Icahn Enterprises L P

NASDAQ: IEP

$17.35

Closing price May 3, 2024

IEP Chart and Intraday Price

IEP Company Data

| Asset Type | Stock |

| Exchange | NASDAQ |

| Currency | USD |

| Country | USA |

| Sector | MANUFACTURING |

| Industry | MOTOR VEHICLE PARTS & ACCESSORIES |

| Address | 16690 COLLINS AVE,, PH-1, SUNNY ISLES BEACH, FL, US |

| Fiscal Year End | December |

| Latest Quarter | 12/31/2023 |

| Market Cap | 8,567.79M USD |

| Shares Outstanding | 429,033,000 |

IEP Articles

The inflationary environment over the past few years has constricted consumer buying power, resulting in supplementary income requirements by many. For those who cannot augment their paychecks with...

Published:

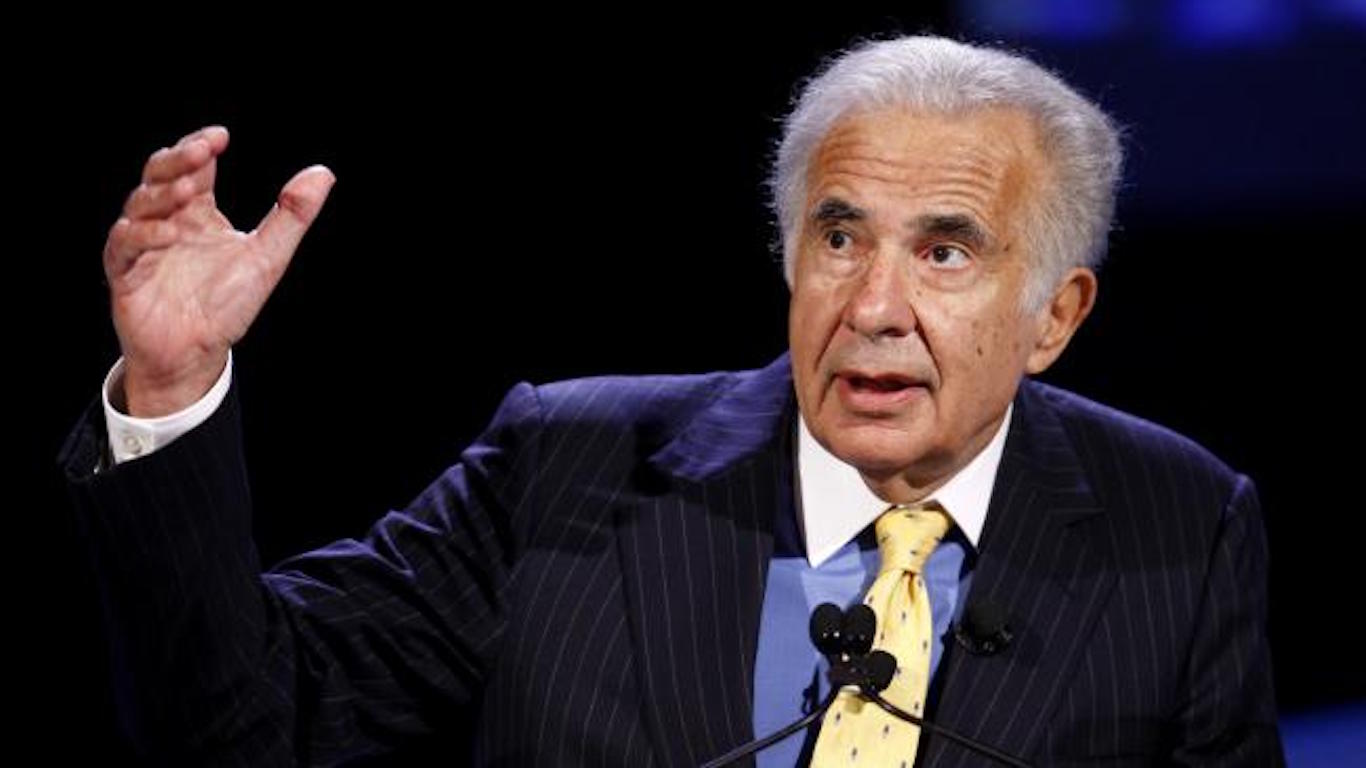

Born in 1936 and worth a reported $5.8 billion, Carl Icahn is considered one of the premier investors of our time. The former corporate raider turned activist investor has been a force on Wall Street...

Published:

Thursday's top analyst upgrades and downgrades included Albemarle, Catalent, Chipotle Mexican Grill, Cinemark, CrowdStrike, DoorDash, Estee Lauder, Icahn Enterprises, McDonald's, ServiceNow and...

Published:

A short-seller report on Icahn Enterprises is, to say the least, unflattering. Regional banks continued Tuesday's slide, and AMD dropped on a weak forecast.

Published:

For growth and income investors, top master limited partnerships may be a gold mine in the current investment environment. The reliable high dividends of these five stocks make them outstanding...

Published:

24/7 Wall St. has screened for companies with a market cap of more than $500 and billion dividend yields of 8% or more based on the current share price.

Published:

Carl Icahn has submitted an SEC filing through his Icahn Enterprises disclosing roughly a 10% stake in Caesars Entertainment, expressing a plan to increase shareholder value by selling the company.

Published:

Last Updated:

Activist investor Carl Icahn has tendered about a quarter of his stake in Herbalife in response to the company's tender offer made last month.

Published:

Last Updated:

At 24/7 Wall St., we are always a little dubious about companies that pay double-digit dividends and distributions, but we are equally intrigued by those that continue to pay them over a long period.

Published:

Last Updated:

Auto parts maker Tenneco has agreed to pay Icahn Enterprises $5.4 billion to acquire Federal-Mogul, another parts supplier.

Published:

Last Updated:

It is no secret that investors love collecting dividends from their investments. Here are 15 entities that have payouts with yields or yield equivalents of 10% or more.

Published:

Last Updated:

These five companies pay massive distributions or dividends and have upside potential.Tthey could pay off big in a total return way for patient investors.

Published:

Last Updated:

Herbalife has been more than a controversial stock over the past three years or more. Short seller and activist investor Bill Ackman had roughly a $1 billion bet against this company and has been a...

Published:

Last Updated:

Thursday's top analyst calls from Wall Street include Cisco Systems, Enterprise Products, J.C. Penney, Kinder Morgan, NetApp, Priceline and Digital Ally.

Published:

Last Updated:

Herbalife is treating this settlement as a victory. The question now is whether it will begin to aggressively go after Bill Ackman for calling Herbalife a pyramid scheme.

Published:

Last Updated: