Social Security is a financial right that protects Americans throughout their lives. According to The United States Social Security Administration (SSA), ”We administer retirement, disability, survivor, and family benefits, and enroll individuals in Medicare.”

However, many individuals don’t fully understand how Social Security works. There are countless misunderstandings regarding Social Security, which often sway how individuals approach it.

Here are eight Social Security myths — debunked by professionals.

1. Social Security Won’t Be There When You Retire

Many people worry Social Security will run out by the time they retire. According to the SSA, “Currently, the Social Security Board of Trustees projects program cost to rise by 2035 so that taxes will be enough to pay for only 75 percent of scheduled benefits … Importantly, this shortfall is basically stable after 2035; adjustments to taxes or benefits that offset the effects of the lower birth rate may restore solvency for the Social Security program on a sustainable basis for the foreseeable future.”

According to professionals, this is an unfounded fear — and there are ways to cope with potential losses.

“Though the solvency of the Social Security program is an ongoing topic of conversation, if you’re already in retirement and receiving Social Security benefits, it is not likely to materially affect you,” said Keith Seago, CFP and Financial Advisor at Guardian Financial Services.

On the other hand, if you’re not near retirement yet, you can still work with a professional to determine any changes or impacts you might experience with your plan. Investing in expert advice will ensure you’re making the necessary updates or adjustments.

2. All Social Security Payments Are the Same

Your Social Security payments will likely increase year over year. Furthermore, they’re impacted by how long you’ve worked.

“Everyone’s social security payments are different, and they’re based on your working years,” said Drew Blackston, CRC® RFC® Certified Retirement Counselor. “They’re based on when you decide to start taking Social Security. So if you take it at 62, you’re going to get less than if you took it at 66 or 67 or even at 70. And someone who works longer than you might actually get more Social Security than you do.”

