Housing

Housing Articles

One of the gold standards for U.S. real estate prices is the S&P CoreLogic Case-Shiller Indices, which is over two decades old. Recently, its monthly numbers have shown that U.S. home prices are...

Published:

Last Updated:

The common lending guideline, or the 28% mortgage rule, stipulates that homeowners should spend 28% or less of their monthly gross income on major housing expenses — including mortgage principal,...

Published:

Home prices have surged in the U.S. in recent years. Driven by rising demand and supply constraints during the pandemic, the median home sale price spiked by nearly 50% from the second quarter of...

Published:

Home prices have surged in the U.S. in recent years. Driven by rising demand and supply constraints during the pandemic, the median home sale price spiked by nearly 50% from the second quarter of...

Published:

Home prices have surged in the U.S. in recent years. Driven by rising demand and supply constraints during the pandemic, the median home sale price spiked by nearly 50% from the second quarter of...

Published:

Home prices have surged in the U.S. in recent years. Driven by rising demand and supply constraints during the pandemic, the median home sale price spiked by nearly 50% from the second quarter of...

Published:

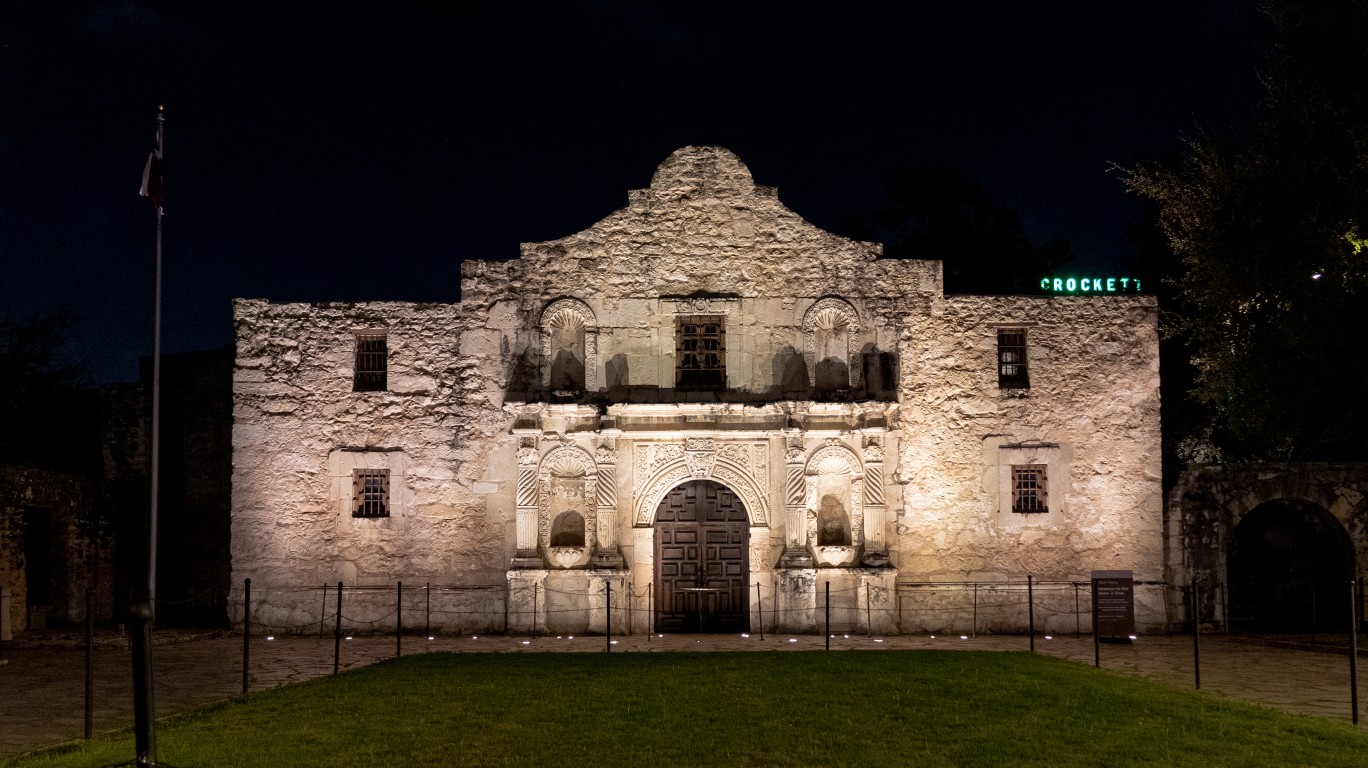

The City of San Antonio, located in southern Texas, is the second-most populous city in the state, with 1.4 million people. One of San Antonio’s primary industries is tourism, with attractions...

Published:

Home prices have surged in the U.S. in recent years. Driven by rising demand and supply constraints during the pandemic, the median home sale price spiked by nearly 50% from the second quarter of...

Published:

Home prices have surged in the U.S. in recent years. Driven by rising demand and supply constraints during the pandemic, the median home sale price spiked by nearly 50% from the second quarter of...

Published:

Home prices have surged in the U.S. in recent years. Driven by rising demand and supply constraints during the pandemic, the median home sale price spiked by nearly 50% from the second quarter of...

Published:

Home prices have surged in the U.S. in recent years. Driven by rising demand and supply constraints during the pandemic, the median home sale price spiked by nearly 50% from the second quarter of...

Published:

The number of active housing listings in March 2024 was 23.5% higher compared to March last year, with listings growing for a fifth straight month, according to Realtor.com. With inventory growing,...

Published:

Home prices have surged in the U.S. in recent years. Driven by rising demand and supply constraints during the pandemic, the median home sale price spiked by nearly 50% from the second quarter of...

Published: