It’s never too late to start saving for retirement. For a variety of reasons, not least of which is our cultural obsession with me-first self-sufficiency, we expect everyone to dedicate the best years of their lives to corporate cubicles and then dump them out on their own once they are old, hopefully with enough change saved up to live the last handful of years of their lives in relative comfort, forgotten and ignored. If you managed to secure a job that leaves a little left over at the end of the day to put into a retirement account, you might have a plethora of questions swimming around your head about what to do. We’re here to help.

Why Are We Talking About This?

Retirement accounts (or pension accounts to most people in the world), and specifically employer-based 401(k)s are America’s way of tying our productive years to a specific company and buying employee loyalty. But the more information you have about your retirement account, the better you can be about planning for your twilight years. We hope every little bit of information makes you a better saver, consumer, and smarter person.

Background on E*Trade

E*Trade was started as an online stock broker in 1991. At the time, stock trading was limited to mail orders, phone calls with brokers, or expensive asset managers. Alternatively, rich people with a lot of money could pay an asset manager to invest their wealth for them, but these services were typically expensive and didn’t deal with people who didn’t have significant funds to invest. All the options took a large commission and other fees in order to trade stocks.

When E*Trade entered the scene, it lowered the barrier to entry by allowing anyone with any amount of money to invest in the stock market. It experienced significant growth and millions began trading stock for the first time. Trading online became easy and much more affordable than it had been in the past.