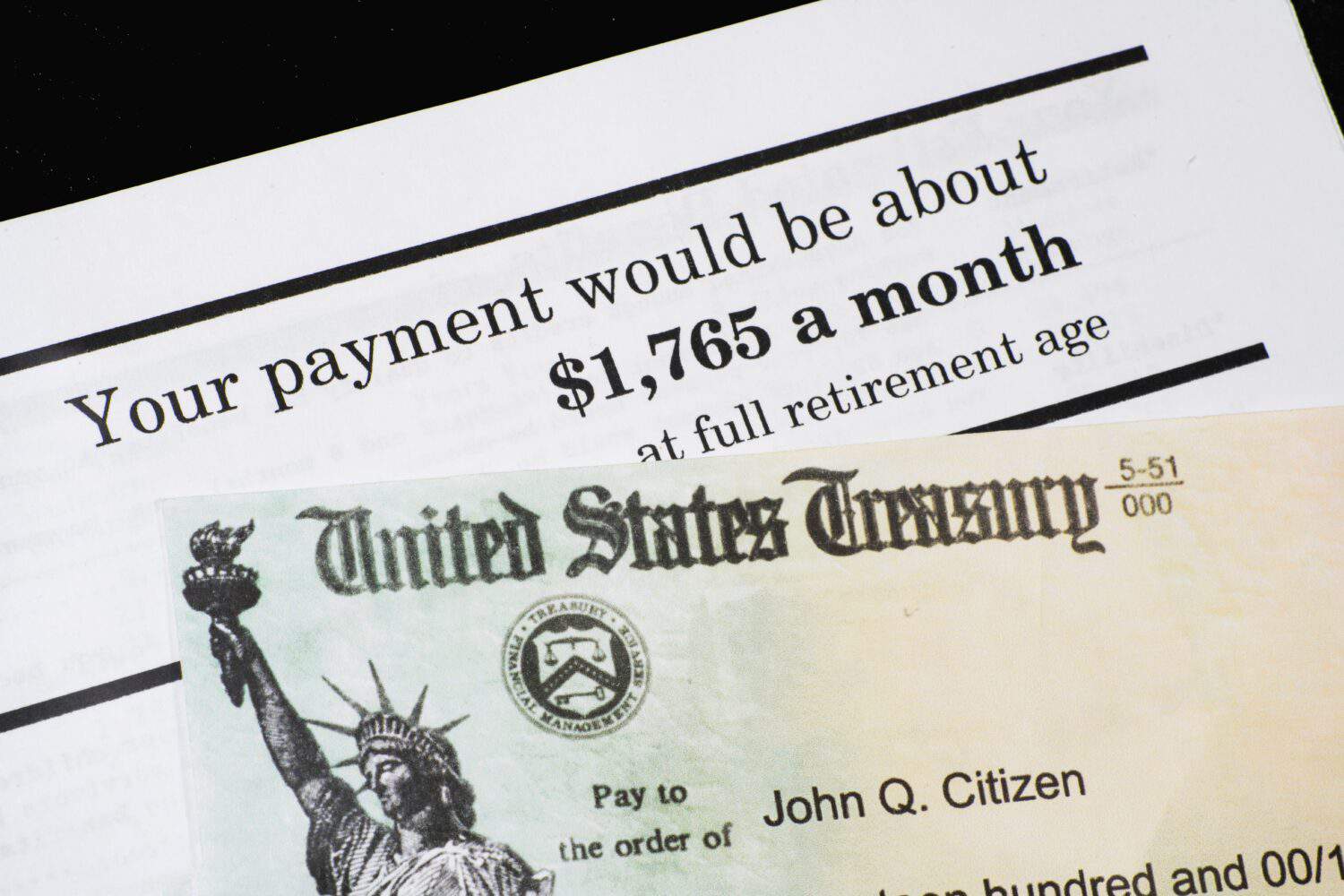

3. Social Security Payments Stay the Same

While many believe Social Security payments remain the same, they actually increase — typically each year — due to the cost of living.

“The average Social Security payment today is $1,500, but that’s going to change year over year,” said Blackston. “The big reason is because, every year, the U.S. government gives a cost-of-living adjustment to Social Security. Some years … are going to be higher than years in the past.”

4. Social Security Payments Will Be a Large Source of Retirement Income

No matter what you do, don’t view your Social Security as your prime source of retirement income.

“While it can be a supplemental income source for retirees, Social Security alone is unlikely to provide enough income for most individuals,” said Seago. “Social Security is one piece of the retirement puzzle, and other streams of income are often needed by retirees to maintain their desired lifestyle.”

5. Social Security Income Is Not Subject to Taxes

Many individuals make the mistake of believing their Social Security is not taxable.

“Even though Social Security is paid out through a federal government program, you may have to pay taxes on the income if your total modified adjusted gross income is above certain limits,” said Seago. “Up to 85% of your Social Security benefits may be taxable, depending on the amount of income you have from other sources.”

6. You Should Wait Until Retirement Age to Take Social Security

According to Blackston, “If you read any kind of financial articles … [they’re] always saying, ‘Wait to take Social Security. Wait as long as you possibly can.’ That doesn’t always work for everyone.”

He then explained two examples of why it wouldn’t be the best idea to wait. First, if you’re in poor health, you won’t want to prolong taking those payments — especially if you don’t feel you’ll make it to your upper 60s or much further past that.

Second, if you’ve retired and have a large amount of money in your IRAs or 401ks, you might not want to live off them due to different tax treatments.

“It’s actually more tax efficient for some to take Social Security early,” Blackston said.

7. You Can Outlive Your Social Security

Many people believe you can outlive your Social Security benefits. However, that’s not the case.

“Regardless of when you choose to begin taking benefits, you cannot outlive Social Security,” Seago stated. “You will receive payments every month until your death. Unlike other income streams, it has the backing of the federal government and is designed to keep pace with inflation.”

8. The Social Security’s Cost of Living Adjustment is Guaranteed

Blackston pointed out that the cost of living adjustment is not always guaranteed in Social Security payments. For example, in 2010, Social Security did not increase because there was no “inflationary pressure on the economy,” according to Blackston. With a cost of living of zero, Social Security remained the same.

However, in most cases, both the cost of living and Social Security increase each year. But again, it’s not necessarily guaranteed. All you can count on is if inflation is increasing, so will your Social Security.

Why We Are Covering This

Social Security is a popular yet often misunderstood topic — especially with the topic of solvency right now. However, the above (debunked) myths will hopefully shed some light on the truth about Social Security, so you can better approach your retirement and benefits.

ALERT: Take This Retirement Quiz Now (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.