Investing

As Apple and Tesla Split, 13 More Companies Should Consider Stock Splits Immediately

Published:

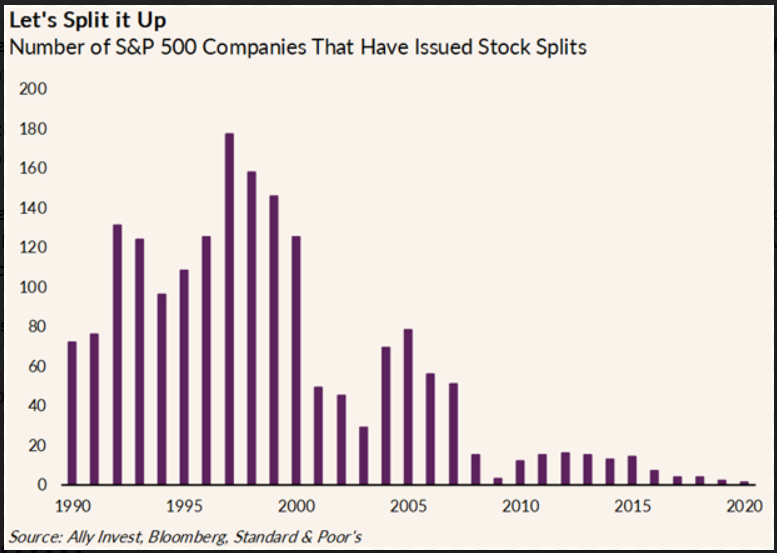

Investing in 2020 has been anything but usual. From an 11-year bull market to a bear market and instant recession, only to be followed by new all-time highs all over again. One trend that used to be very common in raging bull markets was stock splits. As stocks would rise to levels that the company thought was becoming a high dollar amount, they would split their stock and double, triple or quadruple their share count by lowering their stock prices by a similar amount.

Stock splits technically do not change the underlying fundamentals of a company. They are simply a mechanical function around a stock price. After all, the company’s revenues, net income, gross margin and market capitalization are all the same. That said, there is still a very strong argument that can be made showing just how much investors psychologically love seeing stock splits.

After Friday’s close, two very high-profile stock splits are taking place. 24/7 Wall St. thinks there are some other stocks that could and should split their shares in their wake. Sometimes even a mechanical event is worth the effort.

The mighty Apple Inc. (NASDAQ: AAPL) is set to see a four-for-one stock split, and that is its first since Apple’s seven-for-one split back in 2014. Apple was trading at $384.07 ahead of earnings and the split announcement, but the shares popped to $424.28 the next day, and the stock has since hit $500 ahead of the coming iPhone 12 launch.

Tesla Inc. (NASDAQ: TSLA) has claimed that it wants its own shares more affordable for investors and employees. Tesla’s stock price jumped 10% to over $1,500 after the split was announced, but its shares were handily above $2,250 on Friday. Tesla’s stock split is five for one, and its market cap is now well above $400 billion.

One argument that signals the psychological and physical impact of stock splits is the inverse case. With the dreaded reverse-split, a company shrinks its share count and raises its share price by the similar amount. Reverse splits are generally handled to avoid delisting from the New York Stock Exchange or Nasdaq, and they frequently are followed by an attack by short sellers, who see the effort solely as a gimmick and yet another opportunity to short sell more shares at a higher price.

24/7 Wall St. would never suggest that every company with a high stock price needs to announce a split. That said, some stocks look and feel like they could use a split. Some companies may want to appeal to their broad base of customers with a share price adjustment based on the cost of their goods or services. Some companies may even view their own customers as perhaps the most ideal shareholders.

Many investors could argue that 50 or even 100 more companies should consider stock splits. This review focuses on the companies that are more widely traded and are also very well known. We have not suggested how much of a split should be seen, because every company is different. There is also a dark side of stock splits, which is detailed below.

Here are 13 other companies that should seriously entertain splitting their stocks. Some of these are not the so-called FAANG stocks and other high-flying tech stocks. These all have considerably higher share prices. Key performance metrics have been included for each, along with some additional color.

Amazon.com Inc. (NASDAQ: AMZN) was last seen trading at $3,400, and its 52-week range is $1,626.03 to $3,453.00. It has a $1.7 trillion market cap, and its stock has traded with a hefty price for some time, hitting $2,000 for the first time in mid-2018 and breaking above $1,000 in mid-2017. In some ways, Jeff Bezos may have pioneered the trend of not wanting to make stock splits. That said, Amazon obviously pays no dividend, and the history of splits shows that its stock split twice in 1999 and once in 1998, back before the 2000 dot-com bubble burst.

Alphabet Inc. (NASDAQ: GOOGL) was last seen trading above $1,600, and its 52-week range is $1,008.87 to $1,652.79. It now has a $1.1 trillion market cap. Alphabet effected a split in 2014, with the creation of the dual classes of stock. Sadly, most investors today don’t know which Alphabet is which, and many still wonder why the company even bothered changing the Google name. Alphabet pays no dividend and likely will not for the foreseeable future.

AutoZone Inc. (NYSE: AZO) was last seen trading at $1,189.91, in a 52-week range of $684.91 to $1,274.41 and with a market capitalization of $27.8 billion. AutoZone is a strange situation, as a car parts store with a massive stock price. This might not tell its customers who come into the store that perhaps they should buy a share of stock for the same price of five car batteries. Its last splits were both two-to-one, way back in 1994 and 1992.

AutoZone oddly enough pays no dividend, but its history of stockholder returns has been focused on repurchasing its common stock to shrink its float. Even as of October 2019, the company had authorized a total of $23.2 billion in share repurchases since its repurchase program kicked off in 1998.

Booking Holdings Inc. (NASDAQ: BKNG) was last seen trading above $1,900.00, and its 52-week range is $1,107.29 to $2,094.00. It has a $78 billion market cap. One interesting aspect here is that it effected a reverse split back in 2003 (by one-for-six) because its stock price was so low back then, when it was still known to investors as Priceline.com. Its trading volume likely would be considerably higher than the 400,000 on average, and its wide bid-ask spread would narrow as well.

Boston Beer Co. (NYSE: SAM) was last seen trading above $875.00. The stock’s 52-week range is $290.02 to $897.50, and its market cap is now $10.7 billion. Boston Beer is another stock for which such a high share price just makes no sense on the surface. Many people love to drink their beers and seltzers, but one share of common stock now equates to the price of nearly 90 six-packs of their beer.

Charter Communications Inc. (NASDAQ: CHTR) was last seen trading at $610.00, and its 52-week range is $345.67 to $621.04. It has a market cap of $125 billion. Charter Communications has the highest price of any cable and media stock. It is what is left of business combinations with Bright House Networks and Time Warner Cable, now under the Spectrum brand. Those roll-ins are long enough in the past that there is no reason to have such a high share price. Charter also pays no dividend.

Chipotle Mexican Grill Inc. (NYSE: CMG) was last seen trading at $1,300.00, and its 52-week range is $415.00 to $1,301.34. It has a $36 billion market cap, and it now seems almost impossible to fathom that Chipotle was once spun out of McDonald’s. Even after it made customers ill in the past, those customers tend to have extremely high loyalty rates. But what about turning customers into shareholders? When they type in “CMG Stock” as a search on their smartphones, they probably think, “I can buy one share of stock or pay for my next 130 meals with the same cash.” Chipotle still pays no dividend.

Equinix Inc. (NASDAQ: EQIX) was last seen trading at $785.00, and its 52-week range is $477.87 to $805.81. It has a $69 billion market cap, and it is a real estate investment trust involved in data centers. As a REIT, it has close to a 1.4% dividend yield. Some investors consider it somewhat as an AWS without all of the other Amazon operations. The company may have a specific reason to avoid a split though. The last split on record was a reverse split of one-for-32 back in 2002.