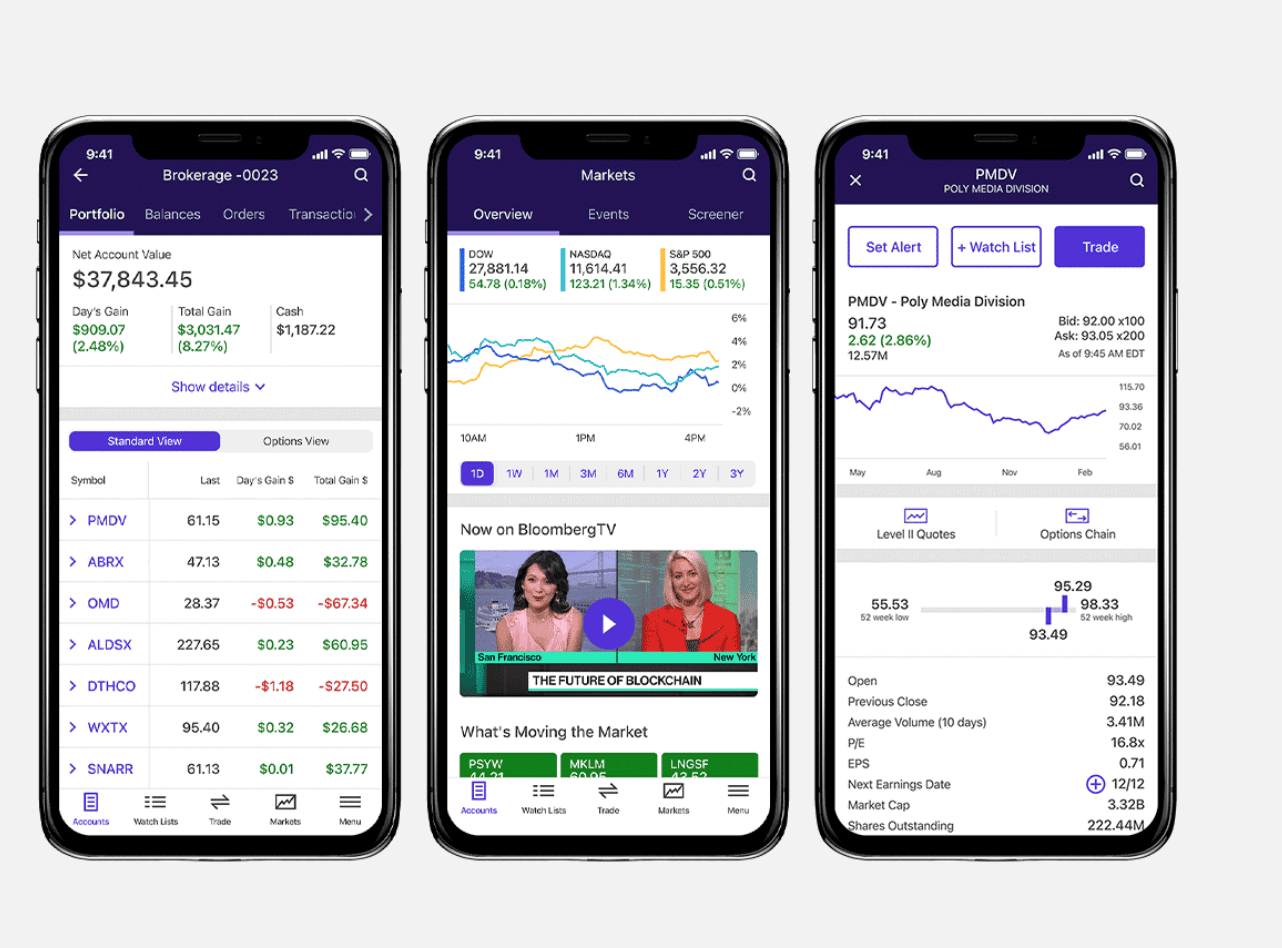

E*Trade remained a major player in the broker industry for years. Then, mobile-first trading platforms entered the market offering stock trades with zero commissions and a streamlined experience. A massive influx of new traders flooded the market, primarily millennials enticed by free stock trades and simple mobile apps. E*Trade followed the example of other legacy brokers and eliminated its own commissions and many of its fees in order to remain competitive. Today, you can buy and sell stocks on E*Trade without paying account fees or commissions on basic trades.

Morgan Stanley (NYSE:MS) acquired E*Trade in 2020 and quickly integrated the company into its online financial ecosystem. Now E*Trade offers a full suite of financial services along with investing in the stock market. Customers can attach a debit card to their uninvested brokerage funds and use it like a checking account, open a high-yield savings account, open a variety of retirement accounts, and much more.

Background on Roth IRAs

A Roth IRA differs primarily from a Traditional IRA in that contributions are made to the account after taxes have been paid and are not tax deductible, whereas all traditional contributions are made pre-tax and are deductible from taxes. Also, any withdrawals from a Roth IRA (under the right conditions) are tax-free, along with the gains made in the account.

Roth IRAs are a relatively new addition to the American financial system, being introduced in just 1997. The reason for its invention was that politicians wanted a way to increase tax revenue while still incentivizing saving for retirement. With a Roth IRA, the government would receive more money in the short term but give up potentially larger gains in the future.

Traditional and Roth IRA accounts have a few differences, but the main differences between tax deferment and tax-free gains, are the primary drivers to deciding which one to use. It is essentially a bet on how you believe the stock market and tax system will behave in the future. If you think taxes will be higher when you retire, then you will want to pay taxes now and avoid taxes in the future. If you think you can pay less tax at retirement age, then a Traditional IRA will help you take advantage of that lower tax by deferring taxes until then.

Review of E*Trade’s Roth IRA

The “features”, such as they are, of E*Trade’s Roth IRA are going to be almost identical to any Roth IRA account at other financial institutions. The only differences will be the investment options for your account and the user experience with the company. If you already have an account of some kind with E*Trade and have enjoyed your experience, then it might be better and easier to simply add a Roth IRA to your existing account. If you are not particular about the platform or usability, then it will simply come down to the investment options and support.

E*Trade offers an IRA selector tool to help customers see whether a Traditional IRA or a Roth IRA is better for them, and if they qualify for either.

For E*Trade, you are able to choose between stocks, bonds, futures, limited margins, options, ETFs, and thousands of different mutual funds. If you are particular about your investments, we suggest you contact E*Trade to get the details of what you want to invest in and whether E*Trade can help.

Also, if you want to save for retirement but don’t like the idea of choosing the investments yourself, E*Trade can help. E*Trade allows users to automate their investments with its robo-advisor called Core Portfolios. There is an account minimum of $500 to begin using this service, of course.

Core Portfolios is a cheaper alternative to a human asset manager, but you still need to pay a monthly fee to use it. The current rate for Core portfolios is 0.30% for all account values, with a minimum fee of $1.50 per month. What do you get for the fee? Core Portfolios includes a customized portfolio designed just for you that keeps your financial situation and investment goals in mind, 24/7 customer service and support, a tailored investment strategy that can be adjusted to your risk tolerances, and finally, constant monitoring that will automatically reinvest and rebalance your investments to keep your retirement secure.

Once you reach age 59 ½, E*Trade offers a free cash management service to all IRA customers to help them manage the disbursements from their IRA account.

In order to open a Roth IRA account with E*Trade you must be at least 18 years old, be a United States citizen, and have a Modified Adjusted Gross Income below a certain level depending if you file taxes as an individual or jointly with someone else. These thresholds can change at any time, so we suggest you visit E*Trade or the IRS websites to see if you still qualify.

Your contributions to your Roth IRA are limited in the same way they are for a Traditional IRA. If you are younger than 50 years old, the 2024 contribution limit is $7,000. If you are older than 50 years old, the limit increases to $8,000.

If you’re curious about any other part of the E*Trade platform, check out this page: a regularly updated list of all our E*Trade guides, news coverage, and lists of benefits.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.