The SPDY S&P 500 ETF Trust (NYSE: SPY) provides investors and easy way to invest in the broad market and before expenses, performance corresponds to the price and yields of the S&P 500 Index. The trust is an excellent way for investors to hold a diversified portfolio of stocks without having to purchase a large basket of equities. The ease of instant diversification and access to all great American businesses is why the ETF is so popular with investors.

But like the S&P 500, the largest corporations have an outsized influence on SPY’s performance due to their massive market capitalizations, meaning when one of the “Magnificent Seven” stocks have a sharp change in share price, the overall performance of the trust follows suit. The “Magnificent Seven” stocks include Apple (Nasdaq: AAPL), Microsoft (Nasdaq: MSFT), Alphabet (Nasdaq: GOOG), Amazon (Nasdaq: AMZN), Nvidia (Nasdaq: NVDA), Meta Platforms (Nasdaq: META) and Tesla (Nasdaq: TSLA).

Heavy Weights of the SPY

With the fluctuation of stock prices, the stock weights of the trust change frequently. For example, Apple was the largest holding in the fund to close out 2023, but that spot has sense been taking over by Microsoft since Apple lost 8% of its total value in 2024 compared to Microsoft’s 6% gain.

| Company | % Weight | Market Capitalization |

| Microsoft Corp | 7.09% | $2.89 T |

| Apple Inc | 5.65% | $2.62 T |

| NVIDIA Corp | 5.06% | $2.16 T |

| Amazon.com Inc | 3.74% | $1.82 T |

| Meta Platforms Inc | 2.42% | $1.09 T |

| Alphabet Inc (GOOG) | 2.02% | $2.03 T |

| Berkshire Hathaway Inc | 1.73% | $855 B |

| Alphabet Inc | 1.70% | $2.01 T |

| Eli Lilly and Co | 1.41% | $742 B |

| Broadcom Inc | 1.32% | $602 B |

| JPMorgan Chase & Co | 1.31% | $550 B |

| Tesla Inc | 1.10% | $584 B |

| Exxon Mobil Corp | 1.05% | $466 B |

| UnitedHealth Group Inc | 1.04% | $445 B |

| Visa Inc | 1.00% | $540 B |

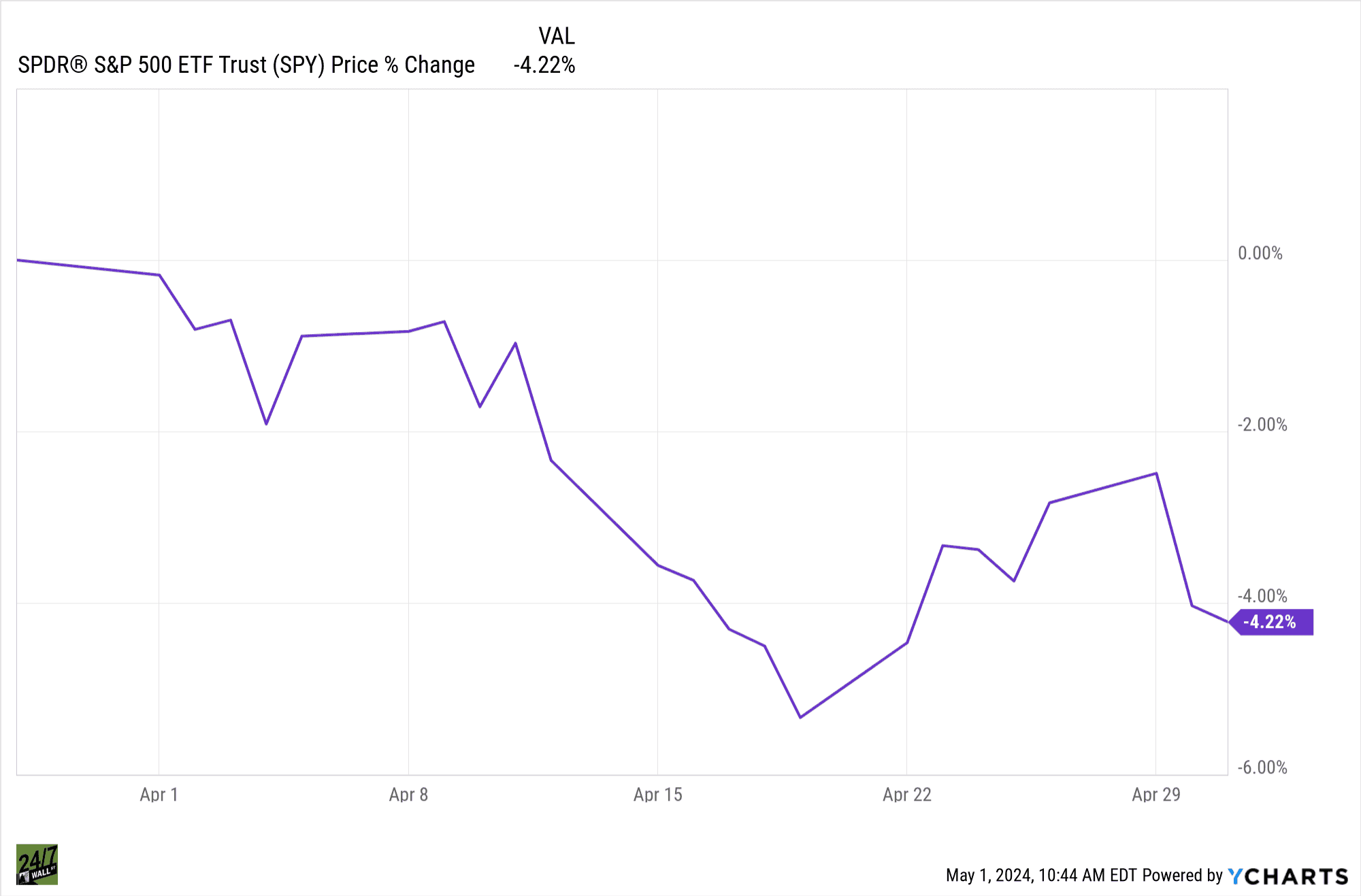

SPDY S&P 500 ETF Trust Down in April

The SPY was down 4% in April, making it the first losing month since October and the worst monthly performance since the Fall of 2022. The macro picture was inflationary worries, government spending and more military activity, which had one major financier calling it a formula for a sharp recession. But looking at the heavy hitters in the fund, 3 tech stocks in particular weighted down the fund, Meta Platforms, Nvidia and Microsoft.

Tech Stocks in April

Only real estate stocks fared worse than technology companies in April, technology sector dropping 5.75% compared to real estate’s 8.45% hit. To put that into perspective, $1 trillion vanished in April just from technology companies. So what happened and who were the biggest laggards of the bunch?

Again sticky inflation put a damper on the market and with higher interest rates not showing signs of easing and investors starting pulling back from high growth AI stocks in particular. Meaning investors were selling higher risk, higher reward stocks. AI darlings like Micro Super Computer (Nasdaq: SMCI) was down 30% alone in April.

Of the heavy weights, Meta Platforms was the worst performer of the month, losing 10% of its market value. Meta reporting 1st quarter earnings on April 24th and despite beating analyst estimates in both earnings per share and revenue, the stock tumbled. Facebook revised its second quarter outlook lower, and the investors immediately started selling.

Meta has been on a tear for the past year, increasing 80% over the past 52 weeks, so any sign of weakness was apparently reason enough for investors to take money off the table.

Nvidia lost 8% of its market value as well and, like Micro Super Computers, was caught up in the AI sell off. Wall Street has been clamoring of “AI fatigue” and that is entirely the case here given Nvidia has trillions of dollars in market value over the last year along. Sure, revenue has grown 240% year-over-year and company continues to turn out market leading chips, but after so meteoric of a rise, a sell-off is going to happen at some point.

Microsoft dropped 6% in the month without any company specific news chasing investors away. Microsoft had gained 37% in the past year before April’s sell off, likely caused by the same macro issues chasing Wall Street money into other forms of investment.

15% of the total weight of SPY is from Microsoft, Nvidia and Meta Platforms and when all three are sold off, the ETF follows suit.

Sponsored: Want to Retire Early? Start Here

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.