What does a massive round of quantitative easing in Europe, an environment of deflationary pressures and a testing of negative interest rates tell you? It spells an economy in trouble. That would be the European Union. So how is it that, less than a few weeks since quantitative easing was announced, the European Commission (EC) is already raising its growth prospects and forecasts for 2015? Source: Thinkstock

Source: Thinkstock

The EC’s new Winter Economic Forecast does say that its outlook has improved, but risks remain. The forecast indicated that the economies of all EU member states are expected to grow again this year — for the first time since 2007. Thursday’s report said:

Over the course of this year, economic activity is expected to pick up moderately in the EU and in the euro area, before accelerating further in 2016. Growth this year is forecast to rise to 1.7% for the EU as a whole and to 1.3% for the euro area. In 2016, annual growth should reach 2.1% and 1.9% respectively, on the back of strengthened domestic and foreign demand, very accommodative monetary policy and a broadly neutral fiscal stance.

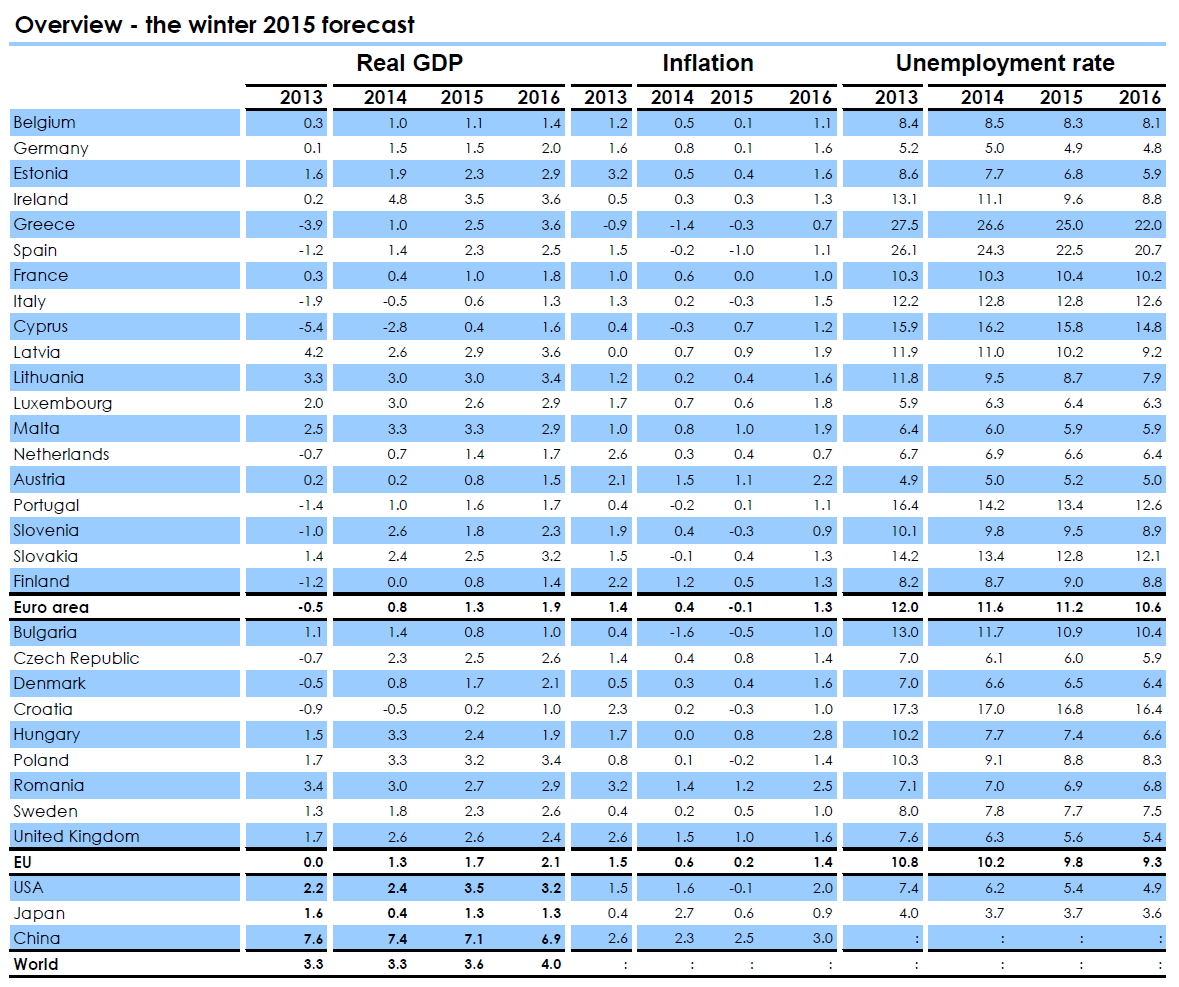

All in all, in 2015, the range of member states’ growth rates is expected to remain broad, from 0.2% (Croatia) to 3.5% (Ireland). For a full county-by-country analysis, we have included the EC’s 2015 national table at the end of this article.

ALSO READ: Euro Area Economy Expected to Grow 1.3% in 2015

There are still many warnings and caveats about the new forecasts for growth in 2015. The EU forecast admits that growth prospects across Europe are still limited, due to a weak investment environment and high unemployment. The key developments that have brightened the near-term outlook are as follows:

- Oil prices have declined faster than before.

- The euro currency has depreciated noticeably.

- The European Central Bank (ECB) has announced quantitative easing.

- The EC has presented its investment plan for Europe.

Europe is also said to remain at a critical juncture, with the right economic conditions in place for sustained growth and job creation. One warning is that the divergence in economic performance across the EU is likely to continue. A weak euro currency is expected to support exports.

A protracted period of very low or negative inflation would also be detrimental to the growth outlook. Other key points brought up are that inflation will fall further before rising in 2016:

- In the EU, inflation is projected at 0.2% in 2015 and 1.4% in 2016. Inflation in the euro area is forecast to be -0.1% this year, before rising to 1.3% in 2016.

- Job creation is set to accelerate, but unemployment will decrease only slowly. The unemployment rate is set to fall to 9.8% in the EU and 11.2% in the euro area in 2015.

- Government deficits continue to fall, but the fiscal stance is now neutral. Deficit-to-GDP ratios are forecast to keep falling over the next two years: to fall to 2.6% in 2015 from 3.0% in 2014, and to 2.2% in 2016. Quote: “For the EU as a whole, the debt-to-GDP ratio is expected to have peaked at 88.4% in 2014. For the euro area, it should peak this year at 94.4%, before declining.”

- Lastly, uncertainty around the existing economic outlook has increased. Downside risks have intensified, while new positive factors have emerged. Quote: “This is due to geopolitical tensions, renewed financial market volatility in a context of diverging monetary-policy across major economies, and incomplete implementation of structural reforms.”

Why does it seem too soon for the EC to be raising growth prospects with all the headlines we have seen? There is one admission that us and the skeptics should make: it is always possible that the negative stance is simply based on the constant disappointment and repeated distractions that only keep coming around and around in Europe and its peripheral nations. Maybe the weaker links are simply too distracting to the larger picture.

ALSO READ: Hope for a Turnaround in Europe

The EC’s table below, which can be expanded, shows a country-by-country forecast for 2015 and 2016 in real GDP, inflation and unemployment.

Sponsored: Want to Retire Early? Start Here

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.