Apparently not satisfied that he has blown through enough of his billions, Tesla Inc. (NASDAQ: TSLA) Elon Musk announced Wednesday that he is launching an artificial intelligence company to be called xAI Corp. In a post on the company’s landing page, x.ai, 12 founders are named, along with one advisor, Dan Hendrycks, who is the director of the Center for AI Safety.

xAI is not part of X Corp., the company Musk formed to replace Twitter, but, xAI “will work closely with X (Twitter), Tesla, and other companies to make progress towards our mission.” That mission, according to a comment Musk made to Tucker Carlson back in April when Carlson still had a TV show, is to build “a maximum truth-seeking AI that tries to understand the nature of the universe.” Make no small plans …

Musk was a co-founder of OpenAI back in 2015, but he gave up his stake after failing to gain control of the company. OpenAI, of course, went on to capture other backers, Microsoft Corp. (NASDAQ: MSFT) chief among them, and the rest is history. Now, also of course, Musk has taken a mixed view of AI, warning that it is “one of the biggest risks to the future of civilization” while stressing that the technology “has great, great promise, great capability.”

As Will Knight at Wired points out, “xAI’s reality-bending rhetoric is primarily about attracting talent” right now. Then it faces the costly problem of building (or buying) a cloud-computing platform to serve up the fruits of xAI to consumers. But money’s no problem, obviously.

