In the fast-paced world of technology, where innovation reigns supreme, some companies cast a long shadow. Google (NASDAQ: GOOGL) has been the name for search engines and advertising.

Investors trying to make a quick buck often rush to the hottest tech darlings, promising to disrupt the industry. However, these new start-ups are incredibly risky, as many of them hardly get off the ground. It’s easy to forget about other (less exciting) companies like Microsoft (NASDAQ: MSFT).

Despite its massive size and mature products, Microsoft’s strategic shift towards cloud computing and AI positions it for explosive growth, potentially making it a millionaire-maker stock in the coming decade.

Yes, Microsoft has been around forever, but it potentially has a lot of growth left to do.

The Shadow of Google

Google is a clear industry titan, casting a long shadow over other tech companies, even bigger ones like Microsoft. Google’s stranglehold on search and advertising is undeniable. Their market shares and revenue streams are absolutely staggering.

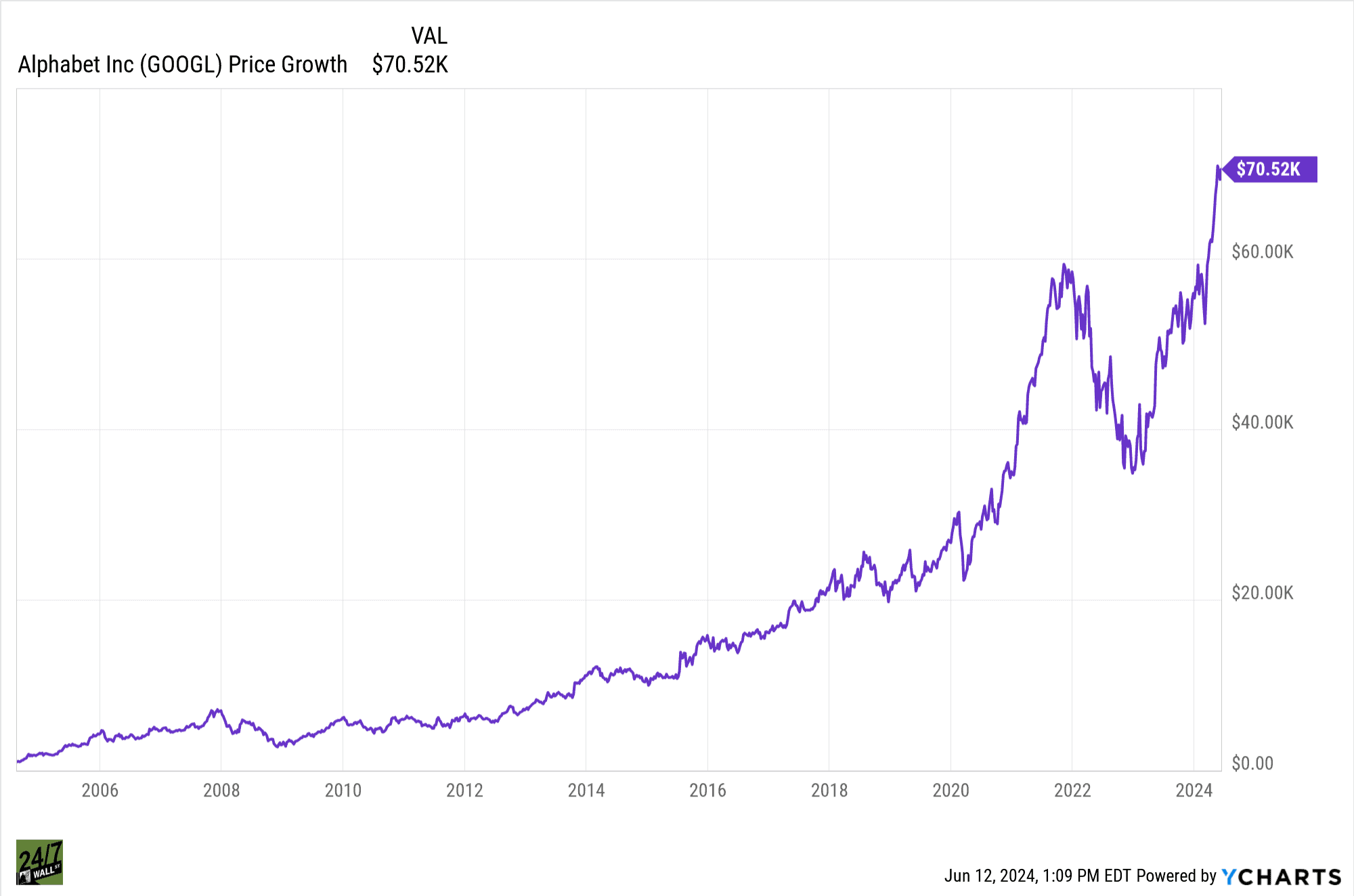

Google is also often perceived as an innovative company. They tend to churn out new products at record speed, especially those that capture the public imagination. Just take a look at their stock chart:

Investors are always eager to chase new, trendy innovations, but those who don’t want to risk their money with a newer company often turn to Google.

Admist the frenzy, well-established technology companies like Microsoft are easily overlooked. They aren’t as fun to talk about. Everyone knows who Microsoft is. Microsoft is decidedly unsexy. However, beyond its established, boring exterior, Microsoft is in a fabulous position for significant future growth.

Microsoft’s Strategic Transformation

Many smaller, innovative companies may grab headlines. However, Microsoft has quietly been expanding its offerings through two key pillars: cloud computing and AI.

One significant development that didn’t get much coverage is the rise of Microsoft Azure. Azure is Microsoft’s cloud computing platform. It offers businesses a range of services like storage, computing power, and databases.

Currently, Amazon Web Services (NASDAQ: AMZN) holds the lead in the cloud market. However, Azure has been experiencing significant growth and steadily capturing market share. If this growth continues, Microsoft will find itself in a very strong position to gobble up more of the cloud computing pie.

Plus, who knows how Azure could expand in the future, potentially becoming a goldmine for Microsoft.

AI is another area where Microsoft is poised to gain a large portion of the market. The company has been heavily invested in AI research and development, potentially allowing them to get ahead of the curve.

This isn’t all theoretical, either. Microsoft is actively integrating AI into its products. For instance, they’ve been adding AI to Office 365, potentially boosting the productivity of those who use it. AI can potentially transform their other products, too. They may even develop their own AI-centered products, opening up another income stream.

These new innovations show that Microsoft isn’t just sticking in its lane. They’re actively expanding and looking for places to flex their well-established muscles, potentially allowing them to outcompete other companies in these new fields.

Why Microsoft Could Be the Next Millionaire-Maker

Beyond it’s strategic success, there are a few other compelling reasons you may want to take a look at Microsoft, especially those seeking long-term gains.

Microsoft has one huge advantage over other stocks: revenue. This company simply makes a lot of money! Microsoft also thrives on subscriptions. Products like Office 365 and Azure generate consistent income, allowing them to focus on other parts of their business (like growth initiatives).

Furthermore, many of Microsoft’s products are considered “necessary.” Microsoft Word is required in many workplaces and on college campuses around the globe. When you need Microsoft Word, a different application simply won’t do.

Plus, these products are fertile ground for upselling new cloud and AI-powered services. Imagine MS Word with AI built in. Many people would pay for that service.

It’s also possible that Microsoft’s stock price is undervalued. While the company’s current price does reflect it’s established success, it may not completely capture its future growth prospects. With Azure’s ascent in the cloud market and the potential for AI offerings, Microsoft’s true potentially may be yet to be seen.

Potential Challenges for Microsoft

Of course, it isn’t all roses for Microsoft. Innovation is hard. If it wasn’t, everyone would do it. Just because Microsoft is in a good position to take advantage of these new markets doesn’t mean they’ll make the best use of their position.

Cloud computing is fiercely competitive. Microsoft faces major players like Amazon and Google in this ever-changing market. Many of these other companies are also well-established and heavily invested in cloud computing. Microsoft will need to maintain its innovative edge and continue to compete.

Similarly, the race for AI dominance is only just starting to heat up. Companies like Google, DeepMind, and Apple (NASDAQ: AAPL) are pouring resources into AI development. In fact, Google is one of the top AI stocks.

Microsoft is doubling down on their AI research, too, but that also means setting themselves up for bigger losses if things don’t work out!

Microsoft’s historical strength lies in enterprise software solutions. While this provides a stable foundation, it also creates a potential risk. If new technologies or business models disrupt the traditional enterprise software market, Microsoft could struggle to adapt.

As one of the tech giants, Microsoft has a long way to fall if things stop going their way. While established companies are often touted as being more stable, they come with risks of their own.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.