Military

Defense Contracts Go to Boeing, Northrop to Begin $1.5 Trillion Upgrade to US Nuclear Arsenal

Published:

Last Updated:

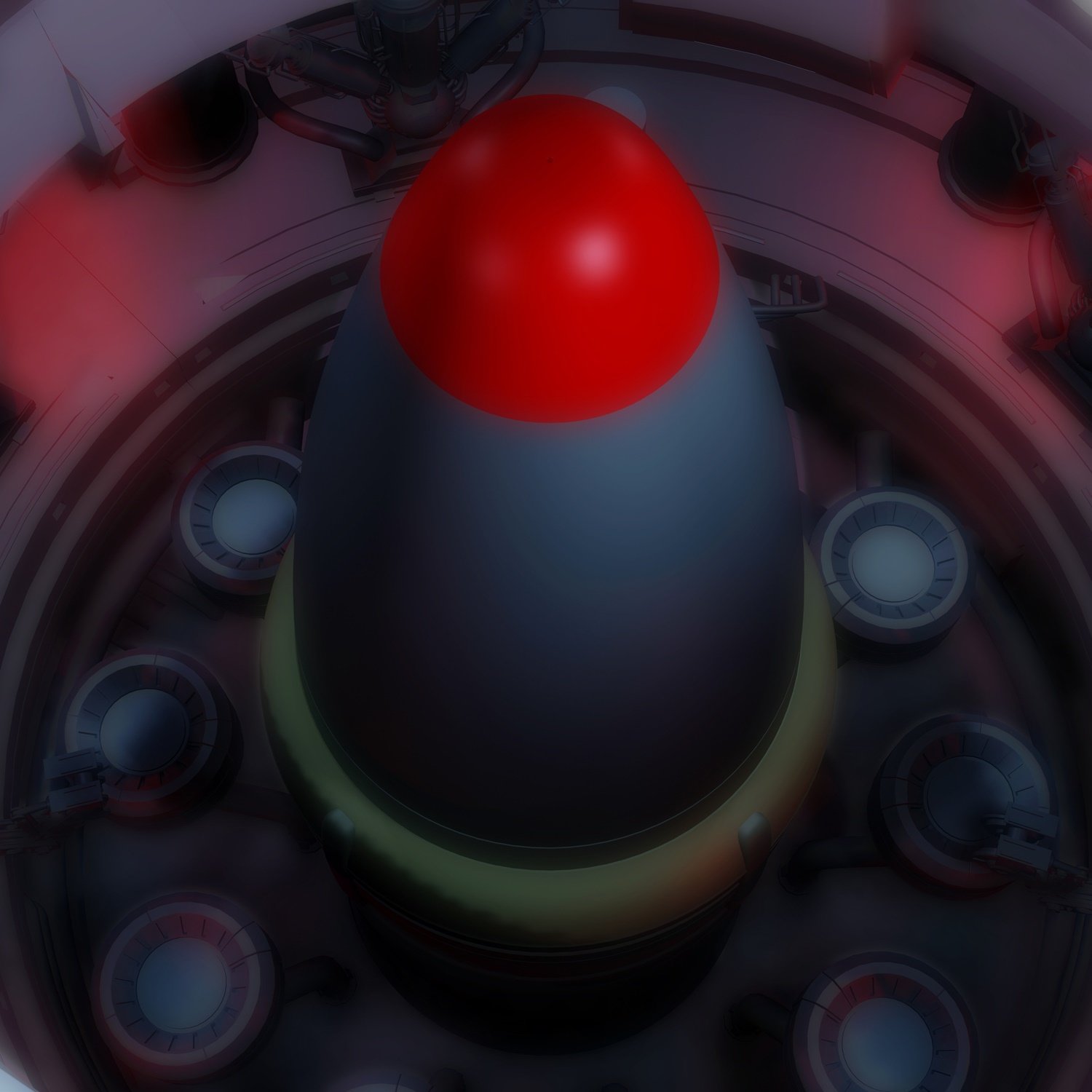

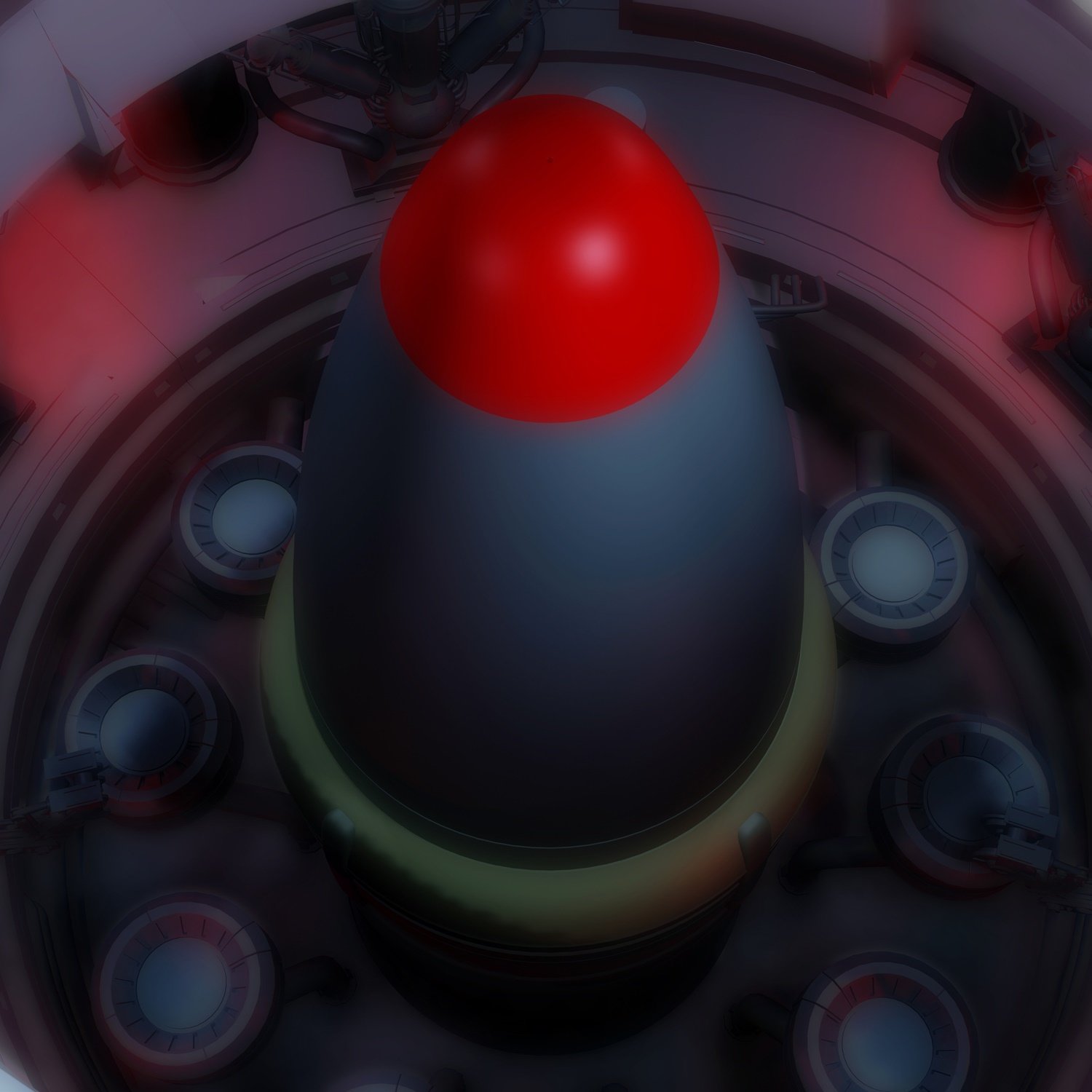

The U.S. Air Force on Monday awarded one contract valued at $349 million to Boeing Co. (NYSE: BA) and another valued at $329 million to Northrop Grumman Corp. (NYSE: NOC) to replace the country’s Minuteman III nuclear missile force. Lockheed Martin Corp. (NYSE: LMT) was the third bidder for the work, but its bid was rejected.

The Air Force contracts call for the companies to “conduct technology maturation and risk reduction to deliver a low technical risk, affordable total system replacement of Minuteman III to meet intercontinental ballistic missiles operational requirements.”

Affordable is in the eye of the beholder. According to a report from the Congressional Budget Office released last February, the federal government will spend $400 million on nuclear weapons between 2017 and 2026. A review by the Arms Control Association, a nonpartisan, nonprofit nuclear weapons watchdog, the total 30-year cost of the program could rise to $1.5 trillion.

One of the two contract winners is expected to be selected to build more than 400 intercontinental ballistic missiles (ICBMs). Boeing was the original builder of the Minuteman III ground-based system.

A Lockheed spokesperson said in an email statement to Defense One that the company was “disappointed” in the results of the bidding and that Lockheed “looks forward to a debrief about the selection.”