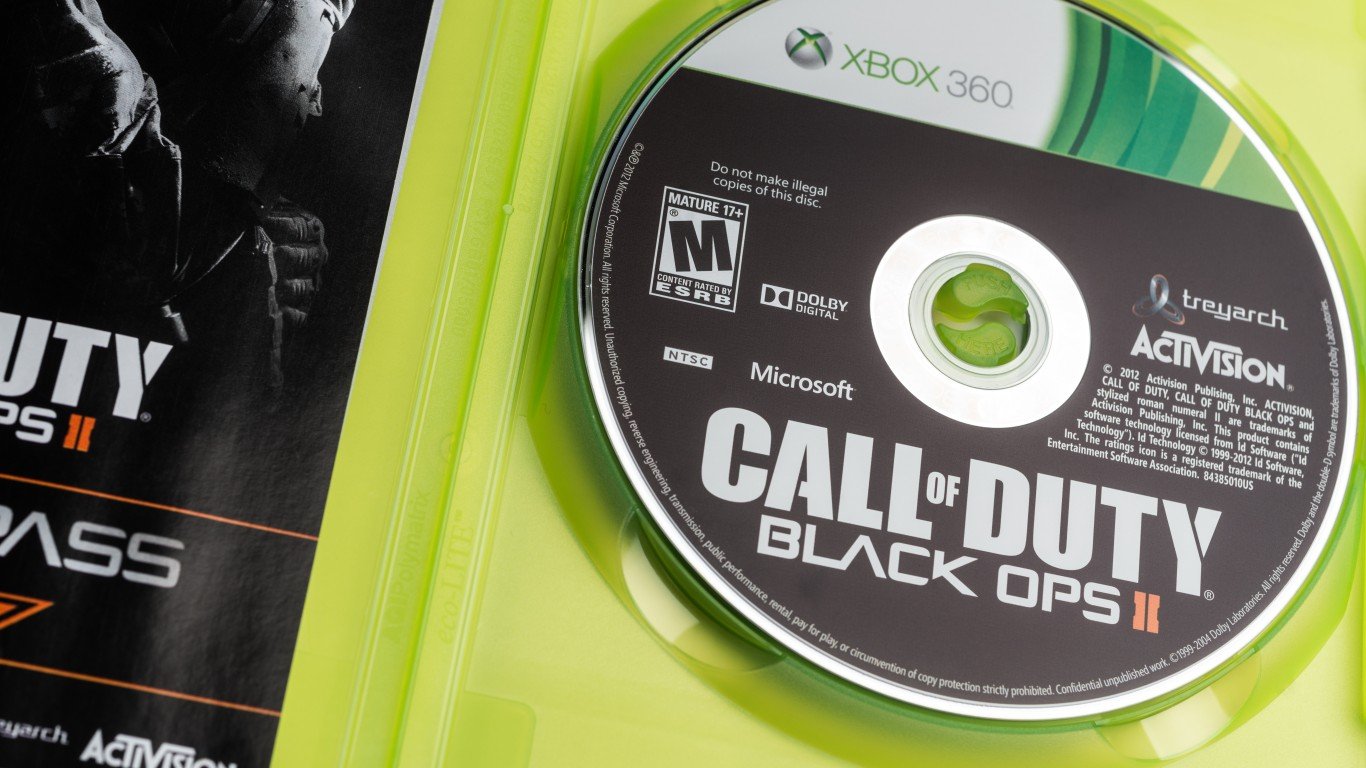

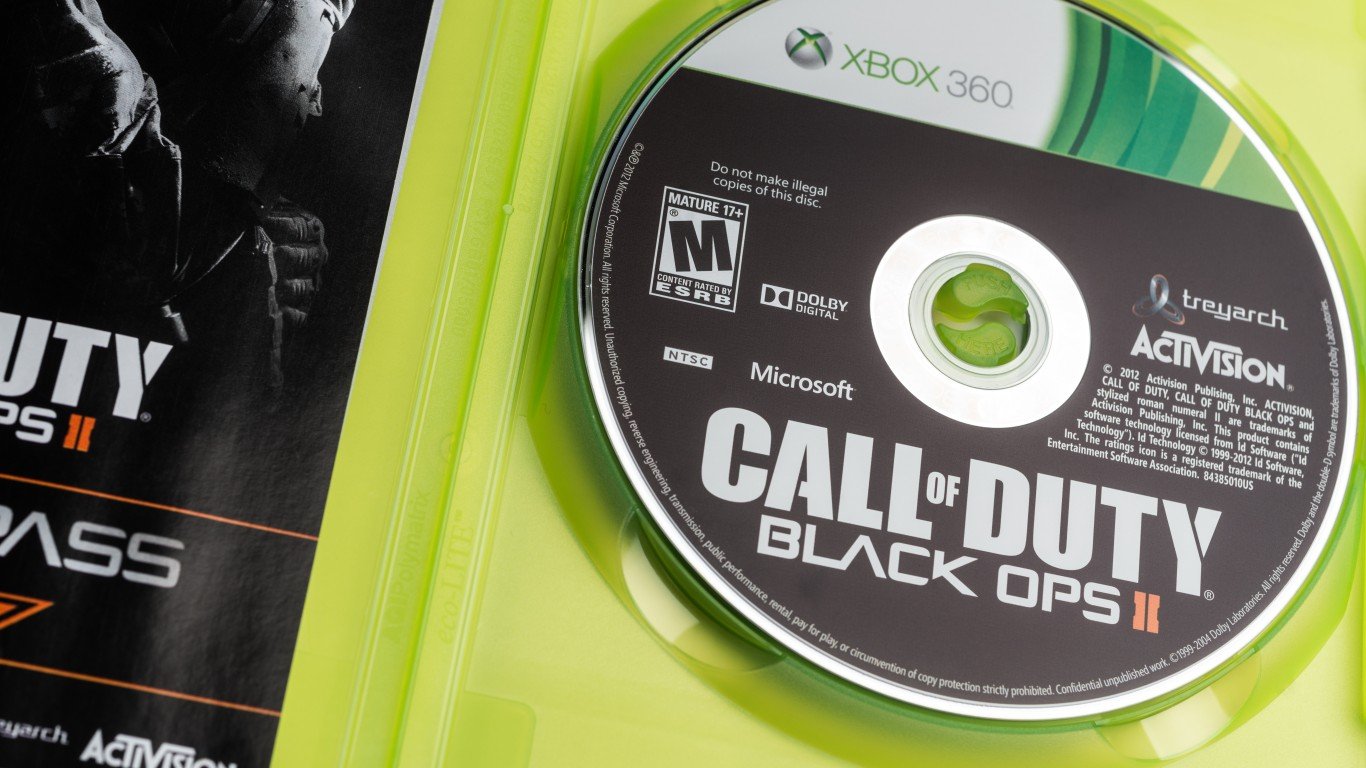

Separately, the Federal Trade Commission has filed an appeal of the Ninth Circuit Court’s refusal to grant the agency a preliminary injunction to halt Microsoft’s proposed $75 billion of Activision Blizzard Inc. (NASDAQ: ATVI). In the court’s ruling issued Tuesday, the judge wrote that “the FTC has not shown a likelihood it will prevail on its claim [that] this particular vertical merger in this specific industry may substantially lessen competition.”

On the earnings front, four of the nation’s largest banks are set to report June quarter results before markets open Friday morning. Citigroup, JPMorgan Chase, State Street Corp., and Wells Fargo are first out of the blocks. Asset manager BlackRock and Dow 30 component UnitedHealth Group will also reveal results Friday morning. Here’s our look at what to expect.

Delta Air Lines Inc. (NYSE: DAL) beat consensus estimates on both the top and bottom lines when it reported second-quarter earnings Thursday morning. The airline issued third-quarter earnings per share (EPS) guidance that topped the Street’s consensus and revenue guidance that was in line with estimates. For the full fiscal year, Delta sees EPS in the range of $6.00 to $7.00 on revenue of$53.36 to $54.73 billion. Both estimates are in line with consensus estimates. The stock traded up about 4.4% in premarket trading Thursday morning.

PepsiCo Inc. (NYSE: PEP) also beat top- and bottom-line estimates. The soft drink and snacks company also issued upside EPS guidance for the full fiscal year and forecast organic revenue growth of 10% year over year, up from a previous forecast for 8% growth. Shares traded up 2.5% before the markets opened Thursday.

Conagra Brands Inc. (NASDAQ: CAG) beat the consensus EPS estimate and missed on revenue. EPS guidance for the 2024 fiscal year that began in June was a bit low, but Conagra raised its dividend by 6% to $1.40 annually. The first quarterly payment of $0.35 per share will be made to shareholders of record on July 31. Shares traded down about 0.5%

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.