Netflix Inc. (NASDAQ: NFLX) has been a massive growth catalyst for the COVID-19 era and long before people started refusing to leave their homes for entertainment. Netflix was last seen trading at $525.00 a share. It has a 52-week range of $252.28 to $575.37 and a $232 billion market cap. Customers may think of one share at $525 or so as being about 50 months of service fees. With close to 20 years of trading history, Netflix split seven-for-one back in 2015 and two-for-one back in 2004.

NVR Inc. (NYSE: NVR) is now a $4,200 stock, the highest of any homebuilding stock price by a factor of close to 40-to-one. The stock has continued hit new all-time highs and has doubled from its lows in March. The company was recently the third-largest homebuilder by market cap, with a $15.5 billion value. NVR also pays no dividend.

Regeneron Pharmaceuticals Inc. (NASDAQ: REGN) was last seen trading near $605.00, and its 52-week range is $271.37 to $664.64. It has a $64 billion market cap. Regeneron is older than many of the large biotechs as it came public back in 1991. This company has never paid a dividend, and we found no record of any stock splits. Regeneron has many things going for it, but the recent developments of COVID-19 have helped it gain more than 50% in 2020 alone.

Sherwin-Williams Co. (NYSE: SHW) was last seen trading at $672.00, and its 52-week range is $325.43 to $681.60. It has a $61 billion market cap. Sherwin-Williams sells paint all around the country and is a very well-known company. While it pays a 0.8% dividend yield, the last time it split its shares was back in the 1990s and 1980s. Many paint-buyers could repaint their entire home or apartment for less than the cost of a single share of stock.

Shopify Inc. (NYSE: SHOP) was last seen trading close to $1,060.00, and its 52-week range is $282.08 to $1,107.92. It has a $119.7 billion market cap. Shopify has become the next big thing for businesses and it has been a definite winner in helping companies small and large build more robust websites for e-commerce. Shopify is a Canadian company, and it has sky-high valuations (50 times revenues!). It pays no dividend and probably will not pay one for years, and there have been no stock splits since its 2015 initial public offering.

These calls for stock splits are not exactly new. We even made some of the same observations in 2015, including about AutoZone, Chipotle, Boston Beer and Sherwin-Williams.

Investors need to know that there are some dangers in splitting a stock too much or by too large of a ratio at any given time. General Electric Co. (NYSE: GE) comes to mind. GE is now trading with a rather embarrassing single-digit stock price, and it was even booted out of the Dow Jones industrial average because its weighting in the index became so low.

Berkshire Hathaway Inc. (NYSE: BRK-A) is one name that comes up over and over for a split due to a more than $300,000 share price, but it now has the Berkshire Hathaway Inc. (NYSE: BRK-B) shares that are closer to $212.00 apiece. Those were created back in 1996. Warren Buffett noted back in the 1980s, even at much lower share prices, that he did not intend to split the stock, but those B-shares split 50-to-one in 2010, and now the stock is much more investable by the public.

One modern reverse split that changed how a stock traded was the case of Rite Aid Corp. (NYSE: RAD). The pharmacy chain operator still has only a $750 million market cap, but at $13.60 this would still be a sub-$1.00 stock had it not conducted a reverse-split of one-for-20 back in 2019. Rite Aid used to be very actively traded, with tens of millions of shares trading hands each day before its reverse split. The prior history shows five splits that took place in the 1980s and 1990s, before the company ran into trouble in 1998 and suffered a low share price thereafter.

Announcing a stock split is not supposed to change the fundamentals of a company at all. Still, shareholders love traditional stock splits. To show that high stock prices in many key stocks have become a barrier to new shareholders, recent efforts by Schwab, Fidelity and other services have created fractional share purchasing or slices. Even if a stock price magically adjusts to $200 or $300 rather than over $1,000, those slices probably are going to remain popular.

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.