smart Investors Are Quietly Loading Up on These “Dividend Legends”

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.