While President Trump has claimed earlier this month that the U.S. nuclear arsenal is “far stronger and more powerful than ever before,” he has so far only called for a review of the country’s nuclear posture that is not likely to be completed before the end of this year. The plan to update the U.S. nuclear arsenal was begun by President Obama, and Trump included funds to move ahead with the project in his first budget request.

Kingston Reif, director for disarmament policy at the Arms Control Association, writes:

The [Trump administration] approach … assumes that the United States will maintain a nuclear arsenal like the one it has now for decades to come. However, the Obama administration, with the support of the Joint Chiefs of staff, determined that the United States can reduce the size of its deployed strategic nuclear arsenal by up to one-third below the 2010 New Strategic Arms Reduction Treaty (New START) levels.

As the projected costs for programs designed to replace and upgrade the nuclear arsenal continue to rise, Congress must demand greater transparency about long-term costs, strengthen oversight over high-risk programs, and consider options to delay, curtail, or cancel programs to save taxpayer dollars while meeting deterrence requirements. Tens, if not hundreds, of billions could be saved in the coming decades by reshaping the plans and funding a smaller number of projects, while still leaving the United States with a highly credible nuclear deterrent.

Whether the amount the United States spends on its nuclear weapons hoard turns out to be some smaller multiple of $400 billion or $1.5 trillion, it’s real money that will have to come from somewhere. The answer to that question has more to do with politics than defense strategy.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.