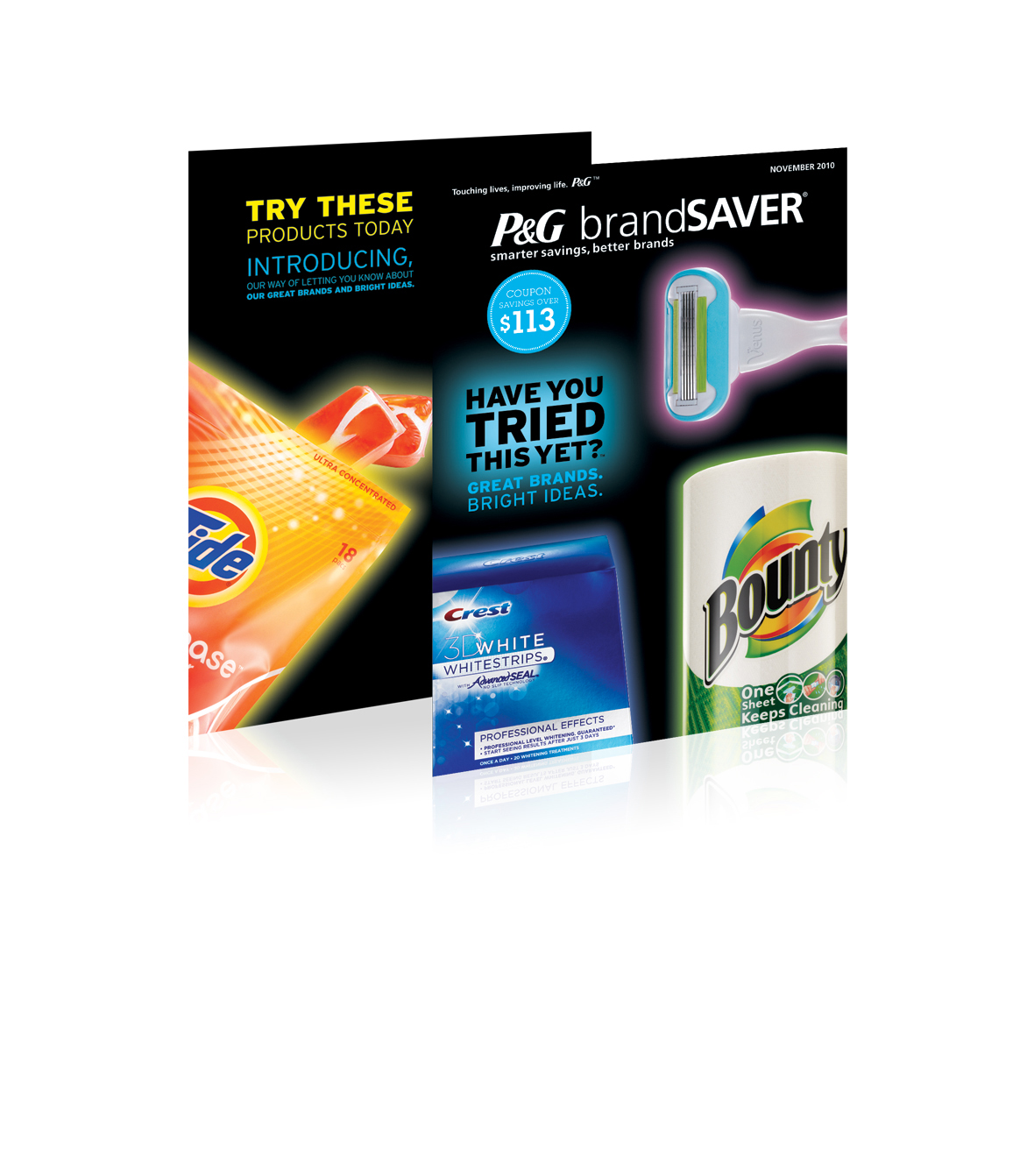

Source: Courtesy The Procter & Gamble Co.

The chairman of the company’s compensation committee, James McNerney, CEO of Boeing Co. (NYSE: BA), was reported by Bloomberg to be unhappy with McDonald after P&G was forced to cut its forecast three times in a year. The irony of that is best left to another day.

P&G announced a layoff of 5,700 employees last year, as well as other cost cutting measures totalling some $10 billion by 2016 to help offset rising commodity costs. That has certainly helped the company’s bottom line, but it’s nothing more than a near-term fix.

McDonald may also get a shareholder challenge led by activist investor William Ackman of Pershing Square Capital Management. Ackman’s hedge fund owns about 1% of P&G’s stock, and while he’s currently busy with Herbalife Ltd. (NYSE: HLF) and J.C. Penney Co. Inc. (NYSE: JCP), if he smells blood in the water here, McDonald could face a tough opponent. Ackman probably thinks he waited too long for results from his hand-picked CEO for Penney’s and is not likely to make that mistake again.

When the notion of replacing McDonald came up last year, many thought that it was premature. After all he’d been at the head of P&G for only about three years and those were the toughest years for the U.S. economy since the Great Depression. But as the quarters roll along and P&G’s performance doesn’t improve, McDonald’s tenure in the corner office gets shakier.

Shares of P&G hit a bottom of around $45 in May of 2009 and have since climbed to an all-time high of more than $82. But growth was pretty flat for the two year to January of 2013, when they turned sharply higher as commodity prices fell and the company’s cost reduction program showed some results. Neither force, however, demonstrates much of a strategic vision.

P&G’s shares are down about 4.8% in mid-afternoon trading today, at $78.05 in a 52-week range of $59.07 to $82.54.